by admin | Dec 15, 2017 | Group Benefit Plans, Health Plan Benchmarking

When most experts think of group healthcare plans, Preferred Provider Organization (PPO) plans largely come to mind—though higher cost, they dominate the market in terms of plan distribution and employee enrollment. But Consumer-Directed Health Plans (CDHPs) have made surprising gains. Despite slight cost increases, CDHP costs are still below average and prevalence and enrollment in these plans continues to grow in most regions—a main reason why it was one of the top 7 survey trends recently announced.

When most experts think of group healthcare plans, Preferred Provider Organization (PPO) plans largely come to mind—though higher cost, they dominate the market in terms of plan distribution and employee enrollment. But Consumer-Directed Health Plans (CDHPs) have made surprising gains. Despite slight cost increases, CDHP costs are still below average and prevalence and enrollment in these plans continues to grow in most regions—a main reason why it was one of the top 7 survey trends recently announced.

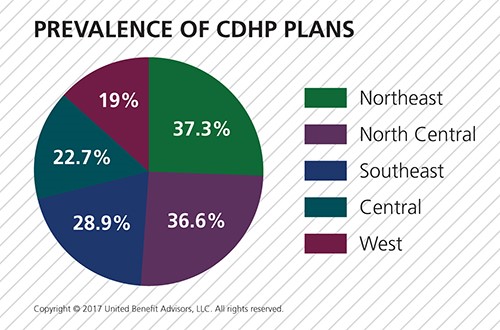

In 2017, 28.6% of all plans are CDHPs. Regionally, CDHPs account for the following percentage of plans offered:

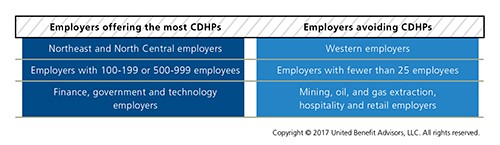

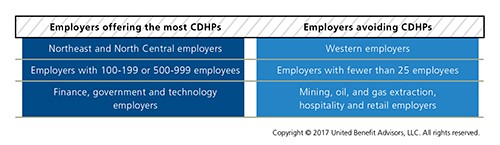

CDHPs have increased in prevalence in all regions except the West. The North Central U.S. saw the greatest increase (13.2%) in the number of CDHPs offered. Looking at size and industry variables, several groups are flocking to CDHPs:

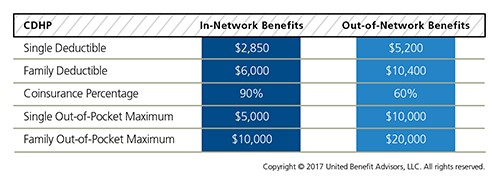

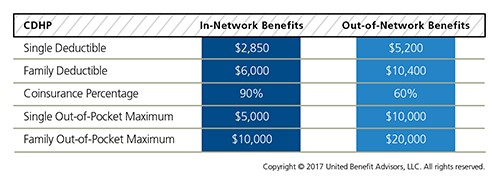

When it comes to enrollment, 31.5% of employees enroll in CDHP plans overall, an increase of 19.3% from 2016, after last year’s stunning increase of 21.7% from 2015. CDHPs see the most enrollment in the North Central U.S. at 46.3%, an increase of 40.7% over 2016. For yet another year in the Northeast, CDHP prevalence and enrollment are nearly equal; CDHP prevalence doesn’t always directly correlate to the number of employees who choose to enroll in them. Though the West held steady in the number of CDHPs offered, there was a 2.6% decrease in the number of employees enrolled. The 12.6% increase in CDHP prevalence in the North Central U.S. garnered a large 40.7% increase in enrollment. CDHP interest among employers isn’t surprising given these plans are less costly than the average plan. But like all cost benchmarks, plan design plays a major part in understanding value. The UBA survey finds the average CDHP benefits are as follows:

By Bill Olson

Originally Published By United Benefit Advisors

by admin | Nov 17, 2017 | Benefit Management, Health Plan Benchmarking, Johnson & Dugan News

We recently unveiled the latest findings from our 2017 Health Plan Survey. With data on 20,099 health plans sponsored by 11,221 employers, the UBA survey is nearly three times larger than the next two of the nation’s largest health plan benchmarking surveys combined. Here are the top trends at a glance.

We recently unveiled the latest findings from our 2017 Health Plan Survey. With data on 20,099 health plans sponsored by 11,221 employers, the UBA survey is nearly three times larger than the next two of the nation’s largest health plan benchmarking surveys combined. Here are the top trends at a glance.

Cost-shifting, plan changes, and other protections influenced rates

- Sustained prevalence of and enrollment in lower-cost consumer-driven health plans (CDHPs) and health maintenance organization (HMO) plans kept rates lower.

- For yet another year, “grandmothered” employers continue to have the options they need to select cheaper plans (ACA-compliant community-rated plans versus pre-ACA composite/health-rated plans) depending on the health status of their groups.

- Increased out-of-network deductibles and out-of-pocket maximums, with greater increases for single coverage rather than family coverage, as well as prescription drug cost shifting, are among the plan design changes influencing premiums.

- UBA Partners leveraged their bargaining power.

Overall costs continue to vary significantly by industry and geography

- Retail, construction, and hospitality employees cost the least to cover; government employees (the historical cost leader) continue to cost among the most.

- As in 2016, plans in the Northeast cost the most and plans in the Central U.S. cost the least.

- Retail and construction employees contribute above average to their plans, so those employers bear even less of the already low costs in these industries, while government employers pass on the least cost to employees despite having the richest plans.

Plan design changes strained employees financially

- Employee contributions are up, while employer contributions toward total costs remained nearly the same.

- Although copays are holding steady, out-of-network deductibles and out-of-pocket maximums are rising.

- Pharmacy benefits have even more tiers and coinsurance, shifting more prescription drug costs to employees.

PPOs, CDHPs have the biggest impact

- Preferred provider organization (PPO) plans cost more than average, but still dominate the market.

- Consumer-driven health plans (CDHPs) cost less than average and enrollment is increasing.

Wellness programs are on the rise despite increased regulations and scrutiny

Metal levels drive plan decisions

- Most plans are at the gold or platinum metal level reflecting employers’ desire to keep coverage high. In the future, we expect this to change since it will be more difficult to meet the ACA metal level requirements and still keep rates in check.

Key trends to watch

- Slow, but steady: increase in self-funding, particularly for small groups.

- Cautious trend: increased CDHP prevalence/enrollment.

- Rapidly emerging: increase of five-tier and six-tier prescription drug plans.

By Bill Olson

Originally posted by www.UBABenefits.com

by admin | Nov 1, 2017 | ACA, Compliance

Two tri-agency (Internal Revenue Service, Employee Benefits Security Administration, and Centers for Medicare and Medicaid Services) Interim Final Rules were released and became effective on October 6, 2017, and will be published on October 31, 2017, allowing a greater number of employers to opt out of providing contraception to employees at no cost through their employer-sponsored health plan. The expanded exemption encompasses all non-governmental plan sponsors that object based on sincerely held religious beliefs, and institutions of higher education in their arrangement of student health plans. The exemption also now encompasses employers who object to providing contraception coverage on the basis of sincerely held moral objections and institutions of higher education in their arrangement of student health plans. Furthermore, if an issuer of health coverage (an insurance company) had sincere religious beliefs or moral objections, it would be exempt from having to sell coverage that provides contraception. The exemptions apply to both non-profit and for-profit entities.

Two tri-agency (Internal Revenue Service, Employee Benefits Security Administration, and Centers for Medicare and Medicaid Services) Interim Final Rules were released and became effective on October 6, 2017, and will be published on October 31, 2017, allowing a greater number of employers to opt out of providing contraception to employees at no cost through their employer-sponsored health plan. The expanded exemption encompasses all non-governmental plan sponsors that object based on sincerely held religious beliefs, and institutions of higher education in their arrangement of student health plans. The exemption also now encompasses employers who object to providing contraception coverage on the basis of sincerely held moral objections and institutions of higher education in their arrangement of student health plans. Furthermore, if an issuer of health coverage (an insurance company) had sincere religious beliefs or moral objections, it would be exempt from having to sell coverage that provides contraception. The exemptions apply to both non-profit and for-profit entities.

The currently-in-place accommodation is also maintained as an optional process for exempt employers, and will provide contraceptive availability for persons covered by the plans of entities that use it (a legitimate program purpose). These rules leave in place the government’s discretion to continue to require contraceptive and sterilization coverage where no such objection exists. These interim final rules also maintain the existence of an accommodation process, but consistent with expansion of the exemption, the process is optional for eligible organizations. Effectively this removes a prior requirement that an employer be a “closely held for-profit” employer to utilize the exemption.

Employers that object to providing contraception on the basis of sincerely held religious beliefs or moral objections, who were previously required to offer contraceptive coverage at no cost, and that wish to remove the benefit from their medical plan are still subject (as applicable) to ERISA, its plan document and SPD requirements, notice requirements, and disclosure requirements relating to a reduction in covered services or benefits. These employers would be obligated to update their plan documents, SBCs, and other reference materials accordingly, and provide notice as required.

Employers are also now permitted to offer group or individual health coverage, separate from the current group health plans, that omits contraception coverage for employees who object to coverage or payment for contraceptive services, if that employee has sincerely held religious beliefs relating to contraception. All other requirements regarding coverage offered to employees would remain in place. Practically speaking, employers should be cautious in issuing individual policies until further guidance is issued, due to other regulations and prohibitions that exist.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Oct 26, 2017 | Benefit Management, Benefit Plan Tips, Tricks and Traps, Human Resources

Fall. With it comes cooler temperatures’, falling leaves, warm seasonal scents like turkey and pumpkin pie, and Open Enrollment. It goes without saying; employees who understand the effectiveness of their benefits are much more pleased with those packages, happier with their employers, and more engaged in their work. So, as your company gears up for a new year of navigating Open Enrollment, here are a few points to keep in mind to make the process smoother for both employees and your benefits department. Bonus: it will lighten the load for both parties alike during an already stress-induced season.

Communicate Open Enrollment Using a Variety of Mediums

Advertise 2018 benefit changes to employees by using a variety of mediums. The more reminders and explanation of benefits staff members have using more than one mode of media, the more likely employees will go into Open Enrollment with more knowledge of your company’s benefit options and when they need to have these options completed for the new year.

- Consider explainer videos to simplify the amount of emails and paperwork individuals need to review come Open Enrollment time. These videos can increase the bottom line as well, eliminating the high cost of print material.

- Opt for placards placed throughout your high-traffic areas. Communicate benefit options and remind employees of Open Enrollment dates for the new year by posting in such areas as the lobby, break room and bathroom stalls.

- Choose SMS texting. Today, over 97% of individuals use text. Ninety-eight percent of those that use text open messages within the first three minutes of receiving them; 6-8 times higher than the engagement rate for email. Delivering a concise message to employees’ mobile devices creates more touch points along the Open Enrollment journey. The key, however, is making it quick so as to entice your employees to take action.

- Promote apps and in-app tools. Push notifications and apps like Remind 101 can help drive employee engagement during Open Enrollment season simply by providing short messages reminding them to enroll. Notifications like these can also be tailored to unique employee groups based on location, job level, eligibility status and more.

Utilize Mobile Apps and Web Portals for Open Enrollment

Now that your company has communication down pat for Open Enrollment, simplify the arduous task employees have of enrolling for the coming year by going paperless. Utilize web portals through benefit brokers and companies like ADP to eliminate the hassle of employees having to fill out paperwork both at renewal, and at the time of hire. With nearly three quarters of individuals in the United States checking their phone once an hour and 90% percent of this time is spent using one app or another as a main source of communication, mobile apps can make benefits engagement much easier due to the anywhere/anytime accessibility they offer.

The personal perks for employees are great too! Staff members with a major lifestyle event can make benefit adjustments quickly with the ease of mobile apps. Employees recognize this valuable and time-saving trend and enjoy having this information at their fingertips.

Open Enrollment season can be a stressful time but hopefully these tips will help for a smoother transition into the next year for your business. Simple things like using explainer videos, placing reminders in high traffic areas and utilizing mobile apps and text messaging can save time and stress in the long run for your employees and benefit department.

by admin | Oct 20, 2017 | ACA

On the evening of October 12, 2017, President Trump announced that cost sharing reductions for low income Americans in relation to the Patient Protection and Affordable Care Act (ACA) would be stopped. The Department of Health and Human Services (HHS) has confirmed that payments will be stopped immediately. While there is no direct impact to employers at this time, UBA will continue to educate employers about changes in the law and its Health Plan Survey will continue to track group health plan rates over time as insurance companies potentially seek to recoup lost revenue. It is anticipated at least some state attorneys general will file lawsuits to block the ending of the subsidy payments, with California Attorney General Xavier Becerra stating he is prepared to file a lawsuit to protect the subsidies.

On the evening of October 12, 2017, President Trump announced that cost sharing reductions for low income Americans in relation to the Patient Protection and Affordable Care Act (ACA) would be stopped. The Department of Health and Human Services (HHS) has confirmed that payments will be stopped immediately. While there is no direct impact to employers at this time, UBA will continue to educate employers about changes in the law and its Health Plan Survey will continue to track group health plan rates over time as insurance companies potentially seek to recoup lost revenue. It is anticipated at least some state attorneys general will file lawsuits to block the ending of the subsidy payments, with California Attorney General Xavier Becerra stating he is prepared to file a lawsuit to protect the subsidies.

Background

Individuals with household modified adjusted gross incomes (AGI) in excess of 100 percent but not exceeding 400 percent of the federal poverty level (FPL) may be eligible for cost-sharing reductions for coverage purchased through health insurance exchanges if they meet a variety of criteria. Cost-sharing reductions are limited to coverage months for which the individual is allowed a premium tax credit. Eligibility for cost-sharing reductions is based on the tax year for which advanced eligibility determinations are made by HHS, rather than the tax year for which premium credits are allowed. In 2015, cost-sharing subsides reduced out-of-pocket (OOP) limits:

- Less than 100 percent but not exceeding 200 percent of FPL: OOP limits reduced by two-thirds

- Greater than 200 percent but not exceeding 300 percent of FPL: OOP limits reduced by one-half

- Greater than 300 percent but not exceeding 400 percent of FPL: OOP limits reduced by one-third

After 2015, the base percentages were shifted based on a percentage of average per capita health insurance premium increases. The cost-sharing reduction is paid directly to the insurer, and is automatically applied when eligible individuals enroll in a silver plan on the Marketplace or Exchange.

The cost-sharing reduction is not the same as the “advance premium tax credit” which is also available to individuals with household modified AGIs of at least 100 percent and not exceeding 400 percent of the FPL.

By Danielle Capilla

Originally posted by www.UBABenefits.com

When most experts think of group healthcare plans, Preferred Provider Organization (PPO) plans largely come to mind—though higher cost, they dominate the market in terms of plan distribution and employee enrollment. But Consumer-Directed Health Plans (CDHPs) have made surprising gains. Despite slight cost increases, CDHP costs are still below average and prevalence and enrollment in these plans continues to grow in most regions—a main reason why it was one of the top 7 survey trends recently announced.

When most experts think of group healthcare plans, Preferred Provider Organization (PPO) plans largely come to mind—though higher cost, they dominate the market in terms of plan distribution and employee enrollment. But Consumer-Directed Health Plans (CDHPs) have made surprising gains. Despite slight cost increases, CDHP costs are still below average and prevalence and enrollment in these plans continues to grow in most regions—a main reason why it was one of the top 7 survey trends recently announced.