by admin | Feb 6, 2025 | ACA, Compliance

For employers subject to the Affordable Care Act (ACA), staying compliant with reporting requirements is non-negotiable. With 2025 due dates just around the corner, now is the time to prepare for distributing Forms 1095-C to employees and filing with the IRS. These forms provide essential information about health coverage offered to employees and are critical for demonstrating compliance with the ACA’s employer mandate. Missing these deadlines can lead to potential costly penalties and compliance headaches.

For employers subject to the Affordable Care Act (ACA), staying compliant with reporting requirements is non-negotiable. With 2025 due dates just around the corner, now is the time to prepare for distributing Forms 1095-C to employees and filing with the IRS. These forms provide essential information about health coverage offered to employees and are critical for demonstrating compliance with the ACA’s employer mandate. Missing these deadlines can lead to potential costly penalties and compliance headaches.

Key ACA Reporting Deadlines for 2025

Here are the critical dates you need to mark on your calendar for reporting on the 2024 tax year:

- March 3, 2025:

Deadline for furnishing Form 1095-C to employees.

Employers must provide their employees with a copy of Form 1095-C, which details the health coverage offered, by this date.

- February 28, 2025:

Deadline for paper filing with the IRS.

Employers filing fewer than 10 forms (aggregated with other forms, such as W-2, 1099) may submit paper forms to the IRS. Note: Paper filing is only an option for small employers below the e-filing threshold.

- March 31, 2025:

Deadline for electronic filing with the IRS.

Employers submitting 10 or more forms are required to file electronically. The extra time provided for electronic filing gives employers a little breathing room, but it’s essential to plan ahead and avoid last-minute delays.

Penalties for Missing ACA Reporting Deadlines

Failing to meet ACA reporting deadlines can result in hefty penalties:

- Late Furnishing to Employees:

Employers can be fined up to $310 per form for not providing Form 1095-C to employees by March 3, 2025.

- Late Filing with the IRS:

Penalties start at $60 per form for filing within 30 days of the deadline but can escalate to $310 per form for longer delays.

- Incorrect or Incomplete Information:

Filing forms with incorrect data, such as employee names or Social Security Numbers, can lead to additional penalties.

- Intentional Disregard:

If the IRS determines that an employer intentionally ignored filing requirements, penalties can skyrocket to $630 per form with no annual cap.

Checklist to Stay on Track for ACA Reporting in 2025

Use this checklist to ensure timely and accurate submissions:

- Verify Employee Data:

Review employee names, SSNs, and coverage details for accuracy.

- Select Your Filing Method:

Determine whether you’ll file on paper (if eligible) or electronically. Ensure you have the necessary software for electronic submissions.

- Monitor Deadlines:

Set reminders for March 3(employee furnishing), February 28 (paper filing), and March 31 (electronic filing).

- Test Your Process:

If filing on your own, conduct a test submission through the IRS AIR system to identify potential errors before the official filing.

- Leverage Technology:

Use an ACA compliance software solution to automate form generation, validation, and submission.

- Train Your Team:

Ensure HR, payroll, and benefits teams understand the reporting requirements and deadlines.

- Work with Experts:

Consider outsourcing ACA compliance to a trusted vendor if your internal resources are limited.

Conclusion

ACA reporting doesn’t have to be overwhelming—preparation is key. By understanding the deadlines, filing methods, and potential pitfalls, employers can stay compliant and avoid penalties. With the reporting season fast approaching, now is the time to finalize your plans, gather your data, and ensure you’re ready to meet the 2025 deadlines.

Originally posted on Mineral

by admin | Nov 9, 2017 | ACA, Human Resources, IRS

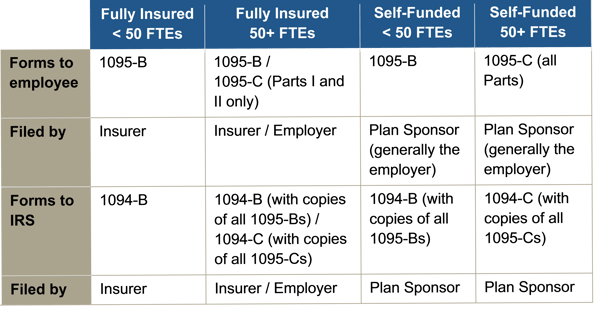

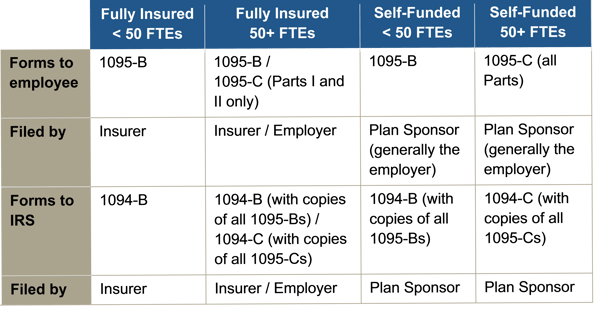

Instructions for both the 1094-B and 1095-B and the 1094-C and 1095-C were released, as were the forms for 1094-B, 1095-B, 1094-C, and 1095-C.

Reporting will be due early in 2018, based on coverage in 2017. For calendar year 2017, Forms 1094-C, 1095-C, 1094-B, and 1095-B must be filed by February 28, 2018, or April 2, 2018, if filing electronically. Statements to employees must be furnished by January 31, 2018. In late 2016, a filing deadline was provided for forms due in early 2017, however it is unknown if that extension will be provided for forms due in early 2018. Until employers are told otherwise, they should plan on meeting the current deadlines.

All reporting will be for the 2017 calendar year, even for non-calendar year plans.

The reporting requirements are in Sections 6055 and 6056 of the ACA. The major reporting requirements are:

by admin | Apr 21, 2017 | ACA, Human Resources

One might describe the series of events leading to the death of the American Health Care Act (Congress’s bill to repeal and replace the Affordable Care Act) as something like a ballistic missile exploding at launch. The Patient Protection and Affordable Care Act (ACA) repeal debate began nearly a decade ago with former President Barack Obama’s first day in office and reemerged as a serious topic during the 2016 presidential election. Even following the retraction of the House bill, repeal of the ACA remains a possibility as the politicians consider alternatives to the recent bill. The possibility of pending legislation has caused some clients to question the need to complete their obligation for ACA reporting on a timely basis this year. The legislative process has produced a great deal of uncertainty which is one thing employers do not like, especially during the busy year end.

One might describe the series of events leading to the death of the American Health Care Act (Congress’s bill to repeal and replace the Affordable Care Act) as something like a ballistic missile exploding at launch. The Patient Protection and Affordable Care Act (ACA) repeal debate began nearly a decade ago with former President Barack Obama’s first day in office and reemerged as a serious topic during the 2016 presidential election. Even following the retraction of the House bill, repeal of the ACA remains a possibility as the politicians consider alternatives to the recent bill. The possibility of pending legislation has caused some clients to question the need to complete their obligation for ACA reporting on a timely basis this year. The legislative process has produced a great deal of uncertainty which is one thing employers do not like, especially during the busy year end.

While the “repeal and replace” activity is continuing, it is imperative that employers and their brokers put their noses to the grindstone to fulfill all required reporting requirements. To accomplish this, employers will need brokers that can effectively guide them through this tumultuous season. We recommend that employers ask their brokers about their strategies for

- Implementing the employer shared responsibility reporting

- Sending all necessary forms to the employer’s employees

- Submitting the employer’s reporting to the IRS

- Closing out the employer’s 2016 filing season

Employers should also inquire about any additional support that the broker provides. They should provide many of the services that we at Health Cost Manager provide to our clients: They should apprise their clients of the latest legislative updates through regular email communication and informational webinars. Brokers should also bring in experts in the field that have interacted with key stakeholders in Washington. And most important, they should remain available during this uncertain period to answer any questions or concerns from clients.

We know employers would prefer not to have to comply with these reporting obligations – many have directly told us so. We understand this requires additional work on their part to gather information for the reporting and increased compliance responsibility. Knowing how stressful the reporting season can be for employers, brokers should go out of their way to help their clients feel confident that they can steer through the reporting process smoothly. The broker’s role should be to take as much of the burden off the employer’s shoulders as possible to enable them to reach compliance in the most expedient manner possible. Sometimes this involves stepping in to solve data or other technical issues, or answering a compliance-related question that helps the client make important decisions. It’s all part of helping employers navigate through the ACA’s strong headwinds during these uncertain times.

By Michael Weiskirch, Originally Published By United Benefit Advisors

For employers subject to the Affordable Care Act (ACA), staying compliant with reporting requirements is non-negotiable. With 2025 due dates just around the corner, now is the time to prepare for distributing Forms 1095-C to employees and filing with the IRS. These forms provide essential information about health coverage offered to employees and are critical for demonstrating compliance with the ACA’s employer mandate. Missing these deadlines can lead to potential costly penalties and compliance headaches.

For employers subject to the Affordable Care Act (ACA), staying compliant with reporting requirements is non-negotiable. With 2025 due dates just around the corner, now is the time to prepare for distributing Forms 1095-C to employees and filing with the IRS. These forms provide essential information about health coverage offered to employees and are critical for demonstrating compliance with the ACA’s employer mandate. Missing these deadlines can lead to potential costly penalties and compliance headaches.