Resources

Blog

Benefits 101: What Is an HDHP?

In today's world of complex health insurance options, High Deductible Health Plans (HDHPs) have become increasingly popular. But with a name like "high deductible," it's natural to have questions. Let’s break down the basics of HDHPs: What is an...

Investing in Health Prevention and Wellness: A Smart Bet

The old adage "an ounce of prevention is worth a pound of cure" rings truer than ever in today's world. While reactive healthcare plays a crucial role in treating illness, a growing emphasis is being placed on the power of health prevention and...

All About Medical Savings Accounts

Taking control of health care expenses is on the top of most people's to-do list for 2018. The...

2018 HSA Family Contribution Limit Reduced by $50

On March 5, 2018, the Internal Revenue Service (IRS) announced a reduction in the maximum annual...

6 Ways to Keep the Flu from Sidelining Your Workplace

This year’s flu season is a rough one. Although the predominant strains of this year’s influenza...

California Employment Law Update – February 2018

Employer Response to Immigration Inspection Notice In January 2018, the California Department of...

Benefits of an Annual Exam

Have you ever heard the proverb "Knowledge is power?" It means that knowledge is more powerful...

Federal Employment Law Update – February 2018

IRS Releases Publication 15 and W-4 Withholding Guidance for 2018 On January 31, 2018, the federal...

CMS Disclosure Requirement for Employer Health Plans

Do you offer health coverage to your employees? Does your group health plan cover outpatient...

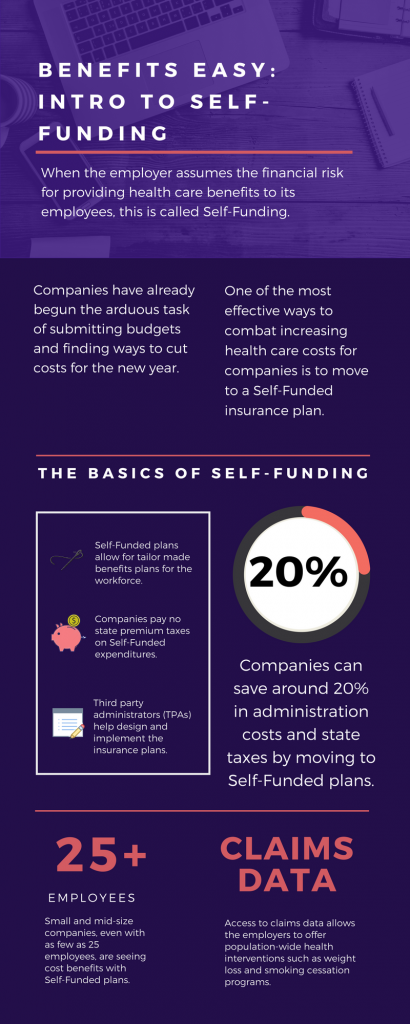

Benefits Easy: Intro to Self-Funding

As we head into the second month of 2018, companies have already begun the arduous task of...

Deadline Approaching: Post Form 300A (Summary of Work-Related Illnesses and Injuries)

This is a reminder that from February 1 through April 30, 2018, impacted employers are required to...

Federal Employment Law Update – January 2018

WHD Revises Test for Unpaid Internships On January 5, 2018, the U.S. Department of Labor’s Wage...

CA Insurance License 0649686. Investment advisory services offered through Global Retirement Partners, LLC, a registered investment advisor. Global Retirement Partners, LLC, and Johnson & Dugan Insurance Services Corporation are separate and non-affiliated companies. All J&D email communications are HIPAA Security Compliant and accessible through the J&D secure email messaging center.

Privacy Policy | Disclosure Statement

Healthcare Transparency

United Healthcare Surprise Billing Disclosure

United Healthcare Machine Readable Files (MRF)

Kaiser Permanente Surprise Billing Disclosure

Kaiser Permanente Machine Readable Files (MRF)

Contact

650.266.9700 | info@johnsondugan.com

Johnson & Dugan

390 Bridge Parkway, Suite 200

Redwood City, CA 94065

Social

Contact

650.266.9700 | info@johnsondugan.com

Johnson & Dugan

390 Bridge Parkway, Suite 200

Redwood City, CA 94065

Social