by admin | Jun 5, 2023 | Employee Benefits, Human Resources

Total rewards packages refer to the compensation and benefits plans that companies offer. This phrase, however, extends beyond mere salary or wages and traditional benefits, like health insurance, to provide both recruits and employees with a rundown of what makes the employer special. Some in Human Resources might regard the total rewards package as the starting line for employee value proposition (EVP).

Total rewards packages refer to the compensation and benefits plans that companies offer. This phrase, however, extends beyond mere salary or wages and traditional benefits, like health insurance, to provide both recruits and employees with a rundown of what makes the employer special. Some in Human Resources might regard the total rewards package as the starting line for employee value proposition (EVP).

Here are the different components of a total rewards package:

Compensation

Compensation, which may refer to wages or salary, is the obvious main feature of the total rewards package. People get paid for their work, so they can afford housing, food, and the basic necessities of life. The money you’re paid to work may include the chance for bonuses and other merit-based rewards, in addition to salary or wages.

Basic Benefits

The most well-known benefits include health, vision, and dental insurance. People have come to expect some form of medical insurance for full-time employment in the United States. In fact, most rely on this benefit for their healthcare because private insurance is astronomically expensive without group membership, and the United States does not have a public option.

Retirement Plans

Offering 401(k) or IRA plans have also become the norm. Companies previously rewarded loyalty with pensions that could help people survive after employment ended. However, nowadays, pensions have been replaced by these other retirement plans, which rely on sometimes volatile markets. There are penalties for taking the money out of such accounts before retirement.

Paid Time Off (PTO)

Paid time off is not a given in every job. However, it refers to the time people are allowed to take vacation, recover from illness or injury, and celebrate holidays while still getting paid. This can include vacation days, sick days, and bank holidays.

Nowadays, some companies are getting creative with PTO. They may include shared days off, where the entire organization takes a break and gets paid. Or they might have unlimited PTO, which means people do not have to accrue or earn days based on seniority. Rather, they can take off when they need to without limit. In those cases, however, employers use an honor system to ensure people do not take advantage of the system.

Family Leave

This is key for new parents, those tending to loved ones who are ill or elderly, or those facing a longer-term illness themselves because they can take time off for care. However, family leave does not have to be paid. Approved family leave requires employers to hold the position for the person, but they do not have to be paid during that time off. It depends on whether they company offers pay for family leave. Many do pay for maternity leave for up to three months, and many others are offering paternity leave now, too. Assessing employment law is a necessity in these cases. And job applicants must do their due diligence when vetting potential employers if they think they may need leave at some point.

Learning and Development and Career Paths

Employees are seeking opportunities to learn, grow, and develop in their careers while on the job. Therefore, more employers are trying to offer training, classes, reimbursement for tuition or coursework, mentorship, leadership development, and other opportunities to gain skills necessary for raises and promotions. It will also help the individual and the employer remain relevant as the skills gap becomes more of a problem in the future of work.

Mental Health and Wellness Programs

For decades now, people have looked to their employers for gyms or gym membership. But now everyone is thinking beyond physical health to mental health as well. As a result, access to mental health help, employee assistance programs (EAPs), classes on mindfulness or yoga, apps for stress management, and more are on the table. Many employers are responding with a wealth of benefits related to wellness and well-being.

Free Food

Providing free lunches, snacks, or special occasion treats has been a hallmark of American companies. Many of the tech giants have campuses that provide services from dry cleaning to dental work, and free food in the cafeteria is a given. As employers try to convince people to return to the office in this post-pandemic era, they try to lure them with bagels or pizza or even other more gourmet options.

Work-Life Balance

Flexibility in where and/or when people work is going mainstream. As the gig economy gains steam, people expect to have more flexibility in their scheduling. Offering remote or hybrid work schedules, understanding when someone must pick up their kid from school or go to a doctor’s appointment, and allowing people to execute asynchronous work during off hours are benefits that impact work-life balance.

Ultimately, the total rewards package a company offers is the first sign of its relationship with employees. It tells the story of how talent is valued by an organization. It usually requires more than just money to satisfy recruits and employees.

By Francesca Di Meglio

Originally posted on HR Exchange Network

by admin | May 30, 2023 | Employee Benefits, HSA/HRA

Are you the type of person who loves to save money? You’ll be happy to know that there’s a way to do so with your health care costs. It starts with medical expense accounts which let you set aside money to pay for certain health products and services. One type of medical expense account is a Health Savings Account (HSA).

