by admin | Feb 22, 2017 | Hot Topics, Human Resources

In January 2017, an NBC news investigation found that an “epidemic” of opioid abuse had helped turn the once-prosperous city of Wilkes Barre, Pennsylvania, into “the most unhappy place in America.” Working in the epicenter of the “scourge” that had resulted in 137 fatal overdoses in a county of only 318,000 people in 2016, the coroner reported that opioid addiction was “eating away at the core of society.”1 Although an extreme example, Wilkes Barre’s unhappy experience is being repeated in communities throughout the United States, resulting in problems that you probably recognize—and a few that you may not be aware of.

One widely recognized effect of the opioid use epidemic is its cost. Nationwide, the total economic burden of opioid abuse is estimated at approximately $78.5 billion annually, of which approximately $29 billion represent increased health care costs and substance abuse treatment.2 On average, commercial insurers spend more than $40 per member per year (PMPY) on narcotic painkillers today, compared with $22 PMPY about a decade ago.3 Medical costs are affected as well. Among opioid-treated employees on workers’ compensation or short-term disability for a work-related injury, health care costs for addicts exceed those of non-addicts by about $10,000 annually.4 And costs may creep up in unforeseen ways. For example, the cost of one auto-injector that “talks” users through the process of administering life-saving naloxone, an emergency treatment for opioid overdose, has increased six-fold in the past two years, from $690 to $4,500 for a pack of two.5

A related effect is threat to safety. From 1993 to 2010, the number of emergency department visits for drug overdose approximately tripled, from seven to 27 per 100,000 population.6 Although less commonly discussed, combining opioids and benzodiazepines (e.g., alprazolam, clonazepam) is particularly dangerous and increasingly common. From 2004 to 2011, emergency department visits and deaths involving this combination approximately tripled in volume.7 Less commonly discussed among benefits managers, but well known to law enforcement, is use of drugs by persons to whom they were not prescribed, known as “diversion,” often by theft.8-10 Additionally, people who use prescription opioids that become addicted, and can no longer afford them, commonly turn to heroin.9 All of these problems diminish both the well-being and productivity of employees, as well as quality of life in surrounding communities.

How can an employer address these critically important problems? Here are some tips to help you get started.

Measure, intervene, monitor. As with any benefits issue, the critically important first step is to determine the extent of the problem. Employers may analyze their own data or may choose to request the necessary reports from a pharmacy benefits manager (PBM) or vendor. In addition to standard measures, such as PMPY claims and expenditures, morphine-milligram equivalents (MMEs) are an important metric. MMEs translate the dosages for all opioid products into a morphine-equivalent value, making it easy to identify abusing enrollees using cut-offs provided by the U.S. Centers for Disease Control and Prevention (CDC).11 For example, 40 milligrams of oxycodone daily, times the MME multiplier of 1.5 for that drug, translates to 60 MMEs per day, which exceeds the 50 MME per day standard at which the risk of overdose is more than doubled.11 To obtain the MME calculators, visit the CDC website.

Employers may wish to consider interventions, such as those that have been employed successfully by some payers and PBMs, with enrollees exceeding CDC MME standards.12-14 If possible, use of integrated medical-pharmacy data in making these assessments is highly recommended to avoid applying MME standards to patients for whom high daily doses of opioids may be medically necessary, such as those in hospice care.

After implementing any initiatives, monitor results and, when necessary, make adjustments to metrics and algorithms so that the intended objectives are achieved.

Consider quantity education and limits. Although the causes of opioid abuse are multifaceted, experts agree that a key factor is opioid oversupply, often because excessive quantities are prescribed for minor surgeries.15-17 Unused medication often sits for long periods of time in medicine cabinets, becoming a prime target for theft.16 Employers may wish to educate prescribers about prudent quantity limits for relief of pain that is expected to be short-term (e.g., wisdom tooth removal for older adolescents). Additionally, limits on quantity dispensed per claim, especially for a first opioid prescription, are a common-sense step.

Tell employees about “take-back” initiatives. Many communities offer “take-back” programs, which allow for the return of unused controlled substances on a “no-questions asked” basis. Monitoring and publishing the dates of these programs may help employees safely dispose of drug supply that may put them and others at risk.

Don’t forget other controlled substances, especially benzodiazepines and stimulants. These drugs also pose risks and are subject to abuse.

References

1 Siemaszko C. Wilkes Barre faces heroin scourge turning it into “the most unhappy place in America.” NBC News. January 9, 2017.

2 Florence CS, Zhou C, Luo F, Xu L. The economic burden of prescription opioid overdose, abuse, and dependence in the United States, 2013. Med Care. 2016;54(10):901-906.

3 Express Scripts drug trend reports: 2015 and 2006.

4 Johnston SS, Alexander AH, Masters ET, et al. Costs and work loss burden of diagnosed opioid abuse among employees on workers compensation or short-term disability. J Occup Environ Med. 2016;58(11):1087-1097.

5 Luthra S. Getting patients hooked on an opioid overdose antidote, then raising the price. Kaiser Health News. January 30, 2017.

6 Hasegawa K, Espinola JA, Brown DF, Camargo CA Jr. Trends in U.S. emergency department visits for opioid overdose, 1993-2010. Pain Med. 2014;15(10):1765-1770.

7 Jones CM, McAninch JK. Emergency department visits and overdose deaths from combined use of opioids and benzodiazepines. Am J Prev Med. 2015;49(4):493-501.

8 Lawrence J. Opioid abuse fuels Capital Region thefts. Times Union. March 19, 2016.

9 Goslee K. Faces of the opioid crisis: police say increased heroin use impacts the entire community. Fox 61. November 17, 2016.

10 Canham M. Feds probe massive theft of opioids from Salt Lake City’s VA hospital. Salt Lake Tribune. March 8, 2016.

12 Aetna. Aetna study shows decrease in prescription drug misuse, waste and abuse through increased monitoring. March 8, 2013.

13 Prime Therapeutics. Prime Therapeutics releases studies on efforts to reduce opioid abuse, misuse. April 19, 2016.

14 Kelly LF. PBMs use new CMS opioid overutilization initiative to strengthen DUR programs. Drug Benefit News. October 11, 2013.

15 Dryden J. Doctors recommend prescribing fewer opioids after surgery. theSource. April 27, 2016.

16 Bates C, Laciak R, Southwick A, Bishoff J. Overprescription of postoperative narcotics: a look at postoperative pain medication delivery, consumption and disposal in urological practice. J Urol. 2011;185:551-555.

17 Kirschner N, Ginsburg J, Sulmasy LS, et al. Prescription drug abuse: executive summary of a policy position paper from the American College of Physicians. Ann Intern Med. 2014;160(3):198.

By Corey Belken, Originally Published By United Benefit Advisors

by admin | Feb 20, 2017 | Group Benefit Plans, Health Plan Benchmarking

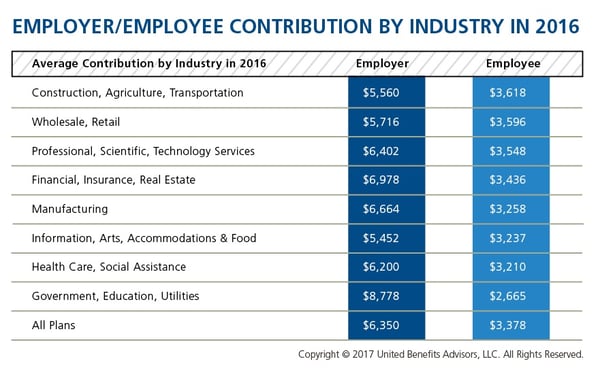

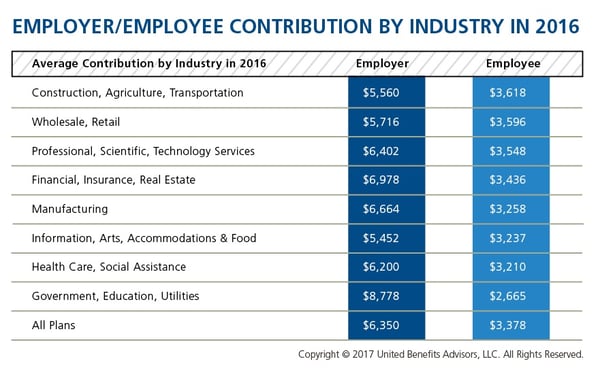

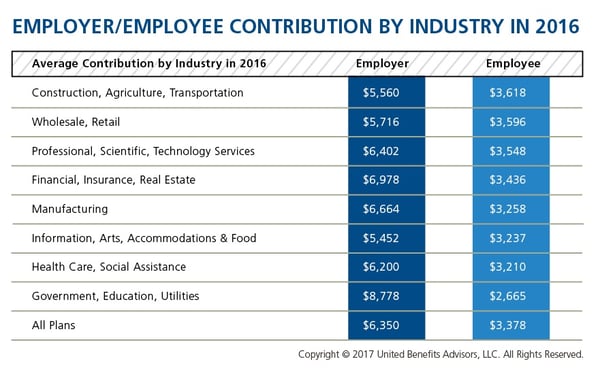

We recently shared healthcare cost benchmarking best practices and reported on the best and worst industries/states for group healthcare. But how much are you contributing toward healthcare costs vs. your employees? That’s a key benchmark, especially when “cost-shifting” is the main strategy for mitigating risk for employers. You may have the most affordable plan, but if you are passing most of that cost on to your employees, you may not be a competitive employer.

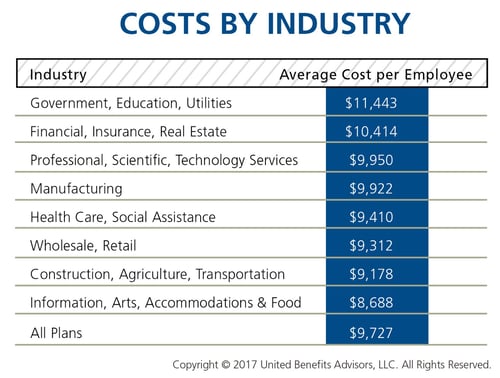

According to the latest UBA Health Plan Survey, total costs per employee for the retail, construction, and hospitality sectors are 4.3 percent to 11.3 percent lower than average, making employees in these industries among the least expensive to cover. But employees in the retail and construction sectors pay 6.3 percent and 6.8 percent above the average employee contribution, respectively (hospitality employees pay slightly below the average employee contribution).

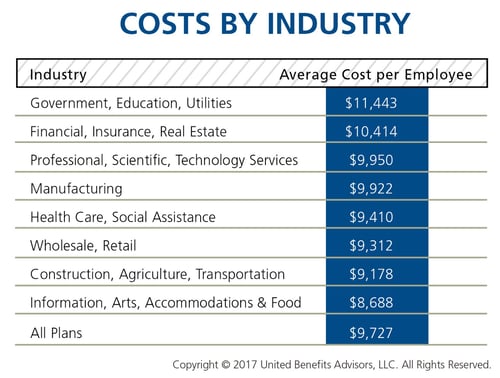

On the other end of the cost spectrum, the government sector has the priciest plans ($11,443 per employee) and passes on the least cost to employees, whose average contributions are more than 23 percent less than average. (Surprisingly, these employees are experiencing sticker shock this year since they’ve seen a 26.6 percent increase in their contributions, which were 45.2 percent below average last year.)

When employees’ out of pocket costs are rising, carefully considering and benchmarking their contributions toward the total cost is important—and not nationally, but compared to your peers. Here’s a look at all the average employer/employee contributions by industry:

By RJ Nelson, Originally Published By United Benefit Advisors

by admin | Feb 16, 2017 | Compliance, Employee Benefits, Hot Topics, Human Resources

Recently, the Department of Labor (DOL), Department of Health and Human Services (HHS), and the Treasury (collectively, the Departments) issued FAQs About Affordable Care Act Implementation Part 35. The FAQ covers a new HIPAA special enrollment period, an update on women’s preventive services that must be covered, and clarifying information on qualifying small employer health reimbursement arrangements (QSE HRAs).

Recently, the Department of Labor (DOL), Department of Health and Human Services (HHS), and the Treasury (collectively, the Departments) issued FAQs About Affordable Care Act Implementation Part 35. The FAQ covers a new HIPAA special enrollment period, an update on women’s preventive services that must be covered, and clarifying information on qualifying small employer health reimbursement arrangements (QSE HRAs).

HIPAA Special Enrollment Period

Under HIPAA, if an individual loses eligibility for coverage in the individual market, then that individual is entitled to special enrollment in group health plan coverage.

The coverage eligibility loss may include coverage purchased through a Marketplace (other than coverage eligibility loss due to failure to pay premiums on a timely basis or termination of coverage for cause, such as making a fraudulent claim or an intentional misrepresentation of material fact). Further, the individual is entitled to special enrollment in group health plan coverage for which the individual is otherwise eligible, regardless of whether the individual may enroll in other individual market coverage, through or outside of a Marketplace.

