by admin | Apr 18, 2018 | Employee Benefits, Human Resources

Did you know that you can save time and money on your prescription drugs by simply signing up for a discount card online? With savings as much as 80% off, these discount cards keep your health care costs down even when the prices of prescriptions are sharply rising. At no cost to the patient, discount drug programs negotiate the price of medicines with pharmacies and then pass the savings on to the consumer. These programs give subscribers a personalized discount card to be used at any pharmacy. While the discount card cannot be used in conjunction with health insurance, the consumer may see that the cost of their medicine is actually LESS with the card than it is with their insurance.

Did you know that you can save time and money on your prescription drugs by simply signing up for a discount card online? With savings as much as 80% off, these discount cards keep your health care costs down even when the prices of prescriptions are sharply rising. At no cost to the patient, discount drug programs negotiate the price of medicines with pharmacies and then pass the savings on to the consumer. These programs give subscribers a personalized discount card to be used at any pharmacy. While the discount card cannot be used in conjunction with health insurance, the consumer may see that the cost of their medicine is actually LESS with the card than it is with their insurance.

Another benefit to the consumer is that these programs will publish at which pharmacy you can find your medicine. This is especially helpful to the person who has specialty drug prescriptions. For example, Rebekah is prescribed a specialty drug for pain and neuropathy due to Multiple Sclerosis. This drug is not commonly stocked in pharmacies and so many times, she has had to wait for them to order it. By using the discount drug program, Rebekah is able to see which pharmacies have her medicine in stock and the estimated price.

So where do you start? Here are a few discount drug programs to investigate costs and providers for your prescriptions:

- staterxplans.us

- Provides free drug cards to reduce the out-of-pocket cost of prescription drugs.

- Click on your state and the site will redirect you to your corresponding prescription assistance program.

- goodrx.com

- Compares prices and discounts at thousands of pharmacies.

- Receive coupons via phone, email, or text to print or present for discounts.

- refillwise.com

- Free drug card to present at pharmacy for cost savings on prescriptions.

- Earn rewards each time you use their card—similar to credit card rewards. Each fill is 500 points and when you reach 5,000 points, you earn a gift card to various retailers.

Being a savvy consumer can save you money! Shop around to find the best cost for your prescription drugs and save time by locating the pharmacy that has your meds in stock. Discount drug programs are a great resource so do your research and find one that fits your needs.

by admin | Apr 11, 2018 | Employee Benefits, Human Resources

When evaluating employee benefits, essentials such as health and dental plans, vacation time and 401(k) contributions quickly come to mind. Another benefit employers should consider involves subsidizing learning as well as ambitions. Grants and reimbursements toward advanced degrees and continuing education can be a smart investment for both employers and employees.

When evaluating employee benefits, essentials such as health and dental plans, vacation time and 401(k) contributions quickly come to mind. Another benefit employers should consider involves subsidizing learning as well as ambitions. Grants and reimbursements toward advanced degrees and continuing education can be a smart investment for both employers and employees.

Educational benefits are strongly linked to worker satisfaction. A survey by the Society for Human Resource Management revealed that nearly 80 percent of responding workers who rated their education benefits highly also rated their employers highly. While only 30 percent of those rating their higher education benefits as fair or poor conversely rated their employer highly.

These benefits are popular with businesses as well. In a survey by the International Foundation of Employee Benefit Plans, nearly five of six responding employers offer some form of educational benefit. Their top reasons are to retain current employees, maintain or raise employee satisfaction, keep skill levels current, attract new talent and boost innovation and productivity. Tax credits offer additional advantages. Qualifying programs offer employers tax credits up to $5,250 per employee, per year.

At the same time, companies should offer these benefits with care as they do pose potential pitfalls. Higher education assistance can be costly, even when not covering full costs. Workers taking advantage can become overwhelmed with the demands of after-hour studies, affecting job performance. Also, employers would be wise to ensure their employees don’t promptly leave and take their new skills elsewhere.

When well-planned, educational benefits will likely prove a good investment. Seventy-five percent of respondents to SHRM’s survey consider their educational-assistance programs successful. To boost your employee morale, skill levels and job-satisfaction scores, consider the benefit that may deliver them all, and more.

Find out more:

IFEBP: Why Educational Assistance Programs Work

EBRI: Fundamentals of Employee Benefit Programs

By Bill Olson, VP, Marketing & Communications at United Benefit Advisors

Originally posted on UBABenefits.com

by admin | Apr 6, 2018 | Benefit Management, Employee Benefits, ERISA

The Department of Labor’s new claim rules for disability benefits took effect April 2, 2018. The changes were announced over a year ago, but the effective date was delayed to give insurers, employers, and plan administrators adequate time for implementation. Although we’ve reported on the key issues in this blog previously, now seems like a good time for a refresher on how the new rules affect employer plans.

The Department of Labor’s new claim rules for disability benefits took effect April 2, 2018. The changes were announced over a year ago, but the effective date was delayed to give insurers, employers, and plan administrators adequate time for implementation. Although we’ve reported on the key issues in this blog previously, now seems like a good time for a refresher on how the new rules affect employer plans.

Affected Plans

The new claim rules apply to disability benefits provided under plans covered by the Employee Retirement Income Security Act (ERISA); that is, plans sponsored by private-sector employers. Then the new rules apply if the ERISA plan must make a determination of disability in order for the claimant to obtain the benefit. Group short- and long-term disability plans are the most common examples, but pension, 401(k), and deferred compensation plans also may be affected.

Many plans do not make their own determination of disability, but instead condition the plan’s benefit on another party’s determination. For instance, employer plans that base the benefit on a disability determination made by the Social Security Administration (SSA) are not affected by the new rules.

New Rules

For ERISA plans affected by the new rules, the following additional requirements apply to disability claims filed on or after April 2, 2018:

- Disclosure Requirements: Benefit denial notices must explain why the plan denied a claim and the standards used in making the decision. For example, the notices must explain the basis for disagreeing with a disability determination made by the SSA if presented by the claimant in support of his or her claim.

- Claim Files and Internal Protocols: Benefit denial notices must include a statement that the claimant is entitled to request and receive the entire claim file and other relevant documents. (Previously this statement was required only in notices denying benefits on appeal, not on initial claim denials.) The notice also must include the internal rules, guidelines, protocols, standards or other similar criteria of the plan that were used in denying a claim or a statement that none were used. (Previously it was optional to include a statement that such rules and protocols were used in denying the claim and that the claimant could request a copy.)

- Right to Review and Respond to New Information Before Final Decision: Plans are prohibited from denying benefits on appeal based on new or additional evidence or rationales that were not included when the benefit was denied at the claims stage, unless the claimant is given notice and a fair opportunity to respond.

- Conflicts of Interest: Claims and appeals must be adjudicated in a manner designed to ensure the independence and impartiality of the persons involved in making the decision. For example, a claims adjudicator or medical or vocational expert could not be hired, promoted, terminated or compensated based on the likelihood of the person denying benefit claims.

- Deemed Exhaustion of Claims and Appeal Processes: If plans do not adhere to all claims processing rules, the claimant is deemed to have exhausted the administrative remedies available under the plan (unless exceptions for minor errors or other conditions apply). In that case, the claimant may immediately pursue his or her claim in court. Plans also must treat a claim as re-filed on appeal upon the plan’s receipt of a court’s decision rejecting the claimant’s request for review.

- Coverage Rescissions: Rescissions of coverage, including retroactive terminations due to alleged misrepresentations or errors in applying for coverage, must be treated as adverse benefit determinations that trigger the plan’s appeals procedures.

- Notices Written in a Culturally and Linguistically Appropriate Manner: Benefit denial notices must be provided in a culturally and linguistically appropriate manner in certain situations. Specifically, if the claimant’s address is in a county where 10 percent or more of the population is literate only in the same non-English language, the notices must include a prominent statement in the relevant non-English language about the availability of language services. The plan would also be required to provide a verbal customer assistance process in the non-English language and provide written notices in the non-English language upon request.

Action Steps for Employers

Employers are reminded to work with their carriers, third-party administrators, and advisors to make sure their plans comply with the new requirements. Consider these steps:

- Identify all plans that are subject to ERISA. (Plans sponsored by governmental employers, such as cities and public school districts, and certain church plans, are exempt from ERISA.)

- Does the ERISA plan provide any benefit based on disability? If so, is the benefit conditioned on a determination of disability made by the plan or by another party, such as Social Security?

- For insured plans, such as group STD and LTD insurance plans, the carrier generally is responsible for compliance with ERISA’s claim rules. The employer, however, does have a duty to make reasonable efforts to ensure the carrier is complying.

- For self-funded plans, the employer is responsible for compliance. Although the employer may engage the services of a third-party claims administrator, the employer remains responsible for the plan’s compliance with all rules.

Originally Published By ThinkHR.com

by admin | Mar 23, 2018 | Employee Benefits, Human Resources

Fear of missing out—is more than just a hashtag. Many Millennials admit that #FOMO drives a lot of their decisions on what they wear, what they do, even what they eat and drink. We live in a world of social influence.

Fear of missing out—is more than just a hashtag. Many Millennials admit that #FOMO drives a lot of their decisions on what they wear, what they do, even what they eat and drink. We live in a world of social influence.

But one area where #FOMO really does you a disservice? No one is afraid of missing out on the benefits of life insurance. And why should you? There are so many other things competing for your dollars. That said, do you know what you’re missing out on by not having it? Are you making one or more of these mistakes?

You think life insurance is much more expensive than it actually is. Three in four Millennials overestimate the cost of life insurance—sometimes by a factor of 2, 3, or even more! (2017 Insurance Barometer Study by Life Happens and LIMRA) Imagine being able to afford life insurance for the cost of that daily latte, and for less money than your avocado toast habit!

You think you can’t qualify for life insurance. Nothing could be further from the truth, and yet four in 10 Millennials think this is true, according to the same study! Younger candidates have an easier time getting life insurance because they are generally healthier.

You’ll turn to GoFundMe if something goes wrong. In an era where social networking does all things, it’s natural to think that your loved ones can crowdfund their way to solvency after something happens. But life insurance benefits aren’t taxed like GoFundMe proceeds are, and life insurance has a defined, immediate payout that GoFundMe does not. Plus, your loved ones don’t need the stress or the stigma of having to ask others for help.

You’d rather spend that money on other things. In fact, one study recently suggested that many Millennials are more concerned about planning their next night out with a significant other than planning for their financial future. But sensible steps now will make for a better future with that significant other long past tomorrow night’s date.

You don’t care because you don’t have people depending on you for money. Take a look at your student loans. Were any of them private loans? Who is liable for them—in full, often immediately—if something happens to you? There are other debts you may need to consider as well—anything where you have a co-signer.

You keep saying you’ll get around to buying insurance, but don’t. Millennials are getting married, having families! Young families have enough to worry about with daycare costs and increased medical costs, right? Well, imagine what your young family would do about those bills if something happened to you. Could your spouse pay the rent or mortgage without your income?

You tune out when “adulting” gets too hard. One recent college grad recently confessed to me that he hadn’t elected into any of his employee benefits at the dream job he got in his field because “my dad takes care of that.” He was shocked to learn what he was missing out on!

Yes, adulting *is* hard, but a sound financial plan that includes retirement and insurance coverage (health, life, and disability insurance are all part of that plan) goes a long way to making sure that you don’t look back on your younger years and think, “Oh, why didn’t I start this sooner?” Plus, you don’t have to do it alone—that’s what insurance agents are for. They will sit down with you at no cost, or obligation, to discuss what you need and how to get coverage to fit your budget. But then, signing up—that IS on you. Don’t miss out.

By Helen Mosher

Originally published by www.LifeHappens.org

by admin | Feb 6, 2018 | Benefit Management, Employee Benefits, Group Benefit Plans

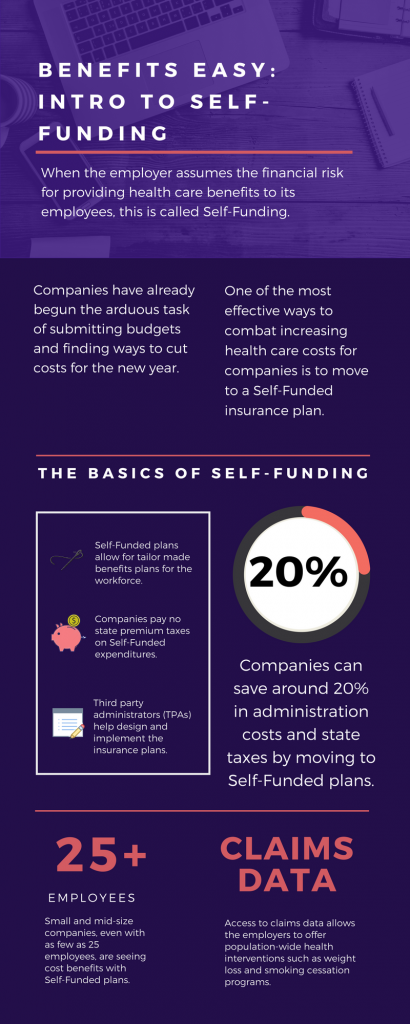

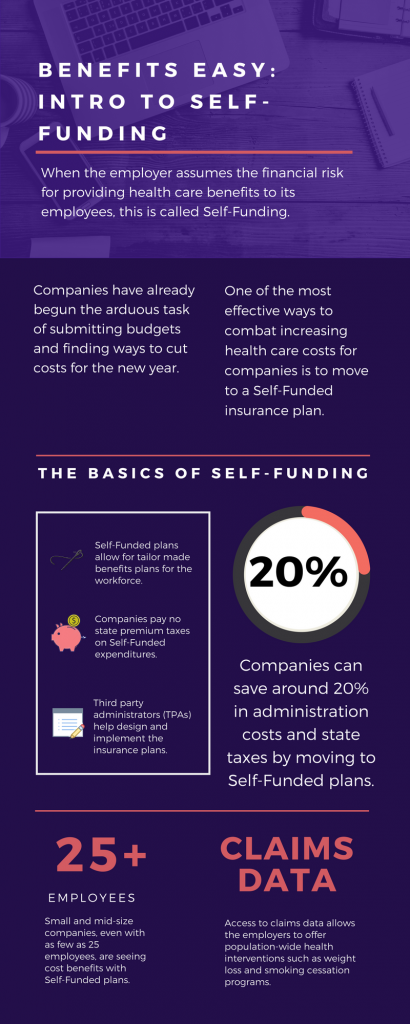

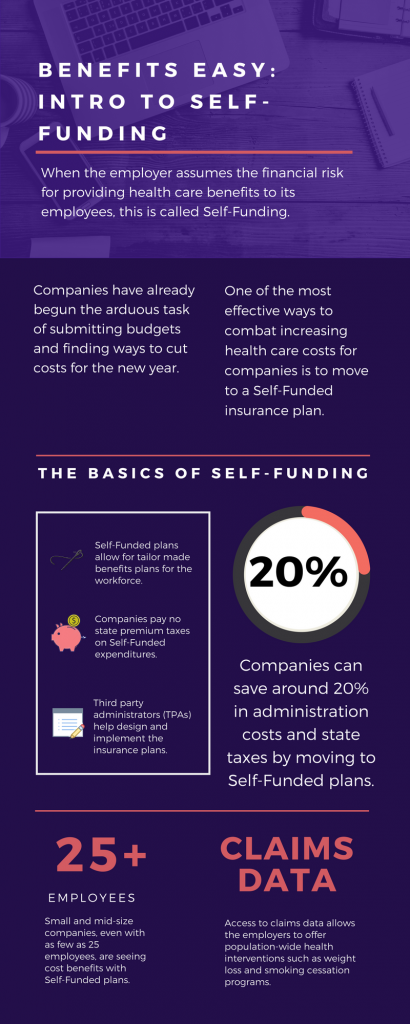

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

The topic of Self-Funding is huge and so we want to break it down into smaller bites for you to digest. This month we want to tackle a basic introduction to Self-Funding and in the coming months, we will cover the benefits, risks, and the stop-loss associated with this type of plan.

THE BASICS

- When the employer assumes the financial risk for providing health care benefits to its employees, this is called Self-Funding.

- Self-Funded plans allow the employer to tailor the benefits plan design to best suit their employees. Employers can look at the demographics of their workforce and decide which benefits would be most utilized as well as cut benefits that are forecasted to be underutilized.

- While previously most used by large companies, small and mid-sized companies, even with as few as 25 employees, are seeing cost benefits to moving to Self-Funded insurance plans.

- Companies pay no state premium taxes on self-funded expenditures. This savings is around 1.5% – 3/5% depending on in which state the company operates.

- Since employers are paying for claims, they have access to claims data. While keeping within HIPAA privacy guidelines, the employer can identify and reach out to employees with certain at-risk conditions (diabetes, heart disease, stroke) and offer assistance with combating these health concerns. This also allows greater population-wide health intervention like weight loss programs and smoking cessation assistance.

- Companies typically hire third-party administrators (TPA) to help design and administer the insurance plans. This allows greater control of the plan benefits and claims payments for the company.

As you can see, Self-Funding has many facets. It’s important to gather as much information as you can and weigh the benefits and risks of moving from a Fully-Funded plan for your company to a Self-Funded one. Doing your research and making the move to a Self-Funded plan could help you gain greater control over your healthcare costs and allow you to design an original plan that best fits your employees.

by admin | Jan 10, 2018 | Employee Benefits, Human Resources

Have you heard the saying “the eyes are the window to your soul”? Well, did you know that your mouth is the window into what is going on with the rest of your body? Poor dental health contributes to major systemic health problems. Conversely, good dental hygiene can help improve your overall health. As a bonus, maintaining good oral health can even REDUCE your healthcare costs!

Have you heard the saying “the eyes are the window to your soul”? Well, did you know that your mouth is the window into what is going on with the rest of your body? Poor dental health contributes to major systemic health problems. Conversely, good dental hygiene can help improve your overall health. As a bonus, maintaining good oral health can even REDUCE your healthcare costs!

Researchers have shown us that there is a close-knit relationship between oral health and overall wellness. With over 500 types of bacteria in your mouth, it’s no surprise that when even one of those types of bacteria enter your bloodstream that a problem can arise in your body. Oral bacteria can contribute to:

- Endocarditis—This infection of the inner lining of the heart can be caused by bacteria that started in your mouth.

- Cardiovascular Disease—Heart disease as well as clogged arteries and even stroke can be traced back to oral bacteria.

- Low birth weight—Poor oral health has been linked to premature birth and low birth weight of newborns.

The healthcare costs for the diseases and conditions, like the ones listed above, can be in the tens of thousands of dollars. Untreated oral diseases can result in the need for costly emergency room visits, hospital stays, and medications, not to mention loss of work time. The pain and discomfort from infected teeth and gums can lead to poor productivity in the workplace, and even loss of income. Children with poor oral health miss school, are more prone to illness, and may require a parent to stay home from work to care for them and take them to costly dental appointments.

So, how do you prevent this nightmare of pain, disease, and increased healthcare costs? It’s simple! By following through with your routine yearly dental check ups and daily preventative care you will give your body a big boost in its general health. Check out these tips for a healthy mouth:

- Maintain a regular brushing/flossing routine—Brush and floss teeth twice daily to remove food and plaque from your teeth, and in between your teeth where bacteria thrive.

- Use the right toothbrush—When your bristles are mashed and bent, you aren’t using the best instrument for cleaning your teeth. Make sure to buy a new toothbrush every three months. If you have braces, get a toothbrush that can easily clean around the brackets on your teeth.

- Visit your dentist—Depending on your healthcare plan, visit your dentist for a check-up at least once a year. He/she will be able to look into that window to your body and keep your mouth clear of bacteria. Your dentist will also be able to alert you to problems they see as a possible warning sign to other health issues, like diabetes, that have a major impact on your overall health and healthcare costs.

- Eat a healthy diet—Staying away from sugary foods and drinks will prevent cavities and tooth decay from the acids produced when bacteria in your mouth comes in contact with sugar. Starches have a similar effect. Eating healthy will reduce your out of pocket costs of fillings, having decayed teeth pulled, and will keep you from the increased health costs of diabetes, obesity-related diseases, and other chronic conditions.

There’s truth in the saying “take care of your teeth and they will take care of you”. By instilling some of the these tips for a healthier mouth, not only will your gums and teeth be thanking you, but you may just be adding years to your life.

Did you know that you can save time and money on your prescription drugs by simply signing up for a discount card online? With savings as much as 80% off, these discount cards keep your health care costs down even when the prices of prescriptions are sharply rising. At no cost to the patient, discount drug programs negotiate the price of medicines with pharmacies and then pass the savings on to the consumer. These programs give subscribers a personalized discount card to be used at any pharmacy. While the discount card cannot be used in conjunction with health insurance, the consumer may see that the cost of their medicine is actually LESS with the card than it is with their insurance.

Did you know that you can save time and money on your prescription drugs by simply signing up for a discount card online? With savings as much as 80% off, these discount cards keep your health care costs down even when the prices of prescriptions are sharply rising. At no cost to the patient, discount drug programs negotiate the price of medicines with pharmacies and then pass the savings on to the consumer. These programs give subscribers a personalized discount card to be used at any pharmacy. While the discount card cannot be used in conjunction with health insurance, the consumer may see that the cost of their medicine is actually LESS with the card than it is with their insurance.