by admin | Jul 1, 2024 | Health Insurance

In today’s world of complex health insurance options, High Deductible Health Plans (HDHPs) have become increasingly popular. But with a name like “high deductible,” it’s natural to have questions. Let’s break down the basics of HDHPs:

In today’s world of complex health insurance options, High Deductible Health Plans (HDHPs) have become increasingly popular. But with a name like “high deductible,” it’s natural to have questions. Let’s break down the basics of HDHPs:

What is an HDHP?

An HDHP is a health insurance plan with a higher deductible than traditional plans. This means you pay more out of pocket for covered medical services before your insurance kicks in and starts sharing the costs. However, HDHPs often come with lower monthly premiums.

Here’s a breakdown of the key features:

- Higher deductible: This is the amount you’re responsible for paying before your insurance starts covering costs. HDHP deductibles are typically in the range of $1,600 for individuals and $3,200 for families (as of 2024).

- Lower monthly premiums: Since you’re shouldering more upfront costs, the monthly premium for an HDHP is usually lower than a traditional plan.

- Possible Health Savings Account (HSA) compatibility: Many HDHPs allow you to open a Health Savings Account (HSA). HSAs are tax-advantaged accounts where you can save money specifically for qualified medical expenses. You contribute pre-tax dollars to the HSA, which reduces your taxable income, and the funds grow tax-free. You can then use the HSA funds to pay for deductibles, copays, and other qualified medical expenses, tax-free.

Pros of HDHPs:

- Lower monthly premiums: This can be a significant advantage, especially for young and healthy individuals who don’t anticipate needing frequent medical care.

- Tax advantages of HSAs: HSAs offer a triple tax benefit – contributions are tax-deductible, funds grow tax-free, and qualified withdrawals for medical expenses are tax-free.

- Potential for cost savings: If you’re generally healthy and have good budgeting skills, an HDHP can lead to overall lower healthcare costs by combining lower premiums and tax-advantaged savings in an HSA.

Cons of HDHPs:

- Higher out-of-pocket costs: With a high deductible, you’ll be responsible for a larger chunk of medical bills before your insurance kicks in. This can be a burden if you have unexpected medical needs.

- Not suitable for everyone: If you have chronic health conditions or anticipate needing frequent medical care, an HDHP might not be the best choice due to the high out-of-pocket costs.

- Requires financial discipline: To truly benefit from an HSA, you need to be able to contribute and save money on a regular basis.

Is an HDHP Right for You?

There’s no one-size-fits-all answer. Consider these factors:

- Your overall health: If you’re generally healthy and have a low risk of needing frequent medical care, an HDHP could be a good option.

- Your budget: Can you comfortably afford to pay a higher deductible if needed?

- Your financial discipline: Are you comfortable managing and contributing to an HSA?

- Your future health needs: Do you anticipate needing frequent medical care in the future?

Make an informed decision before enrolling in an HDHP to ensure that it’s the right choice for you, your family and your medical needs. But remember, you can always re-evaluate your health insurance plan during open enrollment periods.

by admin | Apr 16, 2024 | Health Insurance

Insurance Costs

Insurance Costs

Consumers typically pay the following types of costs when they have insurance.

- Premium: The premium is an amount of money a consumer pays for a health insurance plan. The consumer and/or their employer usually make this payment bi-weekly, monthly, quarterly, or yearly. The premium must be paid regardless of how many services, if any, the consumer uses.

- Cost Sharing: Cost sharing is the share of costs for covered services that consumers must pay out of pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn’t include premiums, balance billing amounts for out-of-network providers, or the cost of non-covered services. Cost sharing in Medicaid and Children’s Health Insurance Program also includes premiums.

- Deductible: The amount a consumer must pay for covered health care services received before their plan begins to pay. For example, if a consumer’s deductible is $1,000, their plan won’t pay anything until the consumer has paid $1,000 for covered health care services. A plan with an overall deductible may also have separate deductibles that apply to specific services or groups of services. For example, a plan may have separate in-network and out-of-network deductibles.

- Copayment: A fixed amount ($20, for example) that a consumer pays for a covered health care service after they’ve paid their deductible.

- Coinsurance: The percentage of the costs of a covered health care service that a consumer pays (for example, 15% of the cost of a prescription) after paying a deductible.

See Appendix A for examples of how cost sharing works.

Tips to Know:

- Sometimes consumers with most types of health insurance don’t have to pay any cost sharing for certain services. This is often true for preventive services like flu shots and some cancer screenings. The goal is to keep enrollees healthy and catch health problems early.

