by admin | Nov 2, 2023 | Employee Benefits

The connection between employee wellness and the benefits of the job might seem obvious. But the conversation should be more nuanced than merely a discussion about health insurance, access to mental healthcare like employee assistance programs (EAPs), and well-being apps to reach zen.

The connection between employee wellness and the benefits of the job might seem obvious. But the conversation should be more nuanced than merely a discussion about health insurance, access to mental healthcare like employee assistance programs (EAPs), and well-being apps to reach zen.

Indeed, Human Resources professionals must reconsider their definition of benefits. It must extend to all the pros of working at a company. This includes the compensation and benefits packages but also other benefits like the team vibe, how managers treat employees, the expectations of employees, the ability for work-life balance, etc.

The New Human Resources

Thinking about this link between wellness and benefits is a key differentiator between traditional approaches to HR and the transformational employee-centric approach of the here and now. In the wake of the pandemic and the arrival of Gen Z employees to the workforce, expectations of employment have changed. HR must put emphasis on empathetic leadership, collegiality, and support for the health and wellness of the team for both recruiting and retention purposes.

HR’s Desire to Support Employee Wellness

The will to support employee mental health and wellness is there. Dating back to the State of HR 2022, when HR leaders who responded to the HR Exchange Network survey made employee engagement the top priority, organizations have been clamoring to improve recruiting, engagement, and retention. The foundation for this crusade is focusing on employee wellness. After all, at the heart of these efforts is job satisfaction.

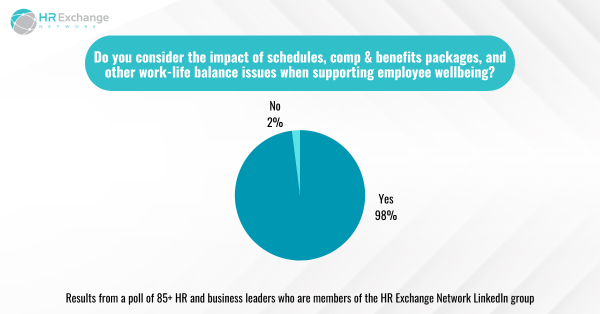

Many HR professionals have great intentions when considering a broader definition of benefits of a job. A whopping 98% of respondents to an HR Exchange Network LinkedIn poll say they consider the impact of schedules, compensation and benefits packages, and other work-life balance issues when supporting employee wellbeing.

Is HR Living Up to Its Ambition?

While most in HR say they want to help employees manage their mental health and wellness, they know employees might not have realized their efforts yet.

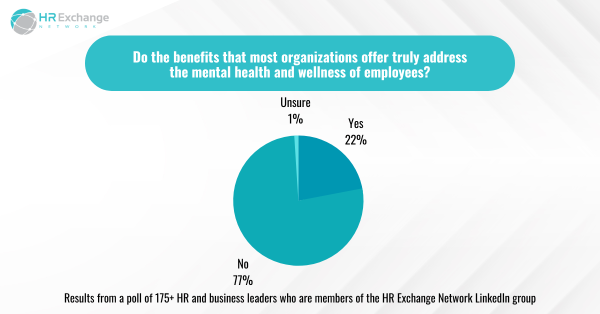

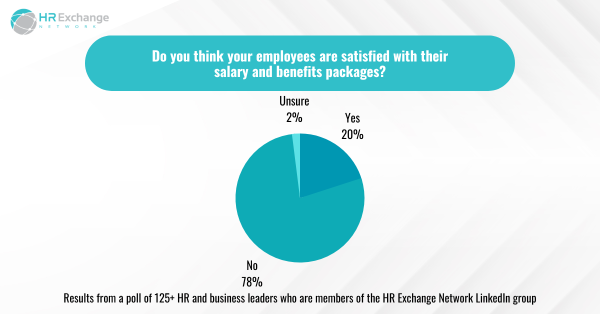

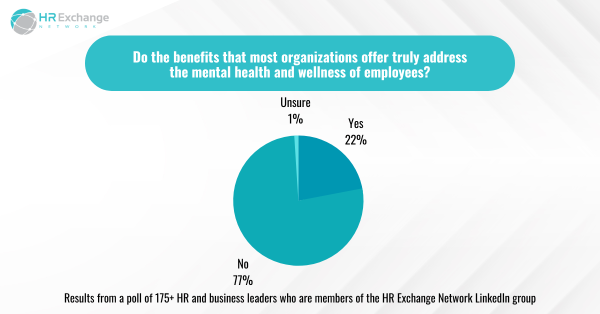

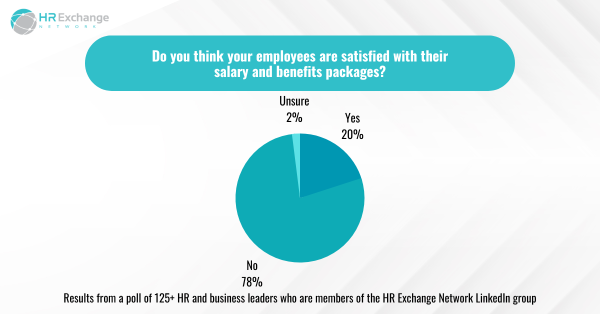

More than 75% – an overwhelming majority – of respondents to another HR Exchange Network LinkedIn poll said that the benefits most organizations offer do not truly address the mental health and wellness of employees. In addition, 78% in another poll on LinkedIn said employees were not satisfied with their salary and benefits packages.

Clearly, most in HR have more work to do when it comes to wellness and benefits. The first step would be to evaluate the company’s offerings. In 2022, respondents to the State of HR said the following were the top five benefits to offer or under consideration:

- Medical, dental, or vision insurance (55%)

- Wellness programs (53%)

- EAPs (45%)

- Mental health coaching (38%)

- Retirement savings (33%)

Worth noting, in the 2023 survey, 20% said they planned to invest in EAPs. In addition, the respondents of that survey shared their top priorities for addressing mental health and wellness:

- Creating a supportive environment for employees to talk about mental health concerns (40%)

- Implementing policies and procedures that address mental health in the workplace (37%)

- Providing accommodations for employees with mental health conditions (34%)

- Encouraging employees to take time off or seek medical attention (33%)

- Gyms/partnerships/fitness apps/fitness classes (27%)

Next Steps

Transformation requires effort and can be slow. Human Resources realizes that employees expect employers to support their mental health and wellness. Until now, that expectation – if ever met – was simply about offering the right kind of insurance and access to mental healthcare. Now, leaders and managers are meant to be empathetic and able to recognize those in need of help. Frankly, most have not had any sort of training, and it’s probably unfair to expect this of them. HR professionals are honest about the lack of support managers are receiving:

Presumably, the next step is to better train managers to provide mental health and wellness support and ensure the business builds itself around a people-centric culture. Certainly, the top priorities of HR professionals in 2023 suggest that employees are gaining leverage with HR:

- Developing and implementing diversity, equity, and inclusion (DEI) initiatives (22%)

- Improving employee engagement and retention (21%)

- Recruiting and retaining top talent (15%)

In fact, DEI is directly related to wellness at work because those efforts contribute to people feeling as though they are treated fairly and included. Providing that sense of belonging is an essential part of wellness, as is improving engagement and retention. To recruit and keep top talent, employers must continue to care for employees and lead HR with heart.

By Francesca Di Meglio

Orignally Posted on HR Exchange Network

by admin | Jun 5, 2023 | Employee Benefits, Human Resources

Total rewards packages refer to the compensation and benefits plans that companies offer. This phrase, however, extends beyond mere salary or wages and traditional benefits, like health insurance, to provide both recruits and employees with a rundown of what makes the employer special. Some in Human Resources might regard the total rewards package as the starting line for employee value proposition (EVP).

Total rewards packages refer to the compensation and benefits plans that companies offer. This phrase, however, extends beyond mere salary or wages and traditional benefits, like health insurance, to provide both recruits and employees with a rundown of what makes the employer special. Some in Human Resources might regard the total rewards package as the starting line for employee value proposition (EVP).

Here are the different components of a total rewards package:

Compensation

Compensation, which may refer to wages or salary, is the obvious main feature of the total rewards package. People get paid for their work, so they can afford housing, food, and the basic necessities of life. The money you’re paid to work may include the chance for bonuses and other merit-based rewards, in addition to salary or wages.

Basic Benefits

The most well-known benefits include health, vision, and dental insurance. People have come to expect some form of medical insurance for full-time employment in the United States. In fact, most rely on this benefit for their healthcare because private insurance is astronomically expensive without group membership, and the United States does not have a public option.

Retirement Plans

Offering 401(k) or IRA plans have also become the norm. Companies previously rewarded loyalty with pensions that could help people survive after employment ended. However, nowadays, pensions have been replaced by these other retirement plans, which rely on sometimes volatile markets. There are penalties for taking the money out of such accounts before retirement.

Paid Time Off (PTO)

Paid time off is not a given in every job. However, it refers to the time people are allowed to take vacation, recover from illness or injury, and celebrate holidays while still getting paid. This can include vacation days, sick days, and bank holidays.

Nowadays, some companies are getting creative with PTO. They may include shared days off, where the entire organization takes a break and gets paid. Or they might have unlimited PTO, which means people do not have to accrue or earn days based on seniority. Rather, they can take off when they need to without limit. In those cases, however, employers use an honor system to ensure people do not take advantage of the system.

Family Leave

This is key for new parents, those tending to loved ones who are ill or elderly, or those facing a longer-term illness themselves because they can take time off for care. However, family leave does not have to be paid. Approved family leave requires employers to hold the position for the person, but they do not have to be paid during that time off. It depends on whether they company offers pay for family leave. Many do pay for maternity leave for up to three months, and many others are offering paternity leave now, too. Assessing employment law is a necessity in these cases. And job applicants must do their due diligence when vetting potential employers if they think they may need leave at some point.

Learning and Development and Career Paths

Employees are seeking opportunities to learn, grow, and develop in their careers while on the job. Therefore, more employers are trying to offer training, classes, reimbursement for tuition or coursework, mentorship, leadership development, and other opportunities to gain skills necessary for raises and promotions. It will also help the individual and the employer remain relevant as the skills gap becomes more of a problem in the future of work.

Mental Health and Wellness Programs

For decades now, people have looked to their employers for gyms or gym membership. But now everyone is thinking beyond physical health to mental health as well. As a result, access to mental health help, employee assistance programs (EAPs), classes on mindfulness or yoga, apps for stress management, and more are on the table. Many employers are responding with a wealth of benefits related to wellness and well-being.

Free Food

Providing free lunches, snacks, or special occasion treats has been a hallmark of American companies. Many of the tech giants have campuses that provide services from dry cleaning to dental work, and free food in the cafeteria is a given. As employers try to convince people to return to the office in this post-pandemic era, they try to lure them with bagels or pizza or even other more gourmet options.

Work-Life Balance

Flexibility in where and/or when people work is going mainstream. As the gig economy gains steam, people expect to have more flexibility in their scheduling. Offering remote or hybrid work schedules, understanding when someone must pick up their kid from school or go to a doctor’s appointment, and allowing people to execute asynchronous work during off hours are benefits that impact work-life balance.

Ultimately, the total rewards package a company offers is the first sign of its relationship with employees. It tells the story of how talent is valued by an organization. It usually requires more than just money to satisfy recruits and employees.

By Francesca Di Meglio

Originally posted on HR Exchange Network

by admin | Jan 23, 2023 | Employee Benefits

A hot labor market that has seen scores of employees leave their jobs for new and better opportunities has HR and benefits leaders planning to up the ante when it comes to benefits that sway workers to stay. But at the same time, employers also are aware of soaring costs and inflation concerns and are looking to make sure any benefits investments are worthwhile.

A hot labor market that has seen scores of employees leave their jobs for new and better opportunities has HR and benefits leaders planning to up the ante when it comes to benefits that sway workers to stay. But at the same time, employers also are aware of soaring costs and inflation concerns and are looking to make sure any benefits investments are worthwhile.

For 2023, employers are uniquely positioned to offer more than just a health care plan, including perks and resources that today’s workers are seeking.

Voluntary Benefits

You can please some of the people some of the time, but you can’t please all the people all the time – unless you embrace voluntary benefits, that is. Voluntary benefits are optional perks that are offered to employees at a discounted group rate which their employer has negotiated with providers. While employees still need to pay to use these benefits, the amount is usually far less than it would be without company subsidies.

These types of benefits give employees the chance to customize their benefits packages to best suit their particular needs. Whether it’s affordable veterinary insurance for pet owners, subsidized pre-K childcare for parents, or student loan repayment programs, offering these types of policies can directly improve the quality of life for employees who choose to take advantage of them.

Financial Wellness Benefits

Employees worry and stress about their finances especially today due to record-high inflation and are searching for financial wellness education and guidance. Nearly 80% of employees say a financial wellness benefit is an important part of a comprehensive benefits package. Some of the popular financial wellness benefits are:

- Retirement Plan Options with Matching Contributions

- Health Savings Accounts

- Flexible Spending Accounts

- Financial Planning Assistance

- Flexible Paydays

- Employee Discount Program

- Financial Reimbursements (Ie. student loan repayment plans, child-care support funds and professional development stipends)

Family-Friendly Benefits

Employers are increasingly looking to expand their family-friendly benefits for employees in 2023.

- Paid family leave is not guaranteed by law in the U.S. but it is a highly sought-after perk. A parental leave policy – one that considers both parents and accounts for adoption and fostering in addition to childbirth – can show your employees you care about supporting their home lives.

- Childcare assistance supports working parents facing rising costs of living. While some larger employers may offer on-site childcare, smaller business can show their commitment to working parents by helping to subsidize the cost of childcare through employer contributions or pre-tax deductions.

- Fertility assistance supports employees who are going through costly infertility treatments, surrogacy, and IVF.

Inclusive and Flexible Care

The diverse workforce of 2023 is prioritizing a better work-life balance. It’s important to develop a benefits package that recognizes a healthy environment for your employees.

- Mental health benefits are in demand since mental health is a crucial part of overall health. Offering an employee assistance program (EAP) is a great way to support workers in tough situations.

- Work flexibility includes not only remote or hybrid work options, but you can also consider flexible start and stop times, a four-day work week or unlimited PTO to attract top talent and increase retention.

Overall, your benefits offerings for 2023 should reflect your organization’s values. Remember, your company depends on being able to keep your employees happy, healthy, and productive. Benefits that show respect for employees and promote a strong, vibrant culture are worth the investment.

by admin | May 8, 2019 | Hot Topics, Retirement

First off, great job on buying life insurance! You took an important step by protecting the ones you love.

First off, great job on buying life insurance! You took an important step by protecting the ones you love.

Every life insurance policy requires you to name a beneficiary. A life insurance beneficiary is typically the person or people who get the payout on your life insurance policy after you die; it may also be a trust, charity or your estate.

You can also name more than one beneficiary, as well as the percentage of the payout you want to go to each one—for instance, you could designate 50% to a spouse and 50% to an adult child.

You’ll typically be asked to pick two kinds of beneficiaries: a primary and a secondary. The secondary beneficiary (also called a “contingent beneficiary”) receives the payout if the primary beneficiary is deceased.

Providing for Kids

A big reason why people buy life insurance is to provide for children left behind. Usually this is done by making the surviving spouse or partner who cares for and is raising the kids the beneficiary. But what if you’re widowed or—God forbid—-both you and your partner pass away at the same time?

First, know that it’s not a good idea to name a minor as a beneficiary. That’s because the law forbids life insurance payouts to anyone who has not reached the age of majority, which is 18 to 21 depending on your state. If a child were to be named, then it would be turned over to probate court. The court will name a guardian who has oversight of the money/estate until the child comes of age.

Fortunately, there are two options. The first is to name an adult custodian. The custodian should be someone you can trust to use the money for things like housing, health care, and education until the child reaches the age of majority. At that point, any remaining money gets turned over the child and they can spend it any way they want.

The second option is to work with an attorney to set up a trust. In this scenario, the trust is the beneficiary and a trustee is named to manage and distribute the funds. The main advantage of a trust over naming a custodian is having more control.

A trust lets you specify how you want the money distributed—and it lets you do so even when your kids are adults. (One quick word of caution: Definitely consult with an attorney if you’re setting up a trust for a special needs child. They can help you create one that doesn’t impact your child’s eligibility for government assistance like Medicaid or Supplemental Security Income.)

Naming a Charity

Do you have a cause that’s near and dear to your heart? If so, you might consider naming a charitable organization as the beneficiary of your life insurance.

There are several ways to do this. They include naming the charity as a beneficiary on a new or existing life insurance policy, making the charity both the owner and the beneficiary of a life insurance policy, adding a charitable-giving rider to a life insurance policy, or working with a community foundation to figure out the best way to distribute a payout.

Final Tips

Think carefully about naming your estate as a beneficiary. This can trigger a long and costly legal process known as probate. A faster and more efficient solution is to name specific individuals or organizations as beneficiaries.

1. Get specific. Instead of naming “my spouse” or “my children” as beneficiaries, list their names along with their addresses and Social Security numbers. This saves a lot of time since the insurance company doesn’t have to track down information.

2. Always name a contingent beneficiary. Passing away and leaving behind life insurance without a living beneficiary could mean the payout goes to someone you never wanted your policy to benefit. It could also require a court-appointed administrator to sort things out.

3. Pick trustworthy custodians and trustees. Really consider who’d you trust your child’s financial well-being with if you weren’t in the picture. Your kids may love their uncle or aunt, but is he or she mature and responsible with money? If not, pick someone else who is.

4. Regularly review your beneficiaries. It’s a good idea to review your beneficiaries about once a year and after major life events like a marriage, divorce, the birth of a child, or a death in the family.

5. Communicate your wishes. Let your beneficiaries know your intentions and how to find the policy.

6. Be aware of special situations. There are some situations that could trigger a tax on the life insurance benefit—for instance, when the policyholder and the insured aren’t the same person. Likewise, things can get sticky if you live in a community property state and don’t name your spouse as a beneficiary. An insurance agent can give you life insurance advice on this and much more.

By Amanda Austin

Originally posted on lifehappens.org

by admin | May 24, 2018 | Flexible Spending Accounts, IRS

Recently the Internal Revenue Service (IRS) issued its 2018 Publication 15-B, which informs

Recently the Internal Revenue Service (IRS) issued its 2018 Publication 15-B, which informs

employers about employment tax treatment of fringe benefits.

Updates include:

- the suspension of qualified bicycle commuting reimbursements from an employee’s income for any tax year after December 31, 2017 and before January 1, 2026;

- the suspension of the exclusion for qualified moving expense reimbursements from an employee’s income for tax years after December 1, 2017 and before January 1, 2026 (with exceptions for active duty U.S. Armed Forces members who move because of a permanent change of station);

- limits on employers’ deductions for certain fringe benefits including meals and transportation commuting; and

- the definition of items that aren’t tangible personal property for purposes of employee achievement awards.

Originally Published By United Benefit Advisors

The connection between employee wellness and the benefits of the job might seem obvious. But the conversation should be more nuanced than merely a discussion about health insurance, access to mental healthcare like employee assistance programs (EAPs), and well-being apps to reach zen.

The connection between employee wellness and the benefits of the job might seem obvious. But the conversation should be more nuanced than merely a discussion about health insurance, access to mental healthcare like employee assistance programs (EAPs), and well-being apps to reach zen.