by admin | Aug 18, 2025 | Human Resources

What if employers could capitalize on this current “I quit” mood? If people are leaving jobs for something better, offer something better! Here are some ideas to create an engaged and committed workforce:

What if employers could capitalize on this current “I quit” mood? If people are leaving jobs for something better, offer something better! Here are some ideas to create an engaged and committed workforce:

1. Understand and Be Responsive to Employee Needs, Motivations, and Priorities

A paycheck may be the reason everyone has a job in the first place, but it’s not the only reason people choose to work or decide to work for one employer over another. Your employees stick with you because there’s something in it for them besides the money. The job is useful to them. Knowing why it’s useful enables you to keep employees satisfied and, better yet, make their jobs even more appealing.

2. Prioritize Employee Development

A work environment in which people gain knowledge, learn new skills, and advance in their careers speaks more clearly and loudly than any marketing message can. People like working where they can grow and develop. According to a LinkedIn report, companies “that excel at internal mobility are able to retain employees nearly twice as long as companies that struggle with it.” And a better trained workforce is also a more productive and profitable workforce!

3. Reward Success

In fact, reward anything you want to see more of. Whether large or small, the rewards have to be meaningful. Ideally, figure out what type of reward speaks to each employee. For some, acknowledgment in a company meeting will make their heart sing. For others, receiving a token of your appreciation, such as a coffee gift card, will be more meaningful.

4. Allow for a Healthy Work-Life Balance

Flexibility is a big selling point for employees looking for better balance between work and life. Your employees have other commitments they need to attend to. Some are caring for young children or other family members while navigating daycare and school closures or multiple appointments. Give employees the time to see to those commitments and have a life outside of work, and you’ll get more from them when they’re on the job. Options may include remote or hybrid work, paid time off, flex hours, four-day workweeks, alternative schedules, and reducing workload. Remember, however, that policies are only as good as the practices around them. Ensure that employees don’t need to jump through hoops to request time off. Remind managers to be responsive to requests for time off and on the look out for signs that employees are feeling overwhelmed.

5. Conduct “Stay Interviews”

Don’t wait until people are leaving to investigate what could have inclined them to stay. Talk to employees now about what’s going well, what pain points they’re experiencing, and what could be done to take the relationship to the next level. Stay interviews enable you to address problems and unfulfilled wishes before they drive people out the door.

By Lisa DeShantz-Cook

Originally posted on Mineral

by admin | Aug 11, 2025 | Health Insurance

Health care terms, medical bills, and forms can be hard to understand. Here are some common health care terms, and what they mean.

Health care terms, medical bills, and forms can be hard to understand. Here are some common health care terms, and what they mean.

Allowed Amount

This is the maximum payment the plan will pay for a covered health care service. May also be called “eligible expense,” “payment allowance,” or “negotiated rate.”

For example, if you get services during an office visit from an in-network provider and your health plan’s allowed amount for an office visit is $100, you’ll pay $100 for that visit if you haven’t met your deductible, and the visit is subject to the deductible. If you’ve met your deductible, you’ll pay your coinsurance or copayment amount instead, if applicable (see coinsurance, copayment, and deductible).

Under certain circumstances, if your provider is out-of-network and charges more than the health plan’s allowed amount, you may have to pay the difference (see “balance billing”).

Balance Billing

When a provider bills you for the balance remaining on the bill that your plan doesn’t cover. This amount is the difference between the actual billed amount and the allowed amount.

For example, if the provider’s charge is $200 and the allowed amount is $110, the provider may bill you for the remaining $90. This happens most often when you see an out-of-network provider (non-preferred provider). A network provider (preferred provider) may not balance bill you for covered services.

Coinsurance

Your share of the costs of a covered health care service, calculated as a percent (for example, 20%) of the allowed amount for the service. You pay the coinsurance plus any deductibles you owe.

For example, if your health insurance plan’s allowed amount for an office visit is $100 and your coinsurance is 20%:

- If you’ve paid your deductible: you pay 20% of $100, or $20. The insurance company pays the rest.

- If you haven’t paid your deductible yet: you pay the full allowed amount, $100 (or the remaining balance until you have paid your yearly deductible, whichever is less).

Complaint

Healthcare providers, emergency facilities, and insurance plans must follow rules that protect consumers from surprise (unexpected out-of-network) medical bills. If you believe your provider, emergency facility, or health plan didn’t follow the rules that protect consumers, you can submit a complaint to the No Surprises Help Desk at 1-800-985-3059. You may need to send supporting documentation like medical bills and your Explanation of Benefits.

Copayment

A fixed amount (for example, $15) you pay for a covered health care service, usually when you receive the service (sometimes called “copay”). The amount can vary by the type of covered health care service.

For example, your health plan’s allowable cost for a doctor’s office visit is $100. Your copayment for a doctor visit is $20:

- If you’ve paid your deductible, you pay $20, usually at the time of the visit.

- If you haven’t paid your deductible, you pay $100, the full allowed amount for that visit (or the remaining balance until you have paid your annual deductible, whichever is less).

Cost Sharing

This is your share of costs for services that a plan covers that you must pay out of your own pocket (sometimes called “out-of-pocket costs”). Some examples of cost sharing are copayments, deductibles, and coinsurance. Family cost sharing is the share of cost for deductibles and out-of-pocket costs you and your spouse and/or child(ren) must pay out of your own pocket. Other costs, including your premiums, penalties you may have to pay, or the cost of care a plan doesn’t cover usually aren’t considered cost sharing.

Deductible

An amount you could owe during a coverage period (usually one year) for covered health care services before your plan begins to pay. An overall deductible applies to all or almost all covered items and services. A plan with an overall deductible may also have separate deductibles that apply to specific services or groups of services. A plan may also have only separate deductibles.

For example, if your deductible is $1,000, your plan won’t pay anything until you’ve met your $1,000 deductible for covered healthcare services subject to the deductible.

Dispute

If you don’t have health insurance or don’t plan to use your insurance to pay for your care, you may be able to use the patient-provider dispute resolution process if you disagree with your medical bill. In this process, you can ask an independent third party to review your case. The third party, called a dispute resolution entity, will review the good faith estimate, your bill, and information from your health care provider or facility to decide if you should pay the amount on your good faith estimate, the billed charge, or a different amount. During the patient-provider dispute resolution process, you may still negotiate your bill with your provider or facility.

Explanation of Benefits (EOB)

This is a summary from your health plan of the total charges for the health care services you received and how much you and your health plan will have to pay. This could be a paper copy that’s mailed to you or an electronic statement. This is not a bill. Learn more about the explanation of benefits.

Good Faith Estimate (GFE)

An estimate from a health care provider or facility for the expected costs of items or services. If you’re uninsured or not using your insurance, the provider or facility generally must give you a GFE before you get a health care service if you ask for one or if you schedule an appointment at least 3 days before you get a health care service. In certain circumstances, a provider that isn’t in your plan’s network must also give you a GFE as part of its notice and consent to charge you more than your plan’s in-network cost sharing amount. Learn more about good faith estimates.

In-network Providers

Providers or facilities that have a contract with your health plan to provide services for plan members at certain costs. Generally, if you get care with an in-network provider or facility, it will cost you less than if you get care with an out-of-network provider or facility.

Insured

Someone with health insurance (this can include people with insurance through their employer or health insurance they bought through the Health Insurance Marketplace®, directly from an insurance company or through an insurance agent or broker, Medicare, Medicaid, or TRICARE).

No Surprises Act

A federal law that provides protections against getting surprise (unexpected) medical bills for out-of-network emergency room services, some out-of-network non-emergency services related to a patient visit to an in-network facility, and out-of-network air ambulance services.

Notice and Consent Form

A form you may get from out-of-network providers or facilities that tell you about your rights and protections against surprise (unexpected out-of-network) medical bills and that gives you the option to waive those rights. If you sign this form, you agree to give up rights that protect you from balance billing and you may be charged more for your medical care. This form is also known as a waiver. This type of notice and consent form is separate from other medical consent forms that a provider or facility may ask you to sign before treating you. Learn more about notice and consent forms.

Out-of-network Provider

A provider who doesn’t have a contract with your plan to provide services.

If your plan covers out-of-network services, you’ll usually pay more to see an out-of-network provider than a preferred provider. Your policy will explain what those costs may be. This may also be called “nonpreferred provider” or “non-participating provider.”

Out-of-pocket Limit

The most you could pay during a coverage period (usually one year) for your share of the costs of covered services. After you meet this limit the plan will usually pay 100% of the allowed amount. This limit helps you plan for health care costs. This limit never includes your premium, balance billed charges or health care your plan doesn’t cover. Some plans don’t count all of your copayments, deductibles, coinsurance payments, out-of-network payments, or other expenses toward this limit.

Preferred Provider

A provider who has a contract with your health insurer or plan who has agreed to provide services to members of a plan. You’ll pay less if you see a provider in the network. Also called “preferred provider” or “participating provider.”

Provider

An individual or facility that provides health care services. Some examples of a provider include a doctor, nurse, chiropractor, physician assistant, hospital, surgical center, skilled nursing facility, and rehabilitation center. The plan may require the provider to be licensed, certified, or accredited as required by state law.

Self-pay

When someone who has health insurance chooses to pay their health care costs out of pocket without using health insurance.

Surprise Bill

An unexpected balance bill for certain types of out-of-network costs your insurance didn’t cover.

Uninsured

Someone without health care coverage.

Originally posted on CMS.gov

by admin | Aug 4, 2025 | Custom Content, Employee Benefits

Employers will see several changes to their health and welfare benefits due to comprehensive new tax and spending legislation. This includes notable improvements to Health Savings Accounts (HSAs), Dependent Care Flexible Spending Arrangements (DCFSAs), and employer-provided student loan payments, as well as the introduction of some new fringe benefit choices.

Employers will see several changes to their health and welfare benefits due to comprehensive new tax and spending legislation. This includes notable improvements to Health Savings Accounts (HSAs), Dependent Care Flexible Spending Arrangements (DCFSAs), and employer-provided student loan payments, as well as the introduction of some new fringe benefit choices.

These updates introduce significant changes to employee benefits. These changes are part of a comprehensive legislative package enacted on July 4, 2025 and will require employers and employees to adjust their understanding and utilization of benefit programs. Some of the most notable provisions are:

- Health Savings Accounts (HSAs) can now cover Direct Primary Care (DPC) fees, up to $150/month for individuals and $300/month for families.

- The telehealth exception for high-deductible health plans (HDHPs) is now permanent, ensuring continued access to virtual care. Employees with HDHPs will have first-dollar coverage of most telehealth services, before meeting their HDHP deductible.

- The dependent care FSA limit has increased from $5,000 to $7,500 ($3,750 for married filing separately), a boost for working parents.

- Bronze and catastrophic ACA exchange plans are now HSA-qualified.

- The tax exclusion for employer-sponsored health insurance remains intact, a win for traditional group benefits.

- Permanent exclusion for student loan assistance allows for a tax exclusion of up to $5,250 per year for employer payments of student loans and offers long-term support for employees managing student debt.

- New tax-advantaged accounts for children (a.k.a. “Trump Accounts”) are individual retirement accounts (IRAs) for children under 18 with an annual contribution cap of $5,000. These accounts allow for employers to contribute up to $2,500 per employee. Additionally, children born between January 1, 2025, and December 31, 2028, are eligible to receive a one-time $1,000 government contribution.

These changes are important as they significantly impact the employee benefits landscape. They also enhance access to care, reduce wait times, and provide greater flexibility, cost savings, and options for both employers and employees. By leveraging these updates, organizations can elevate employee well-being while remaining tax-compliant and strategically competitive.

by admin | Jul 28, 2025 | ACA

Big changes are coming to women’s preventive care coverage! Starting with plan years on or after December 31, 2025, group health plans and health insurance issuers must expand their no-cost coverage for women’s preventive care. This expansion includes additional breast cancer imaging or testing needed to complete an initial mammogram, as well as patient navigation services for breast and cervical cancer screenings.

Big changes are coming to women’s preventive care coverage! Starting with plan years on or after December 31, 2025, group health plans and health insurance issuers must expand their no-cost coverage for women’s preventive care. This expansion includes additional breast cancer imaging or testing needed to complete an initial mammogram, as well as patient navigation services for breast and cervical cancer screenings.

