by admin | Aug 12, 2024 | Hot Topics, Human Resources

The lack of affordable and available child care in the United States continues to take its toll on workers and employers alike. It not only affects working parents with child care needs, consider the effect on coworkers who have to pick up the slack of absent team members or the staffing shortages organizations experience, especially small businesses, when parents take leaves of absence or quit their jobs because of child care complications.

The lack of affordable and available child care in the United States continues to take its toll on workers and employers alike. It not only affects working parents with child care needs, consider the effect on coworkers who have to pick up the slack of absent team members or the staffing shortages organizations experience, especially small businesses, when parents take leaves of absence or quit their jobs because of child care complications.

The Business Case for Providing Support

Employers lose an estimated $23 billion a year because of child care-related complications, resulting in a $122 billion hit to the U.S. economy (lost wages, productivity, and tax revenue), according to a recent study from ReadyNation.

KinderCare, one of the country’s largest day-care operators, is constantly fielding questions from employers asking for help in solving child-care needs—needs they didn’t realize they were a part of before COVID.

In an environment with a tight job market—more job openings than people looking for work—the child-care industry is hit particularly hard. There is a need for more people to work in child care and a need for a career pipeline. But it’s hard to attract workers into a profession that requires credentialing and where the pay is so low. The child-care workforce was one of the slowest to recover from the pandemic, and it was predicted it would lose another 232,000 jobs once the federal pandemic child-care subsidy program ended.

How Employers are Responding

Conflict can often prompt creativity. The same can be said of crisis. Employers are responding in some very unique ways, from the conversion of office space to building new, on-site centers.

Micron Technology opened a center across the street from its HQ in Boise, Idaho and one near a manufacturing plant in central New York. It also invested money to train care providers and early-childhood teachers to address the talent shortage.

The Washington Post reports that Tyson Foods built a center in Humboldt, Tennessee to accommodate its shift workers; Hormel is building a $5 million child-care facility in Austin, Minnesota; and medical services company VGM Group is converting 8,000 square feet of office space into a day-care center in Waterloo, Iowa. While costly, employers are finding that on-site child care can attract and retain employees.

Pittsburgh International Airport opened a child-care center with plans to expand it to round-the-clock care to accommodate night-shift workers. They also added public bus routes to make transportation to work easier.

A charter school in Wisconsin—to avoid losing staff in a tight labor market—converted space into an infant-care center and are providing a 25% subsidy to the parents.

Another creative option is offering tuition subsidies to parents that can be used anywhere or in any manner to meet their needs, such as summer camps or after-school programs. Since child care needs vary over time, there is no one-size-fits-all solution.

Organizations such as Bright Horizons and KinderCare report a large uptick in employers inquiring about on-site child care along with information on backup options for emergency care.

As employers are realizing they need to be part of the solution to this crisis, can they expect to see a return on these hefty investments? According to an analysis of five companies that offer child care benefits, the positive financial impact can include an ROI of up to 425%. The benefits included monthly stipends of $1,000, near-site centers, and emergency on-site daycare. The companies have seen reduced absences and better retention, not to mention increased morale:

“It’s not just the money, it’s the principle. It feels like a ‘thank you.’ It’s an incredible morale booster. Even if another company offered me more money tomorrow, I wouldn’t even consider it, given how much this company has invested in my personal life.”

Government Programs and Public Policymakers

As mentioned in the previous article, most child-care businesses operated with less than a 1% profit before the pandemic. Other countries address that instability by subsidizing parents’ costs, an investment that allows child-care providers to charge adequate rates. However, the United States spends less than almost every other rich country on child care and early education.

During the pandemic the federal government sent out $24 billion in aid packages to the industry, which helped head off 75,000 child-care center closures. However, the Child Care Stabilization Grant expired on September 30, 2023. The Century Foundation’s Child Care Cliff Survey anticipated the impact the expiration of funds will have, including a loss in tax and business revenue of $10.6 billion.

Long-term solutions are needed. In its 2023 Kids Count Data Book, The Annie E. Casey Foundation offers suggestions: federal, state, and local government investment in child care including reauthorizing and strengthening the Child Care and Development Block Grant Act; collaboration among public and private leaders to improve the infrastructure for home-based child care; expanding the federal Child Care Access Means Parents in School program which serves student parents.

Private industry is beginning to see a return on its investment in child care benefits. Imagine the results—and the effect on society—if policymakers along with industry leaders take the leap to implement programs and build a system to make child care more affordable, available, and accessible.

Beyond it being an economic issue, a social issue, and a workforce issue, “…it’s a humanity issue,” writes Petula Dvorak, Washington Post Columnist.

by admin | Aug 5, 2024 | Flexible Spending Accounts, HSA/HRA

Medical expense accounts can help you save on all kinds of healthcare costs. Here are some you may not know about yet.

Medical expense accounts can help you save on all kinds of healthcare costs. Here are some you may not know about yet.

HSA, FSA, and HRA can typically be used for:

- Medical expenses: Doctor visits, surgeries, prescriptions, dental and vision care, and mental health services.

- Over-the-counter (OTC) medications: Many OTC medications, including pain relievers, allergy medications, and cold remedies, are now eligible.

- Medical equipment: Items like crutches, wheelchairs, and diabetic supplies often qualify.

- Qualified medical transportation: Expenses related to getting to and from medical appointments

- Women’s healthcare products: As of 2020, many women’s healthcare and hygiene items—including pads and tampons—were added to the list. Birth control and other contraceptives also count as qualified medical expenses with a prescription.

- Sunscreen: If you buy sunscreen with a sun protection factor (SPF) of 15 or higher, you can pay for it with your FSA or HSA account.

- Health insurance premiums: In some cases, you can use HSA or FSA funds to pay for COBRA premiums or health insurance premiums during periods of unemployment.

- Alcohol or drug treatment: If you need treatment at a hospital for alcohol or drug abuse, you can cover those costs with your FSA or HSA. That includes meals and a treatment center stay. You can also include rides to and from meetings for groups like Alcoholics Anonymous.

Expenses that might be covered, but check your plan:

- Long-term care: Some plans may cover long-term care expenses, but this is often limited.

- Cosmetic surgery: Generally not covered unless medically necessary.

- Weight loss programs: May be eligible if medically supervised.

- Gym memberships: While some plans cover gym memberships, it’s often dependent on specific medical conditions or doctor referrals.

Important Considerations:

- Keep receipts: You’ll generally need receipts to claim reimbursement for your purchases.

- Check eligibility: Not all items are covered, so verify with your plan administrator.

- Maximize your savings: Use your accounts strategically to reduce out-of-pocket costs.

Additional Tips:

- Shop around: Compare prices for medical goods and services to maximize your savings.

- Take advantage of online resources: Many health insurance providers offer online tools and resources to help you understand your coverage.

- Consult with your healthcare provider: Your doctor can recommend treatments and products that may be eligible for reimbursement.

By understanding the nuances of HSAs, FSAs, and HRAs, you can make informed decisions about how to use these accounts to your advantage and maximize your healthcare savings.

by admin | Aug 2, 2024 | Employee Benefits

Managing healthcare costs can feel like deciphering a complex code. Three acronyms frequently pop up: HSAs, HRAs, and FSAs. But what exactly do they mean, and which one is right for you? Let’s break down these accounts and explore how they can help you save on qualified medical expenses.

Managing healthcare costs can feel like deciphering a complex code. Three acronyms frequently pop up: HSAs, HRAs, and FSAs. But what exactly do they mean, and which one is right for you? Let’s break down these accounts and explore how they can help you save on qualified medical expenses.

