by admin | Jan 14, 2025 | Custom Content, Employee Benefits

New to a Health Savings Account (HSA)? Here’s What You Need to Know

New to a Health Savings Account (HSA)? Here’s What You Need to Know

As the name suggests, a Health Savings Account(HSA) is a special savings account used to pay for healthcare-related expenses. An HSA has potential financial benefits for now and later. Not only can you save pre-tax dollars in this account to pay for qualified medical expenses (QMEs), but HSAs can also provide valuable retirement benefits.

If you’re new to HSAs, here are some tips to help you get started:

- Understand the Basics:

- Triple Tax Advantage: HSAs offer a unique triple tax advantage: contributions are tax-deductible, earnings grow tax-deferred, and withdrawals for qualified medical expenses are tax-free.

- Eligibility: To be eligible for an HSA, you must be enrolled in a high-deductible health plan (HDHP). A HDHP is an insurance plan with higher deductibles and out-of-pocket costs. However, HDHPs carry lower premiums than traditional insurance plans, and in most cases, the cost savings in premiums alone are significant.

- Contribution Limits: There are annual contribution limits set by the IRS. The HSA contribution limits for 2025 are $4,300 for self-only coverage and $8,550 for family coverage. Those 55 and older can contribute an additional $1,000 as a catch-up contribution.

2. Maximize Your Contributions:

- Contribute Regularly: Set up automatic contributions to your HSA to make saving consistent and effortless.

- Consider a Catch-Up Contribution: If you’re 55 or older, you can contribute an additional $1,000 as a catch-up contribution.

3. Use Your HSA Strategically:

- Pay for Qualified Medical Expenses: Use your HSA funds to pay for eligible medical expenses, such as doctor visits, prescriptions, and dental care.

- Invest for the Future: Consider investing your HSA funds for long-term growth. This can be a great way to save for other future healthcare needs or even retirement. Once you reach age 65, you can withdraw money from your HSA for any reason without penalty – only ordinary income tax due.

- Unused HSA Funds: HSA funds can be rolled over to the next year. However, if you withdraw funds for non-medical expenses, you’ll pay income tax plus a 20% penalty.

Money that goes in and out of an HSA is tax free as long as payments and reimbursements from the account are used only for Qualified Medical Expenses (QMEs). QMEs are healthcare-related items or services designated by the IRS that you can write off when you do your taxes. There are thousands of medical procedures, services and types of equipment that are considered QMEs, and the IRS frequently updates the list.

It is important to know that your HSA account is yours – not your employers. Unlike healthcare Flexible Spending Accounts (FSAs), which your employer technically owns, your HSA belongs to you. So, when you leave a job, you keep all of the money you’ve saved up in your HSA and can transfer into a new HSA or employer-sponsored HSA at your next job.

The Bottom Line

HSAs are often referred to as triple tax-advantaged and are one of the best savings and investment tools available under the U.S. tax code. As a person ages, medical expenses tend to increase, particularly when reaching retirement age and beyond. Therefore, starting an HSA early and allowing it to accumulate over a long period can contribute greatly to securing your financial future. By understanding the basics of HSAs and following these tips, you can make the most of this valuable financial tool.

by admin | May 30, 2023 | Employee Benefits, HSA/HRA

Are you the type of person who loves to save money? You’ll be happy to know that there’s a way to do so with your health care costs. It starts with medical expense accounts which let you set aside money to pay for certain health products and services. One type of medical expense account is a Health Savings Account (HSA).

Are you the type of person who loves to save money? You’ll be happy to know that there’s a way to do so with your health care costs. It starts with medical expense accounts which let you set aside money to pay for certain health products and services. One type of medical expense account is a Health Savings Account (HSA).

How Does An HSA Work?

An HSA is a type of personal savings account you can use to pay certain health care costs. An HSA lets you pay for qualified health, dental and vision care costs for yourself, spouse and dependents with tax-free money. The money you contribute comes out of your paycheck – before taxes – and that is how you save to pay for your out-of-pocket health care expenses. Like a regular savings account, your HSA has an interest rate that allows your money to grow while sitting in the account. Your employer also has the option of contributing to your HSA, helping it to grow faster.

If you don’t use all of your HSA funds during the calendar year, you can roll that money over. An HSA is owned by you so you take it with you no matter if you change plans, change jobs or if you decide to retire. You will get a debit card which is linked to your HSA when you set up your account that you use to pay for eligible expenses.

You must be enrolled in a High Deductible Health Plan (HDHP) to open and contribute to an HSA. HDHPs medical plans aim to minimize your health care costs if you don’t use your plan a lot but keep you financially protected in cases of illness or emergency. Similar to a car insurance policy, you pay for your expenses up to the point that you meet your deductible and then the insurance coverage begins. The higher the deductible you choose, the smaller the monthly cost will be. But it also means that when you have health expenses, you are responsible for all of the costs up to your deductible amount. Rather than pay for your health expenses that occur before hitting your deductible out of your pocket, you can pay for those expenses using pre-tax dollars from your HSA account.

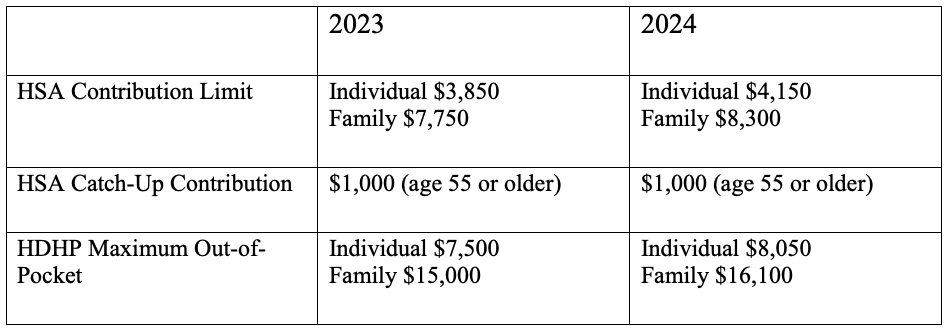

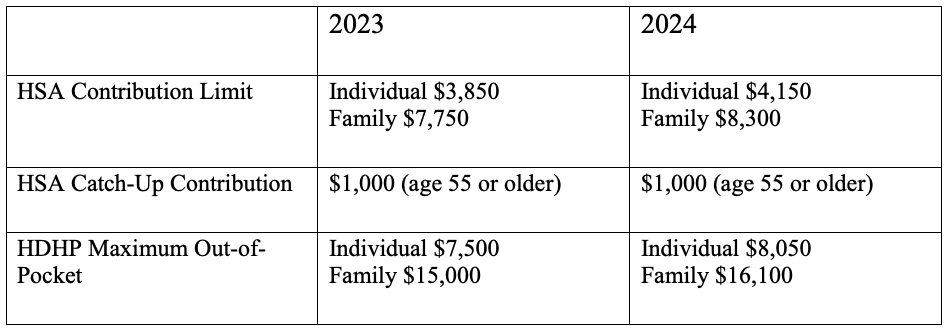

Federal law includes strict guidelines for HSAs including HDHP cost sharing and annual limits on contributions. The amount you contribute can be adjusted throughout the year but they do have an annual limit on how much you can contribute per year. This limit is set by the IRS and usually increases each year. Contribution limits for 2023 and 2024 are:

What Are the Benefits of Having an HSA?

- Money goes in tax-free – Your HSA contributions are made on a pre-tax basis and are also tax deductible

- Money comes out tax-free – Eligible healthcare purchases can be made directly from the HSA account

- Earn interest, tax-free – The interest on HSA funds grows on a tax-free basis. Unlike most savings accounts, interest earned on an HSA is not considered taxable income when funds are used for eligible medical expenses.

- Your HSA balance can be invested – Depending on your HSA, you may be eligible to invest your HSA similar to a 401k or IRA – in an interest-bearing account, mutual fund, stocks or bonds.

- Your HSA balance can be carried over – Unlike a Flexible Spending Account (FSA), an HSA is not a use-it-or-lose-it account. You can carry over your balance year after year.

- You can use your HSA to add to your retirement funds – After the age of 65, you can withdraw funds from your HSA for any reason without penalty.

The Bottom Line

HSAs are often referred to as triple tax-advantaged and are one of the best savings and investment tools available under the U.S. tax code. As a person ages, medical expenses tend to increase, particularly when reaching retirement age and beyond. Therefore, starting an HSA early and allowing it to accumulate over a long period, can contribute greatly to securing your financial future.

by admin | Jun 16, 2017 | HSA/HRA

The average employer contribution to an HSA is $474 for a single employee (down 3.5 percent from 2015 and 17.6 percent from five years ago) and $801 for a family (down 9.2 percent from last year and 13.7 percent from five years ago). There was a 26 percent increase in the number of individuals enrolled in HSAs, likely due to the increase in CDHP enrollment (which often have HSAs tied to them). Since 2013, there has been a 97.7 percent increase in enrollment, showing significant employer and employee interest in these plans over time.

The average employer contribution to an HSA is $474 for a single employee (down 3.5 percent from 2015 and 17.6 percent from five years ago) and $801 for a family (down 9.2 percent from last year and 13.7 percent from five years ago). There was a 26 percent increase in the number of individuals enrolled in HSAs, likely due to the increase in CDHP enrollment (which often have HSAs tied to them). Since 2013, there has been a 97.7 percent increase in enrollment, showing significant employer and employee interest in these plans over time.

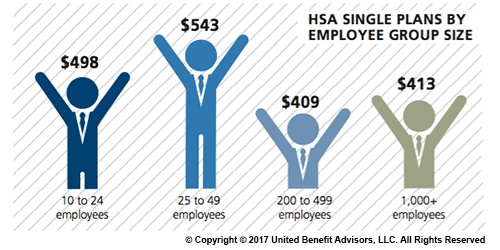

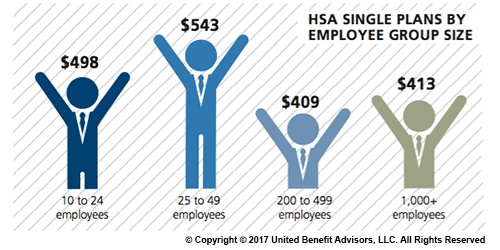

Looking at contributions by group size, singles at companies with 200 to 499 employees receive the lowest HSA contributions ($409). Singles at some of the smallest companies (25 to 49 employees) receive the most generous contributions ($543), on average.

Like their single counterparts, families get more generous contributions from small employers. The average family HSA contribution in groups with 25 to 49 employees was $908 (though, in general, small employer contributions have been declining over time).

Last year, some of the smallest companies (10 to 24 employees) had the highest HSA enrollment (16.3 percent). However, rapid enrollment increases among large employers in recent years now places the largest companies (1,000+ employees) as HSA enrollment leaders with 19.1 percent enrolled.

For a detailed look at the prevalence and enrollment rates among HSA and HRA plans by industry and region, view UBA’s “Special Report: How Health Savings Accounts Measure Up”, to understand which aspects of these accounts are most successful, and least successful.

Benchmarking your health plan with peers of a similar size, industry and/or geography makes a big difference in determining if your plan is competitive. To compare your exact plan with your peers, request a custom benchmarking report.

For fast facts about HSA and HRA plans, including the best and worst plans, average contributions made by employers, and industry trends, download (no form!) “Fast Facts: HSAs vs. HRAs”.

By Bill Olson

Originally Posted By www.ubabenefits.com

New to a Health Savings Account (HSA)? Here’s What You Need to Know

New to a Health Savings Account (HSA)? Here’s What You Need to Know