These updates fall under the Affordable Care Act’s (ACA) preventive care mandate, which requires most health plans to cover a range of preventive services without deductibles, copayments, or coinsurance when using in-network providers. The ACA’s guidelines are regularly updated.

The latest HRSA-supported guidelines, updated on December 30, 2024, specifically expand breast cancer screening to include necessary follow-up imaging (such as MRIs or ultrasounds) or pathology evaluations beyond the initial mammogram. Additionally, starting in 2026, patient navigation services for breast and cervical cancer screening and follow-up will be covered. These services offer personalized support, help with healthcare access, referrals to essential services (like language translation or transportation), and patient education.

by admin | Jul 23, 2025 | Human Resources

When considering employee retention, HR professionals must realize that turnover doesn’t begin with a resignation letter. It starts much earlier—and it’s quieter. A skipped lunch, a missed meeting, fewer Slack messages. These small signs often signal something much bigger: an employee pulling away. Long before someone quits, they disconnect. And in today’s networked workplace, social withdrawal is often the first—and most reliable—indicator that someone’s already halfway out the door.

When considering employee retention, HR professionals must realize that turnover doesn’t begin with a resignation letter. It starts much earlier—and it’s quieter. A skipped lunch, a missed meeting, fewer Slack messages. These small signs often signal something much bigger: an employee pulling away. Long before someone quits, they disconnect. And in today’s networked workplace, social withdrawal is often the first—and most reliable—indicator that someone’s already halfway out the door.

While voluntary turnover has dropped to 13.5 percent—a sharp decline from 24.7 percent in 2022—that doesn’t mean employees are engaged. According to Gallup, more than half of U.S. workers are either actively searching or watching for new jobs. One in three say they’re ready to quit—even without something else lined up. This isn’t just dissatisfaction. It’s detachment. And it’s quietly reshaping our workforce.

Gallup calls this the “Great Detachment.” Employees are still showing up—but they’ve stopped buying in. They’re physically present, but relationally and emotionally checked out. And if left unchecked, this detachment becomes the precursor to departure.

Employee retention: Why people leave before they leave

Network analysis has consistently identified one of the most powerful—and overlooked—predictors of employee turnover: social isolation. While compensation, career mobility, and flexibility certainly matter, they rarely tell the whole story. People don’t just leave because of what they’re missing in their role. They leave because of what they’re missing in their relationships. When employees feel disconnected from their peers, excluded from informal conversations, or cut off from trusted collaborators, a sense of belonging erodes. And once that sense of belonging fades, disengagement—and eventual departure—often follows.

Employees on the edge of the network—those with limited connections—are two to three times more likely to quit. Without strong ties, they’re often left out of critical conversations, informal support, and growth opportunities. In fact, disengagement typically begins at the edges, long before it shows up anywhere else.

But a new pattern is emerging inside organizations: some employees aren’t just stuck on the edges—they’re choosing to move there. They’re intentionally stepping back from collaboration, reducing their interactions, and moving to the periphery of the network by design rather than by default.

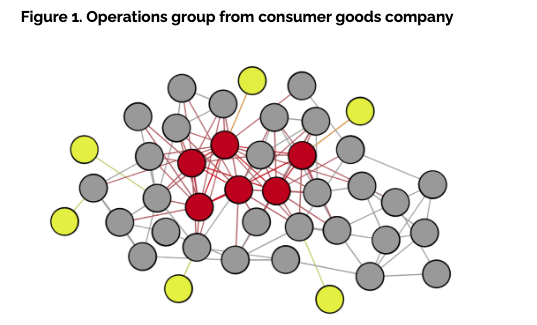

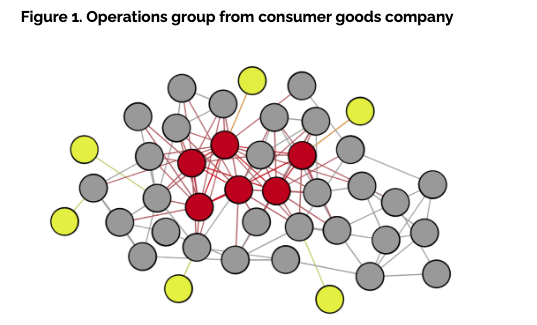

Just consider the organization below, it represents an operations group of just over 40 employees within a global consumer goods company, a network analysis revealed a disturbing trend. Six employees—represented in yellow nodes (Figure 1)—were only connected to one other colleague. Several more had just two connections. And while that level of isolation is concerning on its own, what made it worse was that nearly half of these individuals were previously well-connected just a year earlier. They hadn’t just become isolated. They had chosen to pull back.

