by admin | Feb 28, 2018 | Compliance, Human Resources

Employer Response to Immigration Inspection Notice

Employer Response to Immigration Inspection Notice

In January 2018, the California Department of Labor Standards and Enforcement (DLSE) released its pre-inspection notice, Notice to Employee — Labor Code section 90.2.

Effective January 1, 2018, and except as otherwise required by federal law, California employers must provide notice to current employees of any inspection of I-9 Employment Eligibility Verification forms or other employment records conducted by an immigration agency. This notice is completed by posting the DLSE’s Notice to Employee — Labor Code section 90.2 in the language the employer normally uses to communicate employment-related information to the employee within 72 hours of receiving notice of the inspection.

A copy of the Notice of Inspection of I-9 Employment Eligibility Verification forms, and any accompanying documents, must be posted or given to employees with the DLSE notice.

Originally Published By ThinkHR.com

by admin | Feb 22, 2018 | Hot Topics, Human Resources

Have you ever heard the proverb “Knowledge is power?” It means that knowledge is more powerful than just physical strength and with knowledge people can produce powerful results. This applies to your annual medical physical as well! The #1 goal of your annual exam is to GAIN KNOWLEDGE. Annual exams offer you and your doctor a baseline for your health as well as being key to detecting early signs of diseases and conditions.

Have you ever heard the proverb “Knowledge is power?” It means that knowledge is more powerful than just physical strength and with knowledge people can produce powerful results. This applies to your annual medical physical as well! The #1 goal of your annual exam is to GAIN KNOWLEDGE. Annual exams offer you and your doctor a baseline for your health as well as being key to detecting early signs of diseases and conditions.

According to Malcom Thalor, MD, “A good general exam should include a comprehensive medical history, family history, lifestyle review, problem-focused physical exam, appropriate screening and diagnostic tests and vaccinations, with time for discussion, assessment and education. And a good health care provider will always focus first and foremost on your health goals.”

Early detection of chronic diseases can save both your personal pocketbook as well as your life! By scheduling AND attending your annual physical, you are able to cut down on medical costs of undiagnosed conditions. Catching a disease early means you are able to attack it early. If you wait until you are exhibiting symptoms or have been symptomatic for a long while, then the disease may be to a stage that is costly to treat. Early detection gives you a jump start on treatments and can reduce your out of pocket expenses.

When you are prepared to speak with your Primary Care Physician (PCP), you can set the agenda for your appointment so that you get all your questions answered as well as your PCP’s questions. Here are some tips for a successful annual physical exam:

- Bring a list of medications you are currently taking—You may even take pictures of the bottles so they can see the strength and how many.

- Have a list of any symptoms you are having ready to discuss.

- Bring the results of any relevant surgeries, tests, and medical procedures

- Share a list of the names and numbers of your other doctors that you see on a regular basis.

- If you have an implanted device (insulin pump, spinal cord stimulator, etc) bring the device card with you.

- Bring a list of questions! Doctors want well informed patients leaving their office. Here are some sample questions you may want to ask:

- What vaccines do I need?

- What health screenings do I need?

- What lifestyle changes do I need to make?

- Am I on the right medications?

Becoming a well-informed patient who follows through on going to their annual exam as well as follows the advice given to them from their physician after asking good questions, will not only save your budget, but it can save your life!

by admin | Feb 16, 2018 | Compliance, Human Resources, IRS

IRS Releases Publication 15 and W-4 Withholding Guidance for 2018

IRS Releases Publication 15 and W-4 Withholding Guidance for 2018

On January 31, 2018, the federal Internal Revenue Service (IRS) released Publication 15 — Introductory Material, which includes the following:

- 2018 federal income tax withholding tables.

- Exempt Form W-4.

- New information on:

- Withholding allowance.

- Withholding on supplemental wages.

- Backup withholding.

- Moving expense reimbursement.

- Social Security and Medicare tax for 2018.

- Disaster tax relief.

Read Publication 15 and further details here.

EEOC Penalty Increases for Failure to Post Required Notices

On January 18, 2018, the U.S. Equal Employment Opportunity Commission (EEOC) released a final rule increasing the penalty amount from $534 to $545 for violations of Title VII of the Civil Rights Act (Title VII), the Americans with Disabilities Act (ADA), and the Genetic Information Nondiscrimination Act (GINA) notice posting requirements.

The final rule is effective February 20, 2018.

Originally Published By ThinkHR.com

by admin | Feb 12, 2018 | Benefit Management, Compliance, Group Benefit Plans, Medicare

Do you offer health coverage to your employees? Does your group health plan cover outpatient prescription drugs? If so, federal law requires you to complete an online disclosure form every year with information about your plan’s drug coverage. You have 60 days from the start of your health plan year to complete the form. For instance, for a calendar-year health plan, this year’s deadline is March 1, 2018.

Do you offer health coverage to your employees? Does your group health plan cover outpatient prescription drugs? If so, federal law requires you to complete an online disclosure form every year with information about your plan’s drug coverage. You have 60 days from the start of your health plan year to complete the form. For instance, for a calendar-year health plan, this year’s deadline is March 1, 2018.

Background

The Centers for Medicare and Medicaid Services (CMS) is a federal agency that collects data and administers various federal programs. The agency utilizes the CMS online tool to collect information from employers about whether their group health plan’s prescription drug coverage is creditable or noncreditable. Creditable coverage means the group health plan’s prescription drug coverage is actuarially equivalent to Medicare’s Part D drug plans. In other words, the group plan is considered creditable if its drug benefits are as good as or better than Medicare’s benefits.

To confirm whether your plan provides creditable or noncreditable coverage, check with the plan’s carrier or HMO (if insured) or the plan’s actuary (if self-funded). CMS provides guidance to help plan sponsors, carriers, and actuaries determine the plan’s status.

Deadline for Disclosure

All group health plans that include any outpatient prescription drug benefits, regardless of whether the plan is insured, self-funded, grandfathered, or nongrandfathered, must complete the CMS disclosure requirement. There is no exception for small employers.

Complete the CMS online disclosure form every year within 60 days of the start of the plan year. For instance, for calendar-year plans, this year’s deadline is March 1, 2018.

Additionally, if your plan terminates or its status changes between creditable and noncreditable coverage, you must disclose the updated information to CMS within 30 days of the change.

Completing the Disclosure Form

The CMS online tool is the only method allowed for completing the required disclosure. From this link, follow the prompts to respond to a series of questions regarding the plan. The link is the same regardless of whether the employer’s plan provides creditable or noncreditable coverage.

The entire process usually takes only 5 or 10 minutes to complete. To save time, have the following information handy before you start filling in the form:

- Information about the plan sponsor (employer): Name, address, phone number, and federal Employer Identification Number (EIN).

- Number of prescription drug options offered (e.g., if employer offers two plan options with different benefit levels, the number is “2”).

- Creditable/Noncreditable Offer: Indicate whether all options are creditable or noncreditable or whether some are creditable and others are noncreditable.

- Plan year beginning and ending dates.

- Estimated number of plan participants eligible for Medicare (and how many are participants in the employer’s retiree health plan, if any).

- Date that the plan’s Notice of Creditable (or Noncreditable) Coverage was provided to participants.

- Name, title, and email address of the employer’s authorized individual completing the disclosure.

We suggest you print a copy of the completed disclosure to keep for your records.

Note: Employers that receive the Retiree Drug Subsidy (RDS), or sponsor health plans that contract directly with one or more Medicare Part D plans, should seek the advice of legal counsel regarding the applicable disclosure requirements.

Additional Disclosure Requirement

Separate from the CMS online disclosure requirement, employers also must distribute a disclosure notice to Medicare-eligible group health plan participants. The deadline for distributing the participant notice is October 14 of the preceding year. It often is difficult for employers to identify which employees and spouses may be Medicare-eligible, so most employers simply distribute the notice to all participants regardless of age or status. For information about the notice requirement, see our previous post.

Originally Published By ThinkHR.com

by admin | Feb 6, 2018 | Benefit Management, Employee Benefits, Group Benefit Plans

