IRS Changes Course (Again) and Restores 2018 HSA Family Limit to $6,900

Friday, April 27, the Internal Revenue Service (IRS) announced that the 2018 annual contribution limit to Health Savings Accounts (HSAs) for persons with family coverage under a qualifying High Deductible Health Plan (HDHP) is restored to $6,900. The single-coverage limit of $3,450 is not affected.

This is the final word on what has been an unusual back-and-forth saga. The 2018 family limit of $6,900 had been announced in May 2017. Following passage of the Tax Cuts and Jobs Act in December 2017, however, the IRS was required to modify the methodology used in determining annual inflation-adjusted benefit limits. On March 5, 2018, the IRS announced the 2018 family limit was reduced by $50, retroactively, from $6,900 to $6,850. Since the 2018 tax year was already in progress, this small change was going to require HSA trustees and recordkeepers to implement not-so-small fixes to their systems. The IRS has listened to appeals from the industry, and now is providing relief by reinstating the original 2018 family limit of $6,900.

Employers that offer HSAs to their workers will receive information from their HSA administrator or trustee regarding any updates needed in their payroll files, systems, and employee communications. Note that some administrators had held off making changes after the IRS announcement in March, with the hopes that the IRS would change its position and restore the original limit. So employers will need to consider their specific case with their administrator to determine what steps are needed now.

HSA Summary

An HSA is a tax-exempt savings account employees can use to pay for qualified health expenses. To be eligible to contribute to an HSA, an employee:

- Must be covered by a qualified high deductible health plan (HDHP);

- Must not have any disqualifying health coverage (called “impermissible non-HDHP coverage”);

- Must not be enrolled in Medicare; and

- May not be claimed as a dependent on someone else’s tax return.

HSA 2018 Limits

Limits apply to HSAs based on whether an individual has self-only or family coverage under the qualifying HDHP.

2018 HSA contribution limit:

- Single: $3,450

- Family: $6,900

- Catch-up contributions for those age 55 and older remains at $1,000

2018 HDHP minimum deductible (not applicable to preventive services):

- Single: $1,350

- Family: $2,700

2018 HDHP maximum out-of-pocket limit:

- Single: $6,650

- Family: $13,300*

*If the HDHP is a nongrandfathered plan, a per-person limit of $7,350 also will apply due to the ACA’s cost-sharing provision for essential health benefits.

Originally posted on thinkHR.com

Grandmothers Can Visit a Little Longer

States that permit carriers to renew medical policies without adopting various Affordable Care Act (ACA) requirements may continue to do so through 2019, according to a bulletin released April 9, 2018, by the U.S. Department of Health and Human Services. The bulletin extends transitional relief for non-ACA-compliant policies for another year. The affected category of non-ACA-compliant policies, available in some individual and small group insurance markets, is commonly referred to as grandmothered.

States that permit carriers to renew medical policies without adopting various Affordable Care Act (ACA) requirements may continue to do so through 2019, according to a bulletin released April 9, 2018, by the U.S. Department of Health and Human Services. The bulletin extends transitional relief for non-ACA-compliant policies for another year. The affected category of non-ACA-compliant policies, available in some individual and small group insurance markets, is commonly referred to as grandmothered.

By way of background, the ACA imposes numerous requirements on health plans. Whether a specific requirement applies, however, depends in part on the type of plan – and grandfathers and grandmothers are not the same.

Grandfathers

First, a grandfathered health plan is one that was established no later than March 23, 2010, when the ACA was enacted. The plan can maintain grandfathered status indefinitely, as long as it does not make certain changes to reduce its benefits or increase the employee’s out-of-pocket costs. Basic ACA rules, such as coverage for children up to age 26 and prohibiting annual and lifetime dollar limits on essential health benefits, apply to all plans. A plan that maintains grandfathered status, however, is exempt from many other ACA rules, such as coverage mandates for preventive care, and small group market rules for essential health benefits and adjusted community rating.

Grandmothers

A grandmothered policy does not have grandfathered plan status. It is an individual or small group policy originally issued before 2014 that has been allowed to renew year after year in accordance with the state’s insurance laws. Grandmothering does not apply to policies issued in the large group market. Most states that permit grandmothering also limit small group policies to groups with up to 50 employees.

Depending on the specific state’s rules, a grandmothered policy may be exempt from various ACA rules that otherwise would have taken effect in 2014, such as required coverage for all categories of essential health benefits and adjusted community rating. Currently about 30 states allow some type of grandmothering for individual policies or small group policies, or both, but the details vary from state to state.

States that allow grandmothering may continue to do so for renewals through October 1, 2019, provided the policy ends by December 31, 2019. Note, however, that even if the state’s insurance laws allow grandmothering, carriers are not required to continue renewing non-ACA policies.

What This Means

In summary, state insurance laws continue to control the options, provisions, and requirements that apply to group policies issued in their state. (Self-funded plans are not subject to state insurance laws.) For information about your state’s current insurance laws, refer to a carrier or broker that is licensed to sell products in your state.

Originally posted on ThinkHR.com

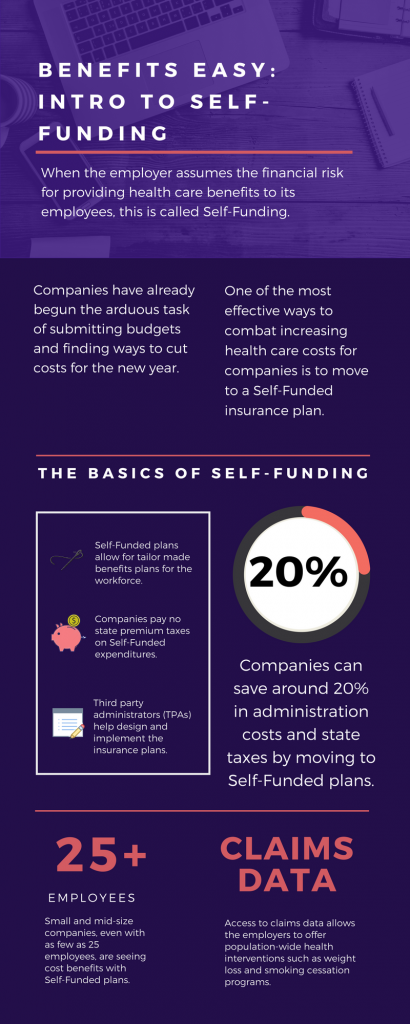

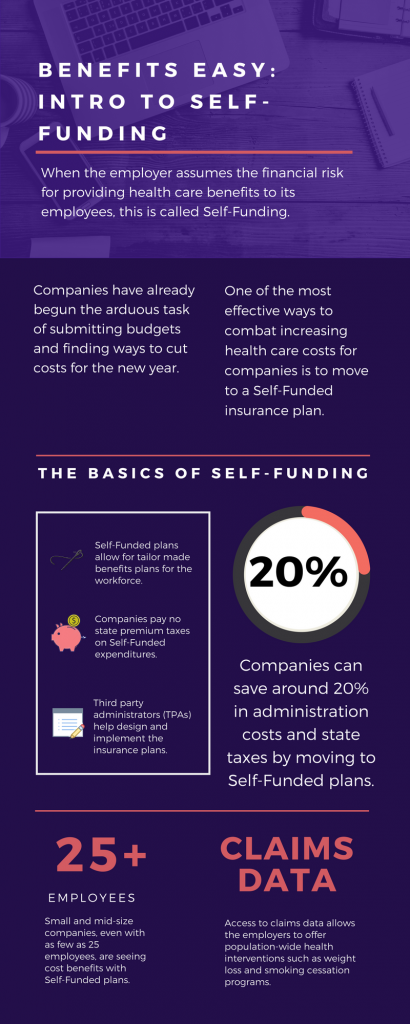

Benefits Easy: Intro to Self-Funding

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

The topic of Self-Funding is huge and so we want to break it down into smaller bites for you to digest. This month we want to tackle a basic introduction to Self-Funding and in the coming months, we will cover the benefits, risks, and the stop-loss associated with this type of plan.

THE BASICS

- When the employer assumes the financial risk for providing health care benefits to its employees, this is called Self-Funding.

- Self-Funded plans allow the employer to tailor the benefits plan design to best suit their employees. Employers can look at the demographics of their workforce and decide which benefits would be most utilized as well as cut benefits that are forecasted to be underutilized.

- While previously most used by large companies, small and mid-sized companies, even with as few as 25 employees, are seeing cost benefits to moving to Self-Funded insurance plans.

- Companies pay no state premium taxes on self-funded expenditures. This savings is around 1.5% – 3/5% depending on in which state the company operates.

- Since employers are paying for claims, they have access to claims data. While keeping within HIPAA privacy guidelines, the employer can identify and reach out to employees with certain at-risk conditions (diabetes, heart disease, stroke) and offer assistance with combating these health concerns. This also allows greater population-wide health intervention like weight loss programs and smoking cessation assistance.

- Companies typically hire third-party administrators (TPA) to help design and administer the insurance plans. This allows greater control of the plan benefits and claims payments for the company.

As you can see, Self-Funding has many facets. It’s important to gather as much information as you can and weigh the benefits and risks of moving from a Fully-Funded plan for your company to a Self-Funded one. Doing your research and making the move to a Self-Funded plan could help you gain greater control over your healthcare costs and allow you to design an original plan that best fits your employees.

Top 7 Trends from 2017 UBA Health Plan Survey

We recently unveiled the latest findings from our 2017 Health Plan Survey. With data on 20,099 health plans sponsored by 11,221 employers, the UBA survey is nearly three times larger than the next two of the nation’s largest health plan benchmarking surveys combined. Here are the top trends at a glance.

We recently unveiled the latest findings from our 2017 Health Plan Survey. With data on 20,099 health plans sponsored by 11,221 employers, the UBA survey is nearly three times larger than the next two of the nation’s largest health plan benchmarking surveys combined. Here are the top trends at a glance.

- Sustained prevalence of and enrollment in lower-cost consumer-driven health plans (CDHPs) and health maintenance organization (HMO) plans kept rates lower.

- For yet another year, “grandmothered” employers continue to have the options they need to select cheaper plans (ACA-compliant community-rated plans versus pre-ACA composite/health-rated plans) depending on the health status of their groups.

- Increased out-of-network deductibles and out-of-pocket maximums, with greater increases for single coverage rather than family coverage, as well as prescription drug cost shifting, are among the plan design changes influencing premiums.

- UBA Partners leveraged their bargaining power.

Overall costs continue to vary significantly by industry and geography

- Retail, construction, and hospitality employees cost the least to cover; government employees (the historical cost leader) continue to cost among the most.

- As in 2016, plans in the Northeast cost the most and plans in the Central U.S. cost the least.

- Retail and construction employees contribute above average to their plans, so those employers bear even less of the already low costs in these industries, while government employers pass on the least cost to employees despite having the richest plans.

Plan design changes strained employees financially

- Employee contributions are up, while employer contributions toward total costs remained nearly the same.

- Although copays are holding steady, out-of-network deductibles and out-of-pocket maximums are rising.

- Pharmacy benefits have even more tiers and coinsurance, shifting more prescription drug costs to employees.

PPOs, CDHPs have the biggest impact

- Preferred provider organization (PPO) plans cost more than average, but still dominate the market.

- Consumer-driven health plans (CDHPs) cost less than average and enrollment is increasing.

Wellness programs are on the rise despite increased regulations and scrutiny

Metal levels drive plan decisions

- Most plans are at the gold or platinum metal level reflecting employers’ desire to keep coverage high. In the future, we expect this to change since it will be more difficult to meet the ACA metal level requirements and still keep rates in check.

Key trends to watch

- Slow, but steady: increase in self-funding, particularly for small groups.

- Cautious trend: increased CDHP prevalence/enrollment.

- Rapidly emerging: increase of five-tier and six-tier prescription drug plans.

By Bill Olson

Originally posted by www.UBABenefits.com