by admin | Feb 28, 2017 | Benefit Management, Employee Benefits, Health Plan Benchmarking, Human Resources

Employer-sponsored health insurance is greatly affected by geographic region, industry, and employer size. While some cost trends have been fairly consistent since the Patient Protection and Affordable Care Act (ACA) was put in place, UBA finds several surprises in its latest Health Plan Survey. Based on responses from more than 11,000 employers, UBA recently announced the top five best and worst states for group health care monthly premiums.

Employer-sponsored health insurance is greatly affected by geographic region, industry, and employer size. While some cost trends have been fairly consistent since the Patient Protection and Affordable Care Act (ACA) was put in place, UBA finds several surprises in its latest Health Plan Survey. Based on responses from more than 11,000 employers, UBA recently announced the top five best and worst states for group health care monthly premiums.

The top five best (least expensive) states are:

1) Hawaii

2) Idaho

3) Utah

4) Arkansas

5) Mississippi

Hawaii, a perennial low-cost leader, actually experienced a nearly seven percent decrease in its single coverage in 2016. New Mexico, a state that was a low-cost winner in 2015, saw a 22 percent increase in monthly premiums for singles and nearly a 30 percent increase in monthly family premiums, dropping it from the “best” list.

The top five worst (most expensive) states are:

1) Alaska

2) Wyoming

3) New York

4) Vermont

5) New Jersey

The UBA Health Plan Survey also enables state ranking based on the average annual cost per employee. The average annual cost per employee looks at all tiers of a plan and places an average cost on that plan based on a weighted average metric. While the resulting rankings are slightly different, they also show some interesting findings.

The 2016 average annual health plan cost per employee for all plan types is $9,727, which is a slight decrease form the average cost of $9,736 in 2015. When you start to look at the average annual cost by region and by state, there is not much change among the top from last year. The Northeast region continues to have the highest average annual cost even with the continued shift to consumer-driven health plans (CDHP). In 2016, enrollment in CDHPs in the Northeast was 34.9 percent, surpassing those enrolled in preferred provider organization (PPO) plans at 33 percent. Even with the continued shift to CDHPs, the average annual costs were $12,202 for New York, which remained the second-highest cost state, followed by $12,064 for New Jersey, and rounding out the top five, Massachusetts and Vermont flip-flopped from 2015 with Massachusetts at $11,956 and Vermont at $11,762.

As was the case in 2015, Alaska continues to lead all states in average health plan costs, topping New York by more than $1,000 per employee, with an average cost of $13,251. While year-over-year the average cost for Alaska only increased 3.35 percent, the gap increased to 36.2 percent above the national average of $9,727.

Keeping close to the national average increase, the top five states all saw a year-over-year increase of less than 4.5 percent. Unfortunately, even at a modest increase, the one thing that the top five have in common is that they all are more than 20 percent above the national average for health plan costs per employee.

By Matt Weimer, Originally Published By United Benefit Advisors

by admin | Jan 26, 2017 | Benefit Management, Employee Benefits, Retirement

Employers I’ve talked to all have the same goal: to help employees build a sound retirement plan to achieve financial success and security. The main components to protect an employee’s financial future are managing a nest egg, growing investments, and safeguarding against uncertainty.

Employers I’ve talked to all have the same goal: to help employees build a sound retirement plan to achieve financial success and security. The main components to protect an employee’s financial future are managing a nest egg, growing investments, and safeguarding against uncertainty.

The Missing Component

As an employer, you may be missing a key component in safeguarding against uncertainty – the need for long-term care. Seventy-five percent of people over the age of 65 will need some form of long-term care in their lifetime1, however, far fewer are financially prepared to handle that need. With nursing home costs averaging $84,000 per year2, it’s not surprising that many Americans are having to spend down their retirement savings to pay for care. Long-term care is custodial care received in an assisted living facility, nursing home, or your own home should you need assistance with activities of daily living or suffer from a severe cognitive impairment.

Long Term Care Insurance

Savvy employers are helping fill the uncertainty gap by introducing long-term care insurance to employees. Employers can offer long-term care insurance plans with reduced underwriting and group pricing that employees wouldn’t be able to get as an individual. Better pricing and easier approval make the product accessible to employees that couldn’t normally qualify for coverage.

Long-term care education is key to helping employees protect their retirement savings. Without your help, employees can fall victim to widely held misconceptions. They may think:

- Other benefits will cover them

- The government will pay for their care

- This is only for old people

The truth is that long-term care insurance is the only benefit that covers this type of custodial care, and government options (Medicaid) are only available to people with low income and limited resources.

Shield and Supplement the 401(k)

Do you already contribute to your employees’ 401(k) plan? If so, you can spend the same amount of employer dollars, but provide richer benefits by pairing a 401(k) with long-term care insurance. By taking a small amount of contributions from the 401(k) plan and directing those toward your long-term care insurance premium, the resulting benefit can provide more than $200,000 of long-term care coverage and only slightly adjust the total 401(k) plan value.

Unlike other benefits, where providers may change from year to year, the majority of long-term care insurance purchasers will hold on to their original plan for life, and 99 percent of employees who have the coverage keep it when they move to their next employer, or into retirement. You can think of it as a “legacy benefit” that employees maintain for life to protect their retirement savings.

By Megan Fromm, Originally published by United Benefit Advisors

by admin | Jan 24, 2017 | Benefit Management, Employee Benefits

Determining how an employer develops the most effective formulary, while protecting the financial stability of the plan, is certainly the challenge of this decade. Prescription management used to mean monitoring that the right people are taking medications to control their disease while creating strategies to move them from brand name to generic medications. With the dawn of specialty medications, formulary management has become a game of maximizing the pass-through of rebates, creating the best prior authorization strategies and tiering of benefits to create some barrier to more expensive medications, all without becoming too disruptive. As benefits managers know, that is a difficult challenge. The latest UBA Health Plan Survey revealed that 53.6 percent of plans offer four tiers or more, a 21.5 percent increase from last year and nearly a 55.5 percent increase in just two years. Thus, making “tiering” a top strategy to control drug costs. There are many additional opportunities to improve and help control the pharmacy investment, but focusing on the key components of formulary management and working on solutions that decrease the demands for medications are critical to successful plan management.

Determining how an employer develops the most effective formulary, while protecting the financial stability of the plan, is certainly the challenge of this decade. Prescription management used to mean monitoring that the right people are taking medications to control their disease while creating strategies to move them from brand name to generic medications. With the dawn of specialty medications, formulary management has become a game of maximizing the pass-through of rebates, creating the best prior authorization strategies and tiering of benefits to create some barrier to more expensive medications, all without becoming too disruptive. As benefits managers know, that is a difficult challenge. The latest UBA Health Plan Survey revealed that 53.6 percent of plans offer four tiers or more, a 21.5 percent increase from last year and nearly a 55.5 percent increase in just two years. Thus, making “tiering” a top strategy to control drug costs. There are many additional opportunities to improve and help control the pharmacy investment, but focusing on the key components of formulary management and working on solutions that decrease the demands for medications are critical to successful plan management.

When developing a formulary, Brenda Motheral, RPh, MBA, Ph.D., CEO of Archimedes, suggests that chasing rebates is not a strategy to optimize your investment. Some of the highest rebates may be from medications that add no better therapeutic value than an inexpensive medication that does not offer a rebate, but net cost is much lower than the brand or specialty medication being offered. Best formulary management will mean that specific medications that do not offer a significant therapeutic value are removed from the formulary, or are covered at a “referenced price” so the member pays the cost difference. Formulary management will need to focus on where the drug is filled and which medications are available.

When setting up parameters on where a drug is to be filled, the decision needs to be made if a plan will promote mail order. Mail order, if used and monitored appropriately, makes it more convenient for a patient to receive their regularly used medications and may provide savings. In fact, the UBA Health Plan Survey finds that more than one-third (36.3 percent) of prescription drug plans provide a 90-day supply at a cost of two times retail copays. But if mail order programs are not monitored, people can continue to receive medications that are no longer required and never used, adding to medical spend waste. Furthermore, in our analysis, we are finding that not all medications are less expensive through mail order, as shown in Figure 1 below. Therefore, examining the cost differential is critical in a decision to promote, or not promote, mail order.

Figure 1

| Drug Name |

Rx Category |

Mail Order |

Retail |

| Zytiga® |

Malignancies |

$8,749 |

$6,027 |

| Sumatriptan Succinate |

Migrane / Neurologic |

$575 |

$308 |

| Ranexa® |

Cardiovascular |

$259 |

$413 |

Another formulary consideration is in monitoring the increase in same drug pricing. The stories surrounding the price increases of EpiPens® has been well-documented, but how well do you understand the impact of price increases on your plan? Monitoring price increases, as shown in Figure 2, may help an employer turn to their pharmacy benefit manager (PBM) to ask for help in controlling these price increases, or help in decisions related to formulary inclusion.