A recent study from Thred provided even more compelling evidence: employees who had recently resigned had 36 percent fewer connections than the company average. Even more telling, they were twice as likely to report having no meaningful friendship relationships at work. These findings point to a deeper insight—relational connectedness is more than a cultural asset; it’s a predictive signal. Building strong interpersonal ties may be one of the most underutilized levers in improving employee retention.

The contagious nature of the center

Research has long shown that employees at the center of an organizational network—those with many active connections—are 24 percent less likely to leave. These individuals, much like the red nodes in Figure 1, are deeply embedded and often serve as the glue that holds teams together. Their centrality provides access to information, influence and support.

And when those connections go beyond the professional—when they include genuine friendships—their likelihood of staying increases even more. Research has found that employees engaged in dual-purpose relationships—blending both professional collaboration and personal rapport—were 37 percent less likely to quit than those with purely transactional ties. When relationships go beyond the task at hand, people are more likely to stay—not just for the work, but for the sense of shared connection.

But here’s where it gets more complex. When well-connected, central employees become burned out, disengaged or disillusioned with the organization’s direction, their influence can shift from stabilizing to destabilizing. According to Thred’s research, when a central employee leaves, as much as 25 percent of their immediate network is likely to follow within months. These aren’t isolated exits—they’re relational chain reactions.

In highly collaborative environments, the ripple effect of a single departure can quickly cascade across a team. Employees who leave often hold more than just a role—they serve as connectors, mentors and informal leaders whose influence stretches far beyond their job title. When they exit, it disrupts not only workflows but the underlying trust networks that hold teams together. Like a contagion, quitting spreads through connection: the closer someone is to a departing colleague, the more likely they are to re-evaluate their own sense of belonging, purpose, and place within the organization.

The effect can cascade across teams, departments and even geographies—especially in highly collaborative organizations. Like a virus, quitting spreads through proximity. The closer you are to someone who leaves, the more likely you are to consider it too.

What HR can—and should—do

For HR leaders, the implications are clear: employee connection is no longer a soft metric. It’s a strategic one. The good news? Relationships are something organizations can influence—with intention.

Here are four high-impact ways to foster friendship—and reduce attrition:

1. Use network analysis to spot flight risk early

Conduct regular organizational network analysis to identify employees with few or declining connections. These individuals are not just disengaged—they’re already on their way out. Early detection can inform re-engagement strategies or personalized outreach. And if you can’t run an analysis, just watch. Notice who is leaning back more often than they used to.

2. Facilitate moments of connection

Friendship doesn’t form by accident—especially in hybrid or remote settings. Use tools like interest-based matching (for example, Thred’s Stitches) to facilitate meaningful one-to-one meetups. Host curated mixers, team swaps or mentorship pairings that prioritize human connection, not just transactional interactions.

3. Support relationship-rich teams

Encourage cross-functional initiatives where both personal rapport and professional trust can develop. Invest in psychologically safe team cultures that allow for vulnerability, shared experience and the blending of professional and personal interest.

4. Routinely pulse check with central employees

Central employees with high trust capital have the greatest influence on the network. If they’re thriving, they’ll lift others with them. But if they’re frustrated or burned out, their exit could trigger a talent drain. Keep these employees close—and engaged.

By Michael Arena

Originally posted on HR Exchange Network

What if employers could capitalize on this current “I quit” mood? If people are leaving jobs for something better, offer something better! Here are some ideas to create an engaged and committed workforce:

What if employers could capitalize on this current “I quit” mood? If people are leaving jobs for something better, offer something better! Here are some ideas to create an engaged and committed workforce: