by admin | Mar 2, 2026 | Custom Content, Employee Benefits, Health Insurance

Choosing a health insurance plan can feel a lot like solving a puzzle—there are many moving pieces, and the best fit depends on how they come together for your unique situation. With so many options and acronyms—HMO, PPO, POS, EPO, HDHP—it’s easy to feel unsure about where to start. This guide breaks down the most common types of health plans to help you understand how they work, what they cost, and which one might align best with your health care needs and budget.

Choosing a health insurance plan can feel a lot like solving a puzzle—there are many moving pieces, and the best fit depends on how they come together for your unique situation. With so many options and acronyms—HMO, PPO, POS, EPO, HDHP—it’s easy to feel unsure about where to start. This guide breaks down the most common types of health plans to help you understand how they work, what they cost, and which one might align best with your health care needs and budget.

What Sets Health Plans Apart

When comparing plans, pay attention to these key differences:

- Whether you must choose a Primary Care Provider (PCP)

- If you need referrals to see specialists or get certain services

- Whether the plan requires preauthorization for certain procedures

- If out-of-network care is covered

- How much cost sharing you’re responsible for (deductible, copay, coinsurance)

- Whether you’ll need to file claims or handle additional paperwork

No single plan works for everyone. The right choice depends on your personal health needs, your family’s situation, and your financial comfort level.

Health Maintenance Organization (HMO)

An HMO plan typically offers lower premiums, smaller deductibles, and predictable copays. In exchange, you’ll need to stay within the plan’s provider network and work through a designated PCP, who must refer you to specialists.

HMOs can be a cost-effective option for individuals with fewer health care needs who are comfortable with a structured system.

Preferred Provider Organization (PPO)

PPO plans allow more flexibility when choosing health care providers—you can see specialists and even out-of-network doctors without referrals. These plans usually have higher premiums, and out-of-network care costs more.

A PPO may be a good fit if you want freedom to choose your providers and anticipate needing multiple types of care.

Point-of-Service (POS)

POS plans blend features of both HMOs and PPOs. You’ll select a PCP but can also choose out-of-network care at a higher cost. For slightly higher premiums than an HMO, POS plans provide flexibility while encouraging coordinated care through your PCP.

A POS plan can work well if you want both structure and the occasional freedom to go out-of-network.

Exclusive Provider Organization (EPO)

An EPO plan offers moderate flexibility. Like an HMO, you must use in-network providers, but unlike an HMO, you usually don’t need a referral to see a specialist. Premiums fall between HMO and PPO rates.

An EPO might be right for you if you’re comfortable with a limited provider network and want easier access to specialists.

High Deductible Health Plan (HDHP)

An HDHP can be structured as an HMO, PPO, POS, or EPO. These plans feature lower premiums but higher deductibles—meaning you’ll pay more upfront before coverage kicks in. HDHPs are often paired with a Health Savings Account (HSA), which lets you set aside pre‑tax dollars for medical expenses and roll over unused funds year to year.

HDHPs can work well for those who don’t anticipate frequent medical needs, such as younger or healthier individuals, but they may not be ideal for those with ongoing health concerns.

Final Thoughts

Because health plans and rules can vary by state (and employer), take time to review the details carefully before enrolling. Understanding the coverage, costs, and flexibility of each option will help you make an informed, confident decision that fits your unique health and financial needs.

by admin | Feb 25, 2026 | ACA

Employers must prepare for Affordable Care Act (ACA) reporting covering the 2025 calendar year. Staying ahead of these deadlines is critical for Applicable Large Employers (ALEs) and providers of self-insured health plans.

Employers must prepare for Affordable Care Act (ACA) reporting covering the 2025 calendar year. Staying ahead of these deadlines is critical for Applicable Large Employers (ALEs) and providers of self-insured health plans.

Who is Required to Report?

Reporting obligations under Internal Revenue Code Sections 6055 and 6056 fall into two main categories:

Self-Insured Health Plan Providers (Section 6055): Any entity providing minimum essential coverage (MEC), including non-ALEs with self-insured plans.

Applicable Large Employers (ALEs) (Section 6056): Organizations with 50 or more full-time employees (including equivalents).

Note for Self-Insured ALEs: If you are an ALE with a self-funded plan, you must comply with both requirements. However, you can simplify the process by using a single combined filing (Forms 1094-C and 1095-C).

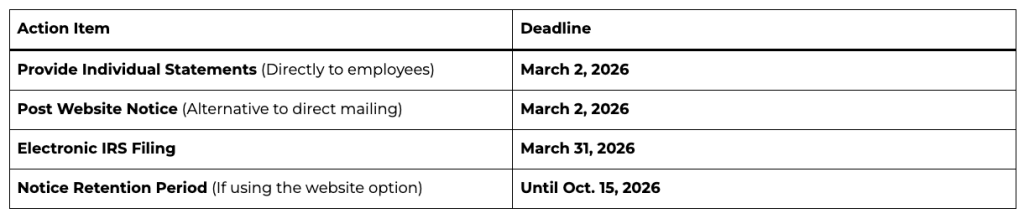

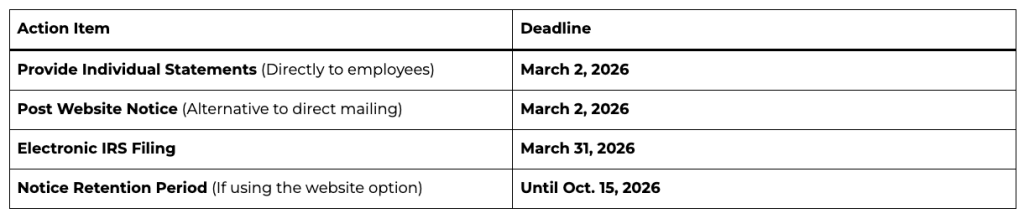

Important Filing Deadlines for 2026

How to Furnish Statements to Individuals

Employers have two options for providing Forms 1095-B or 1095-C to covered individuals:

Direct Delivery: Automatically mail or electronically deliver the forms by March 2, 2026.

Website Notice Alternative: Instead of mailing every form, you may post a “clear, conspicuous, and easily accessible” notice on your website by March 2, 2026.

The notice must state that individuals can request a copy of their form.

It must include an email address, physical address, and phone number for requests.

Requests must be fulfilled within 30 days.

Mandatory Electronic Filing

The IRS now requires electronic filing for almost all employers.

The 10-Return Threshold: If you file 10 or more information returns in total (including W-2s, 1099s, and ACA forms combined), you must file your ACA returns electronically.

The System: Electronic filings must be submitted through the ACA Information Returns (AIR) Program using specific XML formatting.

Extensions and Hardships

Automatic Extension: You can secure an additional 30 days to file with the IRS by submitting Form 8809 by the original March 31 deadline.

Hardship Waivers: While the IRS encourages electronic filing for everyone, waivers may be available for those facing significant technological or financial hardships.

by admin | Feb 18, 2026 | Health & Wellness, Hot Topics

Modern employees expect more from their employers than just standard health benefits. We have entered a new era of wellness defined by personalization, priority, and purpose. Driven largely by younger generations entering the workforce, wellness has transitioned from a fringe “perk” to a core business strategy. In 2026, forward-thinking organizations are expanding their support systems to encompass physical, emotional, social, and professional well-being.

Modern employees expect more from their employers than just standard health benefits. We have entered a new era of wellness defined by personalization, priority, and purpose. Driven largely by younger generations entering the workforce, wellness has transitioned from a fringe “perk” to a core business strategy. In 2026, forward-thinking organizations are expanding their support systems to encompass physical, emotional, social, and professional well-being.

Here are the five critical wellness trends shaping the workplace in 2026.

1. The Generational Shift: Gen Z and Millennials Redefine Wellness

As Millennials and Gen Z (born 1981–2012) now comprise the majority of the workforce, they are fundamentally altering wellness expectations. These generations prioritize holistic health, flexibility, and inclusivity.

For these generations, wellness is a daily commitment rather than an occasional treat. They account for over 41% of annual wellness spending and are increasingly investing in:

-

- Advanced Tech & Fitness: Wearables and specialized fitness regimens.

-

- Recovery & Nutrition: Massage tools, IV drips, gut health, and longevity-focused supplements.

-

- Holistic Healing: Somatic exercises (breathwork/mindfulness) and wellness retreats.

-

- Self-Care: Longevity-based skin/hair care.

2. From Mental Health to “Mental Fitness”

In 2026, the workplace dialogue has shifted from reactive mental health support to proactive mental fitness. Much like physical exercise builds the body, mental fitness builds resilience and emotional stability.

Employers are normalizing these conversations by:

-

- Introducing mental health coaching to develop coping strategies.

-

- Implementing “Mental Fitness Days” to recharge without stigma.

-

- Training managers to identify early signs of burnout before they escalate.

-

- Subsidizing mental health apps and expanding EAPs.

3. A Critical Focus on Women’s Health

Women’s health is no longer a niche benefit; it is integral to workforce stability. Driven by Gen X (born 1965–1980) advocating for perimenopause and menopause support, and younger generations seeking family-building resources, employers are stepping up.

Current high-demand benefits include:

-

- Fertility Support: Coverage for IVF, egg freezing, and preservation.

-

- Maternal Care: Expanded parental leave, doula services, and lactation support.

-

- Menopause Advocacy: Specialized virtual care, symptom management, and hormone therapy coverage to address the historic lack of training in primary care.

4. Cultivating Financial Resilience

Economic volatility has made financial wellness a primary pillar of the employee experience. With nearly 75% of Americans falling short of their 2025 savings goals, there is a renewed focus on building an emergency fund in 2026.

Organizations are addressing generational financial stressors—such as Gen Z’s cost-of-living struggles and Boomers’ concerns over unexpected expenses—by offering:

-

- Student loan repayment programs and debt counseling.

-

- Emergency savings accounts and flexible pay options.

-

- Comprehensive retirement planning and financial workshops.

5. The Rise of AI-Driven Hyper-Personalization

Artificial Intelligence is transforming wellness from a “one-size-fits-all” model to a hyper-personalized experience. By integrating biometric data from wearables, AI platforms can now create real-time, dynamic plans for nutrition, sleep, and stress management.

For employers, this means:

-

- Lower Costs: Predictive analytics can catch metabolic or stress issues early, preventing expensive chronic conditions.

-

- Higher Engagement: Employees are more likely to participate in programs that adapt to their specific physiological needs and behaviors.

Summary

Wellness in 2026 is a deeply personal journey that varies across generations. By evaluating and adopting these trends, employers have a unique opportunity to provide meaningful, science-backed support that fosters a resilient and loyal workforce.

by admin | Feb 10, 2026 | Custom Content, Health & Wellness

February is often filled with symbols of love, but it’s also the perfect time to focus on the most important heart of all—your own. American Heart Month serves as a vital reminder that cardiovascular health is the foundation of a long, vibrant life.

February is often filled with symbols of love, but it’s also the perfect time to focus on the most important heart of all—your own. American Heart Month serves as a vital reminder that cardiovascular health is the foundation of a long, vibrant life.

Heart disease remains a leading health challenge globally, but the good news is that many risk factors are within your control. Here is a guide to help you show your heart some love this month and beyond.

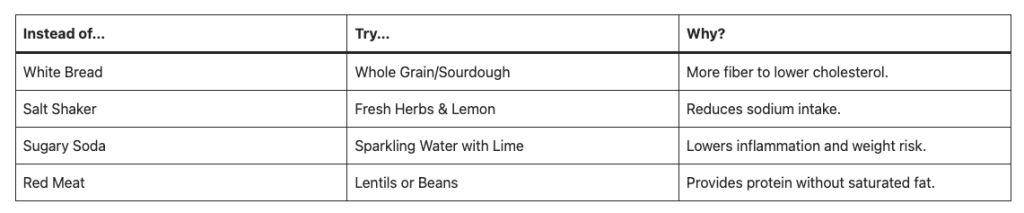

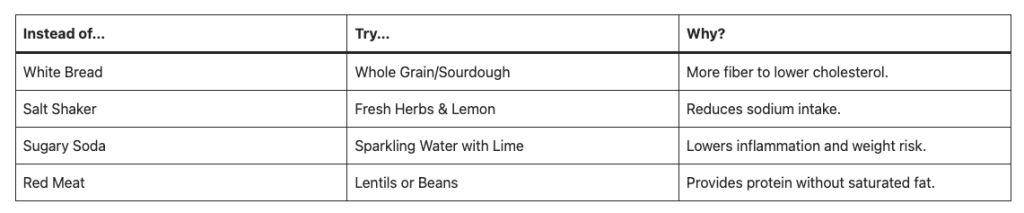

- Fuel Your Heart with the Right Foods

What you put on your plate significantly impacts your blood pressure, cholesterol, and inflammation levels. You don’t need a restrictive “diet”; you need a sustainable way of eating.

- Prioritize Whole Foods: Focus on leafy greens, berries, nuts, and seeds.

- Embrace Healthy Fats: Swap butter for olive oil and include fatty fish like salmon or mackerel (rich in Omega-3s).

- Watch the Sodium: Excess salt is a major contributor to high blood pressure. Aim for less than 2,300mg a day (about one teaspoon).

Smart Swaps for Heart Health

- Move More, Sit Less

Your heart is a muscle, and like any muscle, it needs exercise to stay strong. The American Heart Association recommends at least 150 minutes of moderate-intensity aerobic activity per week.

