by admin | Oct 13, 2017 | ACA, ERISA, Group Benefit Plans, IRS

On October 12, 2017, the White House released an Executive Order, signed by President Trump, titled “Promoting Healthcare Choice and Competition Across the United States.”

On October 12, 2017, the White House released an Executive Order, signed by President Trump, titled “Promoting Healthcare Choice and Competition Across the United States.”

It is important to note that the Executive Order (EO) does not implement any new laws or regulations, but instead directs various federal agencies to explore options relating to association health plans, short term limited-duration coverage (STLDI), and health reimbursement arrangements (HRAs), within the next 60 to 120 days.

The Department of Labor is ordered to explore expansion of association health plans (AHPs) by broadening the scope of ERISA to allow employers within the same line of business across the country to join together in a group health plan. The EO notes employers will not be permitted to exclude employees from an AHP or develop premiums based on health conditions. The Secretary of Labor has 60 days to consider proposing regulations or revising guidance.

Practically speaking, this type of expansion would require considerable effort with all state departments of insurance and key stakeholders across the industry. Employers should not wait to make group health plan decisions based on the EO, as it will take time for even proposed regulations to be developed.

The Department of the Treasury, Department of Labor, and Department of Health and Human Services (the agencies) are directed to consider expanding coverage options from STLDI, which are often much less expensive than Marketplace plans or employer plans. These plans are popular with individuals who are in and outside of the country or who are between jobs. The Secretaries of these agencies have 60 days to consider proposing regulations or revising guidance.

Finally, the EO directs the same three agencies to review and consider changing regulations for HRAs so employers have more flexibility when implementing them for employees. This could lead to an expanded use of HRA dollars for employees, such as for premiums. However, employers should not make any changes to existing HRAs until regulations are issued at a later date. The Secretaries have 120 days to consider proposing regulations or revising guidance.

To benchmark your current HRA plan with other employers, request UBA’s special report: How Health Savings Accounts Measure Up or download our Fast Facts on HSAs vs. HRAs.

By Danielle Capilla

Originally posted by www.UBABenefits.com

by admin | Aug 15, 2017 | Compliance, Health & Wellness

Where to Start?

Where to Start?

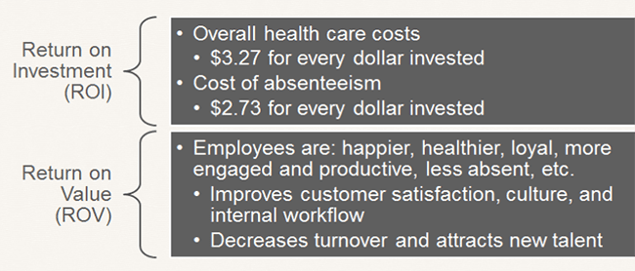

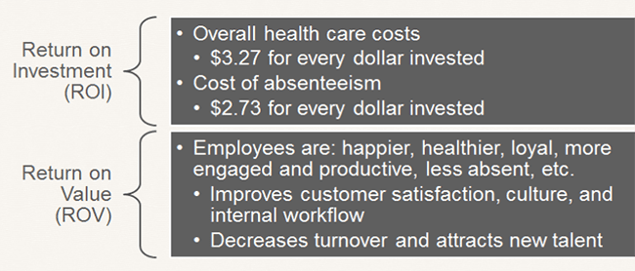

First, expand the usual scope of wellness activity to well-BEING. Include initiatives that support more than just physical fitness, such as career growth, social needs, financial health, and community involvement. By doing this you increase your chances of seeing a return on investment (ROI) and a return on value (ROV). Qualitative results of a successful program are just as valuable as seeing a financial impact of a healthier population.

Source: Katherine Baicker, David Cutler, and Zirui Song, “Workplace Wellness Programs Can Generate Savings,” Health Affairs, February 2010, 29(2): pp 304-311

To create a corporate culture of well-being and ensure the success of your program, there are a few important steps.

- Leadership Support: Programs with leadership support have the highest level of participation. Gain leadership support by having them participate in the programs, give recognition to involved employees, support employee communication, allow use of on-site space, approve of employees spending time on coordinating and facilitating initiatives, and define the budget. Even though you do not need a budget to be successful.

- Create a Committee or Designate a Champion: Do not take this on by yourself. Create a well-being committee, or identify a champion, to share the responsibility and necessary actions of coordinating a program.

