by admin | Mar 2, 2026 | Custom Content, Employee Benefits, Health Insurance

Choosing a health insurance plan can feel a lot like solving a puzzle—there are many moving pieces, and the best fit depends on how they come together for your unique situation. With so many options and acronyms—HMO, PPO, POS, EPO, HDHP—it’s easy to feel unsure about where to start. This guide breaks down the most common types of health plans to help you understand how they work, what they cost, and which one might align best with your health care needs and budget.

Choosing a health insurance plan can feel a lot like solving a puzzle—there are many moving pieces, and the best fit depends on how they come together for your unique situation. With so many options and acronyms—HMO, PPO, POS, EPO, HDHP—it’s easy to feel unsure about where to start. This guide breaks down the most common types of health plans to help you understand how they work, what they cost, and which one might align best with your health care needs and budget.

What Sets Health Plans Apart

When comparing plans, pay attention to these key differences:

- Whether you must choose a Primary Care Provider (PCP)

- If you need referrals to see specialists or get certain services

- Whether the plan requires preauthorization for certain procedures

- If out-of-network care is covered

- How much cost sharing you’re responsible for (deductible, copay, coinsurance)

- Whether you’ll need to file claims or handle additional paperwork

No single plan works for everyone. The right choice depends on your personal health needs, your family’s situation, and your financial comfort level.

Health Maintenance Organization (HMO)

An HMO plan typically offers lower premiums, smaller deductibles, and predictable copays. In exchange, you’ll need to stay within the plan’s provider network and work through a designated PCP, who must refer you to specialists.

HMOs can be a cost-effective option for individuals with fewer health care needs who are comfortable with a structured system.

Preferred Provider Organization (PPO)

PPO plans allow more flexibility when choosing health care providers—you can see specialists and even out-of-network doctors without referrals. These plans usually have higher premiums, and out-of-network care costs more.

A PPO may be a good fit if you want freedom to choose your providers and anticipate needing multiple types of care.

Point-of-Service (POS)

POS plans blend features of both HMOs and PPOs. You’ll select a PCP but can also choose out-of-network care at a higher cost. For slightly higher premiums than an HMO, POS plans provide flexibility while encouraging coordinated care through your PCP.

A POS plan can work well if you want both structure and the occasional freedom to go out-of-network.

Exclusive Provider Organization (EPO)

An EPO plan offers moderate flexibility. Like an HMO, you must use in-network providers, but unlike an HMO, you usually don’t need a referral to see a specialist. Premiums fall between HMO and PPO rates.

An EPO might be right for you if you’re comfortable with a limited provider network and want easier access to specialists.

High Deductible Health Plan (HDHP)

An HDHP can be structured as an HMO, PPO, POS, or EPO. These plans feature lower premiums but higher deductibles—meaning you’ll pay more upfront before coverage kicks in. HDHPs are often paired with a Health Savings Account (HSA), which lets you set aside pre‑tax dollars for medical expenses and roll over unused funds year to year.

HDHPs can work well for those who don’t anticipate frequent medical needs, such as younger or healthier individuals, but they may not be ideal for those with ongoing health concerns.

Final Thoughts

Because health plans and rules can vary by state (and employer), take time to review the details carefully before enrolling. Understanding the coverage, costs, and flexibility of each option will help you make an informed, confident decision that fits your unique health and financial needs.

by admin | Feb 10, 2026 | Custom Content, Health & Wellness

February is often filled with symbols of love, but it’s also the perfect time to focus on the most important heart of all—your own. American Heart Month serves as a vital reminder that cardiovascular health is the foundation of a long, vibrant life.

February is often filled with symbols of love, but it’s also the perfect time to focus on the most important heart of all—your own. American Heart Month serves as a vital reminder that cardiovascular health is the foundation of a long, vibrant life.

Heart disease remains a leading health challenge globally, but the good news is that many risk factors are within your control. Here is a guide to help you show your heart some love this month and beyond.

- Fuel Your Heart with the Right Foods

What you put on your plate significantly impacts your blood pressure, cholesterol, and inflammation levels. You don’t need a restrictive “diet”; you need a sustainable way of eating.

- Prioritize Whole Foods: Focus on leafy greens, berries, nuts, and seeds.

- Embrace Healthy Fats: Swap butter for olive oil and include fatty fish like salmon or mackerel (rich in Omega-3s).

- Watch the Sodium: Excess salt is a major contributor to high blood pressure. Aim for less than 2,300mg a day (about one teaspoon).

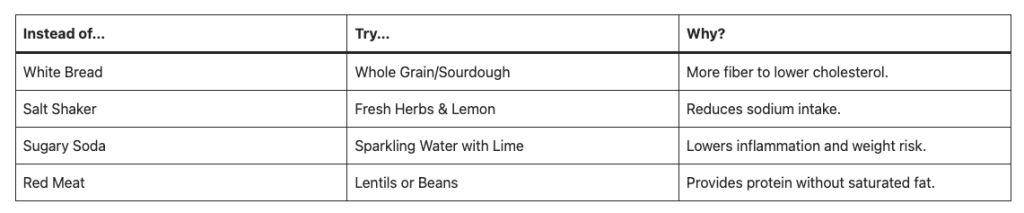

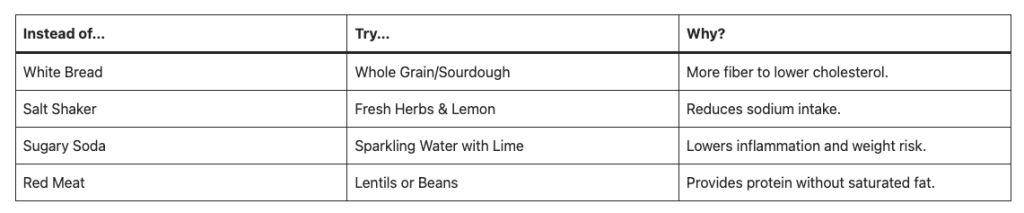

Smart Swaps for Heart Health

- Move More, Sit Less

Your heart is a muscle, and like any muscle, it needs exercise to stay strong. The American Heart Association recommends at least 150 minutes of moderate-intensity aerobic activity per week.

- Find Your “Flow”: You don’t have to run marathons. Brisk walking, swimming, or strength training.

- The Power of 10: If 30 minutes feels daunting, break it into three 10-minute bursts throughout the day.

- Prioritize Quality Sleep and Stress Management

Chronic stress and poor sleep are the “silent” enemies of heart health. When you’re stressed or sleep-deprived, your body stays in a state of high alert, which can damage your arteries over time.

- The 7-9 Hour Rule: Aim for consistent sleep. Lack of sleep is linked to increased calcium buildup in the arteries.

- Mindfulness: Just five minutes of deep breathing or meditation can lower your heart rate and cortisol levels.

- Unplug: Set a “digital sunset” an hour before bed to help your nervous system wind down.

- Know Your Numbers

Knowledge is power. Many heart issues don’t have obvious symptoms until they are advanced. Schedule a check-up this month to track these four key metrics:

- Blood Pressure: Ideally below 120/80 mmHg.

- Cholesterol: Monitor your LDL (bad) and HDL (good) levels.

- Blood Sugar: High glucose levels can damage blood vessels over time.

- Body Mass Index (BMI): Keep a healthy weight to reduce the workload on your heart.

A Note on Smoking: If you smoke or vape, quitting is the single most impactful thing you can do for your heart. Even within one year of quitting, your risk of a heart attack drops significantly.

Small Changes, Big Impact

You don’t have to overhaul your entire life; choose one small change this week—perhaps taking a daily walk or adding a serving of vegetables to dinner. Consistency is the secret to a healthy heart!

by admin | Feb 3, 2026 | Custom Content, Employee Benefits

Offering voluntary benefits is an excellent way to strengthen your overall benefits package, stand out from competitors, and enhance employee satisfaction—all with minimal impact on your budget. However, while employers often provide a wide range of voluntary benefits designed to offer value and convenience, many employees may not fully understand what these benefits are or how they can help. Educating your workforce about the advantages of voluntary benefits ensures both employers and employees gain maximum value.

Offering voluntary benefits is an excellent way to strengthen your overall benefits package, stand out from competitors, and enhance employee satisfaction—all with minimal impact on your budget. However, while employers often provide a wide range of voluntary benefits designed to offer value and convenience, many employees may not fully understand what these benefits are or how they can help. Educating your workforce about the advantages of voluntary benefits ensures both employers and employees gain maximum value.

Showcasing the Value

Employees may not always recognize the value of voluntary benefits, particularly since these options are typically employee-funded. These benefits, which may include options like life insurance, disability coverage, accident insurance, critical illness insurance, cancer insurance or even legal and pet insurance, provide added security and convenience without significantly increasing employer costs.

For example, voluntary insurance purchased through an employer group is often more affordable than an individual policy—but few employees realize this. When highlighting voluntary benefits, clearly explain the advantages of being covered, the potential risks of going without protection, and the convenience of enrolling through payroll deductions.

Promoting Coverage Understanding

Employee education is vital to preventing confusion and frustration about what a policy covers. Misunderstandings can lead to resentment if employees expect coverage that isn’t actually included. To avoid these situations, ensure every employee—whether their benefit is employer-paid or voluntary—understands how the coverage works.

Consider the following strategies to strengthen benefits education:

- Invite current employees to attend orientation or periodic benefits meetings.

- Ask benefit providers to send representatives to explain their products directly to staff.

- Schedule small-group sessions for employees who have detailed questions.

- Leverage social media to share educational materials, reminders, and benefit updates in an accessible way.

Strengthening Employer Value

Beyond increasing participation in voluntary benefits, investing in employee education helps position your organization as a trusted source of benefits knowledge. This approach not only boosts engagement but also strengthens employee satisfaction and loyalty to your company.

by admin | Jan 13, 2026 | Custom Content, Health Care Costs, Health Savings Account

A Health Savings Account (HSA) is a tax-advantaged savings account designed to help you pay for healthcare expenses. It offers valuable benefits now and in the future — from lowering your current healthcare costs to building long-term savings for retirement.

A Health Savings Account (HSA) is a tax-advantaged savings account designed to help you pay for healthcare expenses. It offers valuable benefits now and in the future — from lowering your current healthcare costs to building long-term savings for retirement.

- Understand the Basics

- Triple Tax Advantage: HSAs provide three powerful tax benefits — contributions are tax-deductible, growth is tax-deferred, and withdrawals for qualified medical expenses (QMEs) are completely tax-free.

- Eligibility: To open or contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). These plans typically have higher deductibles and out-of-pocket costs but lower monthly premiums, allowing you to save more overall.

2026 Contribution Limits:

- Self-only coverage: $4,400

- Family coverage: $8,750

- Catch-up contribution (age 55+): $1,000

- Maximize Your Contributions

- Make regular contributions: Set up automatic transfers to your HSA to build your balance consistently.

- Take advantage of catch-up contributions: If you’re 55 or older, contribute an additional $1,000 annually to boost your savings.

- Use Your HSA Strategically

- Cover qualified medical expenses: Use HSA funds for expenses like doctor visits, prescriptions and over the counter medications, dental/vision care, hearing aids and other IRS-approved medical costs.

- Invest for long-term growth: Consider investing your HSA balance to grow tax-free over time. After age 65, you can make withdrawals for non-medical expenses without a penalty (though they’ll be taxed as regular income).

- Carry funds forward: Unlike Flexible Spending Accounts (FSAs), HSA balances roll over year to year — your money stays with you even if you change jobs.

All HSA transactions must go toward Qualified Medical Expenses (QMEs) as defined by the IRS. You can review the full list of eligible expenses in the IRS Publication 502.

The Bottom Line

HSAs are among the most flexible and tax-efficient savings tools available. Because healthcare costs often rise with age, starting early and contributing consistently can significantly strengthen your financial security — both for medical needs and retirement. By understanding the basics of HSAs and following these tips, you can make the most out of this valuable financial tool.

by admin | Jan 5, 2026 | Custom Content, Employee Benefits

In our increasingly busy world, employee expectations are accelerating faster than ever before. A five-year-old benefits strategy simply cannot meet the complex, constant pressures workers face in 2026—be it financial stress, burnout, or caregiving responsibilities. The modern workforce is rejecting generic menus in favor of flexibility, strong financial support, and wellness options that align with their personal lives.

In our increasingly busy world, employee expectations are accelerating faster than ever before. A five-year-old benefits strategy simply cannot meet the complex, constant pressures workers face in 2026—be it financial stress, burnout, or caregiving responsibilities. The modern workforce is rejecting generic menus in favor of flexibility, strong financial support, and wellness options that align with their personal lives.

Employers face a critical challenge in 2026: balancing projected healthcare cost increases (around 10%) with the need to offer personalized, holistic, and competitive benefits.

Top 9 Trends Shaping 2026 Benefits Strategy:

- Managing Rising Healthcare Costs: Employers are adopting cost-management tactics — such as telemedicine, HSAs, and wellness incentives — to balance rising expenses driven by medical inflation, specialty drug use, and delayed care demand.

- Total Health and Well-Being:Benefits now integrate physical, mental, and financial wellness through EAPs, teletherapy, and wellness technology to promote holistic employee health.

- Women’s Health Expansion: Comprehensive care from fertility to menopause is becoming standard, improving retention, equity, and workforce engagement.

- Personalized Benefits Through AI:Technology enables tailored benefits selection, predictive analytics, and mobile access, meeting diverse employee needs.

- Mental Health Integration:Behavioral health is now fundamental, with digital tools, manager training, and open dialogue reducing stigma and driving productivity.

- Family and Caregiving Support:These benefits address the financial and emotional strain on the “sandwich generation” (caring for children and elders simultaneously). Expanded parental leave, dependent-care FSAs, and eldercare resources address pressures on multigenerational caregivers.

- Voluntary Benefits:Supplemental benefits provide a cost-effective way to offer additional value to employees. From pet insurance to identity theft protection, these benefits give employees the flexibility to select coverage that meets their individual needs.

- Financial Wellness and Retirement Security:Initiatives like 401(k) matching, financial counseling, and student-loan repayment reduce stress and strengthen financial stability.

- Upskilling and Development:Investing in employee growth as a key driver of retention and engagement, particularly among Gen Z and Millennials. Continuous learning opportunities, AI-driven training, and mentorship programs help attract and retain talent seeking career growth.

Ultimately, a strategic benefits plan that balances economic realities with genuine care for the workforce will be the decisive factor in attracting talent, boosting engagement, and building a resilient team ready for the year ahead.

by admin | Dec 9, 2025 | Custom Content, Health & Wellness

The transition into winter and the busy holiday season often brings two things: cold weather and packed calendars. While the shorter days and festive cheer are welcome, they also present unique challenges to our health, including managing stress, fighting off seasonal illnesses, and maintaining an active routine.

The transition into winter and the busy holiday season often brings two things: cold weather and packed calendars. While the shorter days and festive cheer are welcome, they also present unique challenges to our health, including managing stress, fighting off seasonal illnesses, and maintaining an active routine.

Staying healthy this winter isn’t about grand gestures; it’s about small, consistent habits that protect your body and mind. Here is your guide to winter wellness.

- Boost Your Immune System and Sleep

The fight against winter colds and the flu starts with strengthening your natural defenses. This season, prioritize three foundational pillars of immunity:

Mind Your Vitamin D

With less sunlight exposure, many people become deficient in Vitamin D, which is crucial for immune function and mood regulation. If you can’t get 10–15 minutes of midday sun exposure, consider speaking to your doctor about a supplement. This small adjustment can make a big difference in fighting off sickness.

Stay Hydrated (Yes, Even in Winter)

The dry winter air and indoor heating dehydrate us faster than we realize, weakening the protective mucous membranes that fight germs. Keep a water bottle within reach and aim to drink herbal tea or warm water throughout the day. Dehydration contributes to fatigue, which makes you more susceptible to illness.

Make Sleep Non-Negotiable

Sleep is your body’s most effective time for immune repair. With holiday parties and deadlines looming, it’s easy to sacrifice an hour of sleep, but this can significantly compromise your health. Aim for 7-9 hours of quality sleep nightly. Stick to a consistent bedtime, even on weekends, to regulate your body’s natural rhythms.

- Managing Holiday Stress and Mental Load

The holidays bring a mix of joy and unique pressures—financial strain, travel headaches, and social commitments. Protect your mental health by applying these strategies:

Practice Proactive Planning

Instead of letting tasks pile up, dedicate 15 minutes each Sunday evening to look at your calendar and budget your energy. Schedule time blocks not just for work meetings, but also for “recharge time” and “boundary setting.”

Set Realistic Boundaries

It’s okay to say no to extra commitments. Whether it’s an optional holiday event or taking on another project before year-end, know your limits. Communicate clearly and politely: “That sounds lovely, but I can’t commit right now.” Protecting your time is vital for preventing burnout.

Embrace Micro-Mindfulness

Use small moments throughout the workday to check in with yourself. Before answering an email or joining a meeting, take two deep, slow breaths. This simple action can lower your heart rate, reduce the stress hormone cortisol, and reset your focus.

- Keep Moving, Inside and Out

When it’s cold and dark, the couch can be a powerful magnet. Counter this by adapting your fitness routine to the season:

Take a “Walking Meeting”

If you are working from home or have an internal call, suggest a walking meeting outside. Even 15 minutes of brisk outdoor walking can boost your mood and provide light exposure to aid Vitamin D production. Remember to layer up!

Find Your Indoor Outlet

Don’t rely solely on outdoor activities. Explore simple indoor options: use resistance bands while watching TV, follow a 15-minute yoga session online, or simply do some stretching and bodyweight exercises before starting your workday. The goal is consistency, not intensity.

Fuel with Focus

The holidays often mean sugary treats, which can lead to energy crashes and sluggishness. Balance celebratory foods with nutrient-dense options. Focus on protein, fiber, and healthy fats to keep your energy stable, especially during peak work hours.

By taking small steps each day – and listening to your body – you can enjoy the winter season, stay healthy, and start the new year feeling your best.

Choosing a health insurance plan can feel a lot like solving a puzzle—there are many moving pieces, and the best fit depends on how they come together for your unique situation. With so many options and acronyms—HMO, PPO, POS, EPO, HDHP—it’s easy to feel unsure about where to start. This guide breaks down the most common types of health plans to help you understand how they work, what they cost, and which one might align best with your health care needs and budget.

Choosing a health insurance plan can feel a lot like solving a puzzle—there are many moving pieces, and the best fit depends on how they come together for your unique situation. With so many options and acronyms—HMO, PPO, POS, EPO, HDHP—it’s easy to feel unsure about where to start. This guide breaks down the most common types of health plans to help you understand how they work, what they cost, and which one might align best with your health care needs and budget.