by admin | Jan 28, 2026 | Health Care Costs, Health Insurance

Health care costs in the United States continue to rise, increasing pressure on both employers and employees. Organizations that provide health benefits must balance growing expenses with transparency and trust from their workforce. Clear, compassionate communication is key to helping employees understand and navigate these rising costs. Consider these strategies:

Health care costs in the United States continue to rise, increasing pressure on both employers and employees. Organizations that provide health benefits must balance growing expenses with transparency and trust from their workforce. Clear, compassionate communication is key to helping employees understand and navigate these rising costs. Consider these strategies:

- Craft messaging that is clear, concise, and easy to grasp. Explain why costs are increasing and what the organization is doing to manage them, highlighting any positive changes such as broader coverage for specialty drugs or added wellness benefits.

- Educate employees about cost drivers and how to use plans effectively. Share practical guidance on reducing unnecessary expenses and appreciating the value of their benefits. Helpful resources include cost comparison tools and provider directories.

- Highlight cost-containment efforts. Demonstrate concrete actions like negotiating with providers, using reference-based pricing, expanding telehealth options, or investing in wellness programs to reassure employees that benefits are being protected.

- Provide real-world examples. Illustrate how a new high-cost medication can affect premiums or why rising mental health utilization, though beneficial, can increase costs.

- Explain macroeconomic factors. Help employees see the broader context by noting that these trends are not unique to your organization. It is vital for employees to know that rising costs aren’t an internal failure, but a national trend. Briefly explain the external factors driving the market, including:

- General inflation and rising labor costs in the medical field.

- Medical breakthroughs in diagnostics and therapeutics that come with high price tags.

- Industry consolidation among hospitals and provider groups.

Employers have a unique opportunity to act as a partner in their employees’ health journeys. By being open about the “how” and “why” of health care costs, you build a culture of resilience and mutual respect.

by admin | Jan 13, 2026 | Custom Content, Health Care Costs, Health Savings Account

A Health Savings Account (HSA) is a tax-advantaged savings account designed to help you pay for healthcare expenses. It offers valuable benefits now and in the future — from lowering your current healthcare costs to building long-term savings for retirement.

A Health Savings Account (HSA) is a tax-advantaged savings account designed to help you pay for healthcare expenses. It offers valuable benefits now and in the future — from lowering your current healthcare costs to building long-term savings for retirement.

- Understand the Basics

- Triple Tax Advantage: HSAs provide three powerful tax benefits — contributions are tax-deductible, growth is tax-deferred, and withdrawals for qualified medical expenses (QMEs) are completely tax-free.

- Eligibility: To open or contribute to an HSA, you must be enrolled in a high-deductible health plan (HDHP). These plans typically have higher deductibles and out-of-pocket costs but lower monthly premiums, allowing you to save more overall.

2026 Contribution Limits:

- Self-only coverage: $4,400

- Family coverage: $8,750

- Catch-up contribution (age 55+): $1,000

- Maximize Your Contributions

- Make regular contributions: Set up automatic transfers to your HSA to build your balance consistently.

- Take advantage of catch-up contributions: If you’re 55 or older, contribute an additional $1,000 annually to boost your savings.

- Use Your HSA Strategically

- Cover qualified medical expenses: Use HSA funds for expenses like doctor visits, prescriptions and over the counter medications, dental/vision care, hearing aids and other IRS-approved medical costs.

- Invest for long-term growth: Consider investing your HSA balance to grow tax-free over time. After age 65, you can make withdrawals for non-medical expenses without a penalty (though they’ll be taxed as regular income).

- Carry funds forward: Unlike Flexible Spending Accounts (FSAs), HSA balances roll over year to year — your money stays with you even if you change jobs.

All HSA transactions must go toward Qualified Medical Expenses (QMEs) as defined by the IRS. You can review the full list of eligible expenses in the IRS Publication 502.

The Bottom Line

HSAs are among the most flexible and tax-efficient savings tools available. Because healthcare costs often rise with age, starting early and contributing consistently can significantly strengthen your financial security — both for medical needs and retirement. By understanding the basics of HSAs and following these tips, you can make the most out of this valuable financial tool.

by admin | Oct 30, 2025 | Custom Content, Employee Benefits, Health Care Costs

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save money on prescriptions.

No doubt about it, prescriptions are expensive. While this may not be a big worry when you’re young and healthy, the costs can add up quickly if you’re diagnosed with a chronic condition or need an expensive drug. Whether you take medications regularly or for an occasional illness, it pays to know how to save money on prescriptions.

Did You Know?

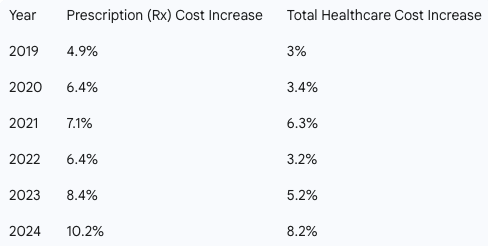

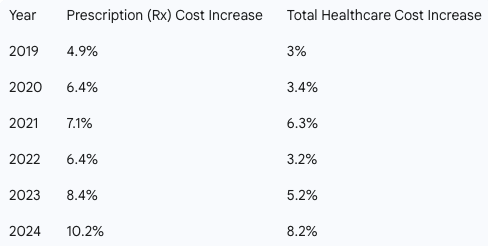

Drug costs are a primary driver of rising healthcare expenses for both employers and employees. Prescription drug spending is consistently growing at a faster rate than overall healthcare costs, with a steady increase of 6.8%. As the fastest-growing part of benefits plans, these costs will continue to climb with new pharmaceutical innovations.

For years in the U.S., cost has been a significant obstacle to sticking with medications with up to 3 in 10 people reporting that they do not take their medications as prescribed.

The Rising Cost of Prescriptions

Historically, prescription drug costs have outpaced total healthcare costs. The following chart highlights this trend from 2019 to 2024.

Prescription drug costs can put a strain on your budget, but with a little research and the right questions, you can reduce expenses without sacrificing your health.

Here are expert-backed strategies to help you save on your medications:

-

-

- Ask About a Generic Drug – Get the same quality and active ingredient as you’d find in a brand name, for less money.

- Save Money with a Pill Splitter – If your prescription comes in a higher dose that can be safely split, you get 2 doses for the price of 1.

- Consider a Combo Pill – Combining two drugs into one pill can help you avoid paying separate copays or coinsurance. Ask if a combo pill is an option for you.

- Buy in Bulk – Opt for a mail-order pharmacy to get a 90-day supply of your meds instead or a 30-day supply. This can often reduce your copay and overall cost.

- Make a List and Check it Twice – Check the list of preferred medications (a.k.a. “the formulary”), which tend to cost less.

- Find Out if You Still Need That Medication – If you’ve been taking the same medication for years, it’s worth checking in with your doctor to see if you still need it. Or if you’ve made a lifestyle change, it may reduce your need for certain medications. It never hurts to ask your doctor.

-

-

-

-

-

The medicines prescribed by your doctor are essential to your good health. With some savvy shopping, you can use the money you save on the things you enjoy!

by admin | Sep 15, 2025 | Health Care Costs, Health Insurance

PwC’s latest annual analysis forecasts that group health insurance costs will increase by 8.5% in 2026—the third straight year at this elevated trend. This sustained rise means health care expenses are now similar to those seen 15 years ago, after a brief dip post-pandemic.

PwC’s latest annual analysis forecasts that group health insurance costs will increase by 8.5% in 2026—the third straight year at this elevated trend. This sustained rise means health care expenses are now similar to those seen 15 years ago, after a brief dip post-pandemic.

Researchers gathered data from actuaries at 24 major U.S. health plans, covering more than 125 million employer-sponsored members and 12 million ACA marketplace members. The “medical cost trend” refers to the expected annual increase in health plan spending.

Key factors driving this growth include:

Hospital expenses: Wages for healthcare workers, supply prices, and rising operational costs all contribute. Many hospitals are intensifying revenue cycle management activities, increasing inpatient admissions, and pushing more costs onto commercial health plans.

Prescription drugs: Spending is up, notably driven by new therapeutics such as GLP-1 medications for chronic illnesses and rare genetic conditions. Drug spending soared by $50billion in 2024, with GLP-1s poised for further approvals.

Behavioral health services: Inpatient behavioral health claims jumped nearly 80%, and outpatient claims rose almost 40%. One in three actuarial leaders cited behavioral health as a top driver of rising costs, projecting a 10%-20% trend for this segment in 2026.

Offsetting factors, though limited in impact, include:

Biosimilars: For the third straight year, biosimilar drugs are cited as a leading cost deflator. Their adoption continues to grow and may help moderate spending.

Care management: Health plans are finding success with cost management strategies, such as utilization management, pharmacy oversight, and AI-powered claims review—tools that could dampen the medical cost trend.

The report also highlights upcoming federal policy changes, like the One Big Beautiful Bill (OBBB) Act, which may bring more cost pressure through adjustments to Medicaid eligibility, lapsing ACA subsidies, and proposed tariffs on imported pharmaceuticals.

Ultimately, industry analysts anticipate medical costs will keep climbing into 2026 and likely beyond, forcing employers to pursue affordability strategies while managing the growing burden of health coverage costs.

by admin | Jan 9, 2025 | Employee Benefits, Health Care Costs

Healthcare costs are projected to rise significantly in 2025. To mitigate these increases, consider these tips:

Healthcare costs are projected to rise significantly in 2025. To mitigate these increases, consider these tips:

- Know Your Plan: Take time to review what your health plan covers—and what it doesn’t—to avoid unexpected costs. Understand your health plan’s coverage, including deductibles, co-pays, and out-of-pocket maximums.

- Utilize In-Network Providers: Receiving care from out-of-network providers can dramatically increase costs. Check your plan details to confirm that your provider is in-network before scheduling any appointments.

- Budget Wisely: Plan for potential healthcare expenses throughout the year.

- Ask Questions: Don’t hesitate to ask your doctor questions during visits. If you need care, inquire about alternative treatments or services that are both effective and more affordable.

- Get Annual Check-Ups and Screenings: The best way to ward off many illnesses is to not them sneak up on you.

- Take Care of Your Health: A simple way to save money on healthcare is to stay healthy. By staying at a healthy weight, exercising regularly, and not smoking lowers your risk for health problems.

- Consider using a Health Savings Account (HSA) or a Flexible Spending Account (FSA): Many employers offer an HSA or FSA. These are savings accounts that allow you to set aside pre-tax dollars for healthcare expenses. This can help save you several hundred dollars per year.

- Telehealth: Utilize telehealth services when appropriate to reduce urgent care or doctor’s visits costs.

Staying informed about your health care benefits—including the fine print—can help you save money. By taking these steps, you can help to manage your healthcare costs and protect your financial well-being.

by admin | Dec 16, 2024 | Health Care Costs

Health care expenses are expected to rise significantly in 2025, with projections indicating a 7%-8% increase. This aligns with similar trends in 2024, showcasing the cumulative impact of ongoing cost growth. Below are the primary drivers of these increases:

Health care expenses are expected to rise significantly in 2025, with projections indicating a 7%-8% increase. This aligns with similar trends in 2024, showcasing the cumulative impact of ongoing cost growth. Below are the primary drivers of these increases:

- GLP-1 Medications: Glucagon-like peptide-1 drugs typically require long-term use to deliver intended health benefits. Currently, 6% of Americans use these medications, with the percentage potentially rising to 9% by 2030.

- Pharmacy Costs: Rising costs in general pharmacy are fueled by price hikes for existing drugs, along with innovations like cell and gene therapies, biologics, and biosimilars.

- Health Care Workforce Costs: Increased spending on wages and staffing in the health care sector often translates into higher costs for employers and patients.

- Chronic Conditions: About 90% of U.S. health care spending is dedicated to managing mental and chronic health conditions, including heart disease, cancer, diabetes, and obesity.

- Aging Population: The number of Americans aged 65 and older continues to rise, with over 55 million aged 55 or older currently. By 2040, nearly 80 million are expected to be in this age group.

Although these rising costs are inevitable, informed employers can proactively address these challenges. Reach out to us for additional insights and resources.

Health care costs in the United States continue to rise, increasing pressure on both employers and employees. Organizations that provide health benefits must balance growing expenses with transparency and trust from their workforce. Clear, compassionate communication is key to helping employees understand and navigate these rising costs. Consider these strategies:

Health care costs in the United States continue to rise, increasing pressure on both employers and employees. Organizations that provide health benefits must balance growing expenses with transparency and trust from their workforce. Clear, compassionate communication is key to helping employees understand and navigate these rising costs. Consider these strategies: