by admin | Feb 3, 2026 | Custom Content, Employee Benefits

Offering voluntary benefits is an excellent way to strengthen your overall benefits package, stand out from competitors, and enhance employee satisfaction—all with minimal impact on your budget. However, while employers often provide a wide range of voluntary benefits designed to offer value and convenience, many employees may not fully understand what these benefits are or how they can help. Educating your workforce about the advantages of voluntary benefits ensures both employers and employees gain maximum value.

Offering voluntary benefits is an excellent way to strengthen your overall benefits package, stand out from competitors, and enhance employee satisfaction—all with minimal impact on your budget. However, while employers often provide a wide range of voluntary benefits designed to offer value and convenience, many employees may not fully understand what these benefits are or how they can help. Educating your workforce about the advantages of voluntary benefits ensures both employers and employees gain maximum value.

Showcasing the Value

Employees may not always recognize the value of voluntary benefits, particularly since these options are typically employee-funded. These benefits, which may include options like life insurance, disability coverage, accident insurance, critical illness insurance, cancer insurance or even legal and pet insurance, provide added security and convenience without significantly increasing employer costs.

For example, voluntary insurance purchased through an employer group is often more affordable than an individual policy—but few employees realize this. When highlighting voluntary benefits, clearly explain the advantages of being covered, the potential risks of going without protection, and the convenience of enrolling through payroll deductions.

Promoting Coverage Understanding

Employee education is vital to preventing confusion and frustration about what a policy covers. Misunderstandings can lead to resentment if employees expect coverage that isn’t actually included. To avoid these situations, ensure every employee—whether their benefit is employer-paid or voluntary—understands how the coverage works.

Consider the following strategies to strengthen benefits education:

- Invite current employees to attend orientation or periodic benefits meetings.

- Ask benefit providers to send representatives to explain their products directly to staff.

- Schedule small-group sessions for employees who have detailed questions.

- Leverage social media to share educational materials, reminders, and benefit updates in an accessible way.

Strengthening Employer Value

Beyond increasing participation in voluntary benefits, investing in employee education helps position your organization as a trusted source of benefits knowledge. This approach not only boosts engagement but also strengthens employee satisfaction and loyalty to your company.

by admin | Jan 19, 2026 | Employee Benefits, Health Insurance

The One Big Beautiful Bill Act (OBBBA) was signed into law on July 4, 2025, introducing significant updates to Health Savings Accounts (HSAs). Following this, the IRS released Notice 2026-5 to provide specific guidance on how these changes expand HSA eligibility and usage.

The One Big Beautiful Bill Act (OBBBA) was signed into law on July 4, 2025, introducing significant updates to Health Savings Accounts (HSAs). Following this, the IRS released Notice 2026-5 to provide specific guidance on how these changes expand HSA eligibility and usage.

The OBBBA broadens HSA availability through the following key provisions:

1. Permanent Telehealth Flexibility

The ability to receive telehealth and other remote care services before reaching the High Deductible Health Plan (HDHP) deductible has been made permanent. This ensures that individuals can access remote care without losing their HSA eligibility. This extension is effective for all plan years beginning after December 31, 2024.

2. Integration with Direct Primary Care (DPC)

The new law officially recognizes Direct Primary Care (DPC) arrangements as compatible with HSAs.

- Individuals in these arrangements can now contribute to an HSA.

- Periodic DPC fees are now classified as qualified medical expenses, meaning they can be paid for using tax-free HSA funds.

3. Expanded Plan Compatibility

Bronze and catastrophic plans offered through the ACA Exchange are now designated as HSA-compatible. This change applies regardless of whether these specific plans meet the traditional IRS requirements for an HDHP, significantly increasing the number of Americans eligible to open and fund an HSA.

Strategic Outlook for Employers

While some provisions are currently active, the majority of the OBBBA’s employee benefit changes will take full effect in 2026. Employers are encouraged to review these regulatory updates immediately to ensure benefit packages remain compliant and optimized for the coming year.

by admin | Jan 5, 2026 | Custom Content, Employee Benefits

In our increasingly busy world, employee expectations are accelerating faster than ever before. A five-year-old benefits strategy simply cannot meet the complex, constant pressures workers face in 2026—be it financial stress, burnout, or caregiving responsibilities. The modern workforce is rejecting generic menus in favor of flexibility, strong financial support, and wellness options that align with their personal lives.

In our increasingly busy world, employee expectations are accelerating faster than ever before. A five-year-old benefits strategy simply cannot meet the complex, constant pressures workers face in 2026—be it financial stress, burnout, or caregiving responsibilities. The modern workforce is rejecting generic menus in favor of flexibility, strong financial support, and wellness options that align with their personal lives.

Employers face a critical challenge in 2026: balancing projected healthcare cost increases (around 10%) with the need to offer personalized, holistic, and competitive benefits.

Top 9 Trends Shaping 2026 Benefits Strategy:

- Managing Rising Healthcare Costs: Employers are adopting cost-management tactics — such as telemedicine, HSAs, and wellness incentives — to balance rising expenses driven by medical inflation, specialty drug use, and delayed care demand.

- Total Health and Well-Being:Benefits now integrate physical, mental, and financial wellness through EAPs, teletherapy, and wellness technology to promote holistic employee health.

- Women’s Health Expansion: Comprehensive care from fertility to menopause is becoming standard, improving retention, equity, and workforce engagement.

- Personalized Benefits Through AI:Technology enables tailored benefits selection, predictive analytics, and mobile access, meeting diverse employee needs.

- Mental Health Integration:Behavioral health is now fundamental, with digital tools, manager training, and open dialogue reducing stigma and driving productivity.

- Family and Caregiving Support:These benefits address the financial and emotional strain on the “sandwich generation” (caring for children and elders simultaneously). Expanded parental leave, dependent-care FSAs, and eldercare resources address pressures on multigenerational caregivers.

- Voluntary Benefits:Supplemental benefits provide a cost-effective way to offer additional value to employees. From pet insurance to identity theft protection, these benefits give employees the flexibility to select coverage that meets their individual needs.

- Financial Wellness and Retirement Security:Initiatives like 401(k) matching, financial counseling, and student-loan repayment reduce stress and strengthen financial stability.

- Upskilling and Development:Investing in employee growth as a key driver of retention and engagement, particularly among Gen Z and Millennials. Continuous learning opportunities, AI-driven training, and mentorship programs help attract and retain talent seeking career growth.

Ultimately, a strategic benefits plan that balances economic realities with genuine care for the workforce will be the decisive factor in attracting talent, boosting engagement, and building a resilient team ready for the year ahead.

by admin | Nov 12, 2025 | Employee Benefits, Hot Topics

Federal regulators—specifically, the Departments of Labor, Health and Human Services, and the Treasury—issued joint guidance on October 16, 2025, making it significantly easier for employers to offer fertility benefits outside of their traditional group health plans.

Federal regulators—specifically, the Departments of Labor, Health and Human Services, and the Treasury—issued joint guidance on October 16, 2025, making it significantly easier for employers to offer fertility benefits outside of their traditional group health plans.

This action was driven by an Executive Order focused on protecting in vitro fertilization (IVF) access and reducing the high out-of-pocket costs associated with fertility treatment. The guidance effectively creates compliant pathways for employers to offer fertility coverage as an excepted benefit.

Key Takeaways for Offering Fertility Coverage

The new guidance provides clear, compliant options for employers to offer fertility support:

- Standalone Excepted Benefit: Employers may offer fertility benefits through a separate, fully insured policy that is not coordinated with the main group health plan. This is a crucial distinction, as individuals enrolled in this separate coverage may still contribute to a Health Savings Account (HSA).

- Excepted Benefit HRA: Employers can use an Excepted Benefit Health Reimbursement Arrangement (HRA) to reimburse employees for out-of-pocket fertility expenses, provided the HRA meets all applicable regulatory standards.

- Limited EAP Services: Benefits for fertility coaching and navigator services (to help employees understand their options) can be offered under an Employee Assistance Program (EAP), as long as the EAP qualifies as a limited excepted benefit and does not offer significant medical care benefits.

What’s Next?

The Departments have indicated they plan to release future rulemaking to explore even more ways to offer fertility benefits as a limited excepted benefit, which could offer employers additional flexibility in the future.

by admin | Nov 4, 2025 | Custom Content, Employee Benefits, Health & Wellness

The future of healthcare is rapidly evolving, with a clear trend toward integrating health interventions directly into employee benefits packages. As employers face rising healthcare costs—projected to increase by over 8% in 2025—they are rethinking how to deliver value to their workforce while managing expenses. This integration is reshaping not just what benefits are offered, but how employees access, use, and experience healthcare.

The future of healthcare is rapidly evolving, with a clear trend toward integrating health interventions directly into employee benefits packages. As employers face rising healthcare costs—projected to increase by over 8% in 2025—they are rethinking how to deliver value to their workforce while managing expenses. This integration is reshaping not just what benefits are offered, but how employees access, use, and experience healthcare.

From Reactive to Proactive: A Paradigm Shift

Historically, employee benefits have largely been reactive, focusing on covering costs after an illness or injury occurs. While essential, this model often overlooks the power of prevention, early intervention, and continuous support. The modern workforce, increasingly diverse in its needs and health goals, demands more. They seek benefits that empower them to manage their health proactively, rather than merely responding to sickness.

Integrating health interventions directly into benefits packages represents a pivotal move towards a proactive, holistic model. This means weaving in tools and programs that actively promote wellness, manage chronic conditions, and address the root causes of health challenges before they escalate.

What Do “Integrated Health Interventions” Look Like?

This new era of benefits goes beyond basic wellness programs. It encompasses a wide array of specialized, often technology-driven, interventions designed to meet specific health needs:

- Personalized Digital Health Platforms: These platforms leverage AI and data to offer tailored recommendations for fitness, nutrition, sleep, and stress management. They can connect employees with virtual coaching, mental health resources, and even provide smart device integration for continuous health monitoring.

- Specialized Chronic Condition Management Programs: For employees managing conditions like diabetes, hypertension, or asthma, integrated benefits offer dedicated support. This might include virtual health coaching, remote monitoring devices, personalized nutrition plans, and direct access to specialists, all aimed at improving adherence, outcomes, and quality of life.

- Mental Health & Well-Being Solutions: Recognizing the escalating importance of mental health, benefits packages are increasingly including access to online therapy platforms, meditation apps, stress reduction programs, and resilience training. These are often integrated with EAPs (Employee Assistance Programs) for a comprehensive support system.

- Preventive Care & Early Detection Initiatives: Beyond standard physicals, this could involve access to advanced health screenings, genetic testing (with proper counseling), smoking cessation programs, and vaccination clinics, all designed to identify risks early and prevent disease.

- Family-Building & Parental Support: Expanding beyond traditional maternity benefits, interventions now include fertility support, adoption assistance, lactation consulting, and comprehensive parental leave policies, acknowledging the full spectrum of family health needs.

The Multi-Layered Benefits of Integration

For employers, the strategic integration of health interventions yields substantial advantages:

- Improved Employee Health Outcomes: Proactive management leads to healthier employees, reducing the incidence and severity of chronic conditions.

- Reduced Healthcare Costs: Early intervention and better management of health issues can significantly lower claims costs, emergency room visits, and long-term medical expenses.

- Enhanced Talent Attraction & Retention: A comprehensive, forward-thinking benefits package is a powerful differentiator in a competitive job market, signaling a true investment in employee well-being.

- Increased Productivity & Engagement: Healthier, less stressed employees are more focused, engaged, and productive, leading to a more vibrant workplace culture.

- Stronger Organizational Culture: Prioritizing employee health fosters a culture of care, support, and appreciation, boosting morale and loyalty.

Challenges and the Path Forward

While the benefits are compelling, integration comes with its challenges, including data privacy concerns, ensuring equitable access, and effectively communicating complex offerings. The future of healthcare within employee benefits is not just about providing access to care, but about actively cultivating health. By seamlessly weaving targeted health interventions into benefits strategies, organizations can build a healthier, more resilient workforce, ultimately contributing to a more sustainable and prosperous business.

by admin | Oct 30, 2025 | Custom Content, Employee Benefits, Health Care Costs

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save money on prescriptions.

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save money on prescriptions.

Did You Know?

Drug costs are a primary driver of rising healthcare expenses for both employers and employees. Prescription drug spending is consistently growing at a faster rate than overall healthcare costs, with a steady increase of 6.8%. As the fastest-growing part of benefits plans, these costs will continue to climb with new pharmaceutical innovations.

For years in the U.S., cost has been a significant obstacle to sticking with medications with up to 3 in 10 people reporting that they do not take their medications as prescribed.

The Rising Cost of Prescriptions

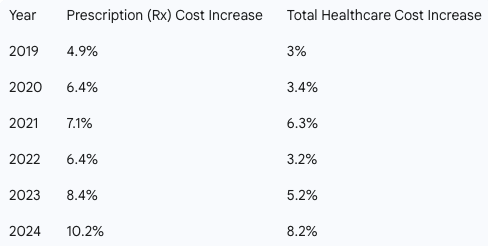

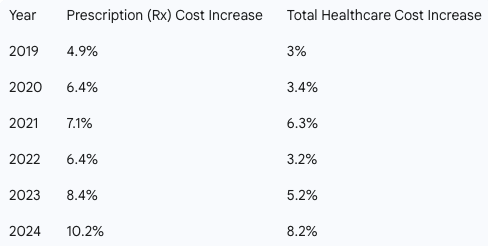

Historically, prescription drug costs have outpaced total healthcare costs. The following chart highlights this trend from 2019 to 2024.

Prescription drug costs can put a strain on your budget, but with a little research and the right questions, you can reduce expenses without sacrificing your health.

Here are expert-backed strategies to help you save on your medications:

-

-

- Ask About a Generic Drug – Get the same quality and active ingredient as you’d find in a brand name, for less money.

- Save Money with a Pill Splitter – If your prescription comes in a higher dose that can be safely split, you get 2 doses for the price of 1.

- Consider a Combo Pill – Combining two drugs into one pill can help you avoid paying separate copays or coinsurance. Ask if a combo pill is an option for you.

- Buy in Bulk – Opt for a mail-order pharmacy to get a 90-day supply of your meds instead or a 30-day supply. This can often reduce your copay and overall cost.

- Make a List and Check it Twice – Check the list of preferred medications (a.k.a. “the formulary”), which tend to cost less.

- Find Out if You Still Need That Medication – If you’ve been taking the same medication for years, it’s worth checking in with your doctor to see if you still need it. Or if you’ve made a lifestyle change, it may reduce your need for certain medications. It never hurts to ask your doctor.

-

-

-

-

-

The medicines prescribed by your doctor are essential to your good health. With some savvy shopping, you can use the money you save on the things you enjoy!

Offering voluntary benefits is an excellent way to strengthen your overall benefits package, stand out from competitors, and enhance employee satisfaction—all with minimal impact on your budget. However, while employers often provide a wide range of voluntary benefits designed to offer value and convenience, many employees may not fully understand what these benefits are or how they can help. Educating your workforce about the advantages of voluntary benefits ensures both employers and employees gain maximum value.

Offering voluntary benefits is an excellent way to strengthen your overall benefits package, stand out from competitors, and enhance employee satisfaction—all with minimal impact on your budget. However, while employers often provide a wide range of voluntary benefits designed to offer value and convenience, many employees may not fully understand what these benefits are or how they can help. Educating your workforce about the advantages of voluntary benefits ensures both employers and employees gain maximum value.