by admin | Nov 24, 2025 | Custom Content, Health & Wellness

The phrase “attitude of gratitude” is more than a simple rhyme—it’s a powerful reminder to intentionally practice thankfulness in our daily lives. Consistently acknowledging what we appreciate not only enhances our own mental and physical health but also positively affects those around us.

The phrase “attitude of gratitude” is more than a simple rhyme—it’s a powerful reminder to intentionally practice thankfulness in our daily lives. Consistently acknowledging what we appreciate not only enhances our own mental and physical health but also positively affects those around us.

What Is Gratitude?

Gratitude means being thankful and ready to show appreciation and return kindness. While saying “thank you” is a common expression of gratitude, it also includes reflecting on positive moments from your day or life and genuinely feeling grateful.

The Profound Health Benefits

The benefits of gratitude extend far beyond simply making someone feel appreciated. Research has consistently demonstrated measurable psychological and physiological advantages for those who practice it regularly.

Mental and Emotional Well-being

Consciously practicing gratitude has been proven to act as a direct counter to stress and anxiety.

- Increased Happiness: Studies show that a single, thoughtful act of gratitude can produce an immediate increase in happiness and a 35% reduction in depressive symptoms.

- Improved Outlook: It fosters greater optimism for the future, improved mental well-being, and greater overall satisfaction with life.

- Reduced Toxic Emotions: Gratitude helps diminish feelings of envy, frustration, resentment, and regret.

- Character Development: It encourages the development of valuable traits like patience, humility, and wisdom.

Physical Health Advantages

The positive effects of gratitude are so deep that they manifest physically:

- Better Health Outcomes: Individuals who focus on gratitude have even reported fewer visits to the doctor.

- Improved Rest: It is linked to better sleep quality and less fatigue.

- Cellular Resilience: Perhaps the most surprising benefit is its effect on the body’s internal state. Regular gratitude is associated with lower levels of cellular inflammation. Since chronic inflammation is a root cause for numerous diseases, this suggests that thankfulness plays a role in long-term disease prevention and better physical health overall.

Simple Ways to Cultivate Gratitude

Building a habit of thankfulness is easy and requires minimal time. Here are practical exercises to strengthen your gratitude muscles every day:

- Daily Acknowledgment: Make it a point to sincerely say “thank you” to people throughout your day.

- Journaling: Keep a dedicated gratitude journal or use a physical gratitude jar to record specific things you are thankful for each day.

- Handwritten Notes: Take the time to write personalized, handwritten thank-you notes.

- Mindful Reflection: Set aside a few minutes daily to think or meditate on positive events.

- Create Rituals: Incorporate thankfulness into a daily routine, such as sharing a high point of the day at the dinner table.

- Visual Reminders: Use sticky notes around your home or workspace to prompt you to pause and appreciate what you have.

The evidence is clear: cultivating an “attitude of gratitude” is not a luxury, but a necessity for optimal health. By committing to mindful reflection and simple daily practices—whether through journaling, enjoying time spent with a loved one, or simply saying thank you—you invest directly in your psychological resilience and physical longevity. Start today to experience the transformative power of thankfulness.

by admin | Nov 17, 2025 | Human Resources

An employee handbook is key for setting workplace expectations and staying compliant. Outdated policies can create legal and operational risk. With evolving compliance requirements in the form of new laws and revised regulations, employers need to keep a watchful eye on their handbook policies to make sure they stay compliant. They should also be sure that the “oldies but goodies” – like harassment prevention and conduct guidelines are up to snuff. If you pulled a template for one of these off the internet in 2007, it’s almost guaranteed to need a refresh.

An employee handbook is key for setting workplace expectations and staying compliant. Outdated policies can create legal and operational risk. With evolving compliance requirements in the form of new laws and revised regulations, employers need to keep a watchful eye on their handbook policies to make sure they stay compliant. They should also be sure that the “oldies but goodies” – like harassment prevention and conduct guidelines are up to snuff. If you pulled a template for one of these off the internet in 2007, it’s almost guaranteed to need a refresh.

Using outdated policies can lead to confusion, operational disorder,and potential legal exposure. Here are some key end-of-year activities to make sure you start the new year off right: year:

1. Keep Up with State Leave Laws

State leave laws of all kinds have been trending for years now from paid family leave, to bereavement, to sick and safe leave. If you haven’t had expert help with your handbook policies, there’s a good chance you’re missing key details. For instance:

- California requires accrued paid sick leave with specific accrual caps and revises its law at least some part of that law on an almost yearly basis.

- Many states, including Massachusetts, New York, New Jersey, Washington, and Illinois have paid family and medical leave programs that offer job protection

- Colorado (and a handful of other states) have expanded their paid sick leave to cover public health emergencies

Why it matters: Multi-state employers face a patchwork of rules. Ignoring them can result in fines, penalties, and disputes.

Action for Employers: Audit leave policies against the laws and rules in each state and locality where you have employees. Clearly outline eligibility, accrual, carryover, duration, and payout provisions to avoid disputes.

2. If Your Discrimination, Harassment, and Complaint Policies Feel Outdated, They Probably Are

Your employee handbook should create a safe and inclusive workplace. But many organizations are still relying on policies written years ago that don’t reflect current laws or best practices.

Common gaps include:

- Outdated lists of protected classes that omit new state or federal protections.

- Limited examples of unacceptable behavior.

- Insufficient or unclear complaint procedures.

- Not having specific language or contact information required by state law.

Action for Employers: Refresh anti-harassment, discrimination, and complaint policies to include any and all information required by state law, clear reporting procedures, and protections against retaliation. Pair handbook policies with mandatory training to reinforce expectations.

3. Review Your Workplace Conduct and Social Media Policies

Although employers have a lot of latitude to dictate employee behavior, the National Labor Relations Act does create some limits, several of which you might find surprising. (If you don’t have union activity, you might be surprised to find that this law applies to you at all!) For instance, you can’t prevent employees from complaining about their working conditions or discussing their wages.

Things to check for in your written and unwritten policies:

- Prohibiting Wage Conversations: Even a word-of-mouth rule against wage discussions is problematic. Make sure your managers understand this and that rules again such discussions haven’t found their way into offer letters or handbooks.

- Rules Against Speaking Up or Having a “Bad Attitude”: Rules like this can crop up in many places, including your policy that covers standards of conduct. While you can certainly try to enforce decorum and respectful behavior in the workplace, the devil is in the details, and you need to be careful about over-restricting employee behavior.

- Social Media Limitations: You can certainly restrict social media use during work hours, but generally you can’t stop employees from discussing their employment conditions online (e.g., wages, hours, safety issues, bad management). Unfortunately for employers, there’s a lot of nuance in this area of law.

Action for Employers: Make sure your handbooks policies–and even unwritten practices–don’t run afoul of the National Labor Relations Act.

4. Ensure Handbook Distribution and Acknowledgment

A great handbook is only effective if employees receive it, read it, and acknowledge it. Too often, employers update policies but fail to track distribution or obtain acknowledgments, leaving them unprotected in a dispute.

Best practices include:

- Communicating changes clearly to avoid misunderstandings. If you’ve made big changes to your handbook, point those out when distributing new copies.

- Requiring signed acknowledgment forms or e-signatures from every employee.

- Storing acknowledgments in a secure and easily accessible format.

- If distributing updated handbooks digitally, also have a print version available in an easily accessible location in the workplace.

Action for Employers: Make handbook acknowledgment part of your compliance checklist every year. Ensure everyone receives important updates promptly.

Why Updating Your Employee Handbook Before 2026 Matters

Updating your employee handbook is not just about avoiding penalties. It helps create a compliant, transparent, and inclusive workplace that builds trust and engagement. Employers with up-to-date handbooks will enter 2026 ready to adapt to new laws, strengthen employee relationships, and reduce compliance risk.

By Brian Costello

Originally posted on Mineral

by admin | Nov 12, 2025 | Employee Benefits, Hot Topics

Federal regulators—specifically, the Departments of Labor, Health and Human Services, and the Treasury—issued joint guidance on October 16, 2025, making it significantly easier for employers to offer fertility benefits outside of their traditional group health plans.

Federal regulators—specifically, the Departments of Labor, Health and Human Services, and the Treasury—issued joint guidance on October 16, 2025, making it significantly easier for employers to offer fertility benefits outside of their traditional group health plans.