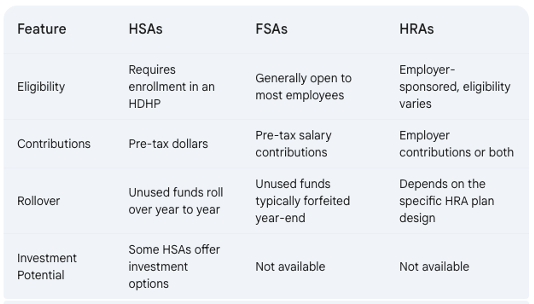

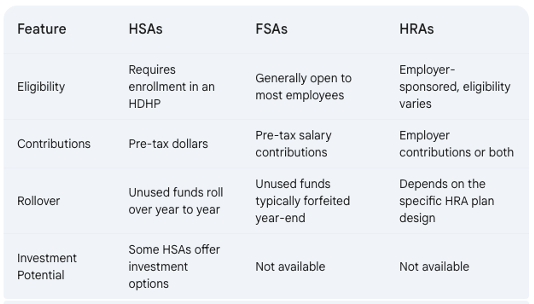

Understanding the Accounts:

-

Health Savings Accounts (HSAs): You contribute pre-tax dollars to your HSA, which acts like a savings account dedicated to qualified medical expenses, including most over-the-counter (OTC) medications. However, to be eligible for an HSA, you must be enrolled in an High Deductible Health Plan (HDHP), which has a higher deductible than traditional health insurance plans. This means you’ll pay more out-of-pocket before your insurance kicks in. HSAs essentially act as a safety net to offset these higher deductible costs.

-

Flexible Spending Accounts (FSAs): These accounts allow you to set aside pre-tax salary contributions to cover qualified medical and dependent care expenses throughout the year. Think of it like a prepaid debit card for approved healthcare costs. Most OTC medications are eligible for reimbursement through an FSA debit card or claim submission process. Unlike HSAs, FSAs are not tied to a specific health insurance plan type, so you might have the option to contribute to an FSA even with a traditional plan (though some employers may have restrictions based on your plan selection). o FSAs have a “use it or lose it” provision: Generally, you must use the money in a FSA within the plan year (but occasionally your employer can offer a grace period of a few months).

-

Health Reimbursement Arrangements (HRAs): These employer-sponsored accounts let companies contribute funds to cover qualified employee medical expenses. The specific eligible expenses, including OTC items, vary depending on the HRA plan design set by your employer. Unlike HSAs and FSAs, you don’t directly contribute to an HRA. Instead, your employer contributes on your behalf, or in some cases, a combination of employer and employee contributions may be allowed.

Who Can Use Them?

-

HSAs: Eligibility hinges on having an HDHP.

-

FSAs: Generally available to most employees, regardless of health plan type (though some employers may restrict enrollment based on plan selection).

-

HRAs: Offered at the discretion of your employer, who determines eligibility and contribution levels.

Tax Benefits:

All three accounts offer tax advantages:

-

Contributions: Reduce your taxable income by contributing pre-tax dollars.

-

Growth: Interest earned on the funds in HSAs and some FSAs (depending on the plan) grows tax-free, allowing your savings to accumulate faster.

-

Withdrawals: When used for qualified medical expenses, withdrawals are tax-free for all three accounts.

Key Differences:

Choosing the Right Account for You:

The best account for you depends on your individual circumstances. Here are some factors to consider:

- Health Status: If you’re generally healthy and have predictable medical expenses, an FSA might be a good choice, allowing you to use the funds throughout the year.

- Financial Risk Tolerance: HSAs offer long-term savings potential with rollovers and investment options (in some plans). However, they require enrollment in an HDHP, which means you’ll shoulder higher upfront costs before insurance kicks in. Consider your comfort level with potentially higher out-of-pocket expenses.

- Employer Benefits: HRAs depend on your employer’s plan design. If your employer offers a generous HRA with significant contributions, it might be a good option for you.

Additional Considerations:

- Use-It-or-Lose-It vs. Rollover: FSAs typically operate on a “use-it-or-lose-it” basis, so plan your contributions carefully to avoid losing funds.

Making an Informed Decision:

By thoroughly understanding HSAs, FSAs, and HRAs, you can choose the account that best aligns with your health needs, financial goals, and employer benefits, ultimately saving you money on healthcare expenses.

by admin | Jul 29, 2024 | Employee Benefits

Today’s workforce is a mix of generations, and Gen X is a group you can’t afford to overlook. Known for their flexibility and problem-solving skills, Gen X employees bring a powerful combination of experience and value to any company.

Today’s workforce is a mix of generations, and Gen X is a group you can’t afford to overlook. Known for their flexibility and problem-solving skills, Gen X employees bring a powerful combination of experience and value to any company.

Gen X, those born between 1965 and 1980, makes up a significant chunk (27%) of today’s workforce. They’re often in the thick of the “sandwich generation” phase, juggling the needs of aging parents and their own children, all while aiming for career advancement and taking care of themselves. The key to attracting and keeping them? Perks that matter to their lives and priorities.

Healthy Gen X = Happy and Productive Gen X

As we age, health becomes a top priority. That’s why Gen X employees appreciate comprehensive health benefits that go beyond the basics. Offering plans with preventive screenings, broad dental and vision coverage for their families, and well-being programs designed for their age group shows you care – and keeps them healthy, happy, and productive at work.

Work-Life Balance Matters: Offer Flexibility

Life for Gen X can be a juggling act. Flexible work arrangements are more than just a benefit – they’re essential. By offering flexible schedules and remote work options, you acknowledge their responsibilities outside of work and show trust in their dedication. This win-win situation keeps Gen X employees happy and allows them to excel while maintaining a healthy work-life balance.

Gen X and Mental Wellness: Addressing a Unique Need

Having navigated a period of rapid technological and societal change, Gen X may face specific mental health challenges. For this demographic, access to mental health resources carries significant weight. By offering initiatives that promote work-life balance and provide mental health support, employers can demonstrate they care and create a work environment that fosters well-being and maximizes the potential of their Gen X employees.

Gen X and the Retirement Edge: Invest in Their Future

With retirement on the horizon, financial security is a top priority for Gen X. Employers who offer robust retirement savings plans and financial planning resources demonstrate they understand this concern and invest in their employees’ long-term well-being. Further sweeten the deal with student loan repayment programs and life insurance options to ease financial burdens and attract this valuable talent pool. By focusing on Gen X’s financial future, you gain a loyal and engaged workforce ready to contribute their expertise for years to come.

Never Stop Learning: Upskilling Gen X Benefits Everyone

The job market’s always changing so staying ahead of the curve is crucial. Gen Xers, known for their adaptability, value opportunities for continuous learning and professional development. By investing in their growth through training programs and resources, you empower them to excel in their roles, stay relevant in the industry, and feel valued as part of the team. A win-win for both employee satisfaction and company success!

by admin | Jul 23, 2024 | Compliance

ACA PREVENTIVE CARE MANDATE REMAINS IN PLACE WITH AN EXCEPTION

ACA PREVENTIVE CARE MANDATE REMAINS IN PLACE WITH AN EXCEPTION

In a recent decision, the U.S. 5th Circuit Court of Appeals upheld a key provision of the Affordable Care Act (ACA) that mandates private insurance cover preventive services without cost to patients. However, the court also ruled that the plaintiffs are exempt from complying with this mandate, setting the stage for potential future challenges. The appellate panel emphasized that the task force responsible for determining which preventive services should be covered must receive congressional confirmation, raising questions about the authority of groups making recommendations on contraception and vaccines.

The case stemmed from a lawsuit by Texas-based Christian companies Braidwood Management and Kelley Orthodontics, arguing that the ACA’s requirement to cover preventive care such as contraception, HPV vaccines, and HIV prevention drugs violated their religious beliefs. Initially, a district court sided with the employers, prompting an appeal by the Biden administration.

While the 5th Circuit overturned the lower court’s nationwide nullification of the preventive services mandate, it acknowledged concerns over the constitutional authority of the U.S. Preventive Services Task Force (USPSTF) to issue binding recommendations. The court’s decision requires USPSTF members to undergo presidential nomination and Senate confirmation moving forward.

The ruling’s implications are significant for the approximately 164 million Americans receiving employer-based health insurance, as it preserves access to vital preventive care services. Despite this immediate relief, advocacy groups caution that the decision could pave the way for future legal challenges that may threaten broader access to these essential health benefits.

EMPLOYER CONSIDERATIONS

Employers must ensure that their health plans continue to comply with the ACA’s preventive care mandate, which requires coverage of certain preventive services without cost-sharing for employees. This includes staying updated on the latest guidelines from the U.S. Preventive Services Task Force (USPSTF) and other relevant regulatory bodies to ensure that all mandated services are covered.

HIPAA PRIVACY RULE TO SUPPORT REPRODUCTIVE HEALTH CARE PRIVACY

The Biden administration’s new rule aimed at safeguarding the privacy of protected health information related to lawful reproductive health care went into effect in June. Under the HIPAA Privacy Rule to Support Reproductive Health Care Privacy, healthcare providers are now barred from disclosing sensitive information such as contraception use, pregnancy-related care, and infertility treatments to law enforcement without patient consent.

Effective June 25, with compliance required by December 23, 2024, the rule addresses concerns that arose following the overturning of Roe v. Wade in June 2022. This decision prompted concern that patients seeking lawful reproductive health services across state lines could face unwarranted scrutiny, compromising their privacy and potentially exposing them to legal repercussions.

The rule mandates that HIPAA-covered entities must now obtain a signed attestation that the request is not for prohibited purposes before disclosing protected health information (PHI) for specific purposes like health oversight, judicial proceedings, and law enforcement inquiries.

In the coming months, the Office for Civil Rights plans to release a standardized attestation form to facilitate compliance with the new regulations. This measure aims to ensure that individuals can confidently access reproductive health care without fear of their private medical information being misused or exploited.

EMPLOYER CONSIDERATIONS

Healthcare providers, health plans, and healthcare clearinghouses regulated under the Final Rule must update their Notice of Privacy Practices (NPPs) to align with the requirements for safeguarding reproductive healthcare privacy.

Employers should update HIPAA policies and procedures to ensure they specify when an attestation is required to disclose PHI and train employees on the new rules.

ENFORCEMENT OF PREGNANT WORKERS FAIRNESS ACT BEGINS

Effective June 18, 2024, the Equal Employment Opportunity Commission (EEOC) will enforce the final rule on the Pregnant Workers Fairness Act (PWFA), which mandates that employers provide reasonable accommodations to employees affected by pregnancy, childbirth, or related medical conditions. This applies to all employers with 15 or more employees, encompassing both public and private sectors. Employees are eligible for accommodation regardless of their tenure with the company.

Under the PWFA, employees can request accommodations akin to those permitted under the Americans with Disabilities Act (ADA). These include adjustments such as breaks, modified schedules, remote work, and changes to work environments, among others. Unlike the ADA, the PWFA stipulates four accommodations that employers are generally expected to grant without extensive documentation, such as access to water, restroom breaks, modified seating, and breaks for eating.

Notably, the PWFA requires employers to provide accommodation even if an employee is temporarily unable to perform essential job functions due to pregnancy-related conditions, provided the employee can resume these functions in the near future. Employers cannot mandate specific healthcare providers for medical certification unless certain conditions are met, ensuring flexibility for employees in documenting their accommodation needs.

Regarding undue hardship, employers must assess accommodations based on factors like those used under the ADA, considering the impact on business operations and resources. Accommodations that impose significant costs, disruptions, or alter the fundamental nature of business operations may qualify as undue hardship.

EMPLOYER CONSIDERATIONS

Employers are advised to update their policies and informational materials to reflect PWFA requirements, including handbook updates and the display of updated federal anti-discrimination posters. They should be prepared to accommodate reasonable requests promptly and without unnecessary bureaucratic hurdles, ensuring compliance with both federal and applicable state laws that offer greater protection to pregnant employees.

SUPREME COURT RULES ON MEDICATION ABORTION

The Supreme Court issued a unanimous decision in upholding the FDA’s current protocol for mifepristone, a drug used in medication abortions. The ruling dismissed a challenge based on procedural grounds, asserting that the challengers lacked standing to contest the FDA’s regulations. Despite this decision, the Court left open the possibility of future challenges related to access to the drug.

This ruling holds significant implications, as medication abortion, which includes mifepristone and misoprostol, accounts for a substantial majority of abortions in the United States. The Court’s decision preserves existing access to medication abortion amid rising restrictions on reproductive healthcare.

Currently, coverage for abortion, including medication abortion, varies widely among employers due to state laws and individual plan provisions. While some states mandate coverage, others prohibit it, creating a complex landscape for employers to navigate. Additionally, access to mifepristone can be challenging, as distribution is limited to certified providers, impacting both in-person and mail-order availability.

EMPLOYER CONSIDERATIONS

Employers should review their medical and pharmacy plans to ensure coverage of mifepristone and assess participant access to certified providers.

PREPARATION FOR FILING FORM 5500 FOR CALENDAR YEAR PLANS

ERISA plans with 100 or more plan participants as of the first day of the plan year are required to file IRS Form 5500 by the last day of the seventh month following the end of the plan year. See the IRS Form 5500 Corner for information.

Employers may obtain an automatic extension to file Form 5500, Form 5500-SF, Form 5500-EZ, Form 8955-SSA, or Form 5330 by filing IRS Form 5558. The extension will allow return/reports to be filed up to the 15th day of the third month after the normal due date.

Due to administrative issues within the IRS, electronic filing of Form 5558 through EFAST2 will be postponed until Jan. 1, 2025. Plan sponsors and administrators should continue to use a paper Form 5558 to request a one-time extension of time to file a Form 5500 series or Form 8955-SSA (up to 2½ months after the normal due date for Form 5500s or Form 8955-SSA).

QUESTION OF THE MONTH

Q: For small group clients that do not have to offer medical plans, should we discourage the use of a cafeteria plan for pre-tax premiums if they want to allow employees to drop the medical plan mid-year if they cannot afford it?

A: If you avoid using a cafeteria plan to allow employees to pay for medical premiums, the downside is that the employees must pay for the premiums on an after-tax basis. The upside is you avoid all of the Section 125 rules that generally require elections be irrevocable for the year, unless there is a qualifying life event (and insurance being too expensive is not a qualifying life event). So a good solution for employers that want to offer employees maximum flexibility is to allow them to pay premiums on an after-tax basis.

If giving employees the choice between pre-tax (through a cafeteria plan) or after-tax premiums is too confusing or administratively complex, the employer could choose NOT to offer a cafeteria plan and make all premiums be paid on an after-tax basis. Of course, if the employer does not think the financial hardship issue will occur too frequently, offering a cafeteria plan makes the most financial sense for the employees and the employer.

©2024 United Benefit Advisors

The lack of affordable and available child care in the United States continues to take its toll on workers and employers alike. It not only affects working parents with child care needs, consider the effect on coworkers who have to pick up the slack of absent team members or the staffing shortages organizations experience, especially small businesses, when parents take leaves of absence or quit their jobs because of child care complications.

The lack of affordable and available child care in the United States continues to take its toll on workers and employers alike. It not only affects working parents with child care needs, consider the effect on coworkers who have to pick up the slack of absent team members or the staffing shortages organizations experience, especially small businesses, when parents take leaves of absence or quit their jobs because of child care complications.