by admin | Jul 13, 2017 | COBRA, Compliance

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. The length of the COBRA coverage period depends on the qualifying event and is usually 18 or 36 months. However, the COBRA coverage period may be extended under the following five circumstances:

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. The length of the COBRA coverage period depends on the qualifying event and is usually 18 or 36 months. However, the COBRA coverage period may be extended under the following five circumstances:

- Multiple Qualifying Events

- Disability

- Extended Notice Rule

- Pre-Termination or Pre-Reduction Medicare Entitlement

- Employer Extension; Employer Bankruptcy

In this blog, we’ll examine the first circumstance above. For a detailed discussion of all the circumstances, request UBA’s Compliance Advisor, “Extension of Maximum COBRA Coverage Period”.

When determining the coverage period under multiple qualifying events, the maximum coverage period for a loss of coverage due to a termination of employment and reduction of hours is 18 months. The maximum coverage period may be extended to 36 months if a second qualifying event or multiple qualifying events occur within the initial 18 months of COBRA coverage from the first qualifying event. The coverage period runs from the start of the original 18-month coverage period.

The first qualifying event must be termination of employment or reduction of hours, but the second qualifying cannot be termination of employment, reduction of hours, or bankruptcy. In order to qualify for the extension, the second qualifying event must be the covered employee’s death, divorce, or child ceasing to be a dependent. In addition, the extension is only available if the second qualifying event would have caused a loss of coverage for the qualified beneficiary if it occurred first.

The extended 36-month period is only for spouses and dependent children. In order to qualify for extended coverage, a qualified beneficiary must have elected COBRA during the first qualifying event and must have been receiving COBRA coverage at the time of the second event. The qualified beneficiary must notify the plan administrator of the second qualifying event within 60 days after the event.

Example: Jim was terminated on June 3, 2017. Then, he got divorced on July 6, 2017. Jim was eligible for COBRA continuation coverage for 18 months after his termination of employment (the first qualifying event). However, his divorce (the second qualifying event) extended his COBRA continuation coverage to 36 months because it occurred within the initial 18 months of COBRA coverage from his termination (the first qualifying event).

The health plan should indicate when the coverage period begins. The plan may provide that that the plan administrator be notified when plan coverage is lost as opposed to when the qualifying event occurs. In that case, the 36-month coverage period would begin on the date coverage was lost.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

by admin | Jul 7, 2017 | Benefit Plan Tips, Tricks and Traps, Employee Benefits, Human Resources

Many employers have invested in benefits administration systems to streamline their processes and connectivity with payroll systems as well as external vendors. From an efficiency and reporting perspective, this works wonderfully. However, when it comes to leveraging that technology for open enrollment and benefits communication, there can be gaps that limit effectiveness.

Many employers have invested in benefits administration systems to streamline their processes and connectivity with payroll systems as well as external vendors. From an efficiency and reporting perspective, this works wonderfully. However, when it comes to leveraging that technology for open enrollment and benefits communication, there can be gaps that limit effectiveness.

Our recent survey found that while technology plays a big role (47 percent of surveyed employees used a platform to enroll in their benefits), only 15 percent used an online tool to learn about their options. The good news is that of those who sought information, 90 percent found that interactive digital experience to be helpful.

The question then is, how do we encourage employees to seek information about the benefits available to them?

In a previous blog post, we talked about the power of personalization. Employees want the ability to customize their benefits package to meet their needs. This can seem challenging if your enrollment experience is limited to a simple (or overly complex) menu of benefits, only accompanied by the ability to elect participate, or waive (some may include links to product information). From a data perspective, this can be a seamless HR experience—but is it a great experience for employees?

There are several ways to create a better employee experience and your UBA advisors and vendor partners can help.

When you are planning your next open enrollment, ask your benefits administration partner what, if any, benefits communication tools they may have. Some platforms have started to incorporate dynamic video and animated presentations that help personalize the enrollment experience. Highlight these tools to your employees as part of the pre-enrollment communication package.

Insurance providers and other vendors are also great resources. Insurers may have product calculators to help employees determine coverage amounts that make sense for them. They may also have videos as well as single sign-on links that provide employees additional information. The same types of tools may be available from other vendors, such as health savings account (HSA) administrators.

Consider one-to-one employee meetings with a benefits counselor. Eighty-six percent of surveyed employees said they want a clearer explanation of benefits choices, and 80 percent want one-on-one time. Remember, your employees learn differently, and many could benefit from having a personal conversation about their needs. In many cases, it is possible to work with a carrier, or vendor, that can actually conduct the meetings and enroll employees on the benefits administration platform. The one-on-one meetings help employees learn about options specific to their circumstances, and the on-site representative can help guide them on how to use the system. This can also be an opportunity to update employee information such as dependents, beneficiaries, and contact information.

Successfully blending personalized benefits communication strategies with benefits administration technology can help increase employee engagement and streamline your processes.

By Kevin D. Seeker

Originally Posted By www.ubabenefits.com

by admin | Jul 6, 2017 | Employee Benefits, Group Benefit Plans

In conversations with HR professionals and benefit brokers, we find that the topic of long-term care insurance (LTCi) is often covered in less than two minutes during renewal meetings. When I ask why the topic of conversation is so short, they tell me, “Employees just aren’t asking about it, so they must not be interested.”

In conversations with HR professionals and benefit brokers, we find that the topic of long-term care insurance (LTCi) is often covered in less than two minutes during renewal meetings. When I ask why the topic of conversation is so short, they tell me, “Employees just aren’t asking about it, so they must not be interested.”

If employees aren’t asking about LTCi, does it mean they aren’t interested? They just may be unaware of the value of LTCi and that it can be offered by their employer with concessions not available in the open market. Here are the top seven reasons why LTCi should be a bigger part of the employee benefits conversation.

- Do you know LTCi can be offered as an employee benefit?

There are multiple employer-sponsored products, including those with pricing discounts, guarantee issue, and payroll deduction.

- Do you believe Medicaid and Medicare will provide long-term care for employees?

This is a popular misconception. Medicare and Medicaid will restrict your employees’ choices of where and how they receive care. These options will either not offer custodial or home care, or they’ll force employees to spend down their assets for care.

- Do you think LTCi is too expensive, or that your employee population is too young to need it?

Many plans can be customized to meet personal budgets and potential care needs. It’s also important to know that rates are based on employees’ ages. The younger the employees are, the lower their rates will be.

- Are you aware of the variety of LTCi plans?

Many policies offer flexible coverage options. Depending on the policy an employer selects, LTCi can cover a wide range of care—in some cases even adult day care and home safety modifications.

- Do you believe the market is unstable?

Today’s products are priced based on conservative assumptions, and employers are enrolling very stable LTCi plans for their employees. Each month, we see new plan options and products being introduced along with new carriers entering the market.

- Do you already offer an LTCi plan but it’s closed to new hires?

Being able to offer a similar LTCi benefit to all employees is crucial for most employers. Find a partner that can assist with the current LTCi plan and can assist with bringing in a new LTCi offering for new hires

By Christine McCullugh

Originally Posted By www.ubabenefits.com

by admin | Jun 21, 2017 | Benefit Management, COBRA

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. Per regulation, qualifying events are specific events that cause or trigger an individual to lose health coverage. The type of qualifying event determines who the qualified beneficiaries are and the maximum length of time a plan must offer continuation coverage. A group health plan may provide longer periods of continuation coverage beyond the maximum 18 or 36 months required by law.

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. Per regulation, qualifying events are specific events that cause or trigger an individual to lose health coverage. The type of qualifying event determines who the qualified beneficiaries are and the maximum length of time a plan must offer continuation coverage. A group health plan may provide longer periods of continuation coverage beyond the maximum 18 or 36 months required by law.

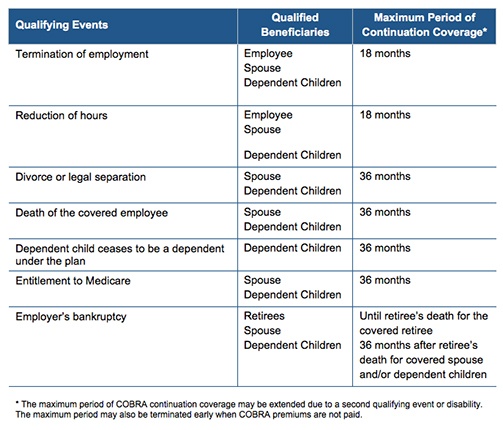

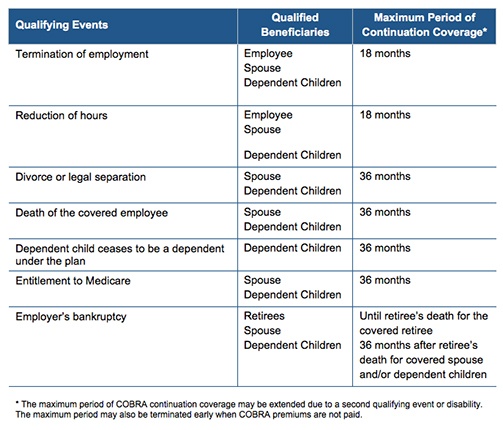

There are seven triggering events that are qualifying events for COBRA coverage if they result in loss of coverage for the qualified beneficiaries, which may include the covered employee, the employee’s spouse, and dependent children.

The following quick reference chart indicates the qualifying event, the individual who is entitled to elect COBRA, and the maximum length of COBRA continuation coverage.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

by admin | Jun 13, 2017 | Benefit Plan Tips, Tricks and Traps, Human Resources

The Section 125 cafeteria plan regulations and the Patient Protection and Affordable Care Act (ACA) require employers to take certain actions when an employee reduces hours.

The Section 125 cafeteria plan regulations and the Patient Protection and Affordable Care Act (ACA) require employers to take certain actions when an employee reduces hours.

Consider this scenario: An employer has an employee who is reducing hours below 30 hours per week. The employee is performing the same job and duties. The employee was determined to be full-time during the most recent measurement period. The employee is currently in a stability period.

What happens when the employee reduces hours during a stability period?

Answer: The employee must be offered coverage through the entire stability period. The employee must remain classified as full-time for the rest of the stability period. An employee’s full-time status determined in the measurement period determines the employee’s status during the subsequent stability period. This is true regardless of why the individual’s hours were reduced, or who chose to reduce the hours.

By Danielle Capilla

Originally Posted By www.ubabenefits.com

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. The length of the COBRA coverage period depends on the qualifying event and is usually 18 or 36 months. However, the COBRA coverage period may be extended under the following five circumstances:

The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA) requires employers to offer covered employees who lose their health benefits due to a qualifying event to continue group health benefits for a limited time at the employee’s own cost. The length of the COBRA coverage period depends on the qualifying event and is usually 18 or 36 months. However, the COBRA coverage period may be extended under the following five circumstances: