by admin | Nov 4, 2025 | Custom Content, Employee Benefits, Health & Wellness

The future of healthcare is rapidly evolving, with a clear trend toward integrating health interventions directly into employee benefits packages. As employers face rising healthcare costs—projected to increase by over 8% in 2025—they are rethinking how to deliver value to their workforce while managing expenses. This integration is reshaping not just what benefits are offered, but how employees access, use, and experience healthcare.

The future of healthcare is rapidly evolving, with a clear trend toward integrating health interventions directly into employee benefits packages. As employers face rising healthcare costs—projected to increase by over 8% in 2025—they are rethinking how to deliver value to their workforce while managing expenses. This integration is reshaping not just what benefits are offered, but how employees access, use, and experience healthcare.

From Reactive to Proactive: A Paradigm Shift

Historically, employee benefits have largely been reactive, focusing on covering costs after an illness or injury occurs. While essential, this model often overlooks the power of prevention, early intervention, and continuous support. The modern workforce, increasingly diverse in its needs and health goals, demands more. They seek benefits that empower them to manage their health proactively, rather than merely responding to sickness.

Integrating health interventions directly into benefits packages represents a pivotal move towards a proactive, holistic model. This means weaving in tools and programs that actively promote wellness, manage chronic conditions, and address the root causes of health challenges before they escalate.

What Do “Integrated Health Interventions” Look Like?

This new era of benefits goes beyond basic wellness programs. It encompasses a wide array of specialized, often technology-driven, interventions designed to meet specific health needs:

- Personalized Digital Health Platforms: These platforms leverage AI and data to offer tailored recommendations for fitness, nutrition, sleep, and stress management. They can connect employees with virtual coaching, mental health resources, and even provide smart device integration for continuous health monitoring.

- Specialized Chronic Condition Management Programs: For employees managing conditions like diabetes, hypertension, or asthma, integrated benefits offer dedicated support. This might include virtual health coaching, remote monitoring devices, personalized nutrition plans, and direct access to specialists, all aimed at improving adherence, outcomes, and quality of life.

- Mental Health & Well-Being Solutions: Recognizing the escalating importance of mental health, benefits packages are increasingly including access to online therapy platforms, meditation apps, stress reduction programs, and resilience training. These are often integrated with EAPs (Employee Assistance Programs) for a comprehensive support system.

- Preventive Care & Early Detection Initiatives: Beyond standard physicals, this could involve access to advanced health screenings, genetic testing (with proper counseling), smoking cessation programs, and vaccination clinics, all designed to identify risks early and prevent disease.

- Family-Building & Parental Support: Expanding beyond traditional maternity benefits, interventions now include fertility support, adoption assistance, lactation consulting, and comprehensive parental leave policies, acknowledging the full spectrum of family health needs.

The Multi-Layered Benefits of Integration

For employers, the strategic integration of health interventions yields substantial advantages:

- Improved Employee Health Outcomes: Proactive management leads to healthier employees, reducing the incidence and severity of chronic conditions.

- Reduced Healthcare Costs: Early intervention and better management of health issues can significantly lower claims costs, emergency room visits, and long-term medical expenses.

- Enhanced Talent Attraction & Retention: A comprehensive, forward-thinking benefits package is a powerful differentiator in a competitive job market, signaling a true investment in employee well-being.

- Increased Productivity & Engagement: Healthier, less stressed employees are more focused, engaged, and productive, leading to a more vibrant workplace culture.

- Stronger Organizational Culture: Prioritizing employee health fosters a culture of care, support, and appreciation, boosting morale and loyalty.

Challenges and the Path Forward

While the benefits are compelling, integration comes with its challenges, including data privacy concerns, ensuring equitable access, and effectively communicating complex offerings. The future of healthcare within employee benefits is not just about providing access to care, but about actively cultivating health. By seamlessly weaving targeted health interventions into benefits strategies, organizations can build a healthier, more resilient workforce, ultimately contributing to a more sustainable and prosperous business.

by admin | Oct 30, 2025 | Custom Content, Employee Benefits, Health Care Costs

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save money on prescriptions.

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save money on prescriptions.

Did You Know?

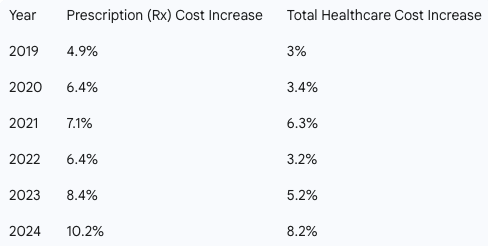

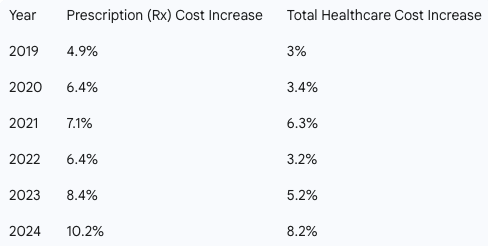

Drug costs are a primary driver of rising healthcare expenses for both employers and employees. Prescription drug spending is consistently growing at a faster rate than overall healthcare costs, with a steady increase of 6.8%. As the fastest-growing part of benefits plans, these costs will continue to climb with new pharmaceutical innovations.

For years in the U.S., cost has been a significant obstacle to sticking with medications with up to 3 in 10 people reporting that they do not take their medications as prescribed.

The Rising Cost of Prescriptions

Historically, prescription drug costs have outpaced total healthcare costs. The following chart highlights this trend from 2019 to 2024.

Prescription drug costs can put a strain on your budget, but with a little research and the right questions, you can reduce expenses without sacrificing your health.

Here are expert-backed strategies to help you save on your medications:

-

-

- Ask About a Generic Drug – Get the same quality and active ingredient as you’d find in a brand name, for less money.

- Save Money with a Pill Splitter – If your prescription comes in a higher dose that can be safely split, you get 2 doses for the price of 1.

- Consider a Combo Pill – Combining two drugs into one pill can help you avoid paying separate copays or coinsurance. Ask if a combo pill is an option for you.

- Buy in Bulk – Opt for a mail-order pharmacy to get a 90-day supply of your meds instead or a 30-day supply. This can often reduce your copay and overall cost.

- Make a List and Check it Twice – Check the list of preferred medications (a.k.a. “the formulary”), which tend to cost less.

- Find Out if You Still Need That Medication – If you’ve been taking the same medication for years, it’s worth checking in with your doctor to see if you still need it. Or if you’ve made a lifestyle change, it may reduce your need for certain medications. It never hurts to ask your doctor.

-

-

-

-

-

The medicines prescribed by your doctor are essential to your good health. With some savvy shopping, you can use the money you save on the things you enjoy!

by admin | Oct 7, 2025 | Custom Content, Employee Benefits

Health Insurance today is significantly more complex for young workers than it was just a decade ago. This complexity is driven in large part by healthcare costs that have outpaced inflation, pushing premiums, copays, and other out-of-pocket expenses to comprise substantial portions of their budgets. For many younger employees, navigating this landscape is confusing – more than 50% of Gen Z and Millennial workers admit to randomly selecting a health insurance plan, and nearly half say they don’t know where to turn for help during open enrollment. This lack of guidance makes it difficult for them to anticipate costs and make informed decisions about their care.

They also don’t truly grasp basic health insurance terms like “premium” or “deductible.” This knowledge gap doesn’t just confuse employees; it costs businesses an estimated $106 billion to $238 billion annually due to poor health literacy.

The good news? We can turn the tide. Empowering employees to become smarter benefits consumers pays off for everyone, leading to better health outcomes and lower costs. The earlier this education begins, the greater the impact. Here are five practical strategies for helping young employees get up to speed on their benefits:

- Begin with the Basics – Assume nothing. Most employees, particularly those just starting out, aren’t familiar with insurance jargon. Start with “Benefits 101” initiatives that cover the absolute basics: common terms, the ins and outs of group health coverage, vesting schedules, and enrollment period restrictions. Laying this groundwork early helps ensure young employees can make the most of their benefits from day one.

- Highlight the Personal Value – Young employees want to know, “What’s in it for me?” Beyond basic definitions, highlight how a deeper understanding can translate into real-world savings. Explain provider networks and demonstrate how a little research can save thousands on medical procedures.

- Mix Up the Messaging – Traditional handouts are helpful, but young employees often engage more with dynamic content. Use a variety of formats—emails, videos, infographics, flyers, posters, and interactive presentations—to make benefits education more appealing and memorable. A diverse approach ensures the message reaches everyone.

- Make Education Ongoing – Benefits education shouldn’t be a one-time event. Start as soon as employees are hired and keep the conversation going year-round. Regularly discuss relevant topics, such as how to handle life events, use telemedicine, fill prescriptions, or choose between urgent care and the ER. Consider implementing a consistent communication schedule, tackling different benefits topics each month to keep knowledge fresh, especially as open enrollment approaches.

- Offer Personalized Support – Even with great resources, some employees will still have questions. Designate an HR team member as the go-to benefits expert, available for email, virtual, or in-person support. Encourage all employees to meet with HR at least once before open enrollment and consider one-on-one sessions to address individual concerns.

It’s up to employers to help their teams understand and use their benefits wisely—especially young employees who can’t be expected to make informed decisions without a solid grasp of the basics. The real-life reasons people give for delaying or avoiding care—or choosing an ER visit over a primary care doctor—are a powerful testament to why this education is so critical. By investing in benefits education, employers set everyone up for better health, financial security, and peace of mind.

by admin | Sep 30, 2025 | Custom Content, Employee Benefits

Open enrollment doesn’t have to be a stressful administrative task. When planned well in advance, it becomes a valuable opportunity to review and enhance your benefits offerings, demonstrating your commitment to your team’s physical, mental, and financial well-being. A well-executed open enrollment can boost employee morale, improve retention, and ensure your workforce is supported.

Open enrollment doesn’t have to be a stressful administrative task. When planned well in advance, it becomes a valuable opportunity to review and enhance your benefits offerings, demonstrating your commitment to your team’s physical, mental, and financial well-being. A well-executed open enrollment can boost employee morale, improve retention, and ensure your workforce is supported.

Use this checklist to guide your organization through a successful open enrollment period, from the initial planning stages to the final follow-up.

Phase 1: Plan and Prepare Early (8-12 Weeks Before)

- Leverage technology: Consider a benefits portal where employees can easily access health plan documents such as benefit summaries, plan flyers, and contributions charts.

- Gather Employee Feedback: Solicit and record employee questions, concerns, and suggestions from the previous year. Consider conducting a survey to understand what benefits or improvements your workforce desires for the upcoming year.

- Evaluate and Enhance Offerings: Identify new or updated enrollment options.

- Develop Core Resources: Begin preparing your benefits guide and consider implementing or updating online enrollment tools and software.

- Create Educational Content: Produce digital educational materials like FAQs and videos.

Phase 2: Communication Kick-Off (4 Weeks Before)

- Launch Communication Campaign: Start sharing enrollment information across all selected online platforms (e.g., intranet, company newsletter, email).

- Equip Management: Develop a resource kit for your management team, including talking points and FAQs, to ensure they can confidently discuss open enrollment with their teams.

- Integrate Reminders: Add open enrollment reminders and key dates to the email signatures of your management team.

Phase 3: The Final Countdown (1-2 Weeks Before)

- Host Informational Sessions: Schedule and host virtual benefits meetings, webinars, and one-on-one sessions as needed to answer specific questions.

- Distribute Physical Materials: Provide informational pamphlets and mailers to employees.

- Prepare for Questions: Have answers ready for FAQs to ensure a smooth process.

Phase 4: During Open Enrollment

- Ensure Full Distribution: Make sure every employee receives the following information:

- The open enrollment timeline and deadlines

- A statement of their current coverage

- Information on plan-specific changes and rates

- Summaries of available plans

- The open enrollment booklet and any necessary forms

- Contact details for all plan carriers

- Promote Discussion: Remind managers to actively discuss benefit options with their teams.

- Provide Support: Offer ample time for enrollment and send frequent reminders throughout the period.

- Last-Minute Reminder: Schedule a company-wide reminder for the day before the enrollment deadline to prevent employees from missing the window.

Phase 5: Post-Enrollment Actions (1-2 Weeks After)

- Audit and Submit: Review all enrollment forms for missing or incorrect information.

- Ensure Compliance: Confirm that all relevant health care reform requirements have been met.

- Follow Up: Collect feedback from employees on their open enrollment experience.

Bonus Tip for Success

Consider holding a separate, off-cycle enrollment period to highlight voluntary benefits that might be overlooked during the busy primary open enrollment. This provides employees with a dedicated opportunity to explore additional benefits, potentially increasing your overall benefits utilization and employee satisfaction.

We are here to help; reach out to us with any open enrollment questions or needs you may have!

by admin | Sep 8, 2025 | Custom Content, Employee Benefits, Health Insurance

When navigating the world of health insurance, you will likely encounter the term PPO (Preferred Provider Organization). A PPO plan – whether medical or dental – is about balancing the cost and convenience of care. With a PPO plan, you get the flexibility to see a wide range of doctors. You’ll save money by staying within the plan’s network of preferred providers, but you can still choose to go out of network and receive partial coverage. Unlike some other plans, a PPO allows you to see specialists without a referral.

How a PPO Works

A PPO plan functions much like other health insurance plans, but with a key difference in how it handles providers. The plan pays its contracted providers a set, pre-negotiated rate for services. Because of this arrangement, you pay less in cost-sharing—such as copays or coinsurance—when you receive care from an in-network provider.

While PPO plans offer the flexibility to see out-of-network providers, your costs will be significantly higher. You will likely pay more and may need to submit an insurance claim yourself. It’s also important to note that most PPO plans have a separate out-of-network deductible that you must meet before your plan benefits will begin to cover those costs.

Key Advantages of a PPO Plan

PPO plans are often chosen for their flexibility and convenience. Key benefits include:

- No Referrals Needed: You do not need a referral from a primary care provider to see a specialist. You have the freedom to schedule an appointment with any in-network specialist at any time.’

- Out-of-Network Coverage: You can choose to see providers outside of the plan’s network, which is particularly beneficial for those who travel frequently or live in different states.

- Large Provider Networks: Many PPO plans have a broad, nationwide provider network, offering a wide range of choices for care.

- No PCP Requirement: Unlike some other plan types, you are not required to choose a primary care provider(PCP).

PPO vs. HMO: The Main Differences

The primary difference between a PPO and an HMO (Health Maintenance Organization) plan lies in their approach to networks and referrals.

An HMO plan typically provides coverage only for services received from providers within its network, except in emergency situations. You are also required to choose a primary care provider and obtain a referral to see a specialist. HMO plans often come with lower premiums, but they offer less flexibility.

A PPO plan, on the other hand, gives you greater freedom. You can see specialists without a referral and have coverage for out-of-network care (albeit at a higher cost). While premiums are generally higher for a PPO, the added flexibility can be a major advantage for those who prioritize choice in their healthcare.

Ultimately, choosing the right health and dental plan depends on your individual needs and priorities. By understanding the core principles of a Preferred Provider Organization, you can make a more informed decision that aligns with your lifestyle and ensure you get the most value from your benefits.

by admin | Aug 26, 2025 | Custom Content, Employee Benefits, Health Insurance

Ever found a confusing document in your mailbox after a doctor’s visit, wondering if it’s a bill, especially with an “amount you owe” at the bottom? You’re not alone! That document is most likely an Explanation of Benefits (EOB) from your health insurance company. It’s crucial to remember: an EOB is NOT a bill.

