by admin | Mar 31, 2022 | Hot Topics, Human Resources

You’ve probably been hearing about the Great Resignation (or however you want to describe it) for months now. Even if you’re not dealing directly with increased turnover, your employees know they have options. Their friends, family, and people they know peripherally or on social media have made the leap and are gleefully announcing it on LinkedIn.

You’ve probably been hearing about the Great Resignation (or however you want to describe it) for months now. Even if you’re not dealing directly with increased turnover, your employees know they have options. Their friends, family, and people they know peripherally or on social media have made the leap and are gleefully announcing it on LinkedIn.

Some job-hoppers may be emboldened by the movement to quit good jobs in the hope of something better—better pay, more flexibility, or more opportunities for advancement. Some have simply been pushed to the brink by dead-end jobs, lousy company culture, or ineffective managers. Others have given up trying to “have it all” and left the workforce completely.

But what if employers could capitalize on this current “I quit” mood? If people are leaving jobs for something better, offer something better! Here are some ideas to create an engaged and committed workforce:

1. Understand and Be Responsive to Employee Needs, Motivations, and Priorities

A paycheck may be the reason everyone has a job in the first place, but it’s not the only reason people choose to work or decide to work for one employer over another. Your employees stick with you because there’s something in it for them besides the money. The job is useful to them. Knowing why it’s useful enables you to keep employees satisfied and, better yet, make their jobs even more appealing.

2. Prioritize Employee Development

A work environment in which people gain knowledge, learn new skills, and advance in their careers speaks more clearly and loudly than any marketing message can. People like working where they can grow and develop. According to a LinkedIn report, companies “that excel at internal mobility are able to retain employees nearly twice as long as companies that struggle with it.” And a better trained workforce is also a more productive and profitable workforce!

3. Reward Success

In fact, reward anything you want to see more of. Whether large or small, the rewards have to be meaningful. Ideally, figure out what type of reward speaks to each employee. For some, acknowledgment in a company meeting will make their heart sing. For others, receiving a token of your appreciation, such as a coffee gift card, will be more meaningful.

4. Allow for a Healthy Work-Life Balance

Flexibility is a big selling point for employees looking for better balance between work and life. Your employees have other commitments they need to attend to. Some are caring for young children or other family members while navigating daycare and school closures or multiple appointments. Give employees the time to see to those commitments and have a life outside of work, and you’ll get more from them when they’re on the job. Options may include remote or hybrid work, paid time off, flex hours, four-day workweeks, alternative schedules, and reducing workload. Remember, however, that policies are only as good as the practices around them. Ensure that employees don’t need to jump through hoops to request time off. Remind managers to be responsive to requests for time off and on the look out for signs that employees are feeling overwhelmed.

5. Conduct “Stay Interviews”

Don’t wait until people are leaving to investigate what could have inclined them to stay. Talk to employees now about what’s going well, what pain points they’re experiencing, and what could be done to take the relationship to the next level. Stay interviews enable you to address problems and unfulfilled wishes before they drive people out the door.

By Lisa DeShantz-Cook

Originally posted on Mineral

by admin | Mar 9, 2022 | Hot Topics

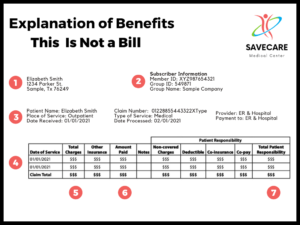

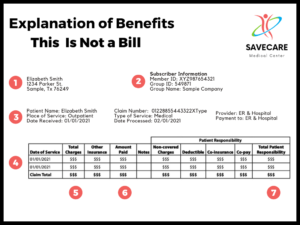

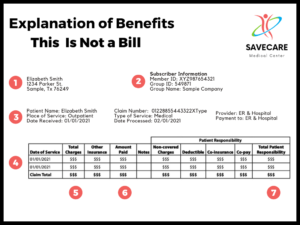

Let’s say that you visited the doctor and you are wondering how much that visit is going to cost. A short while later, you receive something in the mail that looks like a bill – and even says “amount you owe” at the bottom. However, it doesn’t have a return envelope or tear-off portion for the bill. Confused? You’re not the only one!

Let’s say that you visited the doctor and you are wondering how much that visit is going to cost. A short while later, you receive something in the mail that looks like a bill – and even says “amount you owe” at the bottom. However, it doesn’t have a return envelope or tear-off portion for the bill. Confused? You’re not the only one!

Most likely, you’ve just received an Explanation of Benefits (EOB) from your insurance company. The most important thing for you to remember is that an EOB is NOT a bill. It is essentially “one big receipt” that explains your visit. It shows what was billed, how much you can expect your health plan to pay, and what you – the patient – have to pay. It is always important to review your EOB to make sure it is correct.

An EOB is a tool that shows you the value of your health plan. It will detail the cost of the services you received and how much your insurance will pay.

How do EOB’s work?

The health care provider will bill your insurance company after your doctor visit. Then, your insurance company will send your EOB. Later, you will receive a bill for the amount you owe. However, if the bill does arrive before the EOB, don’t pay it yet. Wait until you have the EOB in hand so you can compare it to your medical bill.

While an EOB will differ from one insurance company to another, they typically all include the following information:

- The Account Summary – lists your account information with details like the patient’s name, date(s), and claim number.

- The Claim Details – lists the services provided and the dates of the services.

- The Amounts Billed – details the cost of the services and what costs your health plan did not cover. It will also include any outstanding amount you are responsible for paying. If there is a portion that is not covered by insurance, the reason why will also be listed.

Remember, insurance companies rarely pay 100% of the bill. You will need to pay any applicable deductible, copay and coinsurance.

Deductible: The amount you pay for health care services before your insurance begins to pay anything.

Copay: A flat fee that you pay on the spot each time you go to your doctor or fill a prescription.

Coinsurance: The portion of the medical cost you pay after your deductible has been met. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100%.

Why is Your EOB important?

Medical billing companies sometimes make billing errors. Your EOB is a window into your medical billing history. Review it carefully to make sure that you did receive the service being billed and that your procedure and diagnosis are listed and coded correctly.

EOBs can help you understand how the health insurance system works and provide transparency in the complicated finances of health care. While the EOB may be complicated, understanding it can help ensure that you and your family get the most out of your health insurance. Knowing what an EOB is and what is included on the statement ensures that you stay in control of your health care finances.

by admin | Dec 7, 2021 | Hot Topics

“Children laughing, people passing, meeting smile after smile” stirs happy memories of singing Christmas carols for some, but for others, the holidays can be the most stressful and loneliest time of the year. The holidays often present a dizzying array of demands – shopping, baking, and entertaining to name a few. For those dealing with mental health conditions like depression or or anxiety, the holidays can be even harder.

“Children laughing, people passing, meeting smile after smile” stirs happy memories of singing Christmas carols for some, but for others, the holidays can be the most stressful and loneliest time of the year. The holidays often present a dizzying array of demands – shopping, baking, and entertaining to name a few. For those dealing with mental health conditions like depression or or anxiety, the holidays can be even harder.

Holiday depression can be misinterpreted as being nothing more than the winter blues. So, when it comes to the holidays, people are more focused on their physical health issues instead of their mental health issues. They are more interested in losing weight than taking care of their mental health. Being unaware that there is a problem can make holiday depression evolve into major depression. Counseling and medication are good avenues to seek if you are living with symptoms of depression.

Here are 9 tips that you can use to help you with holiday depression:

- Be realistic – Holidays change just as people change. Kids grow older, people move, and new people will become a part of your life. Focus on those connections, new traditions and remember past holidays with fondness while still enjoying the one right in front of you.

- Schedule Some Down-Time – Even 15-20 minutes a day to enjoy some quiet time, take a bath, listen to music or read a book can do wonders for your stress levels. Plus, it’s ok to say no: you don’t have to attend every party or family event.

- Don’t Isolate Yourself – Look for ways that you can enjoy social connections, even if you aren’t able to go home for the holidays. If you are feeling lonely, ask a friend to come over for a heart to heart or volunteer for something that interests you.

- Drink Only in Moderation – Alcohol is a depressant and can exacerbate negative feelings.

- Exercise Regularly – While hitting the gym can be tough when you are stressed and busy, try going for a short walk. Did you know that exercise can help relieve symptoms of depression?

- Focus on the Positives – Today is a gift. That is why it’s called the present! Being positive and practicing gratitude has a strong positive impact on psychological well-being. It increases self-esteem, enhances positive emotions and makes us more optimistic.

- Keep Expectations Manageable – Try to set realistic goals for yourself and your family. Pace yourself. Organize your time and make a list and prioritize the important activities.

- Let People Close to You Know What’s Going On – Don’t try to hide your holiday depression from your friends and family. Hiding your problem can make your mental health worse. Instead, be honest with them and let them know what you are going through and make sure you let them know that you don’t expect them to make it better.

- Seek Professional Help if You Need It – You may find yourself feeling persistently sad or anxious, unable to sleep, unable to face routine chores or irritable and hopeless despite your best efforts. If these feelings last for a while, talk to your doctor or a mental health professional.

Avoid beating yourself up if you are not full of the “joy of the season.” With some planning, self-care and social connections, it’s possible to tackle depression around the holidays and still enjoy the season. Be gentle with yourself, have realistic expectations, and don’t abandon your healthy habits just because it’s the holiday season. By actively working to manage your mental health, you will be able to make the best of the holidays!

If you are experiencing these symptoms over a period of several weeks, you may be depressed. Talking with a mental health professional or taking a mental health screening test can help you understand how well you are coping with recent events. Seek help.

by admin | Nov 2, 2021 | Hot Topics

Many of us have heard of Alzheimer’s disease but may not know much more than it is a disease that causes memory loss. Experts suggest that more than 6 million Americans, most of them age 65 or older, may have dementia caused by Alzheimer’s. This disease is currently ranked as the sixth leading cause of death in the United States, but recent estimates indicate the disorder may rank third, just behind heart disease and cancer as a cause of death for older people.

Many of us have heard of Alzheimer’s disease but may not know much more than it is a disease that causes memory loss. Experts suggest that more than 6 million Americans, most of them age 65 or older, may have dementia caused by Alzheimer’s. This disease is currently ranked as the sixth leading cause of death in the United States, but recent estimates indicate the disorder may rank third, just behind heart disease and cancer as a cause of death for older people.

Alzheimer’s disease is a progressive brain disorder that slowly destroys memory and thinking skills, and eventually, the ability to carry out the simplest tasks. Changes in the brain may begin a decade or more before symptoms appear. During this very early stage of Alzheimer’s, toxic changes are taking place in the brain. Previously healthy neurons stop functioning, lose connections with other neurons, and die.

Signs and symptoms of Alzheimer’s disease

Memory problems are typically one of the first signs of cognitive impairment related to Alzheimer’s. Alzheimer’s disease progresses in several stages: early, mild (sometimes called mild cognitive impairment), moderate, and severe.

In the Early stage, a person begins to experience memory loss and other cognitive difficulties, though the symptoms appear gradual to the person and their family.

During the Mild Cognitive Impairment(MCI), stage damage occurs in areas of the brain that control language, reasoning, sensory processing, and conscious thought. Conditions such as diabetes, depression, and stroke may increase a person’s risk for MCI.

Some of the signs of MCI include:

- Losing things often

- Forgetting to go to events or appointments

- Having more trouble coming up with words than other people of the same age

MCI can be managed by seeing a doctor or specialist every 6 to 12 months. A doctor can help track any changes in memory and thinking skills over time. People with MCI might also consider participating in clinical trials or studies.

The Moderate stage of Alzheimer’s disease requires more intensive supervision and care becomes necessary.

Symptoms may include:

- Increased memory loss and confusion

- Inability to learn new things

- Difficulty with speech and problems reading, writing and working with numbers

- Difficulty organizing thoughts and logical thinking

- Shorted attention span

- Problems coping with new situations

- Difficulty carrying out multistep tasks, such as getting dressed

- Problems recognizing family and friends

- Hallucinations, delusions, and paranoia

- Impulsive behavior

- Inappropriate outbursts of anger

- Restlessness, agitation, anxiety, wandering in the late afternoon or evening

- Repetitive statements or movement

People with Severe Alzheimer’s cannot communicate and are completely dependent on others for care. The person may also be in the bed most or all the time as the body shuts down.

Symptoms often include:

- Inability to communicate

- Weight loss

- Seizures

- Skin infections

- Difficulty swallowing

- Groaning, moaning, or grunting

- Increased sleeping

- Loss of bowel and bladder control

How is Alzheimer’s disease treated?

Currently, there is no cure for Alzheimer’s, though there are medicines that can help treat the symptoms of the disease. Most medicines work best for people in the early or middle stages of Alzheimer’s. Researchers are exploring other drug therapies and other interventions to delay or prevent the disease as well as treat its symptoms. Some of those include physical activity, diet, cognitive training, and a combination of these.

Alzheimer’s is complex and it is therefore unlikely that any one drug or other intervention will successfully treat it in all people living with the disease. It is important to talk to your doctor if you experience any signs or symptoms of the disease so that appropriate medical tests can be conducted. This will not only give you peace of mind but will help you and your family prepare for the future.

The journey typically lasts for years and for most of that time, people living with Alzheimer’s can still enjoy the same things they always have. Instead of focusing on what is lost, focus on what remains. People still enjoy beauty and feel emotions long after losing the ability to store short-term memories. Recognize each moment as an opportunity to help your loved one experience the joys of life.

by admin | Sep 7, 2021 | Hot Topics, Human Resources, IRS

Employers, have you reminded your employees to check that they are having the right amount of tax withheld from their paychecks? It’s a good idea for everyone to check their payroll withholding every year, but it is particularly important this year due to the many proposed tax changes.

The law’s changes do not affect every taxpayer the same way. Some workers may need to increase their withholding so they will not face a tax bill —and possible penalties — next April when their 2021 tax return is due. Many other workers, however, benefit from the law’s changes and can take home more pay because the withholding amounts are less.

Help your employees avoid being surprised next spring when they prepare their 2021 returns. Remind them now to check their year-to-date withholding so they can make adjustments, if appropriate, on their paychecks for the rest of this year. It’s easy and convenient using tools provided by the IRS.

Here is a sample message to employees:

The IRS encourages everyone to use the Withholding Calculator to perform a quick “paycheck checkup.” This is even more important this year because of recent changes to the tax law for 2021.

The Calculator helps you identify your tax withholding to make sure you have the right amount of tax withheld from your paycheck at work. Use the Calculator to see if you should give your employer a new Form W-4, Employee’s Withholding Allowance Certificate, to adjust your income tax withholding going forward.

To get started, gather your most recent pay stubs and a copy of your last federal tax return (2020 Form 1040). You’ll use the information to estimate your 2021 income and taxes.

The Withholding Calculator does not ask you to provide sensitive personally-identifiable information like your name, Social Security number, address, or bank account numbers. The IRS does not save or record the information you enter on the Calculator.

Ready to start? Make sure Javascript is enabled and go to: Withholding Calculator

by Kathleen Berger

Originally posted on thinkhr.com

by Johnson and Dugan | Aug 6, 2021 | Benefit Plan Tips, Tricks and Traps, Employee Benefits, Hot Topics, Human Resources, IRS

Many employees have the option to choose between their employer’s plan and another program where they meet the eligibility requirements (i.e., spouse’s, domestic partner’s, or parent’s plan). A Cash in Lieu of Benefits program, or cash-out option, offers an incentive for those employees to waive the employer coverage and instead enroll in the other plan. The incentive is in the form of a cash payment added to their paycheck. Properly implementing a Cash in Lieu of Benefits program is crucial, as unexpected tax consequences could occur otherwise.

Many employees have the option to choose between their employer’s plan and another program where they meet the eligibility requirements (i.e., spouse’s, domestic partner’s, or parent’s plan). A Cash in Lieu of Benefits program, or cash-out option, offers an incentive for those employees to waive the employer coverage and instead enroll in the other plan. The incentive is in the form of a cash payment added to their paycheck. Properly implementing a Cash in Lieu of Benefits program is crucial, as unexpected tax consequences could occur otherwise.

Overview

The Internal Revenue Service (IRS) requires a Section 125 plan be in place to be a qualified cash-out option. If the plan is not set up under an IRC Section 125 plan, the plan will be disqualified and employees who elect coverage under the health plan will be taxed on an amount equal to the amount of cash they could have received for waiving coverage.

The IRS has ruled that when an option is available to either elect the health plan, or to receive a cash-out incentive, then the premium payment to the insurance company becomes wages. The reasoning is that when an employer makes payments to the insurance company where the employee has the option of receiving those amounts as wages, the employee is merely assigning future income (cash compensation) for consideration (health insurance coverage). Therefore, the payment is treated as a substitute for the health insurance coverage. By setting up an IRC Section 125 plan, the employer is offering a choice between cash and certain excludable employer-provided benefits, without adverse tax implications.

Plan Set-up

There must be a Plan Document in place and nondiscrimination requirements must be followed, including annual nondiscrimination testing, in order to be a qualified Section 125 plan. To meet nondiscrimination rules, Cash in Lieu of Benefits must be offered to all employees