by admin | Jul 31, 2017 | COBRA, Human Resources

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires group health plans to provide notices to covered employees and their families explaining their COBRA rights when certain events occur. The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan. This notice is issued by the plan administrator within the first 90 days when coverage begins under the group health plan and informs the covered employee (and his or her spouse) of the responsibility to notify the employer within 60 days if certain qualifying events occur in the future.

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires group health plans to provide notices to covered employees and their families explaining their COBRA rights when certain events occur. The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan. This notice is issued by the plan administrator within the first 90 days when coverage begins under the group health plan and informs the covered employee (and his or her spouse) of the responsibility to notify the employer within 60 days if certain qualifying events occur in the future.

The initial notice must include the following information:

- The plan administrator’s contact information

- A general description of the continuation coverage under the plan

- An explanation of the covered employee’s notice obligations, including notice of

- The qualifying events of divorce, legal separation, or a dependent’s ceasing to be a dependent

- The occurrence of a second qualifying event

- A qualified beneficiary’s disability (or cessation of disability) for purposes of the disability extension)

- How to notify the plan administrator about a qualifying event

- A statement that the notice does not fully describe continuation coverage or other rights under the plan, and that more complete information regarding such rights is available from the plan administrator and in the plan’s summary plan description (SPD)

As a best practice, the initial notice should also:

- Direct qualified beneficiaries to the plan’s most recent SPD for current information regarding the plan administrator’s contact information.

- For plans that include health flexible spending arrangements (FSAs), disclose the limited nature of the health FSA’s COBRA obligations (because certain health FSAs are only obligated to offer COBRA through the end of the year to qualified beneficiaries who have underspent accounts).

- Explain that the spouse may notify the plan administrator within 60 days after the entry of divorce or legal separation (even if an employee reduced or eliminated the spouse’s coverage in anticipation of the divorce or legal separation) to elect up to 36 months of COBRA coverage from the date of the divorce or legal separation.

- Define qualified beneficiary to include a child born to or placed for adoption with the covered employee during a period of COBRA continuation coverage.

- Describe that a covered child enrolled in the plan pursuant to a qualified medical child support order during the employee’s employment is entitled to the same COBRA rights as if the child were the employee’s dependent child.

- Clarify the consequences of failing to submit a timely qualifying event notice, timely second qualifying event notice, or timely disability determination notice.

Practically speaking, the initial notice requirement can be satisfied by including the general notice in the group health plan’s SPD and then issuing the SPD to the employee and his or her spouse within 90 days of their group health plan coverage start date.

If the plan doesn’t rely on the SPD for furnishing the initial COBRA notice, then the plan administrator would follow the U.S. Department of Labor (DOL) rules for delivery of ERISA-required items. A single notice addressed to the covered employee and his or her spouse is allowed if the spouse lives at the same address as the covered employee and coverage for both the covered employee and spouse started at the time that notice was provided. The plan administrator is not required to provide an initial notice for dependents.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

by admin | Jul 13, 2017 | COBRA, Compliance

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. The length of the COBRA coverage period depends on the qualifying event and is usually 18 or 36 months. However, the COBRA coverage period may be extended under the following five circumstances:

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. The length of the COBRA coverage period depends on the qualifying event and is usually 18 or 36 months. However, the COBRA coverage period may be extended under the following five circumstances:

- Multiple Qualifying Events

- Disability

- Extended Notice Rule

- Pre-Termination or Pre-Reduction Medicare Entitlement

- Employer Extension; Employer Bankruptcy

In this blog, we’ll examine the first circumstance above. For a detailed discussion of all the circumstances, request UBA’s Compliance Advisor, “Extension of Maximum COBRA Coverage Period”.

When determining the coverage period under multiple qualifying events, the maximum coverage period for a loss of coverage due to a termination of employment and reduction of hours is 18 months. The maximum coverage period may be extended to 36 months if a second qualifying event or multiple qualifying events occur within the initial 18 months of COBRA coverage from the first qualifying event. The coverage period runs from the start of the original 18-month coverage period.

The first qualifying event must be termination of employment or reduction of hours, but the second qualifying cannot be termination of employment, reduction of hours, or bankruptcy. In order to qualify for the extension, the second qualifying event must be the covered employee’s death, divorce, or child ceasing to be a dependent. In addition, the extension is only available if the second qualifying event would have caused a loss of coverage for the qualified beneficiary if it occurred first.

The extended 36-month period is only for spouses and dependent children. In order to qualify for extended coverage, a qualified beneficiary must have elected COBRA during the first qualifying event and must have been receiving COBRA coverage at the time of the second event. The qualified beneficiary must notify the plan administrator of the second qualifying event within 60 days after the event.

Example: Jim was terminated on June 3, 2017. Then, he got divorced on July 6, 2017. Jim was eligible for COBRA continuation coverage for 18 months after his termination of employment (the first qualifying event). However, his divorce (the second qualifying event) extended his COBRA continuation coverage to 36 months because it occurred within the initial 18 months of COBRA coverage from his termination (the first qualifying event).

The health plan should indicate when the coverage period begins. The plan may provide that that the plan administrator be notified when plan coverage is lost as opposed to when the qualifying event occurs. In that case, the 36-month coverage period would begin on the date coverage was lost.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

by admin | Jun 21, 2017 | Benefit Management, COBRA

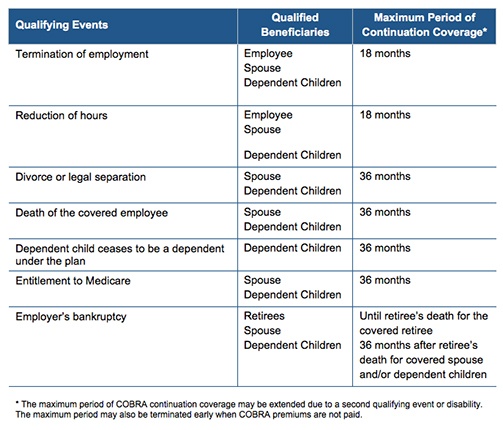

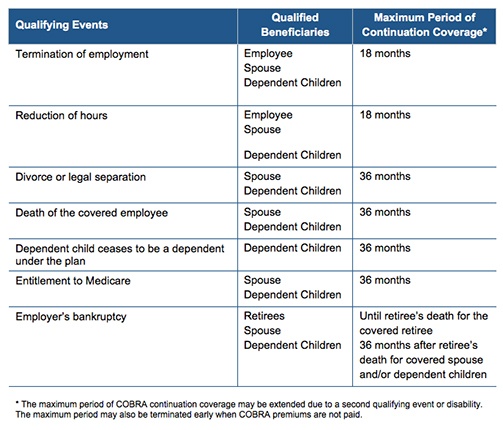

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. Per regulation, qualifying events are specific events that cause or trigger an individual to lose health coverage. The type of qualifying event determines who the qualified beneficiaries are and the maximum length of time a plan must offer continuation coverage. A group health plan may provide longer periods of continuation coverage beyond the maximum 18 or 36 months required by law.

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. Per regulation, qualifying events are specific events that cause or trigger an individual to lose health coverage. The type of qualifying event determines who the qualified beneficiaries are and the maximum length of time a plan must offer continuation coverage. A group health plan may provide longer periods of continuation coverage beyond the maximum 18 or 36 months required by law.

There are seven triggering events that are qualifying events for COBRA coverage if they result in loss of coverage for the qualified beneficiaries, which may include the covered employee, the employee’s spouse, and dependent children.

The following quick reference chart indicates the qualifying event, the individual who is entitled to elect COBRA, and the maximum length of COBRA continuation coverage.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

by admin | Mar 15, 2017 | ACA, Benefit Plan Tips, Tricks and Traps, COBRA, Compliance, Medicare

Our Firm is making a big push to provide compliance assessments for our clients and using them as a marketing tool with prospects. Since the U.S. Department of Labor (DOL) began its Health Benefits Security Project in October 2012, there has been increased scrutiny. While none of our clients have been audited yet, we expect it is only a matter of time and we want to make sure they are prepared.

Our Firm is making a big push to provide compliance assessments for our clients and using them as a marketing tool with prospects. Since the U.S. Department of Labor (DOL) began its Health Benefits Security Project in October 2012, there has been increased scrutiny. While none of our clients have been audited yet, we expect it is only a matter of time and we want to make sure they are prepared.

We knew most fully insured groups did not have a Summary Plan Description (SPD) for their health and welfare plans, but we have been surprised by some of the other things that were missing. Here are the top five compliance surprises we found.

- COBRA Initial Notice. The initial notice is a core piece of compliance with the Consolidated Omnibus Budget and Reconciliation Act (COBRA) and we have been very surprised by how many clients are not distributing this notice. Our clients using a third-party administrator (TPA), or self-administering COBRA, are doing a good job of sending out the required letters after qualifying events. However, we have found that many clients are not distributing the required COBRA initial notice to new enrollees. The DOL has recently updated the COBRA model notices with expiration dates of December 31, 2019. We are trying to get our clients to update their notices and, if they haven’t consistently distributed the initial notice to all participants, to send it out to everyone now and document how it was sent and to whom.

- Prescription Drug Plan Reporting to CMS. To comply with the Medicare Prescription Drug Improvement and Modernization Act, passed in 2003, employer groups offering prescription benefits to Medicare-eligible individuals need to take two actions each year. The first is an annual report on the Centers for Medicare & Medicaid Services (CMS) website regarding whether the prescription drug plan offered by the group is creditable or non-creditable. The second is distributing a notice annually to Medicare-eligible plan members prior to the October 15 beginning of Medicare open enrollment, disclosing whether the prescription coverage is creditable or non-creditable. We have found that the vast majority (but not 100 percent) of our clients are complying with the second requirement by annually distributing notices to employees. Many clients are not complying with the first requirement and do not go to the CMS website annually to update their information. The annual notice on the CMS website must be made within:

- 60 days after the beginning of the plan year,

- 30 days after the termination of the prescription drug plan, or

- 30 days after any change in the creditability status of the prescription drug plan.

- ACA Notice of Exchange Rights. The Patient Protection and Affordable Care Act (ACA) required that, starting in September 2013, all employers subject to the Fair Labor Standards Act (FLSA) distribute written notices to all employees regarding the state exchanges, eligibility for coverage through the employer, and whether the coverage was qualifying coverage. This notice was to be given to all employees at that time and to all new hires within 14 days of their date of hire. We have found many groups have not included this notice in the information they routinely give to new hires. The DOL has acknowledged that there are no penalties for not distributing the notice, but since it is so easy to comply, why take the chance in case of an audit?

- USERRA Notices. The Uniformed Services Employment and Reemployment Rights Act (USERRA) protects the job rights of individuals who voluntarily or involuntarily leave employment for military service or service in the National Disaster Medical System. USERRA also prohibits employers from discriminating against past and present members of the uniformed services. Employers are required to provide a notice of the rights, benefits and obligations under USERRA. Many employers meet the obligation by posting the DOL’s “Your Rights Under USERRA” poster, or including text in their employee handbook. However, even though USERRA has been around since 1994, we are finding many employers are not providing this information.

- Section 79. Internal Revenue Code Section 79 provides regulations for the taxation of employer-provided life insurance. This code has been around since 1964, and while there have been some changes, the basics have been in place for many years. Despite the length of time it has been in place, we have found a number of groups that are not calculating the imputed income. In essence, if an employer provides more than $50,000 in life insurance, then the employee should be paying tax on the excess coverage based on the IRS’s age rated table 2-2. With many employers outsourcing their payroll or using software programs for payroll, calculating the imputed income usually only takes a couple of mouse clicks. However, we have been surprised by how many employers are not complying with this part of the Internal Revenue Code, and are therefore putting their employees’ beneficiaries at risk.

There have been other surprises through this process, but these are a few of the more striking examples. The feedback we received from our compliance assessments has been overwhelmingly positive. Groups don’t always like to change their processes, but they do appreciate knowing what needs to be done.

By Bob Bentley, Originally Published By United Benefit Advisors

by admin | Mar 9, 2017 | ACA, COBRA, Compliance, Human Resources, IRS

The Internal Revenue Service (IRS) recently updated its longstanding Questions and Answers about Information Reporting by Employers on Form 1094-C and Form 1095-C that provides information on:

The Internal Revenue Service (IRS) recently updated its longstanding Questions and Answers about Information Reporting by Employers on Form 1094-C and Form 1095-C that provides information on:

Generally, the Q&A describes when and how an employer reports its offers of coverage and describes the codes that employers should use when completing Form 1094-C and Form 1095-C for calendar year 2016 that are to be filed in 2017. The Q&A should be used in conjunction with the Instructions for Forms 1094-C and 1095-C which provide detailed information about completing the forms.

The updated Q&A provides information on COBRA reporting that had been left pending in earlier versions of the Q&A for the past year. UBA’s ACA Advisor “IRS Q&A About Employer Information Reporting on Form 1094-C and Form 1095-C” reviews the new information and explains other reporting obligations covered under the Q&A.

Reporting Offers of COBRA Continuation Coverage

An offer of COBRA continuation coverage that is made to a former employee due to termination of employment is not reported as an offer of coverage in Part II of Form 1095-C.

If the applicable large employer is required to complete a Form 1095-C for the former employee (because, for example, the individual was a full-time employee for one or more months of the year before terminating employment), the employer should use code 1H, No offer of coverage, on line 14 for any month that the former employee was offered COBRA continuation coverage. For those same months, the employer should use code 2A, Employee not employed during the month, on line 16 for each month in which the individual is not an employee (regardless of whether the former employee enrolled in the COBRA continuation coverage).

An employer that provides COBRA continuation coverage through a self-funded health plan generally must report that coverage for any former employee or family member who enrolls in that COBRA continuation coverage in Part III of the Form 1095-C. Also, the employer may report the coverage on Form 1095-B for any individual who was not an employee during the year and who separately elected the COBRA continuation coverage.

By Danielle Capilla, Originally Published United Benefit Advisors

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires group health plans to provide notices to covered employees and their families explaining their COBRA rights when certain events occur. The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan. This notice is issued by the plan administrator within the first 90 days when coverage begins under the group health plan and informs the covered employee (and his or her spouse) of the responsibility to notify the employer within 60 days if certain qualifying events occur in the future.

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires group health plans to provide notices to covered employees and their families explaining their COBRA rights when certain events occur. The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan. This notice is issued by the plan administrator within the first 90 days when coverage begins under the group health plan and informs the covered employee (and his or her spouse) of the responsibility to notify the employer within 60 days if certain qualifying events occur in the future.