- Many health insurance plans have an out-of-pocket maximum. This is the most a consumer could pay during a coverage period (usually one year) for their share of the costs of covered services. After they meet this limit, the plan will usually pay 100% of the allowed amount. This limit never includes the premiums, balance-billed charges, or care that the consumer’s plan doesn’t cover. Some plans don’t count all of a consumer’s copayments, deductibles, coinsurance payments, out-of-network payments, or other expenses toward this limit.

- In the majority of situations, the most important document for tracking health insurance costs is usually called an Explanation of Benefits (EOB). The EOB is a summary of health care charges that a health plan may send after a consumer receives medical care. It is not a bill. It shows the consumer how much their provider is charging the health plan for the care they received, and the amount the plan will cover. If the plan does not cover the entire cost, the provider may send the consumer a separate bill, unless prohibited by law.

Appendix A

Examples of Health Insurance Cost Sharing

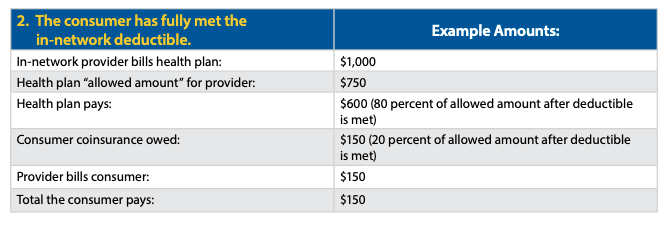

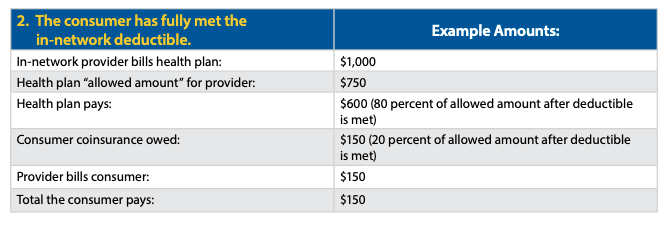

This appendix provides some examples of how health insurance cost sharing works for consumers. These examples show different outcomes depending on whether a consumer has met their deductible and whether their health insurance includes out-of-network coverage. This information is intended to illustrate some of the basic steps that are typically used to calculate cost sharing in the absence of consumer surprise billing protections (or when such protections don’t apply).

IN-NETWORK:

A consumer receives covered items or services from an in-network provider or facility.

If the services are covered by the consumer’s health plan and furnished by an in-network provider or facility, the amount a consumer pays will vary based on whether the consumer has met their in-network deductible as well as the level of their coinsurance. Note the “allowed amount” is the maximum payment the plan will pay for a covered health care item or service and is generally the basis for cost-sharing calculations. In the next two examples, assume the consumer’s health plan specifies that coinsurance is 20 percent of the allowed amount after the consumer has met a $2,000 deductible for in-network coverage.

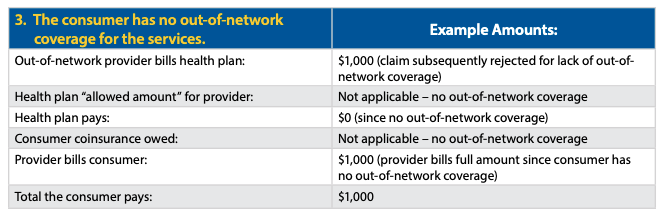

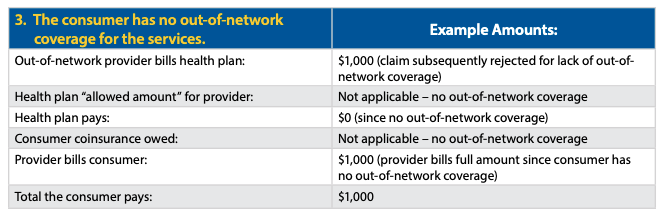

OUT-OF-NETWORK:

The consumer receives covered items or services from an out-of-network provider.

If the covered items or services are received out-of-network, a consumer’s billed amounts will vary based on whether the consumer’s health plan provides any out-of-network coverage and whether the consumer has met their out-of-network deductible.

In some circumstances, the No Surprises Act may limit what a consumer may be billed in each of the following examples. See the No Surprises Act: Overview of Key Consumer Protections.

In the next two examples, the plan covers out-of-network services with consumer coinsurance of 40 percent after the consumer has met a $4,000 deductible for out-of-network services. If the consumer has not paid anything toward the out-of-network deductible, the provider would bill the consumer for the full amount of the charges if the charges are less than $4,000 (example 4). If the consumer has already paid their full deductible, a provider might balance bill a consumer for the difference between what the provider receives from the health plan and the provider’s initial billed amount (example 5).

Originally posted on CMS.gov

by admin | May 16, 2023 | Health Insurance, Hot Topics

Healthcare costs, and consequently employee health benefit costs, have been growing at an alarming rate in recent years. The U.S. as a nation spends more on health care than any other developed country but has worse health outcomes. How is this possible?

Healthcare costs, and consequently employee health benefit costs, have been growing at an alarming rate in recent years. The U.S. as a nation spends more on health care than any other developed country but has worse health outcomes. How is this possible?

Four Key Factors Driving U.S. Healthcare Costs:

Healthcare gets more expensive when the population expands, as people get older and live longer. The Baby Boomers, one of America’s largest adult generations, is approaching retirement age. Because of this, the 65+ population is growing at an unprecedented rate. According to the U.S. Census Bureau, 21% of the entire population will be age 65 or older by 2030. Older Americans will make up almost one-quarter of the population by 2060.

This growth is likely to contribute to rising healthcare costs in two important ways:

- Growth in Medicare enrollment

- More complex, chronic conditions

- U.S. Population Is Growing More Unhealthy

According to the Center for Disease Control and Prevention (CDC), 6 out of every 10 adults in the U.S. have at least one chronic disease, such as asthma, heart disease, high blood pressure, or diabetes, which all drive up health insurance costs. In 2020, the health care costs of people with at least one chronic condition were responsible for 86% of health care spending.

Additionally, recent data finds that nearly 20% of children and 40% of adults over 20 in the U.S. are either overweight or obese, which can lead to chronic diseases and inflated healthcare spending.

On average, Americans shell out almost twice as much for pharmaceutical drugs as citizens of other industrialized countries pay. Moreover, prescription drug spending in the U.S. will grow by 6.1% each year through 2027, according to the Centers for Medicare and Medicaid Services (CMS) estimates.

Drug pricing strategies also contribute to rising healthcare costs. Drug manufacturers establish a list price based on their product’s estimated value, and manufacturers can raise this list price as they see fit. In the United States, there are few regulations to prevent manufacturers from inflating drug prices in this way.

Simply put, multiple systems create waste. “Administrative” costs are frequently cited as a cause for excess medical spending. The U.S. spends about 8% of its health care dollar on administrative costs, compared to 1% to 3% in the 10 other countries the JAMA study looked at.

Why is administrative spending so high in the United States? The U.S. operates within a complex, multi-payor system, in which healthcare costs are financed by many different payors. With so many stakeholders involved, healthcare administration becomes a complicated, inefficient process.

These inefficiencies contribute to excess administrative spending. The main component of excess administrative spending is billing and insurance-related (BIR) costs. These are overhead costs related to medical billing, and include services like claims submission, claims reconciliation and payment processing.

Administrative costs, an aging population, rising prescription drug costs, and lifestyle choices all play a factor in ballooning healthcare expenses. While some of these factors are not in your control, others are. Find out where you can make a difference, not only in health insurance costs, but also to your overall health!

by admin | Jun 13, 2022 | Hot Topics

Smart spending can keep your health care from costing an arm and a leg. With costs rising on everything from gas to food, every penny counts. It pays to shop smart – that is why it helps to learn how to take steps to limit your out-of-pocket health care costs.

Smart spending can keep your health care from costing an arm and a leg. With costs rising on everything from gas to food, every penny counts. It pays to shop smart – that is why it helps to learn how to take steps to limit your out-of-pocket health care costs.

- Save Money on Prescriptions

- Go generic – Always ask your doctor or pharmacist if you can switch to generic medicines. They have the same active ingredients but cost less than brand name drugs.

- Split pills – ask your doctor or pharmacist if your prescription comes in a higher dose that is safe to split. You may be able to get a 2-month supply of medicine in double the dose that you need for the price of a 1-month supply, cutting your prescription cost in half.

- Use a preferred pharmacy – A preferred pharmacy has pre-negotiated lower prices on prescriptions for a particular insurance plan. You can also sign up for home delivery on prescriptions that you take on a regular basis.

- Tune in to Telehealth

With telemedicine, you don’t have to drive to the doctor’s office or sit in a waiting room when you’re sick. Virtual visits can be easier to fit into your busy schedule and you may not even have to arrange for childcare. Doctors also can use telehealth appointments to lessen exposure to other people’s germs.

- Brush Up on HSA & FSA Eligible Expenses

You can withdraw HSA and FSA money tax-free to pay for deductibles and co-payments or coinsurance, as well as for a variety of other expenses including vision expenses and orthodontia. You can also use it for everything from sunscreen and contact solution to baby monitors and over-the-counter medicine like Ibuprofen or cold medicine.

- Save for Retirement with Your HSA

HSA funds don’t expire which makes an HSA a great way to put away money for medical expenses in retirement. An HSA offers a hat trick of tax advantages:

- Contributions to your account are made pre-tax, lowering your taxable income today

- Investments grow tax-free while they are kept in the account

- Withdrawals are free of income tax, as long as you use the money for qualified medical expenses.

Age 65 is when you can use HSA money to pay for non-medical expenses – including day-to-day costs or for home renovations. Those payouts aren’t tax-free but are taxed at the same rate as distributions from a traditional IRA. You’ll simply owe income taxes on whatever you withdraw.

- Review Bills and Insurance Explanations of Benefits

Billing mistakes can happen. In fact, did you know that up to 80% of medical bills contain at least one error? Billing mistakes happen easily when dealing with large numbers of patients, ever-changing medical codes, and payments crossed in the mail and health insurance companies.

The portion of your budget devoted to medical care is always on the rise so it’s never a bad idea to find monetary shortcuts where you can. Knowledge is POWER and when you spend time finding ways to save money on health care, you are empowering yourself! Exercising due diligence to plan for you and your family’s medical needs will save you money and give you confidence in your decisions for care.

by admin | Apr 14, 2022 | Benefit Plan Tips, Tricks and Traps, Hot Topics

Health insurance is essential to protecting your health but the high cost of coverage may leave you feeling sick. Even after employers pick up a substantial amount of the cost, every year Americans spend thousands of dollars on healthcare while costs are continuing to rise. By taking certain steps, you can stretch your healthcare dollars and still receive the care you need to stay healthy.

Health insurance is essential to protecting your health but the high cost of coverage may leave you feeling sick. Even after employers pick up a substantial amount of the cost, every year Americans spend thousands of dollars on healthcare while costs are continuing to rise. By taking certain steps, you can stretch your healthcare dollars and still receive the care you need to stay healthy.

- Understand How Your Health Plan Works

Review your plan to learn how to maximize your benefits. You need to know what is covered (and what is not!) and what procedures you need to follow to ensure your claims will get paid. Know what your copayment, coinsurance and deductible costs are before your visit.

Most health insurance plans cover more of your costs if you use their preferred or in-network doctors. If you visit an out-of-network doctor or medical facility, you’ll pay more and may end up being responsible for 100% of the bill. Use your insurer’s online tools to search for in-network providers.

- Choose the Right Places to Get Care

Running to the emergency room when you get sick after hours could drain your wallet. All too often, those suffering from minor illnesses or injuries visit the ER when they don’t need to. The ER should be your last resort – consider using more affordable options like telemedicine or an urgent care center instead. You can still get the care you require in off-hours without having to schedule an appointment.

If you need surgery, you may save money by having it done at an ambulatory surgical center (ASC) which is a modern healthcare facility focused on same-day surgical care, including diagnostic and preventive procedures. Typically, these centers charge less than a hospital.

- Use a Health Savings Account (HSA) or Flexible Spending Account (FSA)

Opening a HSA or an FSA is a handy way to save for medical expenses and reduce your taxable income. They are like personal savings accounts but the money in them is used to pay for health care expenses. HSAs are owned by you, earn interest, and can be transferred to a new employer. FSAs are owned by your employer, do not earn interest, and must be used within the calendar year.

- Ask Your Doctor About Remote Patient Monitoring (RPM)

RPM is the use of digital technologies to monitor and analyze medical and other health data from patients and electronically transmit this information to healthcare providers for assessment and, when necessary, recommendations and instructions. This type of monitoring is often used to manage high-risk patients, such as those with acute or chronic health conditions such as those with diabetes, hypertension and heart conditions.

- Use Your Preventive Care Benefits

Many health plans pay the full cost for important preventive care. These regular screenings, exams, and immunizations help detect or prevent diseases and medical problems early when they are easier to treat. Annual check-ups, mammograms (usually after the age of 40), flu shots and colonoscopies (usually 1 every 10 years after the age of 50) are examples of preventive care. These checks can save you a lot of money because they catch problems early.

Health insurance isn’t mandatory – there’s no law requiring you to buy it – but, health insurance is an important part of staying healthy, financially and physically. Since most people who don’t have insurance made that decision based on money instead of what is best for their health, they usually don’t have doctor appointments for the same reason – it’s too expensive. But skipping routine care can end up being more expensive than your premiums, especially if you have serious health issues that aren’t caught early. Think of it like care maintenance: regularly changing your oil might be a hassle but it is essential to prevent a major breakdown down the road.

In today’s world of complex health insurance options, High Deductible Health Plans (HDHPs) have become increasingly popular. But with a name like “high deductible,” it’s natural to have questions. Let’s break down the basics of HDHPs:

In today’s world of complex health insurance options, High Deductible Health Plans (HDHPs) have become increasingly popular. But with a name like “high deductible,” it’s natural to have questions. Let’s break down the basics of HDHPs: