by admin | Sep 15, 2017 | COBRA, ERISA, Group Benefit Plans

The DOL issued guidance for employee benefit plans, plan sponsors, and employers located in a county identified for individual assistance by the Federal Emergency Management Agency (FEMA) due to Hurricane Harvey.

The DOL issued guidance for employee benefit plans, plan sponsors, and employers located in a county identified for individual assistance by the Federal Emergency Management Agency (FEMA) due to Hurricane Harvey.

Because plan participants and beneficiaries may have difficulty meeting deadlines for filing ERISA benefit claims and making COBRA elections, the DOL advised plan sponsors to “act reasonably, prudently, and in the interest of the workers and their families who rely on their health plans for their physical and economic well-being. Plan fiduciaries should make reasonable accommodations to prevent the loss of benefits in such cases and should take steps to minimize the possibility of individuals losing benefits because of a failure to comply with pre-established timeframes.”

The DOL acknowledged that group health plans may not be able to timely and fully comply with deadlines due to a physical disruption to a plan’s principal place of business. The DOL’s enforcement approach will emphasize compliance assistance, including grace periods and other relief as appropriate.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Sep 8, 2017 | Flexible Spending Accounts, Human Resources

A dependent care flexible spending account (DCFSA) is a pre-tax benefit account used to pay for eligible dependent care services. The IRS determines which expenses are eligible for reimbursement and these expenses are defined by Internal Revenue Code §129 and the employer’s plan. Eligible DCFSA expenses include: adult day care center, before/after school programs, child care, nanny, preschool, and summer day camp. Day nursing care, nursing home care, tuition for kindergarten and above, food expenses, and overnight camp are ineligible expenses.

A dependent care flexible spending account (DCFSA) is a pre-tax benefit account used to pay for eligible dependent care services. The IRS determines which expenses are eligible for reimbursement and these expenses are defined by Internal Revenue Code §129 and the employer’s plan. Eligible DCFSA expenses include: adult day care center, before/after school programs, child care, nanny, preschool, and summer day camp. Day nursing care, nursing home care, tuition for kindergarten and above, food expenses, and overnight camp are ineligible expenses.

Qualifying Individuals

Only qualifying individuals are eligible for dependent care expenses. A qualifying individual is an individual who spends at least eight hours in the participant’s home.

Dependent care includes care for a child who is under the age of 13 and in the participant’s custody for more than half the year. Dependent care also includes care for a spouse or relative who is physically or mentally incapable of self-care and lives in the participant’s home.

If parents are divorced, then the child is a qualified dependent of the custodial parent. A non-custodial parent cannot be reimbursed under a DCFSA even if the parent claims the child as a tax dependent.

Contributing to a DCFSA

The election is the participant’s contribution amount, which is the amount the participant puts into a DCFSA at enrollment. Participants may change the amount of money to be withheld within a 31-day window after a qualifying event, such as marriage, birth or adoption of a child, dependent death, divorce, or change in employment. Participants may enroll in or renew their election in a DCFSA during open enrollment. Participation is not automatic. Participants must re-enroll every year by the enrollment date.

The employer determines the minimum election amount and the IRS determines the maximum election amount. The IRS sets the following annual contribution limits for a DCFSA:

- $2,500 per year for a married employee who files a separate tax return

- $5,000 per year for a married employee who files a joint tax return

- $5,000 per year for the head of household

- $5,000 per year for a single employee

Even though a different maximum contribution limit may apply depending on the employer’s plan, the maximum contribution cannot exceed the following earned income limitations:

- If you are single, the earned income limit is your salary, excluding contributions to your DCFSA.

- If you are married, the earned income limit is the lesser of: your salary, excluding contributions to your DCFSA, or your spouse’s salary.

All DCFSA contributions are subject to IRS use-it-or-lose-it rules, which means that unused funds within the plan year will be forfeited to the employer unless the employer’s plan offers a grace period extension. Some plans include a two-and-a-half-month grace period.

Participants must report their DCFSA contributions on their federal tax return along with the name, address, and Social Security number (if applicable) of the dependent care service provider.

Reimbursement Requests

A valid DCFSA claim will either have the dependent care provider certify the service by signing the claim form or have the participant provide an itemized statement from the dependent care provider that includes the following: service dates, dependent’s name, type of service, amount billed, and the provider’s name and address along with a completed claim form.

Participants should save supporting documentation related to their DCFSA expenses and claims because the IRS may request itemized receipts to verify the eligibility of their expenses.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Aug 31, 2017 | Benefit Management, Flexible Spending Accounts

A health flexible spending account (FSA) is a pre-tax account used to pay for out-of-pocket health care costs for a participant as well as a participant’s spouse and eligible dependents. Health FSAs are employer-established benefit plans and may be offered with other employer-provided benefits as part of a cafeteria plan. Self-employed individuals are not eligible for FSAs.

Even though a health FSA may be extended to any employee, employers should design their health FSAs so that participation is offered only to employees who are eligible to participate in the employer’s major medical plan. Generally, health FSAs must qualify as excepted benefits, which means other nonexcepted group health plan coverage must be available to the health FSA’s participants for the year through their employment. If a health FSA fails to qualify as an excepted benefit, then this could result in excise taxes of $100 per participant per day or other penalties.

Contributing to an FSA

Money is set aside from the employee’s paycheck before taxes are taken out and the employee may use the money to pay for eligible health care expenses during the plan year. The employer owns the account, but the employee contributes to the account and decides which medical expenses to pay with it.

At the beginning of the plan year, a participant must designate how much to contribute so the employer can deduct an amount every pay day in accordance with the annual election. A participant may contribute with a salary reduction agreement, which is a participant election to have an amount voluntarily withheld by the employer. A participant may change or revoke an election only if there is a change in employment or family status that is specified by the plan.

Per the Patient Protection and Affordable Care Act (ACA), FSAs are capped at $2,600 per year per employee. However, since a plan may have a lower annual limit threshold, employees are encouraged to review their Summary Plan Description (SPD) to find out the annual limit of their plan. A participant’s spouse can put $2,600 in an FSA with the spouse’s own employer. This applies even if both spouses participate in the same health FSA plan sponsored by the same employer.

Generally, employees must use the money in an FSA within the plan year or they lose the money left in the FSA account. However, employers may offer either a grace period of up to two and a half months following the plan year to use the money in the FSA account or allow a carryover of up to $500 per year to use in the following year.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Aug 29, 2017 | ACA, Health Plan Benchmarking

Small employers, those with fewer than 100 employees, have a reputation for not offering health insurance benefits that are competitive with larger employers, but new survey data from UBA’s Health Plan Survey reveals they are keeping pace with the average employer and, in fact, doing a better job of containing costs.

Small employers, those with fewer than 100 employees, have a reputation for not offering health insurance benefits that are competitive with larger employers, but new survey data from UBA’s Health Plan Survey reveals they are keeping pace with the average employer and, in fact, doing a better job of containing costs.

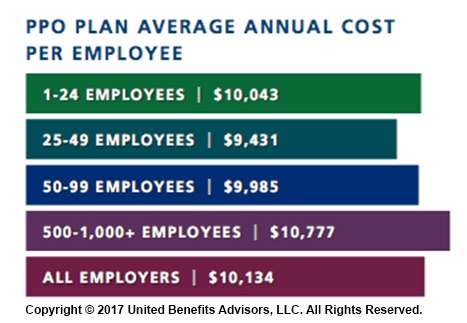

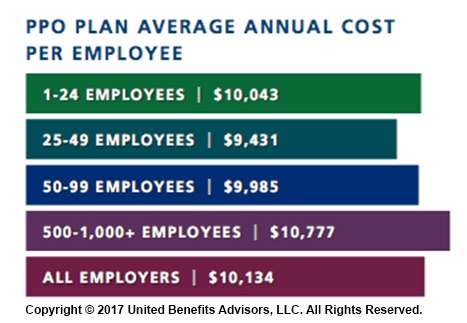

According to our new special report: “Small Businesses Keeping Pace with Nationwide Health Trends,” employees across all plan types pay an average of $3,378 toward annual health insurance benefits, with their employer picking up the rest of the total cost of $9,727. Among small groups, employees pay $3,557, with their employer picking up the balance of $9,474 – only a 5.3 percent difference.

When looking at total average annual cost per employees for PPO plans, small businesses actually cut a better deal even compared to their largest counterparts—their costs are generally below average—and the same holds true for small businesses offering HMO and CDHP plans. (Keep in mind that relief such as grandmothering and the PACE Act helped many of these small groups stay in pre-ACA plans at better rates, unlike their larger counterparts.)

Think small businesses are cutting coverage to drive these bargains? Compared to the nations very largest groups, that may be true, but compared to average employers, small groups are highly competitive.

By Bill Olson

Originally Published By United Benefit Advisors

by admin | Aug 24, 2017 | Benefit Management, COBRA, Compliance

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) allows qualified beneficiaries who lose health benefits due to a qualifying event to continue group health benefits. The COBRA payment process is subject to various rules in terms of grace periods, notification, premium payment methods, and treatment of insignificant shortfalls.

Grace Periods

The initial premium payment is due 45 days after the qualified beneficiary elects COBRA. Premium payments must be made on time; otherwise, a plan may terminate COBRA coverage. Generally, subsequent premium payments are due on the first day of the month. However, under the COBRA grace period rules, premiums will still be considered timely if made within 30 days after the due date. The statutory grace period is a minimum 30-day period, but plans may allow qualified beneficiaries a longer grace period.

A COBRA premium payment is made when it is sent to the plan. Thus, if the qualified beneficiary mails a check, then the payment is made on the date the check was mailed. The plan administrators should look at the postmark date on the envelope to determine whether the payment was made on time. Qualified beneficiaries may use certified mail as evidence that the payment was made on time.

The 30-day grace period applies to subsequent premium payments and not to the initial premium payment. After the initial payment is made, the first 30-day grace period runs from the payment due date and not from the last day of the 45-day initial payment period.

If a COBRA payment has not been paid on its due date and a follow-up billing statement is sent with a new due date, then the plan risks establishing a new 30-day grace period that would begin from the new due date.

Notification

The plan administrator must notify the qualified beneficiary of the COBRA premium payment obligations in terms of how much to pay and when payments are due; however, the plan does not have to renotify the qualified beneficiary to make timely payments. Even though plans are not required to send billing statements each month, many plans send reminder statements to the qualified beneficiaries.

While the only requirement for plan administrators is to send an election notice detailing the plan’s premium deadlines, there are three circumstances under which written notices about COBRA premiums are necessary. First, if the COBRA premium changes, the plan administrator must notify the qualified beneficiary of the change. Second, if the qualified beneficiary made an insignificant shortfall premium payment, the plan administrator must provide notice of the insignificant shortfall unless the plan administrator chooses to ignore it. Last, if a plan administrator terminates a qualified beneficiary’s COBRA coverage for nonpayment or late payment, the plan administrator must provide a termination notice to the qualified beneficiary.

The plan administrator is not required to inform the qualified beneficiary when the premium payment is late. Thus, if a plan administrator does not receive a premium payment by the end of the grace period, then COBRA coverage may be terminated. The plan administrator is not required to send a notice of termination in that case because the COBRA coverage was not in effect. On the other hand, if the qualified beneficiary makes the initial COBRA premium payment and coverage is lost for failure to pay within the 30-day grace period, then the plan administrator must provide a notice of termination due to early termination of COBRA coverage.

By Danielle Capilla

Originally Published By United Benefit Advisors

The DOL issued guidance for employee benefit plans, plan sponsors, and employers located in a county identified for individual assistance by the Federal Emergency Management Agency (FEMA) due to Hurricane Harvey.

The DOL issued guidance for employee benefit plans, plan sponsors, and employers located in a county identified for individual assistance by the Federal Emergency Management Agency (FEMA) due to Hurricane Harvey.