by admin | Jun 29, 2018 | Hot Topics

New technologies are poised to fundamentally change the HR industry as we know it. Just as the smartphone revolutionized the way we communicate, artificial intelligence will reshape all areas of HR, from employee onboarding to learning management to developing top talent. And, similar to smartphones, these changes will take place at lightning speed.

New technologies are poised to fundamentally change the HR industry as we know it. Just as the smartphone revolutionized the way we communicate, artificial intelligence will reshape all areas of HR, from employee onboarding to learning management to developing top talent. And, similar to smartphones, these changes will take place at lightning speed.

But what exactly is artificial intelligence? And what implications might this evolving tech have on the future of health care? Buckle up, because we’re going to take a glimpse into the current AI projects, as well as what the future of health care could look like with AI advancements.

What Is Artificial Intelligence?

In its most basic form, artificial intelligence uses computer programming to develop systems that are able to perform tasks that would normally require human intelligence. These tasks could include speech recognition, decision-making, language translation, and much more.

Have you ever wondered how ridesharing apps like Uber and Lyft are able to predict ETAs for rides? Artificial intelligence. Or, how email platforms know how to filter out spam and nicely categorize your emails into categories? Yep, artificial intelligence. Or, how your banking app is able to process a check deposit via a simple image? You guessed it, artificial intelligence.

Artificial intelligence has become an integral part of many of the technologies and services that we use in our everyday life without us even knowing or really thinking about it.

In addition to its many convenient applications, AI also offers a promising and impactful future in the field of health care.

Examples of Artificial Intelligence in Health Care

The use of artificial intelligence is completely altering the front door of health care as we know it. From specific programs that aid in medical diagnostics to intelligent apps that triage remote patients, AI is making health care more efficient and accessible than ever.

Medical Data Mining

One of the primary areas in which AI shines versus manual human processes in the field of data analysis. Not only can artificial intelligence process complex sets of data at lightning speed, it can also provide meaningful and actionable insight and recommendations based on data sets. DeepMind(acquired by Google in 2014) is an AI-based technology that works to expedite the process in which patients are moved from ‘test’ to ‘treatment’. IBM’s Watsonproduct provides solutions for interpreting, organizing, and easily accessing clinical and patient data, in addition to providing technology for recognizing patient similarity and medical insights. According to IBM, medical data is expected to double every 73 days by 2020. And, each person will generate enough health-related data in their lifetime to fill 300 million physical books. Utilizing AI will not only expedite the process in which health care providers access patient info but also better-organize and analyze data available and even provide predictions on future health concerns and recommendations for treatment plans.

Powering Diagnostics

The FDA recently approved the use of artificial intelligence powered software for the use of medical diagnostics, marking the first use of AI in this application. The program is designed to detect signs of diabetic retinopathy, a condition that can cause long-term vision loss and that impacts more than 30 million people in the United States alone. The technology uses an AI algorithm to scan and analyze multiple images of an eye and then delivers a positive or negative test result. This is the first FDA approved solution that does not require a doctor to interpret test results, and more AI-based diagnostic solutions are expected to get the green light in the next several years.

Drug Development

It’s no secret that testing pharmaceuticals through clinical trials is an expensive and time-consuming process. The full development, testing, and approval process can literally take decades and cost billions. Though pharmaceutical players of all sizes are currently experimenting with AI applications in the drug discovery and development process, GSK is considered a leader in the space. GSK has fully embraced AI research and applications with their dedicated in-house team, ‘In silico Drug Discovery Unit’. The ultimate goal of the GSK project is to leverage artificial intelligence to shorten the drug research, testing, and launch window to under a year, a bold vision. Making the pharmaceutical process more efficient could drastically reduce the cost of medical treatments and the cost of health care in general.

Solving Doctor Shortages

China is facing one of the most alarming doctor shortagesin history, with only 1.5 doctors for every 1,000 residents (compared to 2.5 doctors per person in the United States). The need is dire, and the government is calling for action and loosening restrictions on the use of data and new technology. Currently, more than 100 companies are working to develop AI solutions to address urgent health care needs. A recent reportpredicted that China’s market for AI-powered health care services will reach almost $6B yuan ($930 Million) by 2022. Current projects include diagnostic tools to assist with CT scans, x-rays, ultrasound scans and prosthetic design and manufacturing.

Improving Telemedicine

Which would you prefer – an hour-long wait in a doctor’s office plus the time to actually see the doctor, or a quick 15-minute consultation and diagnosis via your smartphone? Though many assume telemedicine is a modern iteration of health care, this practice has actually been around since the 1950’s. Now, telemedicine is a common alternative to traditional doctor’s visits for simple diagnostics and treatment. A new app, 98point6, is taking this remote-experience to the next level with artificial intelligence. The technology interacts with subscribers to help better understand medical needs and then channels requests to the appropriate doctor for evaluation. The AI-bot essentially serves as a personalized triage service, saving manual time and labor.

The Bottom Line?

The adoption and utilization of artificial intelligence in the health care space will make health care more accessible, efficient, and affordable for everyone.

by Meisha Bochicchio, Content Marketing Manager at PlanSource

Originally posted on blog.ubabenefits.com

by admin | May 1, 2018 | Benefit Management, Group Benefit Plans, HSA/HRA, IRS

Friday, April 27, the Internal Revenue Service (IRS) announced that the 2018 annual contribution limit to Health Savings Accounts (HSAs) for persons with family coverage under a qualifying High Deductible Health Plan (HDHP) is restored to $6,900. The single-coverage limit of $3,450 is not affected.

This is the final word on what has been an unusual back-and-forth saga. The 2018 family limit of $6,900 had been announced in May 2017. Following passage of the Tax Cuts and Jobs Act in December 2017, however, the IRS was required to modify the methodology used in determining annual inflation-adjusted benefit limits. On March 5, 2018, the IRS announced the 2018 family limit was reduced by $50, retroactively, from $6,900 to $6,850. Since the 2018 tax year was already in progress, this small change was going to require HSA trustees and recordkeepers to implement not-so-small fixes to their systems. The IRS has listened to appeals from the industry, and now is providing relief by reinstating the original 2018 family limit of $6,900.

Employers that offer HSAs to their workers will receive information from their HSA administrator or trustee regarding any updates needed in their payroll files, systems, and employee communications. Note that some administrators had held off making changes after the IRS announcement in March, with the hopes that the IRS would change its position and restore the original limit. So employers will need to consider their specific case with their administrator to determine what steps are needed now.

HSA Summary

An HSA is a tax-exempt savings account employees can use to pay for qualified health expenses. To be eligible to contribute to an HSA, an employee:

- Must be covered by a qualified high deductible health plan (HDHP);

- Must not have any disqualifying health coverage (called “impermissible non-HDHP coverage”);

- Must not be enrolled in Medicare; and

- May not be claimed as a dependent on someone else’s tax return.

HSA 2018 Limits

Limits apply to HSAs based on whether an individual has self-only or family coverage under the qualifying HDHP.

2018 HSA contribution limit:

- Single: $3,450

- Family: $6,900

- Catch-up contributions for those age 55 and older remains at $1,000

2018 HDHP minimum deductible (not applicable to preventive services):

- Single: $1,350

- Family: $2,700

2018 HDHP maximum out-of-pocket limit:

- Single: $6,650

- Family: $13,300*

*If the HDHP is a nongrandfathered plan, a per-person limit of $7,350 also will apply due to the ACA’s cost-sharing provision for essential health benefits.

Originally posted on thinkHR.com

by admin | Aug 29, 2017 | ACA, Health Plan Benchmarking

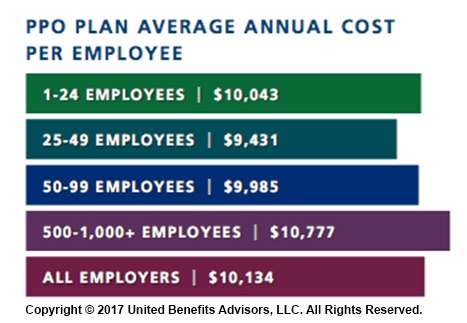

Small employers, those with fewer than 100 employees, have a reputation for not offering health insurance benefits that are competitive with larger employers, but new survey data from UBA’s Health Plan Survey reveals they are keeping pace with the average employer and, in fact, doing a better job of containing costs.

Small employers, those with fewer than 100 employees, have a reputation for not offering health insurance benefits that are competitive with larger employers, but new survey data from UBA’s Health Plan Survey reveals they are keeping pace with the average employer and, in fact, doing a better job of containing costs.

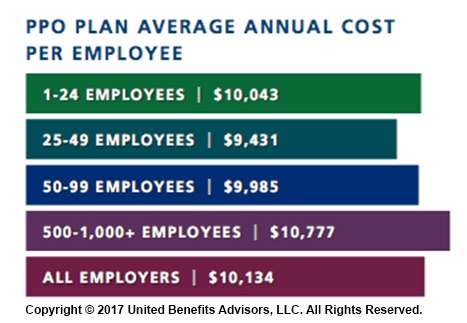

According to our new special report: “Small Businesses Keeping Pace with Nationwide Health Trends,” employees across all plan types pay an average of $3,378 toward annual health insurance benefits, with their employer picking up the rest of the total cost of $9,727. Among small groups, employees pay $3,557, with their employer picking up the balance of $9,474 – only a 5.3 percent difference.

When looking at total average annual cost per employees for PPO plans, small businesses actually cut a better deal even compared to their largest counterparts—their costs are generally below average—and the same holds true for small businesses offering HMO and CDHP plans. (Keep in mind that relief such as grandmothering and the PACE Act helped many of these small groups stay in pre-ACA plans at better rates, unlike their larger counterparts.)

Think small businesses are cutting coverage to drive these bargains? Compared to the nations very largest groups, that may be true, but compared to average employers, small groups are highly competitive.

By Bill Olson

Originally Published By United Benefit Advisors

by Johnson and Dugan | Aug 2, 2017 | Benefit Management

Tired of celebrating the 10% increase? Join us in an innovative discussion on reducing your Health Insurance Premium through Creative Financing for your benefit program. Learn about turning a 10% increase into a 25% decrease.

Keynote Speaker:

Clifford Der, East West Administrators

We will be discussing alternative funding from traditional Self-Funding to Medical Expense Reimbursement Plans. We will also address any legal questions you may have regarding your liability as an employer offering a fully insured program versus a self-funded program.

11:45 a.m. – 12:00 p.m. Registration

12:00 p.m. – 1:00 p.m. Seminar & Complimentary Buffet Lunch

Location: Mistral Restaurant and Bar | 370-6 Bridge Parkway | Redwood Shores, CA 94065

Click Here To Register

About the Presenter:

Clifford Der, East West Administrators – Clifford has been a member of the National Association of Health Underwriters for more than 40 years. His extensive background in healthcare benefits includes developing the Chinese Community Health Plan (EPO-a first in the country), the first acupuncture plan, the development of the Medical Expenses Reimbursement Plans along with custom designed Partial Self-funded Health Plans.

Sponsored by:

by admin | Apr 28, 2017 | ACA, Benefit Management, Compliance

While the health care affordability crisis has become so significant, questions still linger—will private exchanges become a viable solution for employers and payers, and will they will continue to grow? Back in 2015, Accenture estimated that 40 million people would be enrolled in private exchange programs by 2018; the way we see this model’s growth today doesn’t speak to that. So, what is preventing them from taking off as they were initially predicted? We rounded up a few reasons why the private exchange model’s growth may be delayed, or coming to a halt.