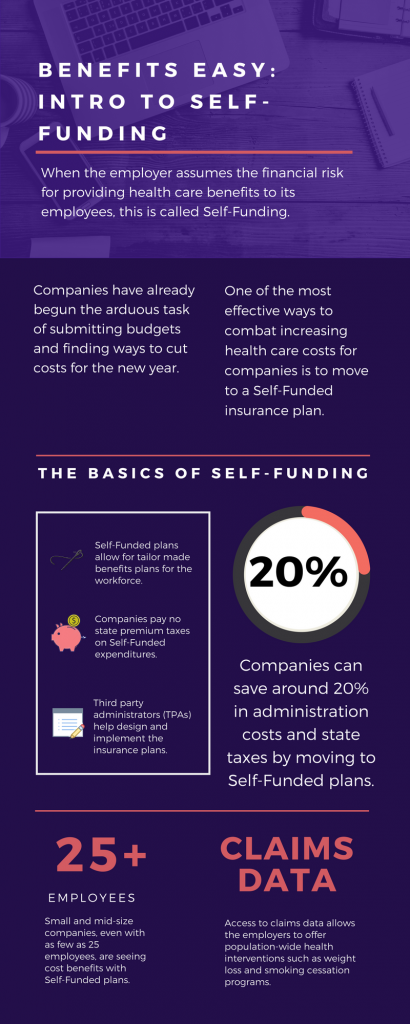

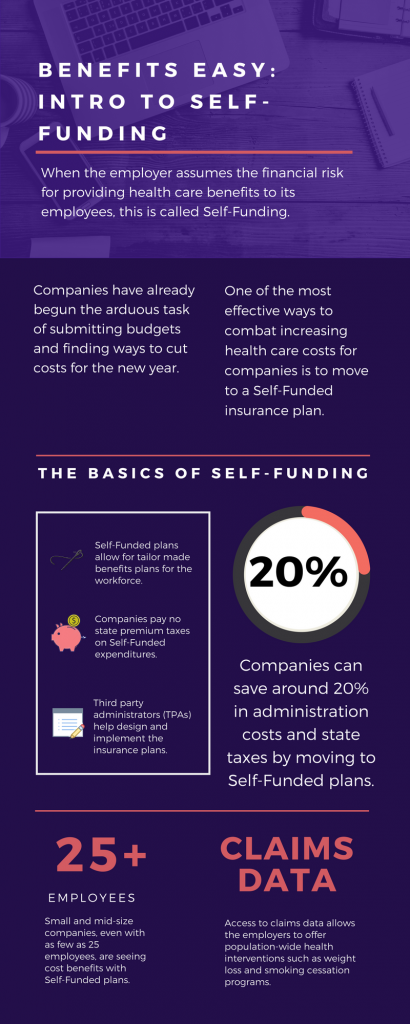

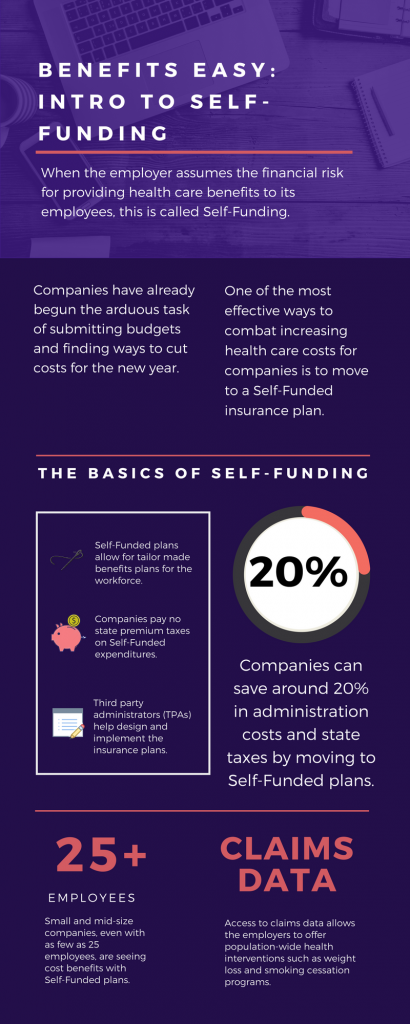

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

As we head into the second month of 2018, companies have already begun the arduous task of submitting budgets and finding ways to cut costs for the new year. One of the most effective ways to combat increasing health care costs for companies is to move to a Self-Funded insurance plan. By paying for claims out-of-pocket instead of paying a premium to an insurance carrier, companies can save around 20% in administration costs and state taxes. That’s quite a cost savings!

The topic of Self-Funding is huge and so we want to break it down into smaller bites for you to digest. This month we want to tackle a basic introduction to Self-Funding and in the coming months, we will cover the benefits, risks, and the stop-loss associated with this type of plan.

THE BASICS

- When the employer assumes the financial risk for providing health care benefits to its employees, this is called Self-Funding.

- Self-Funded plans allow the employer to tailor the benefits plan design to best suit their employees. Employers can look at the demographics of their workforce and decide which benefits would be most utilized as well as cut benefits that are forecasted to be underutilized.

- While previously most used by large companies, small and mid-sized companies, even with as few as 25 employees, are seeing cost benefits to moving to Self-Funded insurance plans.

- Companies pay no state premium taxes on self-funded expenditures. This savings is around 1.5% – 3/5% depending on in which state the company operates.

- Since employers are paying for claims, they have access to claims data. While keeping within HIPAA privacy guidelines, the employer can identify and reach out to employees with certain at-risk conditions (diabetes, heart disease, stroke) and offer assistance with combating these health concerns. This also allows greater population-wide health intervention like weight loss programs and smoking cessation assistance.

- Companies typically hire third-party administrators (TPA) to help design and administer the insurance plans. This allows greater control of the plan benefits and claims payments for the company.

As you can see, Self-Funding has many facets. It’s important to gather as much information as you can and weigh the benefits and risks of moving from a Fully-Funded plan for your company to a Self-Funded one. Doing your research and making the move to a Self-Funded plan could help you gain greater control over your healthcare costs and allow you to design an original plan that best fits your employees.

Employer Response to Immigration Inspection Notice

Employer Response to Immigration Inspection Notice