Figure 2

| Drug Name |

Rx Category |

Plan Paid per

30-day Supply

(SPLY) |

Plan Paid per

30-day Supply |

| Cialis® |

Genito-Urinary / Acute Minor |

$287 |

$442 |

| AndroGel® |

Endocrine / Chronic Meidcal |

$471 |

$523 |

| Viagra® |

Genito-Urinary / Acute Minor |

$615 |

$978 |

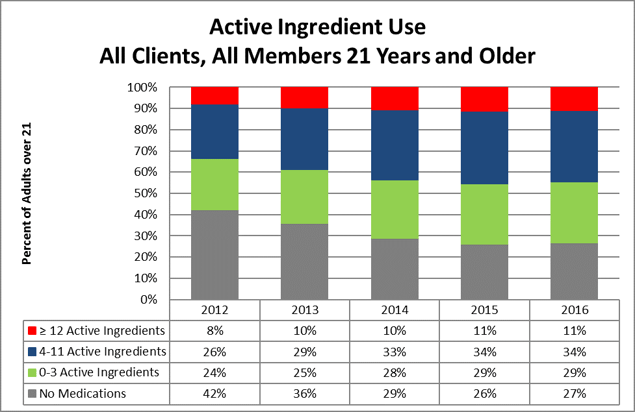

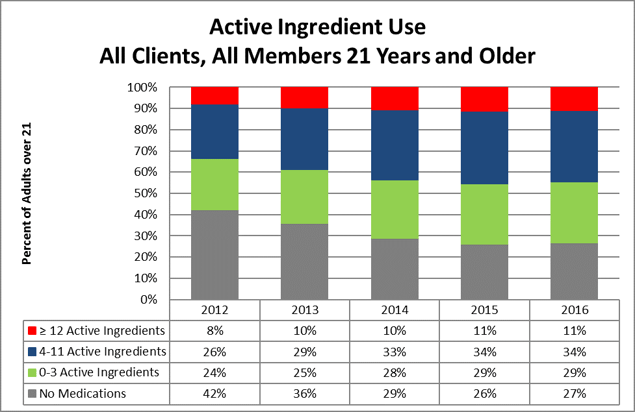

Formulary management solutions can become a cat-and-mouse game. The ultimate approach to manage the total spending on medications is by managing the growing demand. There has been significant press related to the opioid overutilization in the U.S., as illustrated in the article “Prescription Addiction.” But that issue is much broader in our society and relates to taking a pill as a quick solution to solve our medical problems. In March 2016, the Department of Health and Human Services (HHS) stated that 30 percent of the growth in spending related to medications was due to an increase in prescriptions per person. Certainly, medications should be used when there are no alternatives to control disease or pain. However, turning to medications as a first option for chronic condition control for issues like hypertension, blood sugar control, cholesterol control versus improving diet and exercise, etc., is just a band-aid solution that, in most cases, does not resolve the root issue. Yet, because this is sold as a quick fix, we see an increase in the number of individuals on medications. In 2012, 34 percent of plan members engaged in Vital Incite were taking four or more (active ingredients) medications, and that has grown to more than 45 percent in 2016. The data also illustrates that in 2012 more than 42 percent of members were not on any medications, but that group size has shrunk to only 27 percent. No formulary can impact this issue.

This increased use could be considered an improvement in care if their disease were more controlled. Appropriate and medically-impactful utilization would mean that a person is working toward improving diet and exercise and is taking the least expensive, yet effective, medication to control his or her disease.

Considering that diabetes medication options have really expanded, an employer would hope that the more expensive medication is providing the best control of disease. But, taking the medication alone will not control the disease and, at times, the progression of the medication cost can be related to progression of the disease due to a lack of disease management. For instance, a diabetic may have progressed from taking metphormin (marketed under the tradename Glucophage® among others), which costs approximately $27 per month, to metphormin ER (Glucophage® XR), which allows a person to take only one pill a day, so it may provide increased compliance, but costs $274 per month. Now, the option of taking Glumetza® is offered, which can be reimbursed at up to $3,620 per month, and is said to provide more stable results. But, if we examine the A1c control values from Vital Incite, do we find the reduction in A1c values as evidence that this additional investment in medication options is providing better control? Figure 3 provides an example of A1c control by prescription status. The goal would be that those on medications will become controlled. But, in our data, we are not seeing a significant improvement in persons with HgA1c levels above 7 percent. Control is achieved from diet, exercise, and appropriate medications. There are theories that people on these more expensive medications are using that as an approach to help them maintain their unhealthy behaviors. Therefore, taking medications alone does not appear to provide an effective solution and, in fact, providing chronic condition medications for free, without requiring any other effort, may not be the best investment for an employer.

Figure 3

| HgA1c Level |

In Treatment |

Untreated |

Discontinued

Treatment |

Possibly

Untreated |

| < 5.7 |

6 |

1 |

2 |

3 |

| 5.7 to 6.4 |

21 |

2 |

1 |

11 |

| 6.5 to 7.0 |

17 |

|

|

7 |

| > 7.0 |

53 |

4 |

|

5 |

In conclusion, determining which issues are having the most impact on an employer group will allow benefits managers to determine the company’s priorities. This is not an easy task, but with pharmacy spend increasing at a national average of 7.3 percent annually and becoming a higher percentage of the overall medical spend, new strategies need to be considered. Focusing on the key components that balance formulary management with the correct approach to manage the demand on medications can influence total pharmacy spend.

By Mary Delaney, United Benefit Advisors

Employer-sponsored health insurance is greatly affected by geographic region, industry, and employer size. While some cost trends have been fairly consistent since the Patient Protection and Affordable Care Act (ACA) was put in place, UBA finds several surprises in its latest Health Plan Survey. Based on responses from more than 11,000 employers, UBA recently announced the top five best and worst states for group health care monthly premiums.

Employer-sponsored health insurance is greatly affected by geographic region, industry, and employer size. While some cost trends have been fairly consistent since the Patient Protection and Affordable Care Act (ACA) was put in place, UBA finds several surprises in its latest Health Plan Survey. Based on responses from more than 11,000 employers, UBA recently announced the top five best and worst states for group health care monthly premiums.