Are you the type of person who loves to save money? You’ll be happy to know that there’s a way to do so with your health care costs. It starts with medical expense accounts which let you set aside money to pay for certain health products and services. One type of medical expense account is a Health Savings Account (HSA).

How Does An HSA Work?

An HSA is a type of personal savings account you can use to pay certain health care costs. An HSA lets you pay for qualified health, dental and vision care costs for yourself, spouse and dependents with tax-free money. The money you contribute comes out of your paycheck – before taxes – and that is how you save to pay for your out-of-pocket health care expenses. Like a regular savings account, your HSA has an interest rate that allows your money to grow while sitting in the account. Your employer also has the option of contributing to your HSA, helping it to grow faster.

If you don’t use all of your HSA funds during the calendar year, you can roll that money over. An HSA is owned by you so you take it with you no matter if you change plans, change jobs or if you decide to retire. You will get a debit card which is linked to your HSA when you set up your account that you use to pay for eligible expenses.

You must be enrolled in a High Deductible Health Plan (HDHP) to open and contribute to an HSA. HDHPs medical plans aim to minimize your health care costs if you don’t use your plan a lot but keep you financially protected in cases of illness or emergency. Similar to a car insurance policy, you pay for your expenses up to the point that you meet your deductible and then the insurance coverage begins. The higher the deductible you choose, the smaller the monthly cost will be. But it also means that when you have health expenses, you are responsible for all of the costs up to your deductible amount. Rather than pay for your health expenses that occur before hitting your deductible out of your pocket, you can pay for those expenses using pre-tax dollars from your HSA account.

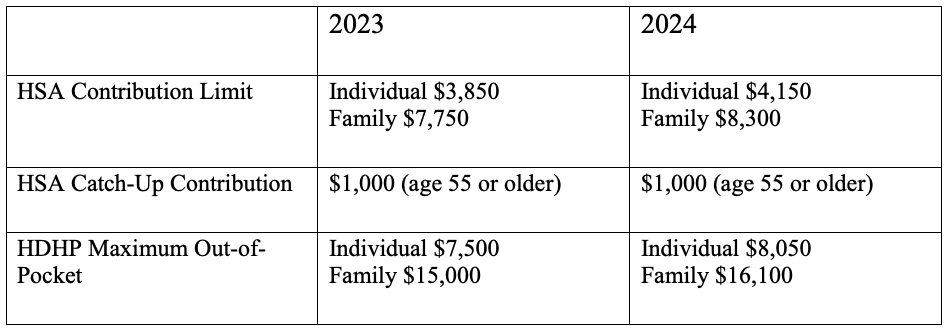

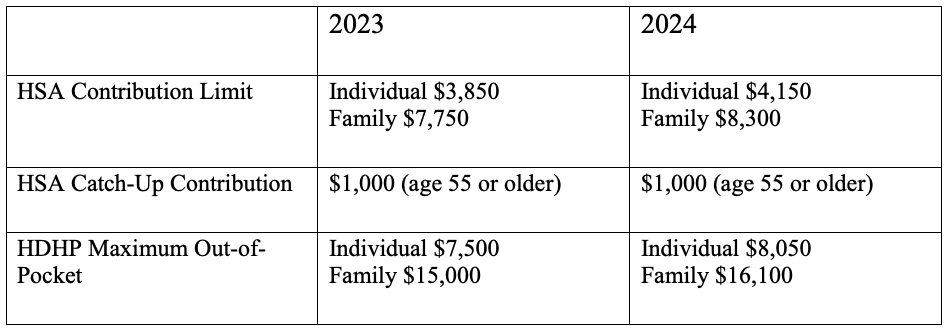

Federal law includes strict guidelines for HSAs including HDHP cost sharing and annual limits on contributions. The amount you contribute can be adjusted throughout the year but they do have an annual limit on how much you can contribute per year. This limit is set by the IRS and usually increases each year. Contribution limits for 2023 and 2024 are:

What Are the Benefits of Having an HSA?

- Money goes in tax-free – Your HSA contributions are made on a pre-tax basis and are also tax deductible

- Money comes out tax-free – Eligible healthcare purchases can be made directly from the HSA account

- Earn interest, tax-free – The interest on HSA funds grows on a tax-free basis. Unlike most savings accounts, interest earned on an HSA is not considered taxable income when funds are used for eligible medical expenses.

- Your HSA balance can be invested – Depending on your HSA, you may be eligible to invest your HSA similar to a 401k or IRA – in an interest-bearing account, mutual fund, stocks or bonds.

- Your HSA balance can be carried over – Unlike a Flexible Spending Account (FSA), an HSA is not a use-it-or-lose-it account. You can carry over your balance year after year.

- You can use your HSA to add to your retirement funds – After the age of 65, you can withdraw funds from your HSA for any reason without penalty.

The Bottom Line

HSAs are often referred to as triple tax-advantaged and are one of the best savings and investment tools available under the U.S. tax code. As a person ages, medical expenses tend to increase, particularly when reaching retirement age and beyond. Therefore, starting an HSA early and allowing it to accumulate over a long period, can contribute greatly to securing your financial future.

by admin | Apr 18, 2023 | Employee Benefits

A Lifestyle Spending Account (LSA) offers employers an opportunity to help fund health and wellness costs that a traditional group health plan won’t cover. LSAs are often used as perks to attract and retain quality employees and could be a desirable piece of the employee benefits puzzle.

A Lifestyle Spending Account (LSA) offers employers an opportunity to help fund health and wellness costs that a traditional group health plan won’t cover. LSAs are often used as perks to attract and retain quality employees and could be a desirable piece of the employee benefits puzzle.

What Is a Lifestyle Spending Account?

A Lifestyle Spending Account (also called Personal Spending Accounts or Wellness Spending Accounts) is a relatively new employee perk that is designed to encourage spending on wellness activities. Many employers already offer Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to help employees save and cover health-related costs but an LSA opens an entirely different type of spending.

In short, LSAs are flexible after-tax funds to support life’s everyday needs. Lifestyle Spending Accounts allow employers to build an account to fund employees’ everyday needs without the burden of managing additional reimbursements. Each employee is unique and a LSA gives the choice to use after-tax funds on expenses that aren’t covered by traditional benefits. With an LSA, employers create the program parameters by defining how much employees will receive and what the funds can be used for. Typically, these benefits support the physical, mental, emotional and financial health of employees.

As employees demand customized benefits packages and more employers offer LSAs, it’s important for employers to understand the specifics of this spending account and consider if they are a good fit for their organization and employees.

What Are Some Examples of LSAs?

- Financial Services (Financial Education, Student Loan Repayment)

- Care Services (Child and Adult Care, Adoption and IVF Services, Pet Care)

- Physical Health (Gym Memberships and Fitness Equipment)

- Work from Home Expenses (Office Supplies and Office Equipment)

- Professional Development (Continuing Education Courses and Conferences)

- Mental Health Services (Counseling Services, Virtual Therapy)

- Wellness (Nutrition Counseling)

How Does a LSA Work?

Employers are the decision-makers when determining what expenses are eligible for reimbursement through a Lifestyle Spending Account. It’s another potential perk that employers can offer to improve their relationship with employees. Additionally, the emphasis on health and wellness can help the employer foster a healthy workplace culture.

Let’s say that you have a lifestyle spending account with $1,000 in it for the year. You spend $500 on a gym membership. When you are reimbursed by your employer for the $500, you’ll have to report that as income at tax time. Although you pay income taxes on the funds spent, it’s a way for employers to prioritize your wellness. You’ll only have to pay taxes on your Lifestyle Spending Account if you actually spend the funds.

While many benefits, like health insurance, are seen as reactive perks for when problems arise, LSAs encourage a more proactive approach. By implementing a LSA, you can encourage your employees to focus on all aspects of wellness by giving them the financial means to build healthy habits and offset costs they’ll face along the way.

Remember, LSAs are entirely employer-funded so it does add to the budget. If you do decide to offer LSAs, it is important to educate your employees on these additional benefits available to them to increase employee utilization. Employers are uniquely positioned to help employees understand the importance of LSAs and how to best spend and boost their overall well-being.

We are, after all, living in the age of personalization. Everything in our lives, from our Netflix subscriptions to our Spotify playlists is customized to us and our preferences. Likewise, lifestyle benefits can be designed in a way that addressed the various needs of your diverse workforce. For example, a working parent can use their monthly allowance on childcare or work from home expenses while a Gen Z employee can use their allowance for paying down student loans or pet care. LSAs offer the choice and personalization that your diverse, multi-generational workforce needs and wants.

by admin | Mar 13, 2023 | Employee Benefits

Employee benefits and open enrollment may be something you only think about a few times a year, and for your employees, it might be even less often. However, with a thoughtful, year-round communications plan, your business can increase employee engagement and smart benefits utilization.

Employee benefits and open enrollment may be something you only think about a few times a year, and for your employees, it might be even less often. However, with a thoughtful, year-round communications plan, your business can increase employee engagement and smart benefits utilization.

Many employees don’t know what benefits are available or how to utilize them. And with many employees working remotely or on a hybrid schedule, communication is even harder. Only communicating with employees regarding their benefits package during open enrollment will most definitely result in them not taking full advantage of all it has to offer. So, what are some creative ways to engage employees with their employee benefits throughout the calendar year?

START WITH THE END IN MIND

As you begin crafting your engagement plan, think of the overall goal you want to accomplish. Perhaps you simply want your employees to be better educated on their plan offerings. Maybe you’d like to reduce the number of questions that employees ask during open enrollment meetings. Maybe you want your employees to utilize a certain plan benefit that has been historically underused resulting in higher costs to the employee or the company. Whatever the case, first set your goal for the communication plan.

CREATE A CALENDAR

Now that you have an end-goal in mind, start thinking of how frequently you want to communicate. Schedule your communication moments to post consistently. Maybe you start a “Benefits Minute” that hits the first Monday of the month. You could also start a “Benefits Blog” that posts every other Friday. Whatever the case, make the communication happen on a schedule so that employees know when to expect it and know what it’s called.

9 out of 10 employees will choose the same benefits year after year. Creating a consistent educational calendar gives people time to find out and digest changes. Be sure to send information and reminders to avoid unwelcome surprises.

KEEP IT SIMPLE

Get to the main point quickly. If your communications are long-winded, employees will likely tune out before they receive the pertinent information. Instead, follow this simple formula when crafting your communication:

- Pitch – “Here’s something you may not know about your benefits.”

- Why – “This is why it’s important/relevant to you.”

- Call to Action – “Here’s what you should do to learn more,

MIX UP YOUR COMMUNICATION STYLE

Communication isn’t one-size-fits-all. People learn in different ways—some may be visual learners while others may be oral learners. Make sure you mix up the way you communicate to cover both types. Also, change up the method of communication. Try emails, videos, printed flyers, and quick virtual presentations. The idea is to get your message out through every channel available to ensure you’re reaching the entirety of your audience.

Ultimately, a good benefits package attracts and retains talent and increases the productivity of people. Following through with strong employee benefit communication is equally as important as the implementation. By following through with consistent and relevant benefits education, you will see that your employees will reap the benefits of a healthy understanding of their benefit plan!

by admin | Mar 7, 2023 | Employee Benefits, Hot Topics

Health care is expensive but there is good news: Most insurance plans come with free preventive care and benefits. There is a lot of confusion around what is and isn’t preventive care – and why it matters. Here is what you need to know.

Health care is expensive but there is good news: Most insurance plans come with free preventive care and benefits. There is a lot of confusion around what is and isn’t preventive care – and why it matters. Here is what you need to know.

What is Preventive Care and Why Is It Important?

Preventive care is routine health care that includes screenings, services and counseling to help prevent illness, disease or other health problems. It is care that helps detect or prevent serious diseases and other medical issues before they become worse.

When you subscribe to a health plan—regardless of whether it’s one offered by your work or one you purchase in the marketplace—most plans will include an array of preventive care services free of charge if you use an in-network provider. Due to the Affordable Care Act (ACA), plan providers are required by law to offer basic preventive care services to you and those covered by your plan with no additional copay, coinsurance, or requirement to meet a deductible.

So why should you go to the doctor when you’re healthy? The simple answer is that preventive care can help you stay healthier and, as a result, lower your health care costs. It can also help identify health problems earlier like diabetes, high blood pressure, or even cancer, when these diseases are most treatable.

Preventive Health Care Examples

- Annual Checkups – This is when your primary care physician checks your overall health. These visits are a great opportunity to bring up anything you may be worried about with your doctor.

- Immunizations – These include Tdap (Tetanus, Diphtheria and Pertussis) boosters, and immunizations against Pneumococcal Conjugate and Shingles. Your annual flu shot is also covered.

- Cancer Screenings – Most people don’t experience cancer symptoms when it is in the earliest, most treatable stage. That’s why it’s important to have regular screenings throughout your life. Preventive screenings for women include pap test and mammograms. It’s also recommended that both men and women begin colorectal cancer screenings starting at age 45.

- Tests and Screenings – These include tests for blood pressure, cholesterol, diabetes, obesity and depression

- Pediatric Screenings – These include screenings for hearing, vision, autism and developmental disorders

- Colonoscopy – 1 typically every 10 years, usually after the age of 50

- Mammogram – 1 per calendar year, usually after the age of 40

Unfortunately, most people in the United States are not taking advantage of preventive care. In fact, one study from 2018 found that only 8% of adults 35 and older received the preventive care recommended to them. Today, the vast majority of deaths in America stem from preventable chronic diseases and 90% of the nation’s $4.1 trillion in annual health care spending goes for people with chronic and mental health conditions.

The U.S. Department of Health and Human Services has provided lists of preventive services that must be covered by most health insurance plans. Lists are available for adults, women and children. Click here for the lists of covered preventive care services.

Preventive health services offer significant health benefits and are covered by most insurance companies. In other words, participating in preventive care usually won’t cost you anything. So, go get those freebies – and improve your health – while you’re at it!

by admin | Feb 6, 2023 | Employee Benefits, Health Insurance

Getting sick can be expensive. Even minor illnesses and injuries can be very costly to diagnose and treat. Health care coverage helps you get the care you need and protects you and your family financially if you get sick or injured.

Getting sick can be expensive. Even minor illnesses and injuries can be very costly to diagnose and treat. Health care coverage helps you get the care you need and protects you and your family financially if you get sick or injured.

We’re breaking down the health insurance basics. Because, when you understand it, you’re more likely to get preventive care, make better health decisions and even reduce your costs.

55% of people can’t answer basic health insurance questions and younger generations struggle with understanding the fundamentals of insurance even more. 69% of millennials and 64% of Gen Zers admitted they’ve opted not to seek care due to uncertainty about their health insurance.

Put simply, health insurance is a way to pay for your health care. Your health insurance protects you from paying the full costs of medical services when you’re injured or sick. And it works the same way your car or home insurance works: you or your employer choose a plan and agree to pay a certain rate, or premium, each month. In return, your health insurer agrees to pay a portion of your covered medical costs.

How Health Insurance Payments Work

Your premium, or how much you pay for your health insurance each month, covers some or all the medical care you receive – everything from prescription drugs to doctors’ visits. Most people choose a health insurance plan based on the benefits and medical services the plan covers, as well as on monthly cost. But there are other factors to consider as well, like what you will be required to pay when you see a doctor or a health care facility.

These out-of-pocket payments are important to understand and know the differences between them:

- Deductible – A deductible is the amount you pay out of pocket on healthcare costs before your insurance company starts to contribute to your healthcare costs for the year. Generally, a plan with a lower deductible will have a higher monthly premium than a plan with a higher deductible.

- Co-pay – A co-pay is a set fee you pay for a doctor visit. For example, if your policy lists a co-payment of $20 for a doctor visit, you pay that amount each time you see the doctor. Keep in mind that the co-pay will differ for different services. What you pay for a trip to the emergency room will probably not be the same as a co-pay for a visit to your primary care physician.

- Co-Insurance – Co-insurance is the amount you pay for covered health care after you meet your deductible. This amount is a percentage of the total cost of care – for example, if your co-insurance is 20%, your insurance covers the other 80%. Co-insurance levels vary by plan, as do deductibles.

- Out-of-Pocket Maximum – An out-of-pocket maximum is a limit on the amount of money you have to pay for covered services in a plan year. After you spend this amount on your deductible, co-payments and co-insurance, your health plan pays 100% of the costs of covered benefits.

Knowing how your insurance and healthcare costs are structured is an important part of your personal finances. When you choose a plan, look at your typical healthcare needs and costs so you can make the best decision for your health, and your wallet.

Total rewards packages refer to the compensation and benefits plans that companies offer. This phrase, however, extends beyond mere salary or wages and traditional benefits, like health insurance, to provide both recruits and employees with a rundown of what makes the employer special. Some in Human Resources might regard the total rewards package as the starting line for employee value proposition (EVP).

Total rewards packages refer to the compensation and benefits plans that companies offer. This phrase, however, extends beyond mere salary or wages and traditional benefits, like health insurance, to provide both recruits and employees with a rundown of what makes the employer special. Some in Human Resources might regard the total rewards package as the starting line for employee value proposition (EVP).