by admin | Aug 10, 2017 | Employee Benefits, Human Resources

Death and loss touch all of us, usually many times throughout our lives. Yet we may feel unprepared and uncomfortable when grief intrudes into our daily routines. As a manager, when grief impacts your employees it’s helpful to have a basic understanding of what they are going through as well as ways you can help.

Death and loss touch all of us, usually many times throughout our lives. Yet we may feel unprepared and uncomfortable when grief intrudes into our daily routines. As a manager, when grief impacts your employees it’s helpful to have a basic understanding of what they are going through as well as ways you can help.

Experiencing Grief

Although we all experience grief in our own way, there are behaviors, emotions and physical sensations that are a common part of the mourning process. J. William Worden’s “Four Tasks of Mourning” will be experienced in some form by anyone who is grieving. These tasks include accepting the reality of the loss, experiencing and accepting our emotions, adjusting to life without the loved one, and investing emotional energy into a new and different life.

Commonly experienced emotions are sadness, anger, frustration, guilt, shock and numbness. Physical sensations include fatigue or weakness, shortness of breath, tightness in the chest and dry mouth.

Manager’s Role

When employees are mourning, it’s important to create a caring, supportive and professional work environment. In most cases, employees will benefit from returning to work. It allows them to resume a regular routine, focus on something besides their loss and boost their confidence by completing work tasks.

At the same time, bereaved employees may experience many challenges when returning to work. They may have poor concentration, be extremely tired, feel depressed or have a short temper and uncontrollable emotions.

As a manager, the best thing you can do is acknowledge the loss and maintain strong lines of communication. Even if you believe someone else is checking in with them, make sure you stay in touch and see if there is anything you can do.

Developing a Return to Work Plan

In order to help your employees have a smooth transition back to work you must listen and understand their needs. Some additional questions you’ll want to answer are:

- What are your company’s policies and procedures for medical and bereavement leave?

- What information do your employees want their co-workers to have and would they rather share this information themselves?

- Do they want to talk about their experience or would they rather focus on work?

- Do they need private time while at work?

- Does their workload and schedule need to be adjusted?

- Do they need help at home – child care, meals, house work, etc.?

- Are there others at work that may be experiencing grief of their own?

Helpful Responses for Managers

- Offer specific help – make meals, wash their car, walk their pet, or anything else that will make their life easier.

- Say something – it can be as simple as, “I’m so sorry for your loss.”

- Listen – be kind but honest.

- Respect privacy – honor closed doors and private moments.

- Expect tears – emotions can hit unexpectedly.

- Thank your staff – for everything they are doing to help.

Grieving is a necessity, not a weakness. It is how we heal and move forward. As a manager, being there for your employees during this time is important in helping them through the grieving process.

An Employee Assistance Program is a great resource for both you and your employees when grief comes to work.

By Kathyrn Schneider

Originally Posted By www.ubabenefits.com

by admin | Aug 7, 2017 | ACA, Employee Benefits, Health & Wellness

Preexisting conditions. While it’s no doubt this term has been a hot topic in recent months—and notably misconstrued—one thing has not changed; insurers cannot deny coverage to anyone with a preexisting condition. Now that House Resolution 1628 has moved to the Senate floor, what can employers and individuals alike expect? If passed by the Senate as is and signed into law; some provisions will take place as early as 2019—possibly 2018 for special enrollment cases. It’s instrumental for companies to gear up now with a plan on how to tackle open enrollment; regardless of whether your company offers medical coverage or not.

Under the current proposed American Health Care Act (AHCA) insurance companies can:

- Price premiums based on health care status/age. The AHCA will provide “continuous coverage” protections to guarantee those insured are not charged more than the standard rate as long as they do not have a break in coverage. However, insurers will be allowed to underwrite certain policies for those that do lapse—hence charging up to 30% more for a preexisting condition if coverage lapses for more than 63 days. This is more common than not, especially for those who are on a leave of absence for illness or need extensive treatment. In addition, under current law, insurers are only allowed to charge individuals 50 and older 3 times as much than those under this age threshold. This ratio will increase 5:1 under AHCA.

- Under the ACA’s current law employers must provide coverage for 10 essential health care benefits. Under AHCA, beginning as early as 2020, insurers will allow states to mandate what they consider essential benefit requirements. This could limit coverage offered to individuals and within group plans by eliminating high cost care like mental health and substance abuse. Not that it’s likely, but large employers could eventually opt out whether they want to provide insurance and/or choose the types of coverage they will provide to their employees.

It’s important to note that states must apply for waivers to increase the ratio on insurance premiums due to age, and determine what they will cover for essential health benefits. In order to have these waivers granted, they would need to provide extensive details on how doing so will help their state and the marketplace.

So what can employers do moving forward? It’s not too soon to think about changing up your benefits package as open enrollment approaches, and educating yourself and your staff on AHCA and what resources are out there if you don’t offer health coverage.

- Make a variety of supplemental tools available to your employees. Anticipate the coming changes by offering or adding more supplemental insurance and tools to your benefits package come open enrollment. Voluntary worksite benefits, such as Cancer, Critical Illness, and Accident Insurance handle a variety of services at no out-of-pocket cost to the employer. HSA’s FSA’s and HRA’s are also valuable supplemental tools to provide your employees if you’re able to do so. Along with the changes listed above, the AHCA has proposed to also increase the contribution amounts in these plans and will allow these plans to cover Over-the-Counter (OTC) medications.

- Continue to customize wellness programs. Most companies offer wellness programs for their employees. Employers that provide this option should continue advancing in this area. Addressing the specific needs of your employees and providing wellness through various platforms will result in the greatest return on investment; and healthier employees to boot. Couple this with frequent evaluations from your staff on your current program to determine effectiveness and keep your wellness programs on point.

- Educate, educate, educate—through technology. Regardless if you employ 10 or 10,000, understanding benefit options is vital for your employees; what you have to offer them and what they may need to know on their own. Digital platforms allow individuals to manage their healthcare benefits and stay in the know with valuable resources at their fingertips. There’s no limit on the mediums available to educate your employees on upcoming changes. Partnering with a strong benefit agency to maximize these resources and keep your employees “in the know” during a constantly changing insurance market is a great way to start.

by admin | Aug 4, 2017 | HSA/HRA

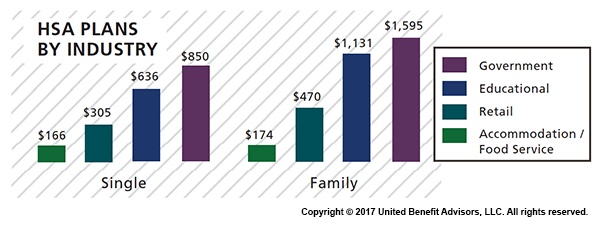

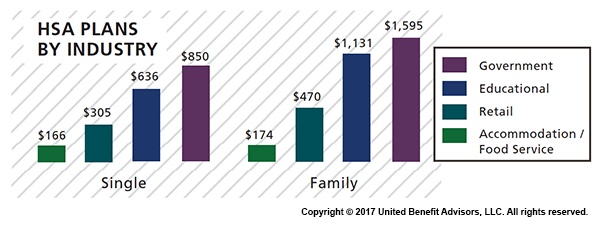

Across most industries, HSA contributions are, for the most part, down or unchanged from three years ago, according to UBA’s Health Plan Survey. The average employer contribution to an HSA is $474 for a single employee (down 3.5 percent from 2015 and 17.6 percent from five years ago) and $801 for a family (down 9.2 percent from last year and 13.7 percent from five years ago). Government and education employers are the only industries with average single contributions well above average and on the rise.

Across most industries, HSA contributions are, for the most part, down or unchanged from three years ago, according to UBA’s Health Plan Survey. The average employer contribution to an HSA is $474 for a single employee (down 3.5 percent from 2015 and 17.6 percent from five years ago) and $801 for a family (down 9.2 percent from last year and 13.7 percent from five years ago). Government and education employers are the only industries with average single contributions well above average and on the rise.

Government employees had the most generous contributions for singles at $850, on average, up from $834 in 2015. This industry also has the highest employer contributions for families, on average, at $1,595 (though that is down from 1,636 in 2015). Educational employers are the next most generous, contributing $636, on average, for singles and $1,131 for families.

Singles in the accommodation/food services industries received virtually no support from employers, with average HSA contributions at $166. The same is true for families with HSA plans in the accommodation/food services industries with average family contributions of $174.

Retail employers also remain among the least generous contributors to single and family HSA plans, contributing $305 and $470, respectively. This may be why they have low enrollment in these plans.

The education services industry has seen a 109 percent increase in HSA enrollment since 2013 (aided by employers’ generous contributions), catapulting the industry to the lead in HSA enrollment at 23.8 percent. The professional/scientific/tech and finance/insurance industries follow closely at 23.3 percent and 22.1 percent, respectively.

The mining/oil/gas industry sees the lowest enrollment at 3.8 percent. The retail, hotel, and food industries continue to have some of the lowest enrollment rates despite the prevalence of these plans, indicating that these industries, in particular, may want to increase employee education efforts about these plans and how they work.

For a detailed look at the prevalence and enrollment rates among HSA and HRA plans by group size and region, view UBA’s “Special Report: How Health Savings Accounts Measure Up”.

Benchmarking your health plan with peers of a similar size, industry or geography makes a big difference in determining if your plan is competitive. To compare your exact plan with your peers, request a custom benchmarking report.

For fast facts about HSA and HRA plans, including the best and worst plans, average contributions made by employers, and industry trends, download (no form!) “Fast Facts: HSAs vs. HRAs”.

By Bill Olson

Originally Posted By www.ubabenefits.com

by Johnson and Dugan | Aug 2, 2017 | Benefit Management

Tired of celebrating the 10% increase? Join us in an innovative discussion on reducing your Health Insurance Premium through Creative Financing for your benefit program. Learn about turning a 10% increase into a 25% decrease.

Keynote Speaker:

Clifford Der, East West Administrators

We will be discussing alternative funding from traditional Self-Funding to Medical Expense Reimbursement Plans. We will also address any legal questions you may have regarding your liability as an employer offering a fully insured program versus a self-funded program.

11:45 a.m. – 12:00 p.m. Registration

12:00 p.m. – 1:00 p.m. Seminar & Complimentary Buffet Lunch

Location: Mistral Restaurant and Bar | 370-6 Bridge Parkway | Redwood Shores, CA 94065

Click Here To Register

About the Presenter:

Clifford Der, East West Administrators – Clifford has been a member of the National Association of Health Underwriters for more than 40 years. His extensive background in healthcare benefits includes developing the Chinese Community Health Plan (EPO-a first in the country), the first acupuncture plan, the development of the Medical Expenses Reimbursement Plans along with custom designed Partial Self-funded Health Plans.

Sponsored by:

by admin | Jul 31, 2017 | COBRA, Human Resources

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires group health plans to provide notices to covered employees and their families explaining their COBRA rights when certain events occur. The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan. This notice is issued by the plan administrator within the first 90 days when coverage begins under the group health plan and informs the covered employee (and his or her spouse) of the responsibility to notify the employer within 60 days if certain qualifying events occur in the future.

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires group health plans to provide notices to covered employees and their families explaining their COBRA rights when certain events occur. The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan. This notice is issued by the plan administrator within the first 90 days when coverage begins under the group health plan and informs the covered employee (and his or her spouse) of the responsibility to notify the employer within 60 days if certain qualifying events occur in the future.

The initial notice must include the following information:

- The plan administrator’s contact information

- A general description of the continuation coverage under the plan

- An explanation of the covered employee’s notice obligations, including notice of

- The qualifying events of divorce, legal separation, or a dependent’s ceasing to be a dependent

- The occurrence of a second qualifying event

- A qualified beneficiary’s disability (or cessation of disability) for purposes of the disability extension)

- How to notify the plan administrator about a qualifying event

- A statement that the notice does not fully describe continuation coverage or other rights under the plan, and that more complete information regarding such rights is available from the plan administrator and in the plan’s summary plan description (SPD)

As a best practice, the initial notice should also:

- Direct qualified beneficiaries to the plan’s most recent SPD for current information regarding the plan administrator’s contact information.

- For plans that include health flexible spending arrangements (FSAs), disclose the limited nature of the health FSA’s COBRA obligations (because certain health FSAs are only obligated to offer COBRA through the end of the year to qualified beneficiaries who have underspent accounts).

- Explain that the spouse may notify the plan administrator within 60 days after the entry of divorce or legal separation (even if an employee reduced or eliminated the spouse’s coverage in anticipation of the divorce or legal separation) to elect up to 36 months of COBRA coverage from the date of the divorce or legal separation.

- Define qualified beneficiary to include a child born to or placed for adoption with the covered employee during a period of COBRA continuation coverage.

- Describe that a covered child enrolled in the plan pursuant to a qualified medical child support order during the employee’s employment is entitled to the same COBRA rights as if the child were the employee’s dependent child.

- Clarify the consequences of failing to submit a timely qualifying event notice, timely second qualifying event notice, or timely disability determination notice.

Practically speaking, the initial notice requirement can be satisfied by including the general notice in the group health plan’s SPD and then issuing the SPD to the employee and his or her spouse within 90 days of their group health plan coverage start date.

If the plan doesn’t rely on the SPD for furnishing the initial COBRA notice, then the plan administrator would follow the U.S. Department of Labor (DOL) rules for delivery of ERISA-required items. A single notice addressed to the covered employee and his or her spouse is allowed if the spouse lives at the same address as the covered employee and coverage for both the covered employee and spouse started at the time that notice was provided. The plan administrator is not required to provide an initial notice for dependents.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

Death and loss touch all of us, usually many times throughout our lives. Yet we may feel unprepared and uncomfortable when grief intrudes into our daily routines. As a manager, when grief impacts your employees it’s helpful to have a basic understanding of what they are going through as well as ways you can help.

Death and loss touch all of us, usually many times throughout our lives. Yet we may feel unprepared and uncomfortable when grief intrudes into our daily routines. As a manager, when grief impacts your employees it’s helpful to have a basic understanding of what they are going through as well as ways you can help.