- Strategic Plan: Create a three-year strategic plan with a mission statement, budget, realistic goals, and measurement tools. Creating a plan like this takes some work and coordination, but the benefits are significant. You can create a successful well-being program with little to no budget, but you need to know what your realistic goals are and have a plan to make them a reality.

- Tools and Resources: Gather and take advantage of available resources. Tools and resources from your broker and/or carrier can help make managing a program much easier. Additionally, an employee survey will help you focus your efforts and accommodate your employees’ immediate needs.

How to Remain Compliant?

As always, remaining compliant can be an unplanned burden on employers. Whether you have a wellness or well-being program, each has their own compliance considerations and requirements to be aware of. However, don’t let that stop your organization from taking action.

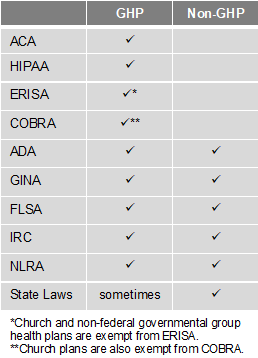

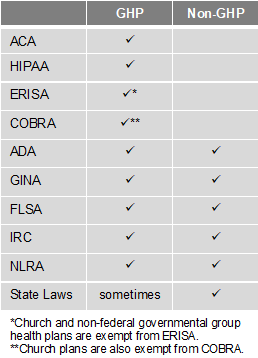

There are two types of programs – Group Health Plans (GHP) and Non-Group Health Plans (Non-GHP). The wellness regulations vary depending on the type of employer and whether the program is considered a GHP or Non-GHP.

Employers looking to avoid some of the compliance burden should design their well-being program to be a Non-GHP. Generally, a well-being program is Non-GHP if it is offered to all employees regardless of their enrollment in the employer’s health plan and does not provide or pay for “medical care.” For example, employees receive $100 for attending a class on nutrition. Here are some other tips to keep your well-being program Non-GHP:

- Financial: Do not pay for medical services (e.g., flu shots, biometric screenings, etc.) or provide medical care. Financial incentives or rewards must be taxed. Do not provide premium discounts or surcharges.

- Voluntary Participation: Include all employees, but do not mandate participation. Make activities easily accessible to those with disabilities or provide a reasonable alternative. Make the program participatory (i.e., educational, seminars, newsletters) rather than health-contingent (i.e., require participants to get BMI below 30 or keep cholesterol below 200). Do not penalize individuals for not participating.

- Health Information: Do not collect genetic data, including family medical history. Any medical records, or information obtained, must be kept confidential. Avoid Health Risk Assessments (i.e. health surveys) that provide advice and analysis with personalized coaching or ask questions about genetics/family medical history.

By Hope DeRocha

Originally Posted By www.ubabenefits.com

by admin | Aug 10, 2017 | Employee Benefits, Human Resources

Death and loss touch all of us, usually many times throughout our lives. Yet we may feel unprepared and uncomfortable when grief intrudes into our daily routines. As a manager, when grief impacts your employees it’s helpful to have a basic understanding of what they are going through as well as ways you can help.

Death and loss touch all of us, usually many times throughout our lives. Yet we may feel unprepared and uncomfortable when grief intrudes into our daily routines. As a manager, when grief impacts your employees it’s helpful to have a basic understanding of what they are going through as well as ways you can help.

Experiencing Grief

Although we all experience grief in our own way, there are behaviors, emotions and physical sensations that are a common part of the mourning process. J. William Worden’s “Four Tasks of Mourning” will be experienced in some form by anyone who is grieving. These tasks include accepting the reality of the loss, experiencing and accepting our emotions, adjusting to life without the loved one, and investing emotional energy into a new and different life.

Commonly experienced emotions are sadness, anger, frustration, guilt, shock and numbness. Physical sensations include fatigue or weakness, shortness of breath, tightness in the chest and dry mouth.

Manager’s Role

When employees are mourning, it’s important to create a caring, supportive and professional work environment. In most cases, employees will benefit from returning to work. It allows them to resume a regular routine, focus on something besides their loss and boost their confidence by completing work tasks.

At the same time, bereaved employees may experience many challenges when returning to work. They may have poor concentration, be extremely tired, feel depressed or have a short temper and uncontrollable emotions.

As a manager, the best thing you can do is acknowledge the loss and maintain strong lines of communication. Even if you believe someone else is checking in with them, make sure you stay in touch and see if there is anything you can do.

Developing a Return to Work Plan

In order to help your employees have a smooth transition back to work you must listen and understand their needs. Some additional questions you’ll want to answer are:

- What are your company’s policies and procedures for medical and bereavement leave?

- What information do your employees want their co-workers to have and would they rather share this information themselves?

- Do they want to talk about their experience or would they rather focus on work?

- Do they need private time while at work?

- Does their workload and schedule need to be adjusted?

- Do they need help at home – child care, meals, house work, etc.?

- Are there others at work that may be experiencing grief of their own?

Helpful Responses for Managers

- Offer specific help – make meals, wash their car, walk their pet, or anything else that will make their life easier.

- Say something – it can be as simple as, “I’m so sorry for your loss.”

- Listen – be kind but honest.

- Respect privacy – honor closed doors and private moments.

- Expect tears – emotions can hit unexpectedly.

- Thank your staff – for everything they are doing to help.

Grieving is a necessity, not a weakness. It is how we heal and move forward. As a manager, being there for your employees during this time is important in helping them through the grieving process.

An Employee Assistance Program is a great resource for both you and your employees when grief comes to work.

By Kathyrn Schneider

Originally Posted By www.ubabenefits.com

by admin | Jul 31, 2017 | COBRA, Human Resources

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires group health plans to provide notices to covered employees and their families explaining their COBRA rights when certain events occur. The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan. This notice is issued by the plan administrator within the first 90 days when coverage begins under the group health plan and informs the covered employee (and his or her spouse) of the responsibility to notify the employer within 60 days if certain qualifying events occur in the future.

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires group health plans to provide notices to covered employees and their families explaining their COBRA rights when certain events occur. The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan. This notice is issued by the plan administrator within the first 90 days when coverage begins under the group health plan and informs the covered employee (and his or her spouse) of the responsibility to notify the employer within 60 days if certain qualifying events occur in the future.

The initial notice must include the following information:

- The plan administrator’s contact information

- A general description of the continuation coverage under the plan

- An explanation of the covered employee’s notice obligations, including notice of

- The qualifying events of divorce, legal separation, or a dependent’s ceasing to be a dependent

- The occurrence of a second qualifying event

- A qualified beneficiary’s disability (or cessation of disability) for purposes of the disability extension)

- How to notify the plan administrator about a qualifying event

- A statement that the notice does not fully describe continuation coverage or other rights under the plan, and that more complete information regarding such rights is available from the plan administrator and in the plan’s summary plan description (SPD)

As a best practice, the initial notice should also:

- Direct qualified beneficiaries to the plan’s most recent SPD for current information regarding the plan administrator’s contact information.

- For plans that include health flexible spending arrangements (FSAs), disclose the limited nature of the health FSA’s COBRA obligations (because certain health FSAs are only obligated to offer COBRA through the end of the year to qualified beneficiaries who have underspent accounts).

- Explain that the spouse may notify the plan administrator within 60 days after the entry of divorce or legal separation (even if an employee reduced or eliminated the spouse’s coverage in anticipation of the divorce or legal separation) to elect up to 36 months of COBRA coverage from the date of the divorce or legal separation.

- Define qualified beneficiary to include a child born to or placed for adoption with the covered employee during a period of COBRA continuation coverage.

- Describe that a covered child enrolled in the plan pursuant to a qualified medical child support order during the employee’s employment is entitled to the same COBRA rights as if the child were the employee’s dependent child.

- Clarify the consequences of failing to submit a timely qualifying event notice, timely second qualifying event notice, or timely disability determination notice.

Practically speaking, the initial notice requirement can be satisfied by including the general notice in the group health plan’s SPD and then issuing the SPD to the employee and his or her spouse within 90 days of their group health plan coverage start date.

If the plan doesn’t rely on the SPD for furnishing the initial COBRA notice, then the plan administrator would follow the U.S. Department of Labor (DOL) rules for delivery of ERISA-required items. A single notice addressed to the covered employee and his or her spouse is allowed if the spouse lives at the same address as the covered employee and coverage for both the covered employee and spouse started at the time that notice was provided. The plan administrator is not required to provide an initial notice for dependents.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

by admin | Jul 11, 2017 | Human Resources, Workplace

When we hear something’s magnetic, it’s likely the first thought that comes to mind is attraction. By definition, a magnetic force is the attraction or repulsion that arises between electrically charged particles because of their motion. What perfect framing for an organization – the desire to attract (or repel) people to help advance your organization. With this framing comes the assumption that there’s motion, which is, hopefully, a result of intentional action.

When we hear something’s magnetic, it’s likely the first thought that comes to mind is attraction. By definition, a magnetic force is the attraction or repulsion that arises between electrically charged particles because of their motion. What perfect framing for an organization – the desire to attract (or repel) people to help advance your organization. With this framing comes the assumption that there’s motion, which is, hopefully, a result of intentional action.

