by admin | Aug 24, 2017 | Benefit Management, COBRA, Compliance

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) allows qualified beneficiaries who lose health benefits due to a qualifying event to continue group health benefits. The COBRA payment process is subject to various rules in terms of grace periods, notification, premium payment methods, and treatment of insignificant shortfalls.

Grace Periods

The initial premium payment is due 45 days after the qualified beneficiary elects COBRA. Premium payments must be made on time; otherwise, a plan may terminate COBRA coverage. Generally, subsequent premium payments are due on the first day of the month. However, under the COBRA grace period rules, premiums will still be considered timely if made within 30 days after the due date. The statutory grace period is a minimum 30-day period, but plans may allow qualified beneficiaries a longer grace period.

A COBRA premium payment is made when it is sent to the plan. Thus, if the qualified beneficiary mails a check, then the payment is made on the date the check was mailed. The plan administrators should look at the postmark date on the envelope to determine whether the payment was made on time. Qualified beneficiaries may use certified mail as evidence that the payment was made on time.

The 30-day grace period applies to subsequent premium payments and not to the initial premium payment. After the initial payment is made, the first 30-day grace period runs from the payment due date and not from the last day of the 45-day initial payment period.

If a COBRA payment has not been paid on its due date and a follow-up billing statement is sent with a new due date, then the plan risks establishing a new 30-day grace period that would begin from the new due date.

Notification

The plan administrator must notify the qualified beneficiary of the COBRA premium payment obligations in terms of how much to pay and when payments are due; however, the plan does not have to renotify the qualified beneficiary to make timely payments. Even though plans are not required to send billing statements each month, many plans send reminder statements to the qualified beneficiaries.

While the only requirement for plan administrators is to send an election notice detailing the plan’s premium deadlines, there are three circumstances under which written notices about COBRA premiums are necessary. First, if the COBRA premium changes, the plan administrator must notify the qualified beneficiary of the change. Second, if the qualified beneficiary made an insignificant shortfall premium payment, the plan administrator must provide notice of the insignificant shortfall unless the plan administrator chooses to ignore it. Last, if a plan administrator terminates a qualified beneficiary’s COBRA coverage for nonpayment or late payment, the plan administrator must provide a termination notice to the qualified beneficiary.

The plan administrator is not required to inform the qualified beneficiary when the premium payment is late. Thus, if a plan administrator does not receive a premium payment by the end of the grace period, then COBRA coverage may be terminated. The plan administrator is not required to send a notice of termination in that case because the COBRA coverage was not in effect. On the other hand, if the qualified beneficiary makes the initial COBRA premium payment and coverage is lost for failure to pay within the 30-day grace period, then the plan administrator must provide a notice of termination due to early termination of COBRA coverage.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Aug 21, 2017 | Benefit Management, Hot Topics, Human Resources

In previous posts, I have talked about several aspects of strategic benefits communication. Now it’s time to put those strategies into action. As we approach enrollment season, let’s look at five key steps to ensuring this year’s open enrollment is successful for you and your employees.

In previous posts, I have talked about several aspects of strategic benefits communication. Now it’s time to put those strategies into action. As we approach enrollment season, let’s look at five key steps to ensuring this year’s open enrollment is successful for you and your employees.

1. Determine your key objectives

What do employees need to know this enrollment season? As you review your benefit plan designs, think once again about your key objectives, and for each, how you will make employees aware and keep them engaged. What are the challenges employees face when making their benefits decisions?

- Are you rolling out new medical plan options? Does this include HDHP options? An HSA? Are there changes in premiums and contribution levels?

- Are there any changes to other lines of coverage such as dental, life insurance, disability insurance?

- Are you adding new voluntary plans this year? How do they integrate with your medical plans? Do they plug gaps in high deductibles and out-of-pocket expenses? Are there existing voluntary plans with low participation?

- Are there other important topics to share with employees, like new wellness programs, or health-driven employee events?

Once you’ve gathered this information, you can develop a communication strategy that will better engage employees in the benefits decision-making process.

2. Perfect your script

What do you know about your employee demographics? Diversity doesn’t refer only to age or gender. It could mean family size, differences in physical demands of the job, income levels, or simply lifestyle. It isn’t a one-size-fits-all world anymore. As you educate employees on benefits, you will want to give examples that fit their lives.

You will also want to keep the explanations as simple as possible. Use as much plain language as you can, as opposed to “insurance speak” and acronyms. Benefit plans are already an overwhelming decision, and as we have seen in our research, employees still don’t fully understand their options.

3. Use a multi-faceted communications strategy

Sun Life research and experience has shown that the most appreciated and effective strategies incorporate multiple methodologies. One helpful tactic is to get a jump-start on enrollment communication. As enrollment season approaches, try dynamic pre-enrollment emails to all employees, using videos or brochures. Once on-site enrollment begins, set up group meetings based on employee demographics. This will arm employees with better knowledge and prepared questions for their one-to-one meeting with a benefits counselor.

Consider hard-to-reach employees as well, and keep your websites updated with helpful links and provide contacts who are available by phone for additional support.

Also, look to open enrollment as a good time to fill any employee data gaps you may have, like beneficiaries, dependents, or emergency contacts.

4. Check your tech!

We have talked in previous posts about leveraging benefits administration technology for effective communications. For open enrollment, especially when you may be introducing new voluntary insurance plans, it is important to check your technology. I recommend this evaluation take place at least 6 to 8 weeks before open enrollment if possible.

Working with your UBA advisor, platform vendor and insurance carriers, some key considerations:

- Provide voluntary product specifications from your carrier to your platform vendor. It is important to check up front that the platform can handle product rules such as issue age and age band pricing, age reduction, benefit/tier changes and guarantee issue rules. Also, confirm how the system will handle evidence of insurability processing, if needed.

- Electronic Data Interface (EDI). Confirm with your platform partner as well as insurance carriers that there is an EDI set-up process that includes testing of file feeds. This is a vital step to ensure seamless integration between your benefits administration platform, payroll and the insurance carriers.

- User Experience. Often benefits administration platforms are very effective at moving data and helping you manage your company’s benefits. As we have discussed, when it comes to your employee’s open enrollment user experience, there can be some challenges. Especially when you are offering voluntary benefits. Confirm with your vendor what, if any, decision support tools are available. Also, check with your voluntary carriers. These could range from benefit calculators, product videos, and even logic-driven presentations.

5. Keep it going

Even when enrollment season is over, ongoing benefits communications are a central tool to keeping employees informed, educated, and engaged. The small window of enrollment season may not be long enough for people to get a full grasp of their benefits needs, and often their decisions are driven by what is easily understood or what they think they need based on other people’s choices. Ongoing communications can be about specific benefits, wellness programs, or other health and benefit related items. This practice will also help new hires who need to make benefits decisions rather quickly.

In summary, work with your UBA consultant to customize benefits and enrollment communications. Leverage resources from your provider, who may, as Sun Life does, offer turnkey services that support communication, engagement, and enrollment. Explore third-party vendors that offer platforms to support the process. The whole thing can seem daunting, but following these steps and considerations will not only make the process easier for you, it will make a world of difference to your employees.

By Kevin D. Seeker

Originally Published By United Benefit Advisors

by admin | Aug 18, 2017 | COBRA, Human Resources

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) allows qualified beneficiaries who lose health benefits due to a qualifying event to continue group health benefits. While some group health plans may provide COBRA continuation coverage at a reduced rate or at no cost, most qualified beneficiaries must pay the full COBRA premium. The COBRA election notice should include information about COBRA premiums.

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) allows qualified beneficiaries who lose health benefits due to a qualifying event to continue group health benefits. While some group health plans may provide COBRA continuation coverage at a reduced rate or at no cost, most qualified beneficiaries must pay the full COBRA premium. The COBRA election notice should include information about COBRA premiums.

For fully insured health plans, the premium is the cost to maintain the plan for similarly situated employees. For self-funded plans, the premium is the cost to maintain the plan for similarly situated employees as determined by an actuary or the past cost from the preceding determination period. The applicable premium calculation for both fully- and self-funded plans includes the cost of providing coverage to both active employees and COBRA qualified beneficiaries. All COBRA premiums must be calculated in good faith compliance with a reasonable interpretation of COBRA requirements.

Generally, COBRA payments are made on an after-tax basis. Qualified beneficiaries have 45 days after the election date to make an initial premium payment. The plan may terminate the qualified beneficiary’s COBRA rights if no initial premium payment is made before the end of the 45-day period. In addition, plans must allow monthly premium payments and cannot require payment on a quarterly basis. As established under COBRA, premiums are due on the first day of each month with a minimum 30-day grace period. A plan may terminate COBRA coverage for nonpayment or insufficient payment of premiums after the grace period.

If a qualified beneficiary makes an insignificant underpayment, then the premium payment will still satisfy the payment obligation. An underpayment is deemed insignificant if the shortfall is no greater than the lesser of $50 or 10 percent of the required amount. However, if the plan notifies the qualified beneficiary of the shortfall and grants a reasonable amount of time to correct the underpayment (usually 30 days after the notice is provided), then the qualified beneficiary is required to make the payment; otherwise, COBRA coverage may be canceled.

Fully Insured Health Plans

Generally, the applicable COBRA premium amount for fully insured plans is the insurance premium charged by the insurer. The applicable premium is based on the total cost of coverage, which includes both the employer and employee portions. The premium amount is based on the cost of coverage for similarly situated individuals who have not incurred a qualifying event.

A group health plan may charge at most 102 percent of the premium during the standard COBRA coverage period for similarly situated plan participants (100 percent of the total cost of coverage plus an additional 2 percent for administrative costs). However, the plan may increase the premium for a disabled qualified beneficiary and charge 150 percent of the applicable premium during the 11-month disability extension period (months 19 through 29). In addition, COBRA regulations permit a plan to charge a 150 percent premium to nondisabled qualified beneficiaries as long as the disabled qualified beneficiary is covered under the plan. If the disabled qualified beneficiary is no longer covered under the plan, then the remaining qualified beneficiaries may continue coverage up to 29 months at 102 percent of the cost of the plan.

If an employer maintains more than one plan, then a separate applicable premium is calculated for each plan. Also, the applicable premium for a single plan may vary due to factors such as the coverage level, the benefit package, and the region in which covered employee resides. For instance, single employees may pay a different applicable premium than employees who include their spouse on the plan. Thus, the plan may charge different premiums based on the varying coverage levels.

The most common tier structures include employee-only, employee-plus-spouse, employee-plus-children, and employee-plus-family. According to Internal Revenue Ruling 96-8, a fully insured plan that pays different premiums for individual versus family coverage must use those same premium tiers for COBRA continuation coverage. Thus, COBRA premiums are divided into multi-rate and single-rate tier structures.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Aug 15, 2017 | Compliance, Health & Wellness

Where to Start?

Where to Start?

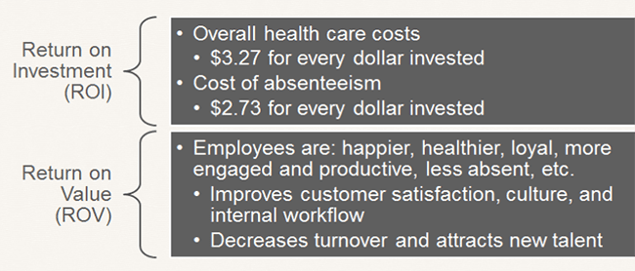

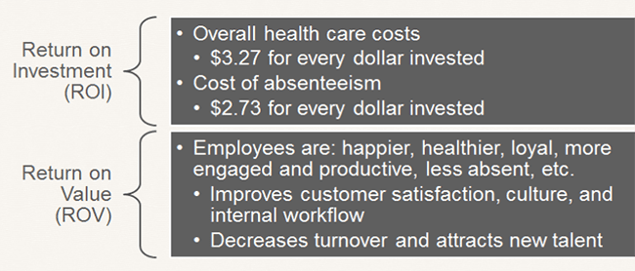

First, expand the usual scope of wellness activity to well-BEING. Include initiatives that support more than just physical fitness, such as career growth, social needs, financial health, and community involvement. By doing this you increase your chances of seeing a return on investment (ROI) and a return on value (ROV). Qualitative results of a successful program are just as valuable as seeing a financial impact of a healthier population.

Source: Katherine Baicker, David Cutler, and Zirui Song, “Workplace Wellness Programs Can Generate Savings,” Health Affairs, February 2010, 29(2): pp 304-311

To create a corporate culture of well-being and ensure the success of your program, there are a few important steps.

- Leadership Support: Programs with leadership support have the highest level of participation. Gain leadership support by having them participate in the programs, give recognition to involved employees, support employee communication, allow use of on-site space, approve of employees spending time on coordinating and facilitating initiatives, and define the budget. Even though you do not need a budget to be successful.

- Create a Committee or Designate a Champion: Do not take this on by yourself. Create a well-being committee, or identify a champion, to share the responsibility and necessary actions of coordinating a program.

- Strategic Plan: Create a three-year strategic plan with a mission statement, budget, realistic goals, and measurement tools. Creating a plan like this takes some work and coordination, but the benefits are significant. You can create a successful well-being program with little to no budget, but you need to know what your realistic goals are and have a plan to make them a reality.

- Tools and Resources: Gather and take advantage of available resources. Tools and resources from your broker and/or carrier can help make managing a program much easier. Additionally, an employee survey will help you focus your efforts and accommodate your employees’ immediate needs.

How to Remain Compliant?

As always, remaining compliant can be an unplanned burden on employers. Whether you have a wellness or well-being program, each has their own compliance considerations and requirements to be aware of. However, don’t let that stop your organization from taking action.

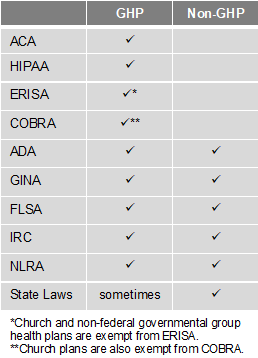

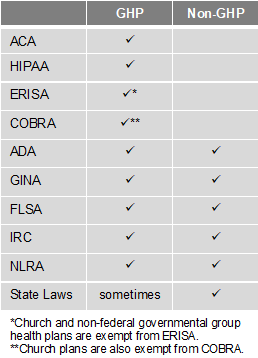

There are two types of programs – Group Health Plans (GHP) and Non-Group Health Plans (Non-GHP). The wellness regulations vary depending on the type of employer and whether the program is considered a GHP or Non-GHP.

Employers looking to avoid some of the compliance burden should design their well-being program to be a Non-GHP. Generally, a well-being program is Non-GHP if it is offered to all employees regardless of their enrollment in the employer’s health plan and does not provide or pay for “medical care.” For example, employees receive $100 for attending a class on nutrition. Here are some other tips to keep your well-being program Non-GHP:

- Financial: Do not pay for medical services (e.g., flu shots, biometric screenings, etc.) or provide medical care. Financial incentives or rewards must be taxed. Do not provide premium discounts or surcharges.

- Voluntary Participation: Include all employees, but do not mandate participation. Make activities easily accessible to those with disabilities or provide a reasonable alternative. Make the program participatory (i.e., educational, seminars, newsletters) rather than health-contingent (i.e., require participants to get BMI below 30 or keep cholesterol below 200). Do not penalize individuals for not participating.

- Health Information: Do not collect genetic data, including family medical history. Any medical records, or information obtained, must be kept confidential. Avoid Health Risk Assessments (i.e. health surveys) that provide advice and analysis with personalized coaching or ask questions about genetics/family medical history.

By Hope DeRocha

Originally Posted By www.ubabenefits.com

by admin | Aug 7, 2017 | ACA, Employee Benefits, Health & Wellness

Preexisting conditions. While it’s no doubt this term has been a hot topic in recent months—and notably misconstrued—one thing has not changed; insurers cannot deny coverage to anyone with a preexisting condition. Now that House Resolution 1628 has moved to the Senate floor, what can employers and individuals alike expect? If passed by the Senate as is and signed into law; some provisions will take place as early as 2019—possibly 2018 for special enrollment cases. It’s instrumental for companies to gear up now with a plan on how to tackle open enrollment; regardless of whether your company offers medical coverage or not.

Under the current proposed American Health Care Act (AHCA) insurance companies can:

- Price premiums based on health care status/age. The AHCA will provide “continuous coverage” protections to guarantee those insured are not charged more than the standard rate as long as they do not have a break in coverage. However, insurers will be allowed to underwrite certain policies for those that do lapse—hence charging up to 30% more for a preexisting condition if coverage lapses for more than 63 days. This is more common than not, especially for those who are on a leave of absence for illness or need extensive treatment. In addition, under current law, insurers are only allowed to charge individuals 50 and older 3 times as much than those under this age threshold. This ratio will increase 5:1 under AHCA.

- Under the ACA’s current law employers must provide coverage for 10 essential health care benefits. Under AHCA, beginning as early as 2020, insurers will allow states to mandate what they consider essential benefit requirements. This could limit coverage offered to individuals and within group plans by eliminating high cost care like mental health and substance abuse. Not that it’s likely, but large employers could eventually opt out whether they want to provide insurance and/or choose the types of coverage they will provide to their employees.

It’s important to note that states must apply for waivers to increase the ratio on insurance premiums due to age, and determine what they will cover for essential health benefits. In order to have these waivers granted, they would need to provide extensive details on how doing so will help their state and the marketplace.

So what can employers do moving forward? It’s not too soon to think about changing up your benefits package as open enrollment approaches, and educating yourself and your staff on AHCA and what resources are out there if you don’t offer health coverage.

- Make a variety of supplemental tools available to your employees. Anticipate the coming changes by offering or adding more supplemental insurance and tools to your benefits package come open enrollment. Voluntary worksite benefits, such as Cancer, Critical Illness, and Accident Insurance handle a variety of services at no out-of-pocket cost to the employer. HSA’s FSA’s and HRA’s are also valuable supplemental tools to provide your employees if you’re able to do so. Along with the changes listed above, the AHCA has proposed to also increase the contribution amounts in these plans and will allow these plans to cover Over-the-Counter (OTC) medications.

- Continue to customize wellness programs. Most companies offer wellness programs for their employees. Employers that provide this option should continue advancing in this area. Addressing the specific needs of your employees and providing wellness through various platforms will result in the greatest return on investment; and healthier employees to boot. Couple this with frequent evaluations from your staff on your current program to determine effectiveness and keep your wellness programs on point.

- Educate, educate, educate—through technology. Regardless if you employ 10 or 10,000, understanding benefit options is vital for your employees; what you have to offer them and what they may need to know on their own. Digital platforms allow individuals to manage their healthcare benefits and stay in the know with valuable resources at their fingertips. There’s no limit on the mediums available to educate your employees on upcoming changes. Partnering with a strong benefit agency to maximize these resources and keep your employees “in the know” during a constantly changing insurance market is a great way to start.