by admin | Dec 15, 2017 | Group Benefit Plans, Health Plan Benchmarking

When most experts think of group healthcare plans, Preferred Provider Organization (PPO) plans largely come to mind—though higher cost, they dominate the market in terms of plan distribution and employee enrollment. But Consumer-Directed Health Plans (CDHPs) have made surprising gains. Despite slight cost increases, CDHP costs are still below average and prevalence and enrollment in these plans continues to grow in most regions—a main reason why it was one of the top 7 survey trends recently announced.

When most experts think of group healthcare plans, Preferred Provider Organization (PPO) plans largely come to mind—though higher cost, they dominate the market in terms of plan distribution and employee enrollment. But Consumer-Directed Health Plans (CDHPs) have made surprising gains. Despite slight cost increases, CDHP costs are still below average and prevalence and enrollment in these plans continues to grow in most regions—a main reason why it was one of the top 7 survey trends recently announced.

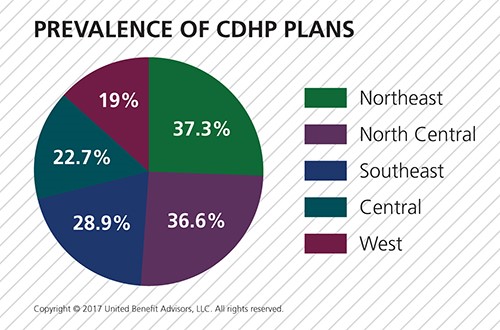

In 2017, 28.6% of all plans are CDHPs. Regionally, CDHPs account for the following percentage of plans offered:

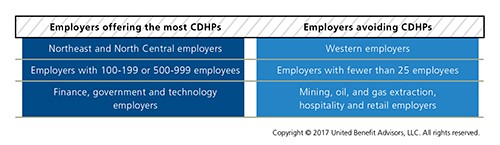

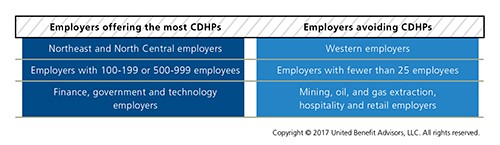

CDHPs have increased in prevalence in all regions except the West. The North Central U.S. saw the greatest increase (13.2%) in the number of CDHPs offered. Looking at size and industry variables, several groups are flocking to CDHPs:

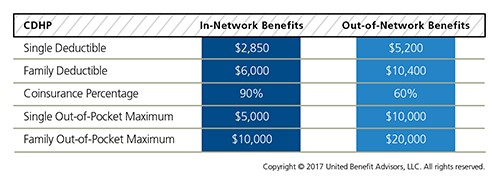

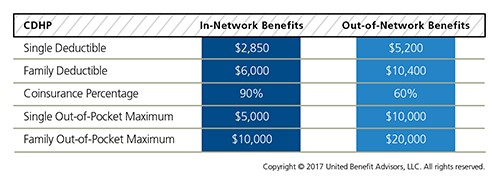

When it comes to enrollment, 31.5% of employees enroll in CDHP plans overall, an increase of 19.3% from 2016, after last year’s stunning increase of 21.7% from 2015. CDHPs see the most enrollment in the North Central U.S. at 46.3%, an increase of 40.7% over 2016. For yet another year in the Northeast, CDHP prevalence and enrollment are nearly equal; CDHP prevalence doesn’t always directly correlate to the number of employees who choose to enroll in them. Though the West held steady in the number of CDHPs offered, there was a 2.6% decrease in the number of employees enrolled. The 12.6% increase in CDHP prevalence in the North Central U.S. garnered a large 40.7% increase in enrollment. CDHP interest among employers isn’t surprising given these plans are less costly than the average plan. But like all cost benchmarks, plan design plays a major part in understanding value. The UBA survey finds the average CDHP benefits are as follows:

By Bill Olson

Originally Published By United Benefit Advisors

by admin | Dec 12, 2017 | ACA, Benefit Management, Compliance, Group Benefit Plans, IRS

Beginning in 2015, to comply with the Patient Protection and Affordable Care Act (ACA), “large” employers must offer their full-time employees health coverage, or pay one of two employer shared responsibility / play-or-pay penalties. The Internal Revenue Service (IRS) determines the penalty each calendar year after employees have filed their federal tax returns.

Beginning in 2015, to comply with the Patient Protection and Affordable Care Act (ACA), “large” employers must offer their full-time employees health coverage, or pay one of two employer shared responsibility / play-or-pay penalties. The Internal Revenue Service (IRS) determines the penalty each calendar year after employees have filed their federal tax returns.

In November 2017, the IRS indicated on its “Questions and Answers on Employer Shared Responsibility Provisions Under the Affordable Care Act” webpage that, in late 2017, it plans to issue Letter 226J to inform large employers of their potential liability for an employer shared responsibility payment for the 2015 calendar year.

The IRS’ determination of an employer’s liability and potential payment is based on information reported to the IRS on Forms 1094-C and 1095-C and information about the employer’s full-time employees that were received the premium tax credit.

The IRS will issue Letter 226J if it determines that, for at least one month in the year, one or more of a large employer’s full-time employees was enrolled in a qualified health plan for which a premium tax credit was allowed (and the employer did not qualify for an affordability safe harbor or other relief for the employee).

Letter 226J will include:

- A brief explanation of Section 4980H, the employer shared responsibility regulations

- An employer shared responsibility payment summary table that includes a monthly itemization of the proposed payment and whether the liability falls under Section 4980H(a) (the “A” or “No Offer” Penalty) or Section 4980H(b) (the “B” or “Inadequate Coverage” Penalty) or neither section

- A payment summary table explanation

- An employer shared responsibility response form (Form 14764 “ESRP Response”)

- An employee premium tax credit list (Form 14765 “Employee Premium Tax Credit (PTC) List”) which lists, by month, the employer’s assessable full-time employees and the indicator codes, if any, the employer reported on lines 14 and 16 of each assessable full-time employee’s Form 1095-C

- Actions the employer should take if it agrees or disagrees with Letter 226J’s proposed employer shared responsibility payment

- Actions the IRS will take if the employer does not timely respond to Letter 226J

- The date by which the employer should respond to Letter 226J, which will generally be 30 days from the date of the letter

- The name and contact information of the IRS employee to contact with questions about the letter

If an employer responds to Letter 226J, then the IRS will acknowledge the response with Letter 227 to describe further actions that the employer can take.

After receiving Letter 227, if the employer disagrees with the proposed or revised shared employer responsibility payment, the employer may request a pre-assessment conference with the IRS Office of Appeals. The employer must request the conference by the response date listed within Letter 227, which will be generally 30 days from the date of the letter.

If the employer does not respond to either Letter 226J or Letter 227, then the IRS will assess the proposed employer shared responsibility payment amount and issue a notice and demand for payment on Notice CP 220J.

Notice CP 220J will include a summary of the employer shared responsibility payment, payments made, credits applied, and the balance due, if any. If a balance is due, Notice CP 220J will instruct an employer how to make payment. For payment options, such as an installment agreement, employers should refer to Publication 594 “The IRS Collection Process.”

Employers are not required to make payment before receiving a notice and demand for payment.

The ACA prohibits employers from making an adverse employment action against an employee because the employee received a tax credit or subsidy. To avoid allegations of retaliation, as a best practice, employers who receive a Letter 226J should separate their employer shared responsibility penalty assessment correspondence from their human resources department and employees who have authority to make employment actions.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Dec 8, 2017 | Hot Topics, Human Resources, Workplace

The end of the year is upon us and a majority of companies celebrate with an end-of-year/holiday party. Although the trend of holiday parties has diminished in recent years, it’s still a good idea to commemorate the year with an office perk like a fun, festive party.

The end of the year is upon us and a majority of companies celebrate with an end-of-year/holiday party. Although the trend of holiday parties has diminished in recent years, it’s still a good idea to commemorate the year with an office perk like a fun, festive party.

BENEFITS OF A YEAR-END CELEBRATION

- Holiday staff parties are a perfect way to thank your employees for a great year. All employees want to feel appreciated and valued. What better way to serve this purpose, than with an end of the year office celebration. Hosting a night out to honor your employees during a festive time of year boosts morale. And if done right, your party can jump start the new year with refreshed, productive employees.

- End-of-year celebrations allow employees to come together outside of their own team. The average American will spend 90,000 hours (45 years) of their life at work. Unless you have a very small office, most employees only engage in relationships within their department. When employees have a chance to mingle outside of their regular 9 to 5 day, they’ll build and cultivate relationships across different teams within the organization; creating a more loyal, cohesive and motivated

- Seasonal parties can provide employers insight on those who work for them. Spending the evening with your employees in a more casual and relaxed atmosphere may reveal talents and ideas you may not have otherwise seen during traditional work hours.

CREATING THE RIGHT FIT

Regardless of office size, if planned right, employers can make a holiday party pop, no matter your budget. Whether this is your first go at an end-of-year celebration for your employees, or you host one every year, keep a few things in mind:

- Plan early. Establish a steering committee to generate ideas for your holiday party. Allow the committee to involve all employees early on in the process. Utilize voting tools like Survey Monkey or Outlook to compile employee votes. This engages not only your entire workforce, but serves you as well when tailoring your party to fit your culture.

- Create set activities. Engaging employees in some type of organized activity not only eases any social anxiety for them and their guests, it cultivates memories and allows colleagues to get to know each other. Consider a “Casino Night”, a photo booth (or two if your company can justify to size), an escape room outing—anything that will kick the night off with ease.

- Incorporate entertainment during the dinner. Have team leads or management members come up with fun awards that emphasize character traits, strengths, and talents others may not know of. This is a great way to create cohesiveness, build relationships, and have your employees enjoy a good laugh at dinner.

- Offer fun door prizes every 15 minutes or so. Prizes don’t have to be expensive to have an impact on employees, just relevant to them. However, with the right planning you may be able to throw in a raffle of larger gift items as well. Just keep in the specific tax rules when it relates to gift-giving. Gift cards associated with a specific dollar amount available to use at any establishment, and larger ticket items, can be subject to your employees having to claim income on them and pay the tax.

- Make the dress code inclusive of everyone. Employees should not feel a financial pinch to attend a holiday office party. Establish a dress code that fits your culture, not the other way around.

TAKE AWAY TIPS FOR A SUCCESSFUL HOLIDAY PARTY

According to the Society of Human Resource Management, statistics show in recent years only 65% of employers have offered holiday parties—down from 72% five years ago. Consider the following tips when hosting your next year-end celebration.

- Keep it light. Eliminate itineraries and board-room like structure. Choose to separate productivity/award celebrations and upcoming year projections from your holiday party.

- Invite spouses and significant others to attend the party. Employees spend a majority of their week with their colleagues. Giving employees this option is a great way to show you value who they spend their time with outside of work.

- Allow employees to leave early on a work day to give them time to get ready and pick up who is attending the party with them.

- Show how you value your employees by chatting with them and meeting their guests.

- Provide comfortable seating areas where employees can rest, eat and talk. Position these in main action areas so no one feels anti-social for taking a seat somewhere.

- Consider tying in employees that work in different locations. Have a slideshow running throughout the night on what events other office locations have done throughout the year.

- Create low-key conversation starters and get people to chat it up. This is valuable especially for those that are new to the company and guests of your employees. Incorporate trivia questions into the décor and table settings. Get them to engage by tying in a prize.

- Keep the tastes and comfort level of your employees in mind. Include a variety of menu items that fit dietary restrictions. Not all employees drink alcohol and not all employees eat meat.

- Limit alcohol to a 2 ticket system per guest. Opt for a cash bar after that to reduce liability.

- Provide access to accommodations or coordinate transportation like Uber or Lyft to get your employees somewhere safely after the party if they choose to drink.

Ultimately, holiday parties can still be a value-add for your employees if done the right way. Feel free to change it up from year to year so these parties don’t get stale and continue to fit to your company’s culture. Contemplate new venues, ideas and activities and change up your steering committee to keep these parties fresh. Employees are more likely to enjoy themselves at an event that fits with their lifestyle, so don’t be afraid to get creative!

by admin | Dec 5, 2017 | Employee Benefits, Flexible Spending Accounts, IRS

On November 2, 2017, House Republicans introduced a tax reform bill (H.R.1-115th Congress) called the “Tax Cuts and Jobs Act” that, if passed, would impact multiple aspects of the tax code. Many of these changes relate to employee benefit plans, particularly in relation to certain fringe benefits.

On November 2, 2017, House Republicans introduced a tax reform bill (H.R.1-115th Congress) called the “Tax Cuts and Jobs Act” that, if passed, would impact multiple aspects of the tax code. Many of these changes relate to employee benefit plans, particularly in relation to certain fringe benefits.

Dependent Care Accounts

A dependent care flexible spending account (DCFSA) is a pre-tax benefit account used to pay for eligible dependent care services. The IRS determines which expenses are eligible for reimbursement and these expenses are defined by Internal Revenue Code section 129 and the employer’s plan. Eligible DCFSA expenses include costs for adult day care centers, before and after school programs, child care, nannies, preschool, and summer day camp. Day nursing care, nursing home care, tuition for kindergarten and above, food expenses, and overnight camp are ineligible expenses. The employer determines the minimum election amount and the IRS determines the maximum election amount. The IRS sets the following annual contribution limits for a DCFSA:

- $2,500 per year for a married employee who files a separate tax return

- $5,000 per year for a married employee who files a joint tax return

- $5,000 per year for the head of household

- $5,000 per year for a single employee

The original version of the tax reform bill completely eliminated dependent care accounts. It is now reported that Representative Kevin Brady (R-Texas) has added an amendment to the bill that reverses the immediate repeal of DCFSAs, and would extend them for five more years.

Adoption Assistance

Employers may currently reimburse employees up to $13,570 (indexed) tax-free for qualified adoption expenses. This is eliminated in the bill.

Education Assistance

Employers may currently reimburse employees up to $5,250 on a tax-free basis for qualified education expenses. This is eliminated in the bill. Employers that are educational institutions can currently provide qualified tuition reductions to employees, their spouses, and dependents tax free, but this would be eliminated under the bill.

Employer Tax Deduction Impact

Under the proposed bill, employers’ corporate tax deduction credits for the following would be eliminated:

- Transportation fringe benefits

- On-premise athletic facilities

- Employer provided child care

The bill is now in markup, with the Ways and Means Committee working to draft a final bill for the House to vote on. If passed, it will be sent to the Senate to vote on.

By Danielle Capilla

Originally Published By United Benefit Advisors

by admin | Nov 30, 2017 | ACA, Employee Benefits, IRS

On December 13, 2016, President Obama signed the 21st Century Cures Act (Cures Act) into law. The Cures Act provides a method for certain small employers to reimburse individual health coverage premiums up to a dollar limit through HRAs called “Qualified Small Employer Health Reimbursement Arrangements” (QSE HRAs). The provision went into effect on January 1, 2017. On October 31, 2017, the IRS released Notice 2017-67, providing guidance on the implementation and administration of QSE HRAs.

On December 13, 2016, President Obama signed the 21st Century Cures Act (Cures Act) into law. The Cures Act provides a method for certain small employers to reimburse individual health coverage premiums up to a dollar limit through HRAs called “Qualified Small Employer Health Reimbursement Arrangements” (QSE HRAs). The provision went into effect on January 1, 2017. On October 31, 2017, the IRS released Notice 2017-67, providing guidance on the implementation and administration of QSE HRAs.

Unless an employer meets all the requirements for offering a QSE HRA, previous IRS guidance prohibiting the reimbursement of individual premiums directly or indirectly, after- or pre-tax, through an HRA, a Section 125 plan, a Section 105 plan, or any other mechanism, remains in full effect. Reimbursing individual premiums in a non-compliant manner will subject an employer to a Patient Protection and Affordable Care Act (ACA) penalty of $100 a day per individual it reimburses, with the potential for other penalties based on the mechanism of the non-compliant reimbursement.

If an employer fails to meet the requirements of providing a QSE HRA, it will be subject to a penalty of $100 per day per affected person for being a non-compliant group health plan. An arrangement will be a group health plan that is not a QSE HRA if it:

- Is not provided by an eligible employer (such as an employer that offers another group health plan to its employees).

- Is not provided on the same terms to all eligible employees.

- Reimburses medical expenses without first requiring proof of minimum essential coverage (MEC).

- Provides a permitted benefit in excess of the statutory dollar limits.

An arrangement’s failure to be a QSE HRA will not cause any reimbursement of a properly substantiated medical expense that is otherwise excludable from income to be included in the employee’s income or wages. Furthermore, an arrangement designed to reimburse expenses other than medical expenses (whether or not also reimbursing medical expenses) is neither a QSE HRA nor a group health plan. Accordingly, all payments under such an arrangement are includible in the employee’s gross income and wages. An employer’s failure to timely provide a compliant written notice does not cause an arrangement to fail to be a QSE HRA, but instead results in the penalty of $50 per employee, not to exceed $2,500.

Answers to Top Three FAQs about QSE HRAs

1, Which employers may offer a QSE HRA?

Employers with fewer than 50 full-time and full-time equivalent employees (under ACA counting rules) that do not offer a group health plan. Employers that do not offer a group health plan, but offer a retiree-only plan to former employees may offer a QSE HRA.

2. Which employers may not offer a QSE HRA?

- Employers with 50 or more full-time and full-time equivalent employees (under ACA counting rules).

- Employers of any size that offer a group health plan, including plans that only provide excepted benefits, such as vision or dental benefits.

- Employers that provide current employees with access to money from health reimbursement arrangements (HRAs) offered in prior years (through a carry-over).

- Employers that offer employees access to carryover amounts in a flexible spending account (FSA).

3. What are the rules for employers in a controlled group?

- Employers with less than 50 full-time and full-time equivalent employees (under ACA counting rules) may offer QSE HRAs, with the headcount including all employees across an entire controlled group.

- If one employer within a controlled group offers a QSE HRA, it must be offered to all employees within the entire controlled group (or each employer must offer an identical QSE HRA).

BY Danielle Capilla

Originally Published By United Benefit Advisors

When most experts think of group healthcare plans, Preferred Provider Organization (PPO) plans largely come to mind—though higher cost, they dominate the market in terms of plan distribution and employee enrollment. But Consumer-Directed Health Plans (CDHPs) have made surprising gains. Despite slight cost increases, CDHP costs are still below average and prevalence and enrollment in these plans continues to grow in most regions—a main reason why it was one of the top 7 survey trends recently announced.

When most experts think of group healthcare plans, Preferred Provider Organization (PPO) plans largely come to mind—though higher cost, they dominate the market in terms of plan distribution and employee enrollment. But Consumer-Directed Health Plans (CDHPs) have made surprising gains. Despite slight cost increases, CDHP costs are still below average and prevalence and enrollment in these plans continues to grow in most regions—a main reason why it was one of the top 7 survey trends recently announced.