To be clear, if an individual has Marketplace coverage and the carrier is discontinuing the plan, the discontinuation event is not a loss of eligibility for coverage; in this case, the individual is not entitled to a special enrollment period.

Women’s Preventive Services

The Health Resources and Services Administration (HRSA) updated its Women’s Preventive Services Guidelines on December 20, 2016, to recommend preventive services and items.

Non-grandfathered group health plans and health insurance issuers must cover, without cost sharing, women’s preventive services consistent with the updated guidelines for plan years beginning on or after December 20, 2017. Until that date, non-grandfathered group health plans and health insurance issuers are required to provide coverage without cost sharing consistent with the previous HRSA guidelines and the Public Health Services Act for recommended services and items.

Generally, under the HRSA guidelines and other federal laws, group health plans established or maintained by religious employers (and group health insurance coverage provided with these plans) are exempt from the requirement to cover contraceptive services.

Qualified Small Employer Health Reimbursement Arrangements

On December 13, 2016, the 21st Century Cures Act (Cures Act) introduced a new type of tax-preferred arrangement called the Qualified Small Employer Health Reimbursement Arrangement (QSE HRA) that small employers may use to help their employees pay for medical expenses.

Under the Cures Act, the QSE HRA is not a group health plan. A QSE HRA is an arrangement offered by an eligible employer that meets the following criteria:

- The arrangement is funded solely by an eligible employer, and no salary reduction contributions may be made under the arrangement.

- The arrangement provides, after the employee provides proof of coverage for the payment to, or reimbursement of, an eligible employee for medical care expenses incurred by the employee or the employee’s family members (as determined under the terms of the arrangement).

- The amount of annual payments and reimbursements do not exceed $4,950 ($10,000 for family) with amounts to be indexed for increases in cost of living.

- The arrangement is provided on the same terms to all eligible employees of the eligible employer.

To be an eligible employer that may offer a QSE HRA, the employer may not be an applicable large employer (ALE) and may not offer a group health plan to any of its employees.

The Departments’ prior guidance concluded that employer payment plans (EPPs) and non-integrated health reimbursement arrangements (HRAs) are group health plans that fail to comply with the group market reform requirements that prohibit annual dollar limits and that require the provision of certain preventive services without cost sharing.

Because a QSE HRA is statutorily excluded from the definition of a group health plan, the group market reform requirements do not apply to a QSE HRA. With respect to EPPs and HRAs that do not qualify as QSE HRAs, the Departments’ prior guidance continues to apply.

The statutory exclusion of QSE HRAs from the group health plan definition is effective for plan years beginning after December 31, 2016. With respect to plan years beginning on or before December 31, 2016, the Cures Act provides that the relief under IRS Notice 2015-17 applies.

Under the extension provided by the Cures Act, for plan years beginning on or before December 31, 2016, the tax penalty will not be asserted for any failure to satisfy the market reforms by EPPs that pay, or reimburse employees for, individual health policy premiums or Medicare Part B or Part D premiums, with respect to employers otherwise eligible for the relief under Notice 2015-17. These employers are not required to file IRS Form 8928 solely because they had such an arrangement for the plan years beginning on or before December 31, 2016.

The Cures Act’s extension of the relief is limited to EPPs and does not extend to stand-alone HRAs or other arrangements to reimburse employees for medical expenses other than insurance premiums. Also, as an employer-provided group health plan, coverage by an HRA or EPP that is not a QSE HRA and that is eligible for the extended relief under the Cures Act would be minimum essential coverage. This means that a taxpayer would not be allowed a premium tax credit for the Marketplace coverage of an employee, or an individual related to the employee, who is covered by an HRA or EPP other than a QSE HRA.

Practically speaking, the Departments’ prior regulations and guidance continue to apply to EPPs and HRAs that do not qualify as QSE HRAs, including arrangements offered by employers that are not eligible employers as defined under the Cures Act, such as ALEs.

By Danielle Capilla, Originally Published By UBA

by admin | Feb 2, 2017 | Compliance, Hot Topics, Human Resources

Recently, the Equal Employment Opportunity Commission (EEOC) issued new guidance on national origin discrimination. National origin discrimination is discrimination because an individual is, or the individual’s ancestors are, from a certain place or has the physical, cultural, or linguistic characteristics of a particular national origin group, including Native American tribes. A member of one national origin group can discriminate against a member of the same group. While many of the previous rules and regulations remain intact, new protections have been added.

Recently, the Equal Employment Opportunity Commission (EEOC) issued new guidance on national origin discrimination. National origin discrimination is discrimination because an individual is, or the individual’s ancestors are, from a certain place or has the physical, cultural, or linguistic characteristics of a particular national origin group, including Native American tribes. A member of one national origin group can discriminate against a member of the same group. While many of the previous rules and regulations remain intact, new protections have been added.

One of the key changes is the addition of perceived national origin to the definition. Title VII of the Civil Rights Act of 1964 prohibits employment discrimination based on the belief that an individual is (or the individual’s ancestors are) from one or more particular countries, or belongs to one or more particular national origin groups. The EEOC’s example describes discrimination against someone who is perceived to be from the Middle East, regardless of whether he or she is from the Middle East or ethnically Arab. It is also unlawful to discriminate based on association; for example, you cannot discriminate against an employee because the employee is married to, friends with, or has a child with someone of a different national origin or ethnicity.

Language issues are also emphasized in the new guidance. Specifically, business necessity and material impact on job performance are the only legitimate reasons for basing employment decisions on linguistic characteristics, such as accents. Applying uniform fluency requirements to a broad range of jobs or requiring a greater level of fluency than necessary may result in a violation of Title VII. The EEOC’s long-standing English-only guidelines, issued in 1980, provide that rules requiring employees to speak English in the workplace at all times are presumed to violate Title VII.

Title VII applies to all employment decisions, including those involving:

- Recruitment

- Hiring

- Promotion

- Work assignments

- Segregation and classification

- Transfer

- Wages and benefits

- Leave

- Training and apprenticeship programs

- Discipline

- Layoff and termination

- Other terms and conditions of employment

The new EEOC guidance reinforces and clarifies standing obligations of employers who may be in violation of Title VII if they implement discriminatory practices based on customer, client, or employee preferences. This includes but is not limited to:

- Segregation of employees by protected class, such as one ethnic group working in back rooms while others are customer-facing.

- Failure by employers to take steps to protect employees who are harassed by customers based on the employees’ national origin.

- Failure to take advantage of preventive or corrective opportunities when a supervisor or employees engage in discrimination.

- An employer may also be jointly liable with staffing firms that provide workers if the employer knowingly ignores discriminatory practices. Human trafficking that includes employer misconduct has been added to the definition of unlawful harassment.

The guidance includes “promising practices” for employers that are meant to reduce the risk of Title VII violations. This includes:

- Avoiding word-of-mouth recruitment to attract a diverse applicant pool.

- Establishing written criteria for hiring and promotion and applying the standards consistently.

- Offering training in the languages spoken by employees.

- Developing objective, job-related criteria for identifying the unsatisfactory performance or conduct that can result in discipline, demotion, or discharge.

- Clearly communicating to employees through policies and actions that harassment will not be tolerated and that employees who violate the prohibition against harassment will be disciplined.

Employers should keep in mind that national origin discrimination is often intersectional; individuals can be members of two or more protected classes, such as race, national origin, and sex. Intersectionality can add complexity to discrimination claims.

On the heels of an acrimonious election that has frequently placed national origin in the spotlight, employers should revisit workplace practices, including talent acquisition policies, training and development protocols, anti-harassment training, and complaint resolution practices.

By Nancy Bourque, Originally Published By United Benefit Advisors

by admin | Jan 31, 2017 | Health Plan Benchmarking

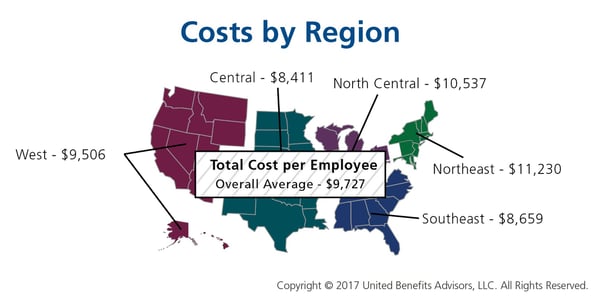

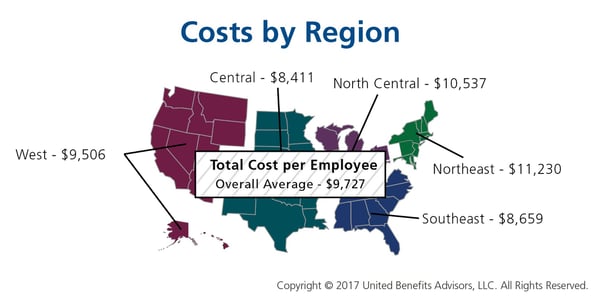

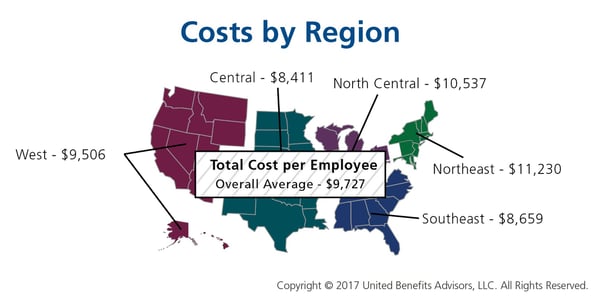

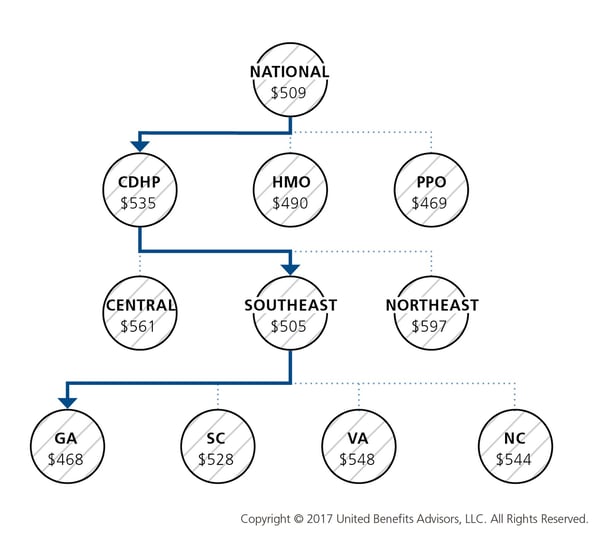

Many employers benchmark their health plan against carrier provided national data. While that is a good place to start, regional cost averages vary, making it essential to benchmark both nationally and regionally—as well as state by state. For example, a significant difference exists between the cost to insure an employee in the Northeast versus the Central U.S.—plans in the Northeast continue to cost the most since they typically have lower deductibles, contain more state-mandated benefits, and feature higher in-network coinsurance, among other factors.

Drilling down even more, comparing yourself to your industry peers can tell a very different story.

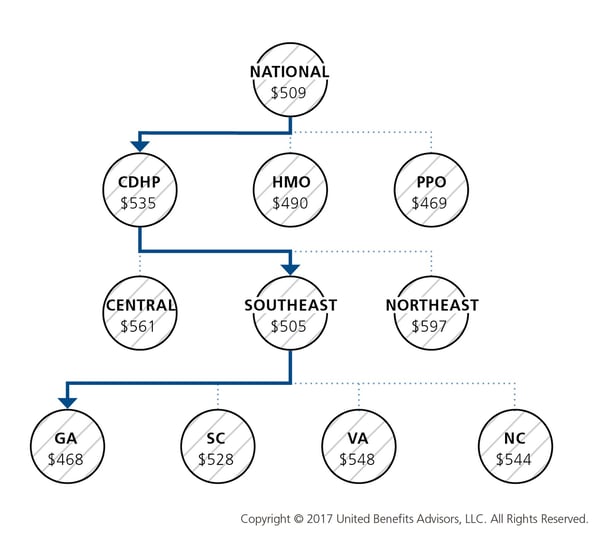

Consider a manufacturing plant in Georgia that offers a PPO. Its premium cost for single coverage is $507 per month. Compare this with the benchmarks for all plans and you can see that it is $2 per month less than the national average. When compared with other PPOs in the Southeast region, this employer’s cost is actually $2 more than the average. This employer’s cost appears to be higher or lower compared with national and regional benchmarks, depending on which benchmark is used. Yet this employer’s cost is actually higher than its closest peers’ costs when using the state-specific benchmark, which in Georgia is $468. Bottom line, this employer’s monthly single premium is actually $39 more than its competitors in the state.

As our CEO, Les McPhearson, recently stated, “Benchmarking by state, region, industry, and group size is critical. We see it time and time again, especially with new clients. An employer benchmarks their rates nationally and they seem at or below average, but once we look at their rates by plan type across multiple carriers and among their neighboring competitors or like-size groups, we find many employers leave a lot on the bargaining table.”

By RJ Nelson, Originally Published By United Benefit Advisors