by admin | Jan 5, 2026 | Custom Content, Employee Benefits

In our increasingly busy world, employee expectations are accelerating faster than ever before. A five-year-old benefits strategy simply cannot meet the complex, constant pressures workers face in 2026—be it financial stress, burnout, or caregiving responsibilities. The modern workforce is rejecting generic menus in favor of flexibility, strong financial support, and wellness options that align with their personal lives.

In our increasingly busy world, employee expectations are accelerating faster than ever before. A five-year-old benefits strategy simply cannot meet the complex, constant pressures workers face in 2026—be it financial stress, burnout, or caregiving responsibilities. The modern workforce is rejecting generic menus in favor of flexibility, strong financial support, and wellness options that align with their personal lives.

Employers face a critical challenge in 2026: balancing projected healthcare cost increases (around 10%) with the need to offer personalized, holistic, and competitive benefits.

Top 9 Trends Shaping 2026 Benefits Strategy:

- Managing Rising Healthcare Costs: Employers are adopting cost-management tactics — such as telemedicine, HSAs, and wellness incentives — to balance rising expenses driven by medical inflation, specialty drug use, and delayed care demand.

- Total Health and Well-Being:Benefits now integrate physical, mental, and financial wellness through EAPs, teletherapy, and wellness technology to promote holistic employee health.

- Women’s Health Expansion: Comprehensive care from fertility to menopause is becoming standard, improving retention, equity, and workforce engagement.

- Personalized Benefits Through AI:Technology enables tailored benefits selection, predictive analytics, and mobile access, meeting diverse employee needs.

- Mental Health Integration:Behavioral health is now fundamental, with digital tools, manager training, and open dialogue reducing stigma and driving productivity.

- Family and Caregiving Support:These benefits address the financial and emotional strain on the “sandwich generation” (caring for children and elders simultaneously). Expanded parental leave, dependent-care FSAs, and eldercare resources address pressures on multigenerational caregivers.

- Voluntary Benefits:Supplemental benefits provide a cost-effective way to offer additional value to employees. From pet insurance to identity theft protection, these benefits give employees the flexibility to select coverage that meets their individual needs.

- Financial Wellness and Retirement Security:Initiatives like 401(k) matching, financial counseling, and student-loan repayment reduce stress and strengthen financial stability.

- Upskilling and Development:Investing in employee growth as a key driver of retention and engagement, particularly among Gen Z and Millennials. Continuous learning opportunities, AI-driven training, and mentorship programs help attract and retain talent seeking career growth.

Ultimately, a strategic benefits plan that balances economic realities with genuine care for the workforce will be the decisive factor in attracting talent, boosting engagement, and building a resilient team ready for the year ahead.

by admin | Dec 28, 2025 | Compliance

The Internal Revenue Service (IRS) has issued Notice 2025-61, announcing a significant increase to the Patient-Centered Outcomes Research Institute (PCORI) fee amount. Employers with self-insured health plans and health insurance issuers must take note of the new rate and upcoming compliance deadlines.

The Internal Revenue Service (IRS) has issued Notice 2025-61, announcing a significant increase to the Patient-Centered Outcomes Research Institute (PCORI) fee amount. Employers with self-insured health plans and health insurance issuers must take note of the new rate and upcoming compliance deadlines.

What is the New PCORI Fee Amount?

The PCORI fee is increasing to $3.84 per covered life. This new rate applies to plan years that end on or after October 1, 2025, and before October 1, 2026.

For comparison, the previous fee amount (for plan years that ended on or after Oct. 1, 2024, and before Oct. 1, 2025) was $3.47 multiplied by the average number of lives covered under the plan.

Background and Applicability

The PCORI fee was originally established by the Affordable Care Act (ACA) to fund comparative effectiveness research. Though initially set to expire in 2019, federal legislation extended the fee for an additional 10 years. The PCORI fee is now scheduled to apply through the plan or policy year ending before October 1, 2029.

The fee is imposed on:

- Health insurance issuers

- Sponsors of self-insured health plans

The fee is calculated based on the average number of covered lives under the plan, which generally includes employees, their enrolled spouses, and dependents (unless the plan is an HRA or FSA).

Reporting and Payment Deadlines

The PCORI fee must be reported and paid annually using IRS Form 720 (Quarterly Federal Excise Tax Return).

The fee is always due by July 31st of the year following the last day of the plan year.

Action for Self-Insured Plans: Employers with self-insured health plans should ensure they use the correct rate and meet the upcoming July 31st deadline corresponding to their plan year end.

Additional Resources:

PCORI Fee Overview Page

PCORI Fee FAQs

by admin | Dec 10, 2025 | Compliance, HIPAA

The U.S. Department of Health and Human Services (HHS) has issued a final rule that requires covered entities—including many health plans—to update their Notice of Privacy Practices (Privacy Notice). This change enhances privacy protections for highly sensitive Substance Use Disorder (SUD) treatment records.

The U.S. Department of Health and Human Services (HHS) has issued a final rule that requires covered entities—including many health plans—to update their Notice of Privacy Practices (Privacy Notice). This change enhances privacy protections for highly sensitive Substance Use Disorder (SUD) treatment records.

Why the Update is Necessary

The HIPAA Privacy Rule already mandates that covered entities provide a Privacy Notice to explain how an individual’s Protected Health Information (PHI) is used.

However, the April 2024 final rule specifically addresses patient records involving SUD treatment from federally assisted programs (often referred to as “Part 2 programs”). Any covered entity that receives or maintains these Part 2 records must now update their Privacy Notice to reflect these additional, heightened protections.

The mandatory deadline for updating and distributing these notices is February 16, 2026.

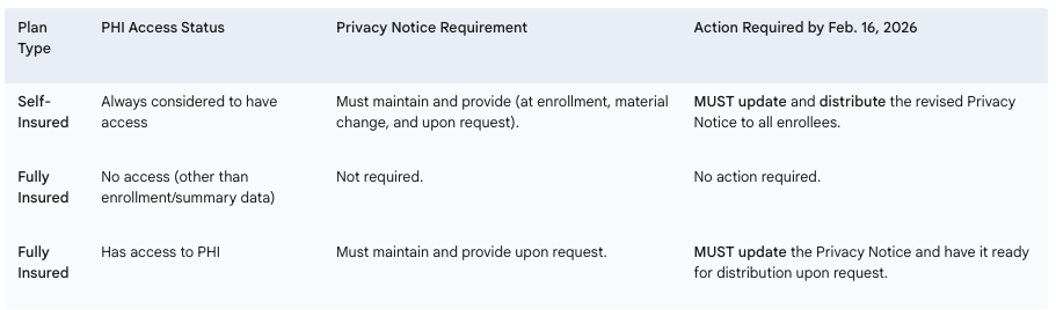

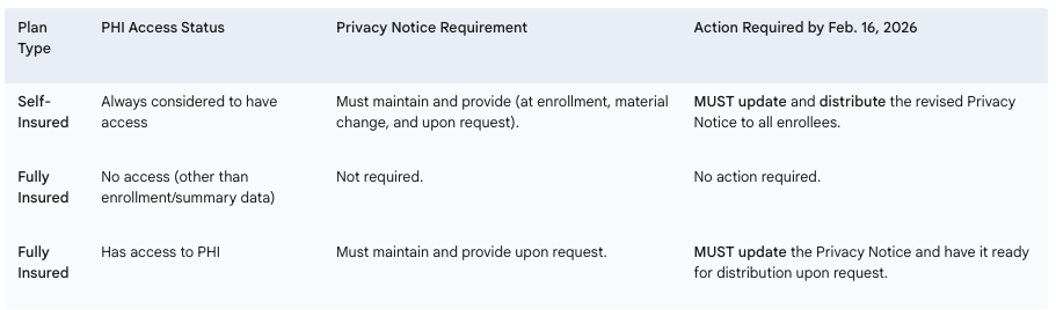

Required Employer Actions by Plan Type

Employers sponsoring health plans must determine their level of responsibility based on their plan’s funding structure and access to PHI.

Next Steps for Employers: Employers with self-insured health plans, or fully insured plans that manage PHI, must immediately begin the process of updating their Privacy Notices to incorporate the new requirements for SUD treatment records. It is currently uncertain if HHS will release updated model privacy notices before the deadline.

by admin | Dec 9, 2025 | Custom Content, Health & Wellness

The transition into winter and the busy holiday season often brings two things: cold weather and packed calendars. While the shorter days and festive cheer are welcome, they also present unique challenges to our health, including managing stress, fighting off seasonal illnesses, and maintaining an active routine.

The transition into winter and the busy holiday season often brings two things: cold weather and packed calendars. While the shorter days and festive cheer are welcome, they also present unique challenges to our health, including managing stress, fighting off seasonal illnesses, and maintaining an active routine.

Staying healthy this winter isn’t about grand gestures; it’s about small, consistent habits that protect your body and mind. Here is your guide to winter wellness.

- Boost Your Immune System and Sleep

The fight against winter colds and the flu starts with strengthening your natural defenses. This season, prioritize three foundational pillars of immunity:

Mind Your Vitamin D

With less sunlight exposure, many people become deficient in Vitamin D, which is crucial for immune function and mood regulation. If you can’t get 10–15 minutes of midday sun exposure, consider speaking to your doctor about a supplement. This small adjustment can make a big difference in fighting off sickness.

Stay Hydrated (Yes, Even in Winter)

The dry winter air and indoor heating dehydrate us faster than we realize, weakening the protective mucous membranes that fight germs. Keep a water bottle within reach and aim to drink herbal tea or warm water throughout the day. Dehydration contributes to fatigue, which makes you more susceptible to illness.

Make Sleep Non-Negotiable

Sleep is your body’s most effective time for immune repair. With holiday parties and deadlines looming, it’s easy to sacrifice an hour of sleep, but this can significantly compromise your health. Aim for 7-9 hours of quality sleep nightly. Stick to a consistent bedtime, even on weekends, to regulate your body’s natural rhythms.

- Managing Holiday Stress and Mental Load

The holidays bring a mix of joy and unique pressures—financial strain, travel headaches, and social commitments. Protect your mental health by applying these strategies:

Practice Proactive Planning

Instead of letting tasks pile up, dedicate 15 minutes each Sunday evening to look at your calendar and budget your energy. Schedule time blocks not just for work meetings, but also for “recharge time” and “boundary setting.”

Set Realistic Boundaries

It’s okay to say no to extra commitments. Whether it’s an optional holiday event or taking on another project before year-end, know your limits. Communicate clearly and politely: “That sounds lovely, but I can’t commit right now.” Protecting your time is vital for preventing burnout.

Embrace Micro-Mindfulness

Use small moments throughout the workday to check in with yourself. Before answering an email or joining a meeting, take two deep, slow breaths. This simple action can lower your heart rate, reduce the stress hormone cortisol, and reset your focus.

- Keep Moving, Inside and Out

When it’s cold and dark, the couch can be a powerful magnet. Counter this by adapting your fitness routine to the season:

Take a “Walking Meeting”

If you are working from home or have an internal call, suggest a walking meeting outside. Even 15 minutes of brisk outdoor walking can boost your mood and provide light exposure to aid Vitamin D production. Remember to layer up!

Find Your Indoor Outlet

Don’t rely solely on outdoor activities. Explore simple indoor options: use resistance bands while watching TV, follow a 15-minute yoga session online, or simply do some stretching and bodyweight exercises before starting your workday. The goal is consistency, not intensity.

Fuel with Focus

The holidays often mean sugary treats, which can lead to energy crashes and sluggishness. Balance celebratory foods with nutrient-dense options. Focus on protein, fiber, and healthy fats to keep your energy stable, especially during peak work hours.

By taking small steps each day – and listening to your body – you can enjoy the winter season, stay healthy, and start the new year feeling your best.

by admin | Dec 2, 2025 | Compliance, ERISA

Employers with insured health plans may have received a Medical Loss Ratio (MLR) rebate from their health insurance carrier this year. Rebates were required for plans not meeting the 2024 MLR standards and had to be issued by September 30, 2025, either as premium credits or lump-sum payments.

Employers with insured health plans may have received a Medical Loss Ratio (MLR) rebate from their health insurance carrier this year. Rebates were required for plans not meeting the 2024 MLR standards and had to be issued by September 30, 2025, either as premium credits or lump-sum payments.

If any part of the rebate qualifies as a plan asset under ERISA, it must benefit plan participants and beneficiaries exclusively. Employers can fulfill this requirement by distributing the plan asset portion using a fair and reasonable allocation method. Alternatively, if direct payments aren’t practical, the rebate can be used for other allowable plan purposes, such as future premium reductions or benefit enhancements.

ERISA generally requires that plan assets be kept in trust, but this is waived if any rebate amount considered a plan asset is used within three months of receipt, so employers must pay careful attention to the timeline. For example, rebates received on September 30, 2025, must be used by December 30, 2025.

Key points:

- Under the Affordable Care Act, health insurers must spend a minimum percentage of premiums on medical care and quality improvements; if not, rebates are required.

- Employers must determine if any rebate portion qualifies as a plan asset under ERISA.

- Plan assets must only benefit plan participants and beneficiaries and generally must be used within three months of receiving the rebate to remain ERISA-compliant.

Employers should review current obligations to ensure any rebate qualifying as a plan asset is properly allocated and used in accordance with federal requirements.

In our increasingly busy world, employee expectations are accelerating faster than ever before. A five-year-old benefits strategy simply cannot meet the complex, constant pressures workers face in 2026—be it financial stress, burnout, or caregiving responsibilities. The modern workforce is rejecting generic menus in favor of flexibility, strong financial support, and wellness options that align with their personal lives.

In our increasingly busy world, employee expectations are accelerating faster than ever before. A five-year-old benefits strategy simply cannot meet the complex, constant pressures workers face in 2026—be it financial stress, burnout, or caregiving responsibilities. The modern workforce is rejecting generic menus in favor of flexibility, strong financial support, and wellness options that align with their personal lives.