by admin | Nov 30, 2017 | ACA, Employee Benefits, IRS

On December 13, 2016, President Obama signed the 21st Century Cures Act (Cures Act) into law. The Cures Act provides a method for certain small employers to reimburse individual health coverage premiums up to a dollar limit through HRAs called “Qualified Small Employer Health Reimbursement Arrangements” (QSE HRAs). The provision went into effect on January 1, 2017. On October 31, 2017, the IRS released Notice 2017-67, providing guidance on the implementation and administration of QSE HRAs.

On December 13, 2016, President Obama signed the 21st Century Cures Act (Cures Act) into law. The Cures Act provides a method for certain small employers to reimburse individual health coverage premiums up to a dollar limit through HRAs called “Qualified Small Employer Health Reimbursement Arrangements” (QSE HRAs). The provision went into effect on January 1, 2017. On October 31, 2017, the IRS released Notice 2017-67, providing guidance on the implementation and administration of QSE HRAs.

Unless an employer meets all the requirements for offering a QSE HRA, previous IRS guidance prohibiting the reimbursement of individual premiums directly or indirectly, after- or pre-tax, through an HRA, a Section 125 plan, a Section 105 plan, or any other mechanism, remains in full effect. Reimbursing individual premiums in a non-compliant manner will subject an employer to a Patient Protection and Affordable Care Act (ACA) penalty of $100 a day per individual it reimburses, with the potential for other penalties based on the mechanism of the non-compliant reimbursement.

If an employer fails to meet the requirements of providing a QSE HRA, it will be subject to a penalty of $100 per day per affected person for being a non-compliant group health plan. An arrangement will be a group health plan that is not a QSE HRA if it:

- Is not provided by an eligible employer (such as an employer that offers another group health plan to its employees).

- Is not provided on the same terms to all eligible employees.

- Reimburses medical expenses without first requiring proof of minimum essential coverage (MEC).

- Provides a permitted benefit in excess of the statutory dollar limits.

An arrangement’s failure to be a QSE HRA will not cause any reimbursement of a properly substantiated medical expense that is otherwise excludable from income to be included in the employee’s income or wages. Furthermore, an arrangement designed to reimburse expenses other than medical expenses (whether or not also reimbursing medical expenses) is neither a QSE HRA nor a group health plan. Accordingly, all payments under such an arrangement are includible in the employee’s gross income and wages. An employer’s failure to timely provide a compliant written notice does not cause an arrangement to fail to be a QSE HRA, but instead results in the penalty of $50 per employee, not to exceed $2,500.

Answers to Top Three FAQs about QSE HRAs

1, Which employers may offer a QSE HRA?

Employers with fewer than 50 full-time and full-time equivalent employees (under ACA counting rules) that do not offer a group health plan. Employers that do not offer a group health plan, but offer a retiree-only plan to former employees may offer a QSE HRA.

2. Which employers may not offer a QSE HRA?

- Employers with 50 or more full-time and full-time equivalent employees (under ACA counting rules).

- Employers of any size that offer a group health plan, including plans that only provide excepted benefits, such as vision or dental benefits.

- Employers that provide current employees with access to money from health reimbursement arrangements (HRAs) offered in prior years (through a carry-over).

- Employers that offer employees access to carryover amounts in a flexible spending account (FSA).

3. What are the rules for employers in a controlled group?

- Employers with less than 50 full-time and full-time equivalent employees (under ACA counting rules) may offer QSE HRAs, with the headcount including all employees across an entire controlled group.

- If one employer within a controlled group offers a QSE HRA, it must be offered to all employees within the entire controlled group (or each employer must offer an identical QSE HRA).

BY Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Nov 27, 2017 | ACA, COBRA, IRS

Recently, the Internal Revenue Service (IRS) issued the instructions for Forms 1094/1095 for the 2017 tax year, announced PCORI fees for 2017-18, and announced cost-of-living adjustments for 2018. The IRS provided additional guidance on leave-based donation programs’ tax treatment and released an information letter on COBRA and Medicare. Here’s a recap of these actions for your reference.IRS Announces Cost-of-Living Adjustments for 2018

Recently, the Internal Revenue Service (IRS) issued the instructions for Forms 1094/1095 for the 2017 tax year, announced PCORI fees for 2017-18, and announced cost-of-living adjustments for 2018. The IRS provided additional guidance on leave-based donation programs’ tax treatment and released an information letter on COBRA and Medicare. Here’s a recap of these actions for your reference.IRS Announces Cost-of-Living Adjustments for 2018

The IRS released Revenue Procedures 2017-58 and Notice 2017-64 to announce cost-of-living adjustments for 2018. For example, the dollar limit on voluntary employee salary reductions for contributions to health flexible spending accounts (FSAs) is $2,650, for taxable years beginning with 2018.

Request UBA’s 2018 desk reference card with an at-a glance summary of the various limits.

IRS Announces PCORI Fee for 2017-18

The IRS announced the Patient-Centered Outcomes Research Institute (PCORI) fee for 2017-18. The fee is $1.00 per covered life in the first year the fee is in effect. The fee is $2.00 per covered life in the second year. In the third through seventh years, the fee is $2.00, adjusted for medical inflation, per covered life.

For plan years that end on or after October 1, 2016, and before October 1, 2017, the indexed fee is $2.26. For plan years that end on or after October 1, 2017, and before October 1, 2018, the indexed fee is $2.39.

For more information, view UBA’s FAQ on the PCORI Fee.

IRS Provides Additional Guidance on Leave-Based Donation Programs’ Tax Treatment

Last month, the IRS provided guidance for employers who adopt leave-based donation programs to provide charitable relief for victims of Hurricane and Tropical Storm Irma. This month, the IRS issued Notice 2017-62 which extends the guidance to employers’ programs adopted for the relief of victims of Hurricane and Tropical Storm Maria.

These leave-based donation programs allow employees to forgo vacation, sick, or personal leave in exchange for cash payments that the employer will make to charitable organizations described under Internal Revenue Code Section 170(c).

The employer’s cash payments will not constitute gross income or wages of the employees if paid before January 1, 2019, to the Section 170(c) charitable organizations for the relief of victims of Hurricane or Tropical Storm Maria. Employers do not need to include these payments in Box 1, 3, or 5 of an employee’s Form W-2.

IRS Releases Information Letter on COBRA and Medicare

The IRS released Information Letter 2017-0022 that explains that a covered employee’s spouse can receive COBRA continuation coverage for up to 36 months if the employee became entitled to Medicare benefits before employment termination. In this case, the spouse’s maximum COBRA continuation period ends the later of: 36 months after the employee’s Medicare entitlement, or 18 months (or 29 months if there is a disability extension) after the employment termination.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Nov 14, 2017 | ACA, Group Benefit Plans, Human Resources, IRS

October was a busy month in the employee benefits world. President Trump announced a new Acting Secretary for the U.S. Department of Health and Human Services (HHS). Eric Hargan fills the position vacated by Tom Price, who resigned in late September 2017. The U.S. Department of Labor (DOL) issued a proposed rule to delay a disability claims procedure regulation’s applicability date and HHS released its proposed rule on benefits and payment parameters for 2019. The U.S. Department of the Treasury (Treasury) issued its Priority Guidance Plan for projects it intends to complete during the first half of 2018.

October was a busy month in the employee benefits world. President Trump announced a new Acting Secretary for the U.S. Department of Health and Human Services (HHS). Eric Hargan fills the position vacated by Tom Price, who resigned in late September 2017. The U.S. Department of Labor (DOL) issued a proposed rule to delay a disability claims procedure regulation’s applicability date and HHS released its proposed rule on benefits and payment parameters for 2019. The U.S. Department of the Treasury (Treasury) issued its Priority Guidance Plan for projects it intends to complete during the first half of 2018.

DOL Proposes Delay to Final Disability Claims Procedures Regulations’ Applicability Date

The DOL issued a proposed rule to delay the applicability date of its final rule that amends the claims procedure requirements applicable to ERISA-covered employee benefit plans that provide disability benefits. The DOL’s Fact Sheet contains a summary of the final rule’s requirements.

The DOL is delaying the applicability date from January 1, 2018, to April 1, 2018, to consider whether to rescind, modify, or retain the regulations and to give the public an additional opportunity to submit comments and data concerning the final rule’s potential impact.

CMS Releases 2019 Benefits Payment and Parameters Proposed Rule

The Centers for Medicare & Medicaid Services (CMS) released a proposed rule and fact sheet for the 2019 Benefit Payment and Parameters. The proposed rule is intended to increase individual market flexibility, improve program integrity, and reduce regulatory burdens associated with the Patient Protection and Affordable Care Act (ACA) in many ways, including updates and annual provisions to:

- Essential health benefits

- Small Business Health Options Program (SHOP)

- Special enrollment periods (SEPs)

- Exemptions

- Termination effective dates

- Medical loss ratio (MLR)

CMS usually finalizes the Benefit Payment and Parameters rule in the first quarter of the year following the proposed rule’s release. November 27, 2017, is the due date for public comments on the proposed rule.

Almost all the topics addressed in the proposed rule would affect the individual market and the Exchanges, particularly the Small Business Health Options Program (SHOP) Exchanges.

Of interest to small group health plans, CMS proposes to change how states will select essential health benefits benchmark plans. If CMS keeps this change in its final rule, then it will affect non-grandfathered small group health plans for benefit years 2019 and beyond.

Treasury Issues its Priority Guidance Plan

The Treasury issued its 2017-2018 Priority Guidance Plan that lists projects that it intends to complete by June 30, 2018, including:

- Guidance on issues related to the employer shared responsibility provisions

- Regulations regarding the excise tax on high cost employer-provided coverage (“Cadillac tax”)

- Guidance on Qualified Small Employer Health Reimbursement Arrangements (QSE HRAs)

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Nov 9, 2017 | ACA, Human Resources, IRS

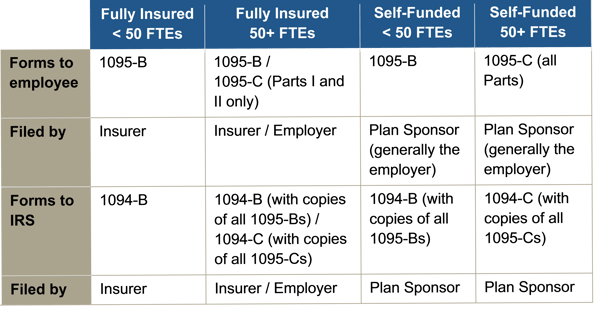

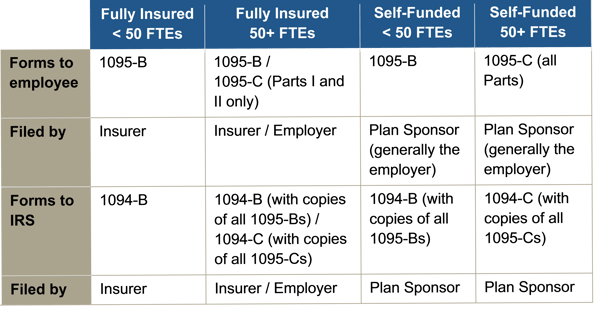

Instructions for both the 1094-B and 1095-B and the 1094-C and 1095-C were released, as were the forms for 1094-B, 1095-B, 1094-C, and 1095-C.

Reporting will be due early in 2018, based on coverage in 2017. For calendar year 2017, Forms 1094-C, 1095-C, 1094-B, and 1095-B must be filed by February 28, 2018, or April 2, 2018, if filing electronically. Statements to employees must be furnished by January 31, 2018. In late 2016, a filing deadline was provided for forms due in early 2017, however it is unknown if that extension will be provided for forms due in early 2018. Until employers are told otherwise, they should plan on meeting the current deadlines.

All reporting will be for the 2017 calendar year, even for non-calendar year plans.

The reporting requirements are in Sections 6055 and 6056 of the ACA. The major reporting requirements are:

by admin | Nov 1, 2017 | ACA, Compliance

Two tri-agency (Internal Revenue Service, Employee Benefits Security Administration, and Centers for Medicare and Medicaid Services) Interim Final Rules were released and became effective on October 6, 2017, and will be published on October 31, 2017, allowing a greater number of employers to opt out of providing contraception to employees at no cost through their employer-sponsored health plan. The expanded exemption encompasses all non-governmental plan sponsors that object based on sincerely held religious beliefs, and institutions of higher education in their arrangement of student health plans. The exemption also now encompasses employers who object to providing contraception coverage on the basis of sincerely held moral objections and institutions of higher education in their arrangement of student health plans. Furthermore, if an issuer of health coverage (an insurance company) had sincere religious beliefs or moral objections, it would be exempt from having to sell coverage that provides contraception. The exemptions apply to both non-profit and for-profit entities.

Two tri-agency (Internal Revenue Service, Employee Benefits Security Administration, and Centers for Medicare and Medicaid Services) Interim Final Rules were released and became effective on October 6, 2017, and will be published on October 31, 2017, allowing a greater number of employers to opt out of providing contraception to employees at no cost through their employer-sponsored health plan. The expanded exemption encompasses all non-governmental plan sponsors that object based on sincerely held religious beliefs, and institutions of higher education in their arrangement of student health plans. The exemption also now encompasses employers who object to providing contraception coverage on the basis of sincerely held moral objections and institutions of higher education in their arrangement of student health plans. Furthermore, if an issuer of health coverage (an insurance company) had sincere religious beliefs or moral objections, it would be exempt from having to sell coverage that provides contraception. The exemptions apply to both non-profit and for-profit entities.

The currently-in-place accommodation is also maintained as an optional process for exempt employers, and will provide contraceptive availability for persons covered by the plans of entities that use it (a legitimate program purpose). These rules leave in place the government’s discretion to continue to require contraceptive and sterilization coverage where no such objection exists. These interim final rules also maintain the existence of an accommodation process, but consistent with expansion of the exemption, the process is optional for eligible organizations. Effectively this removes a prior requirement that an employer be a “closely held for-profit” employer to utilize the exemption.

Employers that object to providing contraception on the basis of sincerely held religious beliefs or moral objections, who were previously required to offer contraceptive coverage at no cost, and that wish to remove the benefit from their medical plan are still subject (as applicable) to ERISA, its plan document and SPD requirements, notice requirements, and disclosure requirements relating to a reduction in covered services or benefits. These employers would be obligated to update their plan documents, SBCs, and other reference materials accordingly, and provide notice as required.

Employers are also now permitted to offer group or individual health coverage, separate from the current group health plans, that omits contraception coverage for employees who object to coverage or payment for contraceptive services, if that employee has sincerely held religious beliefs relating to contraception. All other requirements regarding coverage offered to employees would remain in place. Practically speaking, employers should be cautious in issuing individual policies until further guidance is issued, due to other regulations and prohibitions that exist.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Oct 20, 2017 | ACA

On the evening of October 12, 2017, President Trump announced that cost sharing reductions for low income Americans in relation to the Patient Protection and Affordable Care Act (ACA) would be stopped. The Department of Health and Human Services (HHS) has confirmed that payments will be stopped immediately. While there is no direct impact to employers at this time, UBA will continue to educate employers about changes in the law and its Health Plan Survey will continue to track group health plan rates over time as insurance companies potentially seek to recoup lost revenue. It is anticipated at least some state attorneys general will file lawsuits to block the ending of the subsidy payments, with California Attorney General Xavier Becerra stating he is prepared to file a lawsuit to protect the subsidies.

On the evening of October 12, 2017, President Trump announced that cost sharing reductions for low income Americans in relation to the Patient Protection and Affordable Care Act (ACA) would be stopped. The Department of Health and Human Services (HHS) has confirmed that payments will be stopped immediately. While there is no direct impact to employers at this time, UBA will continue to educate employers about changes in the law and its Health Plan Survey will continue to track group health plan rates over time as insurance companies potentially seek to recoup lost revenue. It is anticipated at least some state attorneys general will file lawsuits to block the ending of the subsidy payments, with California Attorney General Xavier Becerra stating he is prepared to file a lawsuit to protect the subsidies.

Background

Individuals with household modified adjusted gross incomes (AGI) in excess of 100 percent but not exceeding 400 percent of the federal poverty level (FPL) may be eligible for cost-sharing reductions for coverage purchased through health insurance exchanges if they meet a variety of criteria. Cost-sharing reductions are limited to coverage months for which the individual is allowed a premium tax credit. Eligibility for cost-sharing reductions is based on the tax year for which advanced eligibility determinations are made by HHS, rather than the tax year for which premium credits are allowed. In 2015, cost-sharing subsides reduced out-of-pocket (OOP) limits:

- Less than 100 percent but not exceeding 200 percent of FPL: OOP limits reduced by two-thirds

- Greater than 200 percent but not exceeding 300 percent of FPL: OOP limits reduced by one-half

- Greater than 300 percent but not exceeding 400 percent of FPL: OOP limits reduced by one-third

After 2015, the base percentages were shifted based on a percentage of average per capita health insurance premium increases. The cost-sharing reduction is paid directly to the insurer, and is automatically applied when eligible individuals enroll in a silver plan on the Marketplace or Exchange.

The cost-sharing reduction is not the same as the “advance premium tax credit” which is also available to individuals with household modified AGIs of at least 100 percent and not exceeding 400 percent of the FPL.

By Danielle Capilla

Originally posted by www.UBABenefits.com

On December 13, 2016, President Obama signed the 21st Century Cures Act (Cures Act) into law. The Cures Act provides a method for certain small employers to reimburse individual health coverage premiums up to a dollar limit through HRAs called “Qualified Small Employer Health Reimbursement Arrangements” (QSE HRAs). The provision went into effect on January 1, 2017. On October 31, 2017, the IRS released Notice 2017-67, providing guidance on the implementation and administration of QSE HRAs.

On December 13, 2016, President Obama signed the 21st Century Cures Act (Cures Act) into law. The Cures Act provides a method for certain small employers to reimburse individual health coverage premiums up to a dollar limit through HRAs called “Qualified Small Employer Health Reimbursement Arrangements” (QSE HRAs). The provision went into effect on January 1, 2017. On October 31, 2017, the IRS released Notice 2017-67, providing guidance on the implementation and administration of QSE HRAs.