Resources

Blog

Disability Insurance Explained: Long-Term Disability

Your most valuable asset isn’t your house, car or retirement account. It’s the ability to make a living. Long-term disability insurance (LTD) provides financial protection by replacing a portion of your income—typically 50% to 70%—if you become...

From Anxiety to Action: Managing the Impact of Doomscrolling on Your Well-Being

In stressful or uncertain times, it’s easy to get caught in an endless cycle of scrolling through negative news and social media. This behavior, known as doomscrolling, is increasingly common—but it can take a serious toll on your mental and...

The 4 W’s of Lifestyle Benefits

Competitive wages are no longer enough to satisfy and support valued employees. Today,...

Mental Health is Wealth, So Start Saving Up Now!

“Suck it up,” “cheer up,” “snap out of it,” “but you don’t look sick”- these are just some of the...

Transparency Rules Require Plan Sponsors to Act Now Before July 1 Deadline

The Departments of Health and Human Services, Labor, and Treasury (the Departments) released...

As Cybercriminals Act More Like Businesses, Insurers Must Think More Like Criminals

Cybersecurity is no longer an emerging risk but a clear and present one for organizations of all...

Generational Myths Part 2: Millennials

Today’s offices potentially span five full generations ranging from Generation Z to the Silent...

5 Tips to Save Money on Health Care: Part 1

Health insurance is essential to protecting your health but the high cost of coverage may leave...

What Employees Want: Hybrid Work and Flexibility

2021 was quittin’ time in America. Last year alone over 47.4 million Americans quit their jobs....

5 Ways to Create an Engaged, Committed Workforce

You’ve probably been hearing about the Great Resignation (or however you want to describe it) for...

6 Ways to Reduce Burnout When You’re Understaffed

Question We’ve been both super busy and understaffed recently. Is there anything we can do during...

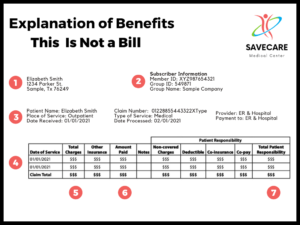

Understanding Your EOB

Let’s say that you visited the doctor and you are wondering how much that visit is going to cost. ...

CA Insurance License 0649686. Investment advisory services offered through Global Retirement Partners, LLC, a registered investment advisor. Global Retirement Partners, LLC, and Johnson & Dugan Insurance Services Corporation are separate and non-affiliated companies. All J&D email communications are HIPAA Security Compliant and accessible through the J&D secure email messaging center.

Privacy Policy | Disclosure Statement

Healthcare Transparency

United Healthcare Surprise Billing Disclosure

United Healthcare Machine Readable Files (MRF)

Kaiser Permanente Surprise Billing Disclosure

Kaiser Permanente Machine Readable Files (MRF)

Contact

650.266.9700 | info@johnsondugan.com

Johnson & Dugan

390 Bridge Parkway, Suite 200

Redwood City, CA 94065

Social

Contact

650.266.9700 | info@johnsondugan.com

Johnson & Dugan

390 Bridge Parkway, Suite 200

Redwood City, CA 94065

Social