- Find Your “Flow”: You don’t have to run marathons. Brisk walking, swimming, or strength training.

- The Power of 10: If 30 minutes feels daunting, break it into three 10-minute bursts throughout the day.

- Prioritize Quality Sleep and Stress Management

Chronic stress and poor sleep are the “silent” enemies of heart health. When you’re stressed or sleep-deprived, your body stays in a state of high alert, which can damage your arteries over time.

- The 7-9 Hour Rule: Aim for consistent sleep. Lack of sleep is linked to increased calcium buildup in the arteries.

- Mindfulness: Just five minutes of deep breathing or meditation can lower your heart rate and cortisol levels.

- Unplug: Set a “digital sunset” an hour before bed to help your nervous system wind down.

- Know Your Numbers

Knowledge is power. Many heart issues don’t have obvious symptoms until they are advanced. Schedule a check-up this month to track these four key metrics:

- Blood Pressure: Ideally below 120/80 mmHg.

- Cholesterol: Monitor your LDL (bad) and HDL (good) levels.

- Blood Sugar: High glucose levels can damage blood vessels over time.

- Body Mass Index (BMI): Keep a healthy weight to reduce the workload on your heart.

A Note on Smoking: If you smoke or vape, quitting is the single most impactful thing you can do for your heart. Even within one year of quitting, your risk of a heart attack drops significantly.

Small Changes, Big Impact

You don’t have to overhaul your entire life; choose one small change this week—perhaps taking a daily walk or adding a serving of vegetables to dinner. Consistency is the secret to a healthy heart!

by admin | Feb 3, 2026 | Custom Content, Employee Benefits

Offering voluntary benefits is an excellent way to strengthen your overall benefits package, stand out from competitors, and enhance employee satisfaction—all with minimal impact on your budget. However, while employers often provide a wide range of voluntary benefits designed to offer value and convenience, many employees may not fully understand what these benefits are or how they can help. Educating your workforce about the advantages of voluntary benefits ensures both employers and employees gain maximum value.

Offering voluntary benefits is an excellent way to strengthen your overall benefits package, stand out from competitors, and enhance employee satisfaction—all with minimal impact on your budget. However, while employers often provide a wide range of voluntary benefits designed to offer value and convenience, many employees may not fully understand what these benefits are or how they can help. Educating your workforce about the advantages of voluntary benefits ensures both employers and employees gain maximum value.

Showcasing the Value

Employees may not always recognize the value of voluntary benefits, particularly since these options are typically employee-funded. These benefits, which may include options like life insurance, disability coverage, accident insurance, critical illness insurance, cancer insurance or even legal and pet insurance, provide added security and convenience without significantly increasing employer costs.

For example, voluntary insurance purchased through an employer group is often more affordable than an individual policy—but few employees realize this. When highlighting voluntary benefits, clearly explain the advantages of being covered, the potential risks of going without protection, and the convenience of enrolling through payroll deductions.

Promoting Coverage Understanding

Employee education is vital to preventing confusion and frustration about what a policy covers. Misunderstandings can lead to resentment if employees expect coverage that isn’t actually included. To avoid these situations, ensure every employee—whether their benefit is employer-paid or voluntary—understands how the coverage works.

Consider the following strategies to strengthen benefits education:

- Invite current employees to attend orientation or periodic benefits meetings.

- Ask benefit providers to send representatives to explain their products directly to staff.

- Schedule small-group sessions for employees who have detailed questions.

- Leverage social media to share educational materials, reminders, and benefit updates in an accessible way.

Strengthening Employer Value

Beyond increasing participation in voluntary benefits, investing in employee education helps position your organization as a trusted source of benefits knowledge. This approach not only boosts engagement but also strengthens employee satisfaction and loyalty to your company.

Choosing a health insurance plan can feel a lot like solving a puzzle—there are many moving pieces, and the best fit depends on how they come together for your unique situation. With so many options and acronyms—HMO, PPO, POS, EPO, HDHP—it’s easy to feel unsure about where to start. This guide breaks down the most common types of health plans to help you understand how they work, what they cost, and which one might align best with your health care needs and budget.

Choosing a health insurance plan can feel a lot like solving a puzzle—there are many moving pieces, and the best fit depends on how they come together for your unique situation. With so many options and acronyms—HMO, PPO, POS, EPO, HDHP—it’s easy to feel unsure about where to start. This guide breaks down the most common types of health plans to help you understand how they work, what they cost, and which one might align best with your health care needs and budget.