by admin | Dec 28, 2025 | Compliance

The Internal Revenue Service (IRS) has issued Notice 2025-61, announcing a significant increase to the Patient-Centered Outcomes Research Institute (PCORI) fee amount. Employers with self-insured health plans and health insurance issuers must take note of the new rate and upcoming compliance deadlines.

The Internal Revenue Service (IRS) has issued Notice 2025-61, announcing a significant increase to the Patient-Centered Outcomes Research Institute (PCORI) fee amount. Employers with self-insured health plans and health insurance issuers must take note of the new rate and upcoming compliance deadlines.

What is the New PCORI Fee Amount?

The PCORI fee is increasing to $3.84 per covered life. This new rate applies to plan years that end on or after October 1, 2025, and before October 1, 2026.

For comparison, the previous fee amount (for plan years that ended on or after Oct. 1, 2024, and before Oct. 1, 2025) was $3.47 multiplied by the average number of lives covered under the plan.

Background and Applicability

The PCORI fee was originally established by the Affordable Care Act (ACA) to fund comparative effectiveness research. Though initially set to expire in 2019, federal legislation extended the fee for an additional 10 years. The PCORI fee is now scheduled to apply through the plan or policy year ending before October 1, 2029.

The fee is imposed on:

- Health insurance issuers

- Sponsors of self-insured health plans

The fee is calculated based on the average number of covered lives under the plan, which generally includes employees, their enrolled spouses, and dependents (unless the plan is an HRA or FSA).

Reporting and Payment Deadlines

The PCORI fee must be reported and paid annually using IRS Form 720 (Quarterly Federal Excise Tax Return).

The fee is always due by July 31st of the year following the last day of the plan year.

Action for Self-Insured Plans: Employers with self-insured health plans should ensure they use the correct rate and meet the upcoming July 31st deadline corresponding to their plan year end.

Additional Resources:

PCORI Fee Overview Page

PCORI Fee FAQs

by admin | Dec 10, 2025 | Compliance, HIPAA

The U.S. Department of Health and Human Services (HHS) has issued a final rule that requires covered entities—including many health plans—to update their Notice of Privacy Practices (Privacy Notice). This change enhances privacy protections for highly sensitive Substance Use Disorder (SUD) treatment records.

The U.S. Department of Health and Human Services (HHS) has issued a final rule that requires covered entities—including many health plans—to update their Notice of Privacy Practices (Privacy Notice). This change enhances privacy protections for highly sensitive Substance Use Disorder (SUD) treatment records.

Why the Update is Necessary

The HIPAA Privacy Rule already mandates that covered entities provide a Privacy Notice to explain how an individual’s Protected Health Information (PHI) is used.

However, the April 2024 final rule specifically addresses patient records involving SUD treatment from federally assisted programs (often referred to as “Part 2 programs”). Any covered entity that receives or maintains these Part 2 records must now update their Privacy Notice to reflect these additional, heightened protections.

The mandatory deadline for updating and distributing these notices is February 16, 2026.

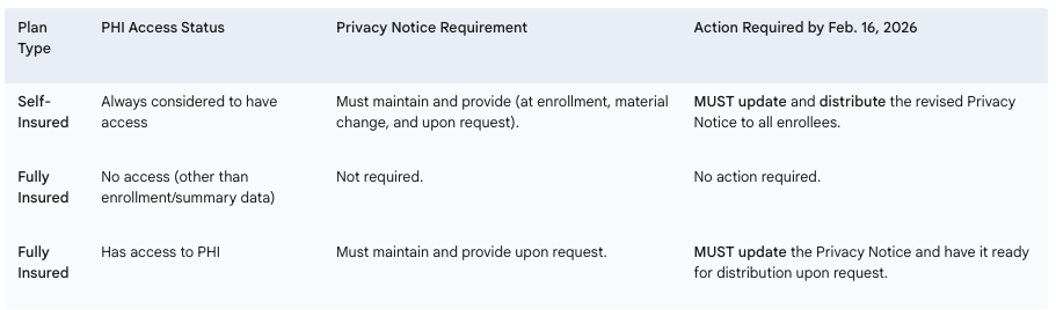

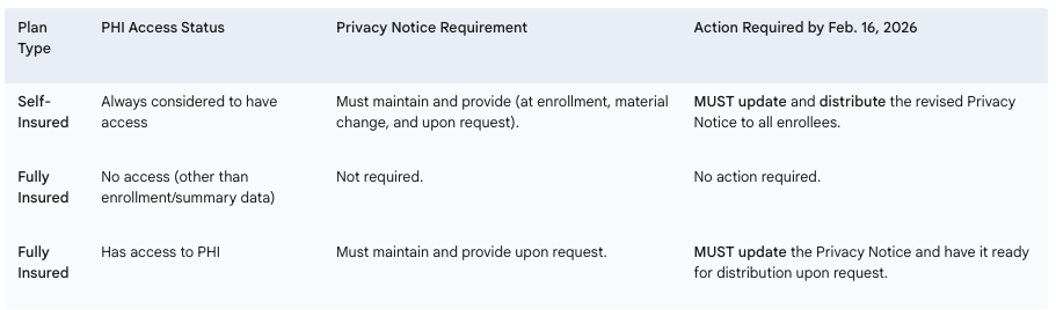

Required Employer Actions by Plan Type

Employers sponsoring health plans must determine their level of responsibility based on their plan’s funding structure and access to PHI.

Next Steps for Employers: Employers with self-insured health plans, or fully insured plans that manage PHI, must immediately begin the process of updating their Privacy Notices to incorporate the new requirements for SUD treatment records. It is currently uncertain if HHS will release updated model privacy notices before the deadline.

by admin | Dec 2, 2025 | Compliance, ERISA

Employers with insured health plans may have received a Medical Loss Ratio (MLR) rebate from their health insurance carrier this year. Rebates were required for plans not meeting the 2024 MLR standards and had to be issued by September 30, 2025, either as premium credits or lump-sum payments.

Employers with insured health plans may have received a Medical Loss Ratio (MLR) rebate from their health insurance carrier this year. Rebates were required for plans not meeting the 2024 MLR standards and had to be issued by September 30, 2025, either as premium credits or lump-sum payments.

If any part of the rebate qualifies as a plan asset under ERISA, it must benefit plan participants and beneficiaries exclusively. Employers can fulfill this requirement by distributing the plan asset portion using a fair and reasonable allocation method. Alternatively, if direct payments aren’t practical, the rebate can be used for other allowable plan purposes, such as future premium reductions or benefit enhancements.

ERISA generally requires that plan assets be kept in trust, but this is waived if any rebate amount considered a plan asset is used within three months of receipt, so employers must pay careful attention to the timeline. For example, rebates received on September 30, 2025, must be used by December 30, 2025.

Key points:

- Under the Affordable Care Act, health insurers must spend a minimum percentage of premiums on medical care and quality improvements; if not, rebates are required.

- Employers must determine if any rebate portion qualifies as a plan asset under ERISA.

- Plan assets must only benefit plan participants and beneficiaries and generally must be used within three months of receiving the rebate to remain ERISA-compliant.

Employers should review current obligations to ensure any rebate qualifying as a plan asset is properly allocated and used in accordance with federal requirements.

by admin | Sep 2, 2025 | ACA, Compliance, Employee Benefits

How to position yourself as a trusted ACA compliance advisor

How to position yourself as a trusted ACA compliance advisor

For brokers and benefits advisors, Q4 planning doesn’t start in October. It starts now.

September marks a critical moment in the annual ACA compliance cycle, when employers begin thinking about year-end strategies, benefits renewals, and how to avoid last-minute reporting panic. That makes now the perfect time to deepen your role as a strategic advisor and help clients get ahead of the curve.

Here’s how you can stand out by guiding clients through ACA compliance before it becomes a scramble, and why it will pay dividends well into 2026.

📌 Step 1: Help Clients Take Stock of Their Workforce Now

The foundation of ACA compliance is accurate employee classification. Yet many employers still struggle to determine:

Brokers can add immediate value by helping clients audit their headcounts and hours before Q4 begins. That insight informs both ACA reporting and benefits planning decisions, and helps prevent costly missteps when deadlines hit.

🧠 Step 2: Educate on What’s Changed and What’s Coming

ACA rules don’t change often, but confusion persists. Many clients are unaware of:

- State-specific ACA mandates (California, New Jersey, Rhode Island, Vermont, Massachusetts, and Washington DC)

- Updated penalty thresholds and IRS enforcement priorities

- New reporting formats or system changes that could impact submissions

Providing timely updates and checklists positions you not just as a broker but as a compliance partner. You can even use these touchpoints to introduce solutions like ACA reporting automation or integrated compliance tools.

📊 Step 3: Map Out a Reporting Game Plan Before the Crunch

ACA compliance starts with good planning, and now is the time to get ahead. By August, many employers are wrapping up plan design decisions for the next year, making it an ideal time for brokers to:

- Review last year’s filing process (what worked and what didn’t)

- Flag missing or incomplete employee data

- Identify vendors or tools that can simplify electronic filing

- Offer ACA services or connect clients to trusted platforms

The earlier your clients begin organizing data and confirming eligibility, the fewer errors and penalties they’ll face later. And the more indispensable you become in their eyes.

🎯 Position Yourself as the Solution, Not Just the Messenger

ACA compliance is often seen as a burden. But for brokers, it’s a huge opportunity to differentiate. Instead of only alerting clients to upcoming requirements, step in as the solution:

✅ Offer ACA strategy sessions during annual benefits reviews

✅ Share tools and resources that support self-filing or full-service options

✅ Leverage partnerships with platforms like Mitratech Mineral to deliver expert-backed compliance

When you help clients manage risk and reduce workload, you go from being a benefits provider to a business advisor and partner.

🗓 Ready to Dive Deeper?

Join us for a special webinar:

Beyond the Basics: Mastering ACA Compliance for Multi-State Employers

📅 Thursday, September 18, 2025 | 1:00 PM ET

🎙️ Featuring Angela Surra, Principal Benefits Expert at Mitratech Mineral

👉 Register Now

Final Thought

The best brokers know that compliance isn’t a once-a-year conversation, it’s an ongoing strategy. By helping your clients get ACA-ready now, you’re not just solving a problem. You’re showing up as the expert they trust to protect their business, simplify their operations, and keep them ahead of what’s next.

Looking for the right tool to help your clients stay compliant and stress-free? The ACA Reporting Hub from Mitratech Mineral is purpose-built to support brokers and the employers they serve. Whether you’re offering ACA as a service or guiding clients through self-filing, our platform combines automation with compliance expertise to simplify the entire process.

By Brian Costello

Originally posted on Mineral.com

by admin | Jun 2, 2025 | Compliance

The annual EEO-1 Report, mandated by the Equal Employment Opportunity Commission (EEOC), is a cornerstone of workplace diversity and anti-discrimination efforts in the United States. This data collection provides a demographic snapshot of America’s workforce, helping to monitor for discrimination and promote equal employment opportunity. Missing the deadline can lead to serious consequences, making it imperative for eligible employers to understand the reporting requirements and act promptly.

The annual EEO-1 Report, mandated by the Equal Employment Opportunity Commission (EEOC), is a cornerstone of workplace diversity and anti-discrimination efforts in the United States. This data collection provides a demographic snapshot of America’s workforce, helping to monitor for discrimination and promote equal employment opportunity. Missing the deadline can lead to serious consequences, making it imperative for eligible employers to understand the reporting requirements and act promptly.

Who Must File?

Generally, the following employers are required to file an annual EEO-1 Component 1 report:

Private sector employers with 100 or more employees during an employer-selected payroll period (workforce snapshot period) in the fourth quarter (October 1 through December 31) of the reporting year.

Federal contractors and first-tier subcontractors with 50 or more employees and a contract, subcontract, or purchase order amounting to $50,000 or more, or who serve as a depository of Government funds in any amount, or act as an issuing and paying agent for U.S. Savings Bonds and Notes.

It’s crucial to note that even if an employer has fewer than 100 employees during the selected snapshot period, they may still be required to file if their total employee count reached 100 or more at any point during the fourth quarter of the reporting year, or if they are affiliated with a parent company that meets the 100-employee threshold.

The All-Important Deadline: June 24, 2025 (for 2024 data)

For the 2024 EEO-1 Component 1 report, the data collection period opened on May 20, 2025, and the deadline to submit and certify reports is Tuesday, June 24, 2025, at 11:00 PM ET.

This year, the EEOC has emphasized a shorter collection period compared to some previous cycles. This means employers have a more condensed window to gather their data, review for accuracy, and submit their reports through the EEO-1 Component 1 Online Filing System (OFS).

by admin | Feb 6, 2025 | ACA, Compliance

For employers subject to the Affordable Care Act (ACA), staying compliant with reporting requirements is non-negotiable. With 2025 due dates just around the corner, now is the time to prepare for distributing Forms 1095-C to employees and filing with the IRS. These forms provide essential information about health coverage offered to employees and are critical for demonstrating compliance with the ACA’s employer mandate. Missing these deadlines can lead to potential costly penalties and compliance headaches.

For employers subject to the Affordable Care Act (ACA), staying compliant with reporting requirements is non-negotiable. With 2025 due dates just around the corner, now is the time to prepare for distributing Forms 1095-C to employees and filing with the IRS. These forms provide essential information about health coverage offered to employees and are critical for demonstrating compliance with the ACA’s employer mandate. Missing these deadlines can lead to potential costly penalties and compliance headaches.

Key ACA Reporting Deadlines for 2025

Here are the critical dates you need to mark on your calendar for reporting on the 2024 tax year:

- March 3, 2025:

Deadline for furnishing Form 1095-C to employees.

Employers must provide their employees with a copy of Form 1095-C, which details the health coverage offered, by this date.

- February 28, 2025:

Deadline for paper filing with the IRS.

Employers filing fewer than 10 forms (aggregated with other forms, such as W-2, 1099) may submit paper forms to the IRS. Note: Paper filing is only an option for small employers below the e-filing threshold.

- March 31, 2025:

Deadline for electronic filing with the IRS.

Employers submitting 10 or more forms are required to file electronically. The extra time provided for electronic filing gives employers a little breathing room, but it’s essential to plan ahead and avoid last-minute delays.

Penalties for Missing ACA Reporting Deadlines

Failing to meet ACA reporting deadlines can result in hefty penalties:

- Late Furnishing to Employees:

Employers can be fined up to $310 per form for not providing Form 1095-C to employees by March 3, 2025.

- Late Filing with the IRS:

Penalties start at $60 per form for filing within 30 days of the deadline but can escalate to $310 per form for longer delays.

- Incorrect or Incomplete Information:

Filing forms with incorrect data, such as employee names or Social Security Numbers, can lead to additional penalties.

- Intentional Disregard:

If the IRS determines that an employer intentionally ignored filing requirements, penalties can skyrocket to $630 per form with no annual cap.

Checklist to Stay on Track for ACA Reporting in 2025

Use this checklist to ensure timely and accurate submissions:

- Verify Employee Data:

Review employee names, SSNs, and coverage details for accuracy.

- Select Your Filing Method:

Determine whether you’ll file on paper (if eligible) or electronically. Ensure you have the necessary software for electronic submissions.

- Monitor Deadlines:

Set reminders for March 3(employee furnishing), February 28 (paper filing), and March 31 (electronic filing).

- Test Your Process:

If filing on your own, conduct a test submission through the IRS AIR system to identify potential errors before the official filing.

- Leverage Technology:

Use an ACA compliance software solution to automate form generation, validation, and submission.

- Train Your Team:

Ensure HR, payroll, and benefits teams understand the reporting requirements and deadlines.

- Work with Experts:

Consider outsourcing ACA compliance to a trusted vendor if your internal resources are limited.

Conclusion

ACA reporting doesn’t have to be overwhelming—preparation is key. By understanding the deadlines, filing methods, and potential pitfalls, employers can stay compliant and avoid penalties. With the reporting season fast approaching, now is the time to finalize your plans, gather your data, and ensure you’re ready to meet the 2025 deadlines.

Originally posted on Mineral

The Internal Revenue Service (IRS) has issued Notice 2025-61, announcing a significant increase to the Patient-Centered Outcomes Research Institute (PCORI) fee amount. Employers with self-insured health plans and health insurance issuers must take note of the new rate and upcoming compliance deadlines.

The Internal Revenue Service (IRS) has issued Notice 2025-61, announcing a significant increase to the Patient-Centered Outcomes Research Institute (PCORI) fee amount. Employers with self-insured health plans and health insurance issuers must take note of the new rate and upcoming compliance deadlines.