by admin | Mar 31, 2017 | Employee Benefits, Group Benefit Plans, Human Resources

The age-old adage, “you get what you pay for,” certainly holds true in the stop loss industry. I cannot stress enough how important it is to look at more than just the premium rates on a spreadsheet.

The age-old adage, “you get what you pay for,” certainly holds true in the stop loss industry. I cannot stress enough how important it is to look at more than just the premium rates on a spreadsheet.

To understand the importance, let’s use the auto insurance industry as a comparable example. If you were purchasing car insurance for yourself, would you always accept the lowest price without doing a coverage comparison? How would you know if that insurance company might jack up your rates on renewal, or once you have an accident, or possibly delay your claims and find every reason or loophole not to pay them?

Apply that same thinking to stop loss coverage with larger dollar amounts at risk. Not every stop loss policy is alike and not every carrier is going to provide you with the coverage you are seeking. As an employer, you want to make sure the employee benefit plan you sponsor for your employees will not result in any significant liabilities for your company. You want the peace of mind of knowing there won’t be any surprises along the way.

All stop loss carrier policies are different. Over my 20-plus years in the industry, I have seen some very unique language and provisions in stop loss policies that most people would not notice without looking at the fine print. You must be aware of these potential provisions that could cause significant gaps in coverage between your employee benefit plan and your stop loss policy.

How can you best protect your company? You can start by working with your broker or administrator to narrow down the list of stop loss providers to those that best meet your needs. Brokers and administrators are best suited to understand the complexities of stop loss insurance and provide you with the best possible information regarding policies and choices.

By keeping this, and the following items, in mind during your selection process, you should be able to find a carrier to serve your needs.

The most important advice I can provide is to look beyond just price and at the actual stop loss policy. The lowest price doesn’t always mean the best value. So make sure to:

- Read the stop loss policy before you purchase your coverage

- Ask for a sample policy

- Understand ALL the provisions of the policy itself

- Ask your broker or administrator to review the policy if you don’t understand all the provisions

Additionally, there are a few other things you will want to look for, or ask about, when selecting a stop loss carrier. In part two of this blog, which will be posted the first week of April, I will discuss some of the most frequent items I have seen that cause issues or gaps in coverage.

By Steven Goethel, Originally Published By United Benefit Advisors

by admin | Mar 24, 2017 | ACA, Group Benefit Plans, IRS

A fixed indemnity health plan pays a specific amount of cash for certain health-related events (for example, $40 per office visit or $100 per hospital day). The amount paid is neither related to the medical expense incurred, nor coordinated with other health coverage. Further, a fixed indemnity health plan is considered an “excepted benefit.”

A fixed indemnity health plan pays a specific amount of cash for certain health-related events (for example, $40 per office visit or $100 per hospital day). The amount paid is neither related to the medical expense incurred, nor coordinated with other health coverage. Further, a fixed indemnity health plan is considered an “excepted benefit.”

Under HIPAA, fixed dollar indemnity policies are excepted benefits if they are offered as “independent, non-coordinated benefits.” Under the Patient Protection and Affordable Care Act (ACA), excepted benefits are not subject to the ACA’s health insurance requirements or prohibitions (for example, annual and lifetime dollar limits, out-of-pocket limits, requiring individual and small-group policies to cover ten essential health benefits, etc.). This means that excepted benefit policies can exclude preexisting conditions, can have dollar limits, and do not legally have to guarantee renewal when the coverage is cancelled.

Further, under the ACA, excepted benefits are not minimum essential coverage so a large employer cannot comply with its employer shared responsibility obligations by offering only fixed indemnity coverage to its full-time employees.

Some examples of fixed indemnity health plans are AFLAC or similar coverage, or cancer insurance policies.

Recently, the IRS released a Memorandum on the tax treatment of benefits paid by fixed indemnity health plans that addresses two questions:

- Are payments to an employee under an employer-provided fixed indemnity health plan excludible from the employee’s income under Internal Revenue Code §105?

- Are payments to an employee under an employer-provided fixed indemnity health plan excludible from the employee’s income under Internal Revenue Code §105 if the payments are made by salary reduction through a §125 cafeteria plan?

By Danielle Capilla, Originally Published By United Benefit Advisors

by admin | Mar 2, 2017 | ACA, Group Benefit Plans, Human Resources

Last fall, President Barack Obama signed the Protecting Affordable Coverage for Employees Act (PACE), which preserved the historical definition of small employer to mean an employer that employs 1 to 50 employees. Prior to this newly signed legislation, the Patient Protection and Affordable Care Act (ACA) was set to expand the definition of a small employer to include companies with 51 to 100 employees (mid-size segment) beginning January 1, 2016.

Last fall, President Barack Obama signed the Protecting Affordable Coverage for Employees Act (PACE), which preserved the historical definition of small employer to mean an employer that employs 1 to 50 employees. Prior to this newly signed legislation, the Patient Protection and Affordable Care Act (ACA) was set to expand the definition of a small employer to include companies with 51 to 100 employees (mid-size segment) beginning January 1, 2016.

If not for PACE, the mid-size segment would have become subject to the ACA provisions that impact small employers. Included in these provisions is a mandate that requires coverage for essential health benefits (not to be confused with minimum essential coverage, which the ACA requires of applicable large employers) and a requirement that small group plans provide coverage levels that equate to specific actuarial values. The original intent of expanding the definition of small group plans was to lower premium costs and to increase mandated benefits to a larger portion of the population.

The lower cost theory was based on the premise that broadening the risk pool of covered individuals within the small group market would spread the costs over a larger population, thereby reducing premiums to all. However, after further scrutiny and comments, there was concern that the expanded definition would actually increase premium costs to the mid-size segment because they would now be subject to community rating insurance standards. This shift to small group plans might also encourage mid-size groups to leave the fully insured market by self-insuring – a move that could actually negate the intended benefits of the expanded definition.

Another issue with the ACA’s expanded definition of small group plans was that it would have resulted in a double standard for the mid-size segment. Not only would they be subject to the small group coverage requirements, but they would also be subject to the large employer mandate because they would meet the ACA’s definition of an applicable large employer.

Note: Although this bill preserves the traditional definition of a small employer, it does allow states to expand the definition to include organizations with 51 to 100 employees, if so desired.

By Vicki Randall, Originally Published By United Benefit Advisors

by admin | Feb 20, 2017 | Group Benefit Plans, Health Plan Benchmarking

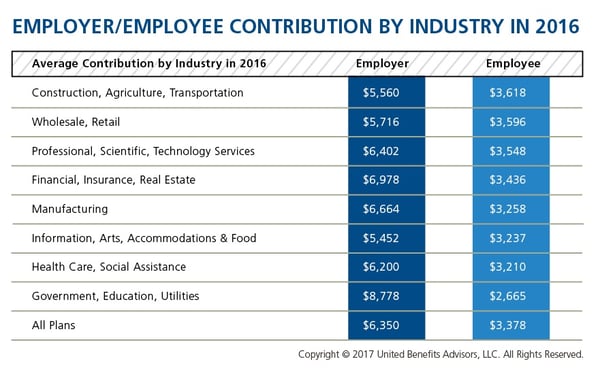

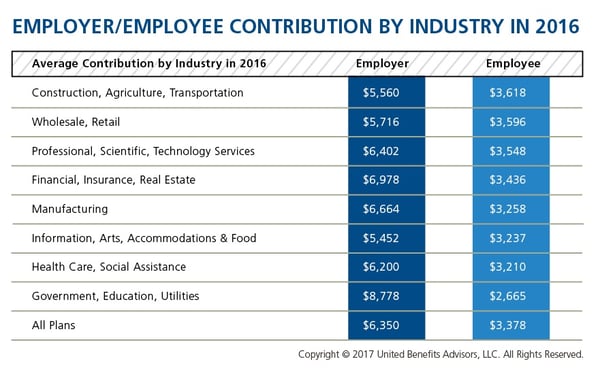

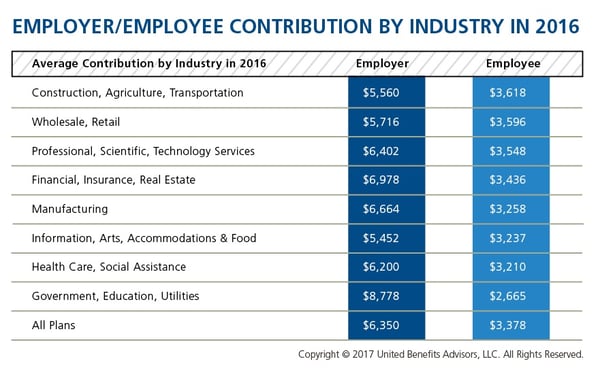

We recently shared healthcare cost benchmarking best practices and reported on the best and worst industries/states for group healthcare. But how much are you contributing toward healthcare costs vs. your employees? That’s a key benchmark, especially when “cost-shifting” is the main strategy for mitigating risk for employers. You may have the most affordable plan, but if you are passing most of that cost on to your employees, you may not be a competitive employer.

According to the latest UBA Health Plan Survey, total costs per employee for the retail, construction, and hospitality sectors are 4.3 percent to 11.3 percent lower than average, making employees in these industries among the least expensive to cover. But employees in the retail and construction sectors pay 6.3 percent and 6.8 percent above the average employee contribution, respectively (hospitality employees pay slightly below the average employee contribution).

On the other end of the cost spectrum, the government sector has the priciest plans ($11,443 per employee) and passes on the least cost to employees, whose average contributions are more than 23 percent less than average. (Surprisingly, these employees are experiencing sticker shock this year since they’ve seen a 26.6 percent increase in their contributions, which were 45.2 percent below average last year.)

When employees’ out of pocket costs are rising, carefully considering and benchmarking their contributions toward the total cost is important—and not nationally, but compared to your peers. Here’s a look at all the average employer/employee contributions by industry:

By RJ Nelson, Originally Published By United Benefit Advisors

The age-old adage, “you get what you pay for,” certainly holds true in the stop loss industry. I cannot stress enough how important it is to look at more than just the premium rates on a spreadsheet.

The age-old adage, “you get what you pay for,” certainly holds true in the stop loss industry. I cannot stress enough how important it is to look at more than just the premium rates on a spreadsheet.