While the health care affordability crisis has become so significant, questions still linger—will private exchanges become a viable solution for employers and payers, and will they will continue to grow? Back in 2015, Accenture estimated that 40 million people would be enrolled in private exchange programs by 2018; the way we see this model’s growth today doesn’t speak to that. So, what is preventing them from taking off as they were initially predicted? We rounded up a few reasons why the private exchange model’s growth may be delayed, or coming to a halt.

They Are Not Easy to Deploy

There is a reason why customized benefits technology was the talk of the town over the last two years; it takes very little work up-front to customize your onboarding process. Alternatively, private exchange programs don’t hold the same reputation. The online platform selection, build, and test alone can get you three to six months into the weeds. Underwriting, which includes an analysis of the population’s demographics, family content, claims history, industry, and geographic location, will need to take place before obtaining plan pricing if you are a company of a certain size. Moreover, employee education can make up a significant time cost, as a lack of understanding and too many options can lead to an inevitable resistance to changing health plans. Using a broker, or an advisor, for this transition will prove a valuable asset should you choose to go this route.

A Lack of Education and a Relative Unfamiliarity Revolves Around Private Exchanges

Employers would rather spend their time running their businesses than understanding the distinctions between defined contribution and defined benefits models, let alone the true value proposition of private exchanges. With the ever-changing political landscape, employers are met with an additional challenge and are understandably concerned about the tax and legal implications of making these potential changes. They also worry that, because private exchanges are so new, they haven’t undergone proper testing to determine their ability to succeed, and early adoption of this model has yet to secure a favorable cost-benefit analysis that would encourage employers to convert to this new program.

They May Not Be Addressing All Key Employer and Payer Concerns

We see four key concerns stemming from employers and payers:

- Maintaining competitive benefits: Exceptional benefits have become a popular way for employers to differentiate themselves in recruiting and retaining top talent. What’s the irony? More options to choose from across providers and plans means employees lose access to group rates and can ultimately pay more, making certain benefits less. As millennials make up more of today’s workforce and continue to redefine the value they put behind benefits, many employers fear they’ll lose their competitive advantage with private exchanges when looking to recruit and retain new team members.

- Inexperienced private exchange administrators: Because many organizations have limited experience with private exchanges, they need an expert who can provide expertise and customer support for both them and their employees. Some administrators may not be up to snuff with what their employees need and expect.

- Margin compression: In the eyes of informed payers, multi-carrier exchanges not only commoditize health coverage, but perpetuate a concern that they could lead to higher fees. Furthermore, payers may have to go as far as pitching in for an individual brokerage commission on what was formerly a group sale.

- Disintermediation: Private exchanges essentially remove payer influence over employers. Bargaining power shifts from payers to employers and transfers a majority of the financial burden from these decisions back onto the payer.

It Potentially Serves as Only a Temporary Solution to Rising Health Care Costs

Although private exchanges help employers limit what they pay for health benefits, they have yet to be linked to controlling health care costs. Some experts argue that the increased bargaining power of employers forces insurers to be more competitive with their pricing, but there is a reduced incentive for employers to ask for those lower prices when providing multiple plans to payers. Instead, payers are left with the decision to educate themselves on the value of each plan. With premiums for family coverage continuing to rise year-over-year—faster than inflation, according to Forbes back in 2015—it seems private exchanges may only be a band-aid to an increasingly worrisome health care landscape.

Thus, at the end of it all, change is hard. Shifting payers’, employers’, and ultimately the market’s perspective on the projected long-term success of private exchanges will be difficult. But, if the market is essentially rejecting the model, shouldn’t we be paying attention?

By Paul Rooney, Originally Published By United Benefit Advisors

New technologies are poised to fundamentally change the HR industry as we know it. Just as the smartphone revolutionized the way we communicate, artificial intelligence will reshape all areas of HR, from employee onboarding to learning management to developing top talent. And, similar to smartphones, these changes will take place at lightning speed.

New technologies are poised to fundamentally change the HR industry as we know it. Just as the smartphone revolutionized the way we communicate, artificial intelligence will reshape all areas of HR, from employee onboarding to learning management to developing top talent. And, similar to smartphones, these changes will take place at lightning speed.