This action was driven by an Executive Order focused on protecting in vitro fertilization (IVF) access and reducing the high out-of-pocket costs associated with fertility treatment. The guidance effectively creates compliant pathways for employers to offer fertility coverage as an excepted benefit.

Key Takeaways for Offering Fertility Coverage

The new guidance provides clear, compliant options for employers to offer fertility support:

- Standalone Excepted Benefit: Employers may offer fertility benefits through a separate, fully insured policy that is not coordinated with the main group health plan. This is a crucial distinction, as individuals enrolled in this separate coverage may still contribute to a Health Savings Account (HSA).

- Excepted Benefit HRA: Employers can use an Excepted Benefit Health Reimbursement Arrangement (HRA) to reimburse employees for out-of-pocket fertility expenses, provided the HRA meets all applicable regulatory standards.

- Limited EAP Services: Benefits for fertility coaching and navigator services (to help employees understand their options) can be offered under an Employee Assistance Program (EAP), as long as the EAP qualifies as a limited excepted benefit and does not offer significant medical care benefits.

What’s Next?

The Departments have indicated they plan to release future rulemaking to explore even more ways to offer fertility benefits as a limited excepted benefit, which could offer employers additional flexibility in the future.

by admin | Nov 4, 2025 | Custom Content, Employee Benefits, Health & Wellness

The future of healthcare is rapidly evolving, with a clear trend toward integrating health interventions directly into employee benefits packages. As employers face rising healthcare costs—projected to increase by over 8% in 2025—they are rethinking how to deliver value to their workforce while managing expenses. This integration is reshaping not just what benefits are offered, but how employees access, use, and experience healthcare.

The future of healthcare is rapidly evolving, with a clear trend toward integrating health interventions directly into employee benefits packages. As employers face rising healthcare costs—projected to increase by over 8% in 2025—they are rethinking how to deliver value to their workforce while managing expenses. This integration is reshaping not just what benefits are offered, but how employees access, use, and experience healthcare.

From Reactive to Proactive: A Paradigm Shift

Historically, employee benefits have largely been reactive, focusing on covering costs after an illness or injury occurs. While essential, this model often overlooks the power of prevention, early intervention, and continuous support. The modern workforce, increasingly diverse in its needs and health goals, demands more. They seek benefits that empower them to manage their health proactively, rather than merely responding to sickness.

Integrating health interventions directly into benefits packages represents a pivotal move towards a proactive, holistic model. This means weaving in tools and programs that actively promote wellness, manage chronic conditions, and address the root causes of health challenges before they escalate.

What Do “Integrated Health Interventions” Look Like?

This new era of benefits goes beyond basic wellness programs. It encompasses a wide array of specialized, often technology-driven, interventions designed to meet specific health needs:

- Personalized Digital Health Platforms: These platforms leverage AI and data to offer tailored recommendations for fitness, nutrition, sleep, and stress management. They can connect employees with virtual coaching, mental health resources, and even provide smart device integration for continuous health monitoring.

- Specialized Chronic Condition Management Programs: For employees managing conditions like diabetes, hypertension, or asthma, integrated benefits offer dedicated support. This might include virtual health coaching, remote monitoring devices, personalized nutrition plans, and direct access to specialists, all aimed at improving adherence, outcomes, and quality of life.

- Mental Health & Well-Being Solutions: Recognizing the escalating importance of mental health, benefits packages are increasingly including access to online therapy platforms, meditation apps, stress reduction programs, and resilience training. These are often integrated with EAPs (Employee Assistance Programs) for a comprehensive support system.

- Preventive Care & Early Detection Initiatives: Beyond standard physicals, this could involve access to advanced health screenings, genetic testing (with proper counseling), smoking cessation programs, and vaccination clinics, all designed to identify risks early and prevent disease.

- Family-Building & Parental Support: Expanding beyond traditional maternity benefits, interventions now include fertility support, adoption assistance, lactation consulting, and comprehensive parental leave policies, acknowledging the full spectrum of family health needs.

The Multi-Layered Benefits of Integration

For employers, the strategic integration of health interventions yields substantial advantages:

- Improved Employee Health Outcomes: Proactive management leads to healthier employees, reducing the incidence and severity of chronic conditions.

- Reduced Healthcare Costs: Early intervention and better management of health issues can significantly lower claims costs, emergency room visits, and long-term medical expenses.

- Enhanced Talent Attraction & Retention: A comprehensive, forward-thinking benefits package is a powerful differentiator in a competitive job market, signaling a true investment in employee well-being.

- Increased Productivity & Engagement: Healthier, less stressed employees are more focused, engaged, and productive, leading to a more vibrant workplace culture.

- Stronger Organizational Culture: Prioritizing employee health fosters a culture of care, support, and appreciation, boosting morale and loyalty.

Challenges and the Path Forward

While the benefits are compelling, integration comes with its challenges, including data privacy concerns, ensuring equitable access, and effectively communicating complex offerings. The future of healthcare within employee benefits is not just about providing access to care, but about actively cultivating health. By seamlessly weaving targeted health interventions into benefits strategies, organizations can build a healthier, more resilient workforce, ultimately contributing to a more sustainable and prosperous business.

by admin | Oct 30, 2025 | Custom Content, Employee Benefits, Health Care Costs

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save money on prescriptions.

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save money on prescriptions.

Did You Know?

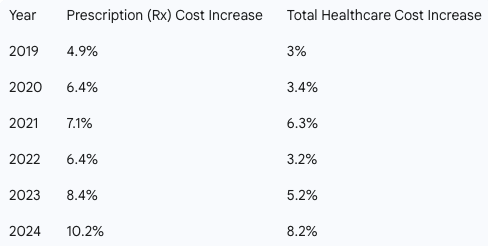

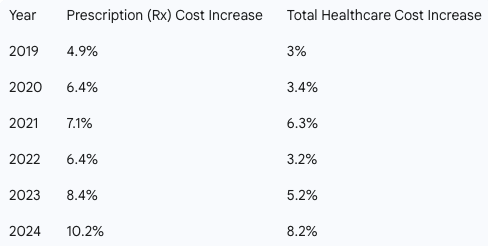

Drug costs are a primary driver of rising healthcare expenses for both employers and employees. Prescription drug spending is consistently growing at a faster rate than overall healthcare costs, with a steady increase of 6.8%. As the fastest-growing part of benefits plans, these costs will continue to climb with new pharmaceutical innovations.

For years in the U.S., cost has been a significant obstacle to sticking with medications with up to 3 in 10 people reporting that they do not take their medications as prescribed.

The Rising Cost of Prescriptions

Historically, prescription drug costs have outpaced total healthcare costs. The following chart highlights this trend from 2019 to 2024.

Prescription drug costs can put a strain on your budget, but with a little research and the right questions, you can reduce expenses without sacrificing your health.

Here are expert-backed strategies to help you save on your medications:

-

-

- Ask About a Generic Drug – Get the same quality and active ingredient as you’d find in a brand name, for less money.

- Save Money with a Pill Splitter – If your prescription comes in a higher dose that can be safely split, you get 2 doses for the price of 1.

- Consider a Combo Pill – Combining two drugs into one pill can help you avoid paying separate copays or coinsurance. Ask if a combo pill is an option for you.

- Buy in Bulk – Opt for a mail-order pharmacy to get a 90-day supply of your meds instead or a 30-day supply. This can often reduce your copay and overall cost.

- Make a List and Check it Twice – Check the list of preferred medications (a.k.a. “the formulary”), which tend to cost less.

- Find Out if You Still Need That Medication – If you’ve been taking the same medication for years, it’s worth checking in with your doctor to see if you still need it. Or if you’ve made a lifestyle change, it may reduce your need for certain medications. It never hurts to ask your doctor.

-

-

-

-

-

The medicines prescribed by your doctor are essential to your good health. With some savvy shopping, you can use the money you save on the things you enjoy!

The phrase “attitude of gratitude” is more than a simple rhyme—it’s a powerful reminder to intentionally practice thankfulness in our daily lives. Consistently acknowledging what we appreciate not only enhances our own mental and physical health but also positively affects those around us.

The phrase “attitude of gratitude” is more than a simple rhyme—it’s a powerful reminder to intentionally practice thankfulness in our daily lives. Consistently acknowledging what we appreciate not only enhances our own mental and physical health but also positively affects those around us.