by admin | Sep 27, 2023 | Employee Benefits

For millions of Americans, the end of the year is open enrollment season – a yearly opportunity to take stock of your health care needs and select the health insurance plan that works best for you. It is a window of time – typically in the fall – when you can sign up for health insurance, review, assess, and modify your existing benefits.

For millions of Americans, the end of the year is open enrollment season – a yearly opportunity to take stock of your health care needs and select the health insurance plan that works best for you. It is a window of time – typically in the fall – when you can sign up for health insurance, review, assess, and modify your existing benefits.

There are more choices than ever to help you find a plan that will best suit your health needs. Think of it like planning a trip: you don’t pack a surfboard if you are planning to hike in the mountains. Likewise, there is a lot to think about when selecting a health plan for the next year. What does it cost? Does it include your prescription or preferred doctors? Understanding health insurance basics and how open enrollment works is essential for making informed choices about your benefits and insurance coverage.

Here’s How Open Enrollment Typically Works:

- Eligibility: Anyone eligible for health insurance can participate in Open Enrollment. This includes you, your dependents, and individuals looking to buy insurance through the individual marketplace (e.g., through the ACA exchanges)

- Review Options: During the Open Enrollment period, you have the opportunity to review your current insurance coverage and assess their healthcare needs for the upcoming year. You should consider factors like changes in your health, anticipated medical expenses, and any new coverage options that might be available.

- Enrollment or Changes: You can use the Open Enrollment period to either enroll in a new insurance plan, make changes to your existing plan, or renew your current coverage. This might involve switching plans, adding or removing dependents, changing coverage levels, or adjusting other plan details.

- Deadline: Open Enrollment is time sensitive. Once the designated period ends, you generally cannot make changes to your insurance coverage until the next Open Enrollment period unless you experience a qualifying life event (such as marriage, birth of a child, job loss, or relocation), which triggers a Special Enrollment Period.

- Coverage Start: The new coverage usually begins at the start of the upcoming calendar year, though this can vary depending on the specific insurance plan and enrollment date.

Which Plans Don’t Use Open Enrollment?

- CHIP (Children’s Health Insurance Program) – CHIP offers low-cost health coverage for children from birth through age 18. CHIP permits enrollment at any time so you can ensure your children have coverage year-round.

- Medicaid – Medicaid is a joint federal and state program that helps cover medical costs for some people with limited income and resources. Medicaid allows enrollment in health insurance during any time of year, provided you qualify.

- Short-Term Health Insurance – health insurance plan with a limited duration, typically several months to a year. These plans are geared toward people who need temporary medical insurance to bridge the gap between longer-term plans. These plans don’t have enrollment periods because the need for this type of insurance is difficult to predict.

It’s important to note that missing the Open Enrollment period without a qualifying life event can result in being without health insurance coverage until the next Open Enrollment period. To ensure you have the coverage you need, carefully review your options and make any necessary changes during the designated Open Enrollment timeframe.

Health insurance providers are committed to helping all Americans make informed health coverage choices for themselves and their families. Open Enrollment is a great time to explore the benefits already available to you in your current plan, including discounts and wellness opportunities that can save you money and keep you healthy.

by admin | Sep 14, 2023 | Employee Benefits, Johnson & Dugan News

Redwood City, CA, September 13, 2023 – Mployer Advisor, the leading independent platform for employers to research, review, and evaluate insurance advisors has named Johnson & Dugan Insurance Servies a winner of its third annual “Top Employee Benefits Consultant Awards” for 2023. Mployer Advisor’s Top Employee Benefits Consultant Award Program evaluates brokers based on breadth and depth of experience across employer industries, sizes, insurance products, and employer reviews. We recognize esteemed brokers that demonstrate market-leading competencies and a proven track record of success among employers, insurance providers, and peers.

Redwood City, CA, September 13, 2023 – Mployer Advisor, the leading independent platform for employers to research, review, and evaluate insurance advisors has named Johnson & Dugan Insurance Servies a winner of its third annual “Top Employee Benefits Consultant Awards” for 2023. Mployer Advisor’s Top Employee Benefits Consultant Award Program evaluates brokers based on breadth and depth of experience across employer industries, sizes, insurance products, and employer reviews. We recognize esteemed brokers that demonstrate market-leading competencies and a proven track record of success among employers, insurance providers, and peers.

For 40 years, Johnson & Dugan’s highest priority has been to make it easy for any company to expertly plan and administer employee benefits. Johnson & Dugan prides itself on consistently delivering and maintaining high standards of quality for each and every one of our clients. All of the companies we work with receive superior customer service, regardless of their size or the level of complexity of their employee benefits program, Michael Johnson, CEO.

Our team is proud to recognize this group of 2023 top-rated insurance advisors as part of our third annual Top Employee Benefits Consultant Awards,” said Brian Freeman, the Founder and CEO of Mployer Advisor. “Employer-sponsored healthcare and benefits cover over 150M Americans. Who an employer selects as their benefits advisor has more impact on employee cost and satisfaction with their healthcare than who an employer chooses as the insurance carrier. We have rated these brokerages utilizing sophisticated, industry-first algorithms, and we applaud the winners’ demonstrated commitment to service, quality, and positive employer feedback.”

Mployer Advisor determined the winners of the third annual “Top Employee Benefits Consultant Award” by analyzing each brokerage based on historical data, online reviews, their M Score rating, and demonstrated business experience.

To view a complete list of the 2023 recipients of Mployer Advisor’s “Top Employee Benefits Consult Award,” visit MployerAdvisor.com.

To view Johnson & Dugan’s profile on Mployer Advisor, visit https://mployeradvisor.com/insurance-brokers/california/redwood-city/johnson-dugan-insurance-services-corporation.

About Johnson & Dugan:

Since 1983, Johnson & Dugan’s highest priority has been to make it easy for any company to expertly plan and administer their employee benefits plans.

Unlike other employee benefits consulting firms, J&D does not deliver one-size-fits-all solutions — our team works with each client to deliver the right mix of expertise, products, services and support based on the scope of their needs — with the flexibility necessary to adapt to organizational changes.

About Mployer Advisor:

Mployer Advisor is changing the way employers search, evaluate, and select insurance advisors. The intuitive platform connects employers and employees to great benefits and insurance plans by providing employers with actionable data to easily evaluate and select the best advisor for a company’s specific needs. Most brokerages have a profile on Mployer Advisor, which provides independent ratings of insurance advisors to support employers. Insurance brokers cannot pay to influence their Mployer Advisor rating. Only highly rated brokerages are allowed to advertise on the platform. To learn more about Mployer Advisor, visit https://mployeradvisor.com and follow us on LinkedIn.

Disclaimer: Rankings are dynamic, and this report may not reflect the rankings currently listed on Mployer Advisor’s website. Because Mployer Advisor’s research is ongoing, interested companies that want to join next year’s list are encouraged to claim their free profile on Mployer Advisor.

by admin | Sep 7, 2023 | Employee Benefits

If the so-called Great Resignation taught us anything, it’s that employees are looking for more than just a salary when it comes to their jobs. Employee benefits have a crucial part in enhancing engagement, attracting new employees, and retaining top talent.

If the so-called Great Resignation taught us anything, it’s that employees are looking for more than just a salary when it comes to their jobs. Employee benefits have a crucial part in enhancing engagement, attracting new employees, and retaining top talent.

Employee benefits refer to any form of compensation that employees receive in addition to their base wages or salaries, such as insurance (medical, dental, life), stock options, and cell phone plans.

During the recent State of HR in Asia-Pacific survey, it became clear that HR professionals are thinking more strategically about the benefits they offer employees. According to the survey, 35.52% of professionals are offering wellness benefits, while 34.15% have implemented employee assistance programs (EAPs). More than a quarter are offering childcare support (25.41%) and 24.04% include mental health coaching.

Nowadays, employee benefits extend far beyond these examples, encompassing a wide range of offerings, including training opportunities and stock options, mental health breaks, and even a few more unusual perks. Here are just a few:

Health Stipends

PwC Australia has always done things differently, including famously abolishing its employee dress code in 2017. The company partnered with health and fitness companies across the continent to offer compelling health and fitness perks to their staff.

“The well-being of our people is critical now, but the focus will continue to grow, and we’ll need to enhance the support provided. Employees are increasingly looking to their employer to provide support in all aspects of their life – we’ll need to continue to evolve our value proposition to meet these needs,” says Catherine Walsh, Head of People and Culture at PwC Australia.

Employee wellness programs are essential perks to offer because they prioritize the well-being and health of employees, leading to numerous benefits for both individuals and organizations. By providing wellness initiatives such as fitness programs, mental health support, healthy lifestyle resources, and stress management techniques, employers demonstrate their commitment to the overall well-being of their workforce. Wellness programs have also been known to reduce absenteeism and burnout.

Power Naps

The power nap system may seem unusual, but it’s commonplace in Japan. Called inemuri (or the principle of sleeping at work) was added as a perk by companies like the construction firm Okuta years ago. Japanese workers are generally hesitant to take time off, work more overtime than other countries, and generally get less sleep. Napping on the job has become commonplace, with several businesses installing special sleep pods for workers. Power naps can be a valuable employee perk due to their positive impact on productivity and well-being.

Offering dedicated spaces or designated break times for power naps recognizes the importance of rest and rejuvenation in maintaining optimal performance. Short periods of sleep have been shown to enhance cognitive function, memory, and creativity, allowing employees to return to their tasks with improved focus and alertness. Power naps can help combat midday fatigue, reducing the likelihood of errors and accidents.

Major Discounts

Australian airline Qantas offers staff generous perks when they are traveling, including 25% off Qantas flights, 10% off hotel bookings, 15% off car rentals, and discounts on airport parking, tours, and cruises. This not only attracts employees who love to travel but gives staff an opportunity to experience traveling with Qantas first-hand. In addition, by extending discounts on various travel-related expenses, Qantas demonstrates its commitment to supporting the travel experiences of its staff, creating a positive work environment, and promoting a culture of work-life balance.

Giving Back

According to a blog post by Salesforce Australia, 93% of employees who engage in pro-bono work feel happier and more purposeful, while 91% believe they are productive and engaged. The survey also found that employees who volunteer are 40% more likely to stay with the company. That’s why Salesforce Australia offers employees seven days off every year to spend volunteering. “It’s a great feeling to know that we’re helping the environment as well as the community. Plus, the benefits for the team were getting to know each other outside of work, building connections, and having fun,” says Angelica Veness, Senior Manager of Solution Engineering at Salesforce.

Sabbaticals

Deloitte Singapore introduced a generous sabbatical policy as part of their Work-Life Integration program. Audit and Assurance Associate at Deloitte Singapore Clement Chow took a 12-month sabbatical to care for his young son but had previously taken time off (with a paid allowance) to compete as a Team Singapore triathlete.

Deloitte Australia also introduced a program called Career Flex that allows staff to take three months’ unpaid leave to study, refresh, or travel.

Balance and Breaks

Most companies have maternity (and sometimes paternity) leave, family responsibility leave, and study leave on offer for employees who need it, but others are thinking differently about the breaks employees might need. Hime & Company in Japan gave staff two mornings off per year to attend sales as well as “heartbreak vacations” for employees going through breakups several years ago; today, it’s available from businesses in Japan, Germany, and other countries. The policy was popular enough to become part of Japan’s labor laws in 2020.

While those examples might sound unusual, recognizing that employees need time off to spend on personal matters can have a big impact on their well-being, engagement, and overall job satisfaction.

Chinese mega-brand Alibaba provided staff with an extremely generous leave package following a challenging period in the company, including giving employees seven days paid leave to attend family reunions following COVID, ten extra days of leave for new parents, and a once-off twenty days of leave for employees who have worked for the company for ten years or more. This is a true reflection of Alibaba’s company values, which states: “Work is for now, but life is forever. We want our employees to treat life seriously when they work and enjoy work as one enjoys life. We respect the work-life balance decisions of every individual.”

Stock Options

ICICI Bank in India is known for its generous employee benefits, but they’ve recently upped the ante by introducing an ESOP program (employee stock option scheme) for employees. The company allotted equity shares to employees under the ICICI Bank Employees Stock Option Scheme 2000.

Stock options give employees the opportunity to become partial owners of the company. This sense of ownership can foster a stronger connection and alignment between employees and the organization’s goals and performance. When employees have a stake in the company’s success, they are more likely to work towards its growth and profitability.

Four-day Workweek

Whereas some Japanese companies are offering naps on company time in response to their over-commitment to work, others are leaning into compressed work weeks. Panasonic started offering employees the option of taking a four-day workweek. Considering that only 8% of Japanese companies offer more than two guaranteed days of leave a week, it’s a radical policy.

With an extra day off each week, employees have more time for personal activities, hobbies, and spending quality time with family and friends. This improved work-life balance can lead to reduced stress levels, increased job satisfaction, and overall well-being.

While it may seem counterintuitive, many studies and real-world examples have shown that reducing the workweek to four days can actually boost productivity. With a shorter workweek, employees tend to be more focused, motivated, and efficient in completing their tasks. They often prioritize their work, avoid unnecessary distractions, and find innovative ways to increase productivity within the reduced timeframe.

According to recent research, more than three in every four Singaporeans are interested in jobs offering a four-day workweek.

“In mature economies like Singapore, it starts to become about the quality of life and what work means,” says Jaya Dass, MD of Randstad Singapore as reported by CNBC. According to Das, Singaporeans are not willing to sacrifice their personal lives for their careers anymore and find a four-day workweek very appealing.

Being a Standout Employer with Unique Benefits

The APAC region is a diverse and competitive market. Offering unique perks can help organizations stand out as attractive employers, attracting and retaining top talent. With some of these examples, we’ve seen how innovative perks related to work-life balance and well-being can resonate well with the local workforce. By offering interesting employee benefits, you can differentiate yourself, boost employee satisfaction, and gain a competitive edge in the talent market.

By Francesca Di Meglio

Originally posted on HR Exchange Network

by admin | Jul 18, 2023 | Employee Benefits

In the wake of the Great Depression and WWII, employers started to add benefits packages. Healthcare had fallen by the wayside for families working to access the basic necessities of life. The idea was to support the employee’s personal needs while keeping and attracting the best talents in the workforce. This trend of offering benefits has continued into the 21st century. In the present era, most employees that join the workforce are Millennials (born between 1981-1996) and Generation Z (born between 1997-2012). Over half of them have said they want help building a more secure financial future. Over half of them have said they want help building a more secure financial future.

In the wake of the Great Depression and WWII, employers started to add benefits packages. Healthcare had fallen by the wayside for families working to access the basic necessities of life. The idea was to support the employee’s personal needs while keeping and attracting the best talents in the workforce. This trend of offering benefits has continued into the 21st century. In the present era, most employees that join the workforce are Millennials (born between 1981-1996) and Generation Z (born between 1997-2012). Over half of them have said they want help building a more secure financial future. Over half of them have said they want help building a more secure financial future.

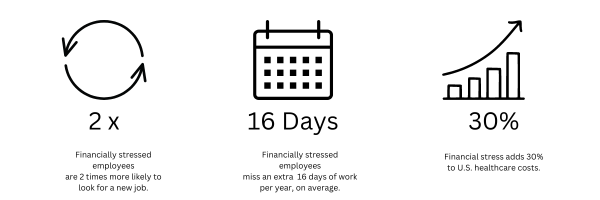

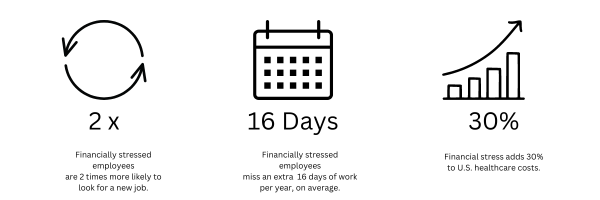

Employee benefits play a crucial role in providing financial safety nets for employees. When employees experience less financial stress, employers see better employee productivity and fewer work absences. To aid with financial guidance and resources, many employers are offering financial wellness benefits beyond typical retirement plans. Here are some common financial safety nets that may be included in employee benefit packages:

- Retirement Plans: Employer-sponsored retirement plans, such as 401(k) or pension plans, enable employees to save for their post-employment years. These plans typically offer contributions from both the employer and employee, providing a safety net for financial stability during retirement.

- Disability Insurance: Disability insurance provides income replacement if an employee becomes unable to work due to a disability. It helps protect against loss of income during an extended period of absence from work. More disabilities are caused by illness rather than injury – including common conditions like heart disease, back pain or arthritis.

- Life Insurance: Life insurance offers financial protection to employees’ beneficiaries in the event of their death. It provides a lump sum payment or regular income to dependents, helping them cope with financial obligations.

- Paid Time Off (PTO): Paid leave policies, such as vacation days, sick leave, and personal days, offer employees the flexibility to take time off while still receiving their regular pay. This benefit supports employees during times of illness, personal emergencies, or the need for work-life balance.

- Flexible Spending Accounts (FSAs) or Health Savings Accounts (HSAs): FSAs and HSAs allow employees to set aside pre-tax dollars for qualified healthcare expenses or dependent care expenses. These accounts reduce the financial burden of medical or childcare costs.

- Tuition Reimbursement or Assistance Programs: Realizing student loans burden many employees, a growing number of employers are willing to offer help. Employers may also offer educational assistance programs to help employees pursue further education or skill development.

- Financial Education and Counseling: Employers may provide financial education programs and counseling services to help employees manage their finances effectively. Financial planning provides access to financial advisors who can help employees develop an overall financial plan including retirement savings and investing. Financial coaching helps employees manage their personal finances, such as budgeting and managing credit.

- Employee Assistance Programs (EAP): EAPs offer confidential counseling, mental health support, and resources to employees and their families. These programs help employees address personal and work-related challenges and promote overall well-being.

It’s important to note that the specific benefits offered by employers can vary widely. When it comes to benefits, employers know the cost of providing the best options pays off with better talent and more productive workers. Ultimately, having some financial safety nets in place for employees helps workers achieve their financial goals and save more of their hard-earned money for both expected and unexpected expenses.

by admin | Jun 12, 2023 | Employee Benefits

As much as employers might prefer that employees’ personal affairs do not interfere with their work, the reality is that problems outside of the workplace can and do impact job performance. Many of these issues go unaddressed due to fear of stigmatization, leading to further declines in employee health and productivity. Anxiety and stress, financial troubles, substance abuse and other personal problems can also lead to increased absenteeism. To help combat these issues, many employers offer a workplace benefit called an Employee Assistance Program (EAP) that is designed to help employees address everyday challenges.

As much as employers might prefer that employees’ personal affairs do not interfere with their work, the reality is that problems outside of the workplace can and do impact job performance. Many of these issues go unaddressed due to fear of stigmatization, leading to further declines in employee health and productivity. Anxiety and stress, financial troubles, substance abuse and other personal problems can also lead to increased absenteeism. To help combat these issues, many employers offer a workplace benefit called an Employee Assistance Program (EAP) that is designed to help employees address everyday challenges.

What is an EAP?

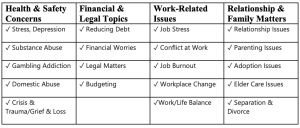

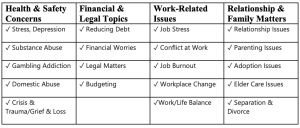

An EAP provides voluntary, confidential services to employees who need help managing personal difficulties or life challenges. The idea is to address personal issues before they interfere with work performance. The employee assistance program is one of the top benefits employers offer in America—for a good reason. They are one way that companies support the well-being of their employees. An EAP generally offers confidential assessment, short-term counseling, referrals and follow-up services for employees.

Typically, an EAP grants employees access to a set number of sessions with a therapist, and the employee would not accrue any co-pay, deductible, or other out-of-pocket costs for the service. For example, Nick has been struggling with depression. To sooth his anxiety, he has begun drinking every day. It’s gradually escalated to the point where he is late to work, has frequent absences, and is missing deadlines. He knows he needs to talk with someone who can offer him alcohol abuse resources. He accesses his company-sponsored EAP.

Meredith is a full-time, married employee with two small children and is also caring for her aging mother who suffers from Alzheimer’s. She is constantly stressed due to the heavy burden of her daily life. The schedule has left her exhausted and she misses work each month due to feeling burnt out. She reaches out to her EAP counselor for time management and mental health tips.

Here are some other common services included in EAPs:

One reason behind the popularity of EAPs is that it’s a mutually beneficial program for employers and employees. After all, your employees are the foundation of your company. Healthy and happy employees are more productive and engaged in their jobs which is great for your company’s bottom line!

For millions of Americans, the end of the year is open enrollment season – a yearly opportunity to take stock of your health care needs and select the health insurance plan that works best for you. It is a window of time – typically in the fall – when you can sign up for health insurance, review, assess, and modify your existing benefits.

For millions of Americans, the end of the year is open enrollment season – a yearly opportunity to take stock of your health care needs and select the health insurance plan that works best for you. It is a window of time – typically in the fall – when you can sign up for health insurance, review, assess, and modify your existing benefits.