Ever found a confusing document in your mailbox after a doctor’s visit, wondering if it’s a bill, especially with an “amount you owe” at the bottom? You’re not alone! That document is most likely an Explanation of Benefits (EOB) from your health insurance company. It’s crucial to remember: an EOB is NOT a bill.

Think of your EOB as a detailed receipt or a comprehensive financial statement from your insurance provider. It breaks down the services you received, how much your healthcare provider charged, how much your health plan covered, and any portion you’re responsible for paying. It’s an essential tool for transparency and helps ensure accuracy in your medical billing.

How EOBs Work

The process generally follows these steps:

- Provider Bills Your Insurer: After your medical service, your healthcare provider submits a claim to your insurance company.

- Insurer Processes and Sends EOB: Your insurance company processes the claim, determines coverage based on your plan, and then sends the EOB to you.

- Bill Arrives Separately: You will receive a separate bill from your healthcare provider for the amount you owe after you’ve received and reviewed your EOB. It’s a good practice to wait for your EOB before paying any medical bill to compare the two documents.

What Information Will You Find on an EOB?

While the exact format can vary, most EOBs include similar key sections:

- Account Summary: This lists basic details like the patient’s name, the date(s) of service, and a unique claim number.

- Claim Details: This section provides a breakdown of the specific services you received, including procedure codes, the dates services were provided, and the healthcare provider’s name.

- Amounts Billed & Covered: This crucial part details:

- The total amount your provider charged for each service.

- The amount your health plan paid or approved.

- Any discounts or adjustments negotiated by your insurance company.

- The reason if any portion of the service was not covered (e.g., “not a covered service,” “deductible not met”).

- Your estimated patient responsibility, which is the “amount you owe.”

Remember, insurance rarely covers 100% of costs. Your out-of-pocket expenses will depend on your specific plan’s structure, including:

- Deductible: The amount you must pay for covered healthcare services before your insurance plan begins to pay.

- Copay: A fixed amount you pay for a covered healthcare service, like a doctor’s visit or prescription, usually paid at the time of service.

- Coinsurance: Your share of the costs of a healthcare service, calculated as a percentage (e.g., 20%) of the allowed amount for the service after you’ve met your deductible.

Why Your EOB is So Important

Regularly reviewing your EOB offers several critical benefits:

- Catching Errors: Medical billing errors can occur. Your EOB acts as a window into your medical billing history, allowing you to cross-reference the services listed against what you actually received. You can verify that procedures and diagnoses are coded correctly, potentially saving you money.

- Understanding Your Plan: EOBs provide transparency in the often-complicated world of healthcare finances. By understanding what your plan covers and why certain amounts are or aren’t paid, you gain a clearer picture of how your health insurance truly works.

- Financial Control: Knowing what an EOB is and understanding its contents empowers you to stay in control of your healthcare expenses, ensuring you maximize your benefits and only pay what you genuinely owe.

While an EOB might seem intimidating at first glance, taking the time to understand this document is a vital step in becoming a more informed and empowered healthcare consumer. It’s your financial roadmap to navigating your health plan effectively!

The future of healthcare is rapidly evolving, with a clear trend toward integrating health interventions directly into employee benefits packages. As employers face rising healthcare costs—projected to increase by over 8% in 2025—they are rethinking how to deliver value to their workforce while managing expenses. This integration is reshaping not just what benefits are offered, but how employees access, use, and experience healthcare.

The future of healthcare is rapidly evolving, with a clear trend toward integrating health interventions directly into employee benefits packages. As employers face rising healthcare costs—projected to increase by over 8% in 2025—they are rethinking how to deliver value to their workforce while managing expenses. This integration is reshaping not just what benefits are offered, but how employees access, use, and experience healthcare.