If we follow the thought of intentional action, there are seven steps (and many more details for each step that would be too lengthy to include here) that attract what’s desired and repel what’s not desired.

Seven Steps to Being a Magnetic Organization

1. Decide what you want for the company

Simple, right? Yes. However, often an assumption is made that everybody knows what’s wanted. The best way to determine if you know what’s wanted is to ask the question, “Can I paint a clear, colorful and compelling story of the future?” This is one of the most important roles of leadership in an organization. Create, and tell a compelling story worthy of the effort it will take to get there.

2. Get 100 percent buy-in from top leadership

It’s not enough for the CEO or owner to own the future story, every top leader who’s responsible for the performance and experience of employees and customers needs to be 100 percent committed to the future. This is perhaps the most telling test of how quickly and assuredly you will achieve the goals to support the future state. It’s critical to check for this buy-in up front as well as at key milestone points along the way.

3. Communicate

As important as the first two steps are, a pinnacle point in the process is sharing with your employees, customers, and other stakeholders what you intend to do.

This is a step that is often overlooked and undervalued. If you ascribe to the rule of seven for marketing, it takes at least seven exposures for a person to hear something with the likelihood of remembering the message. Communicate often and keep your message clear and consistent. Also, keep in mind that people absorb information differently. This absorption is relative to learning styles. Presenting information will be accepted differently if someone is visual, aural, verbal, physical, logical, social, or solitary in their learning style.

As you design your communication plan, explore not only what you’ll share, but how you’ll promote the messages.

4. Build Your Culture

This speaks to the actions necessary to achieve desired outcomes. It’s intentionally ordered after communication. Reinforce the mission of the company, or roll it out if it’s newly created. To move forward, you need every employee to be aware of the direction and expectations for the organization. Share organizational goals and keep leaders accountable to create alignment for their teams, including working with each person on their team to understand how his or her unique role fits into the overall picture. This will drive interactions that contribute to, or detract from, success.

Involve employees in the early phases of culture change and share quick wins. Consider including stories and testimonials from employees that show how the company is already making strides to get to the future vision.

Assure the right fit of employees. Clearly identify the top three expectations for each role and then find people who will be on fire to do these things well.

David Pink, in his book Drive, explores exactly what motivates people and claims that true motivation consists of: 1) autonomy, the desire to direct our own lives; 2) mastery, the desire to continually improve at something that matters; and 3) purpose, the desire to do things in service of something larger than ourselves.

In addition, make a habit of catching people doing the right things right. Recognition of work well done continuously reinforced will add fuel to building a positive culture. Finally, allow people to be who they are and find ways to insert moments of fun.

5. Evaluate

There are many evaluation tools to help identify what’s happening. Asking for feedback from employees and customers can be a highly effective way to help understand where the best practices exist and where improvements are needed. Measuring what’s happening on a regular basis offers identification of value in processes and with products.

According to the Predictions for 2017 Bersin by Deloitte report, “Driven by the need to understand and improve engagement, and the continuous need to measure and improve employee productivity, real time feedback and analytics will explode.”

6. Assess

The intention of assessment is to determine how things are going and then focus on improvement. The people who know the operations the best are the ones working the business. Trust your employees. As you understand the frustrations and barriers employees encounter, there’s an opportunity to reengineer how to tailor processes, deliver services, and provide products to support the changing needs of the customer.

7. Adjust

When you identify what’s working and what needs to be changed – act with a sense of urgency to make the necessary changes. The organizations who adapt are the ones who have the greatest longevity. Market changes are constant and the ability to understand what’s happening and move toward what will occur in the future is not only admirable, but necessary for sustainability.

It’s obvious how these steps attract people with desired talents and attitudes to help advance your organization, but how will these same actions repel those who don’t align? When there’s consistent reinforcement of the culture, those who don’t fit will have a sense that your company just isn’t the right place for them, like trying to fit into a jacket that is too small or too large. This will be true for current employees and potential employees.

Not getting the results you want? Consider revisiting these actions – one step at a time.

By Joan Morehead

Originally Posted By www.ubabenefits.com

On October 12, 2017, the White House released an Executive Order, signed by President Trump, titled “Promoting Healthcare Choice and Competition Across the United States.”

On October 12, 2017, the White House released an Executive Order, signed by President Trump, titled “Promoting Healthcare Choice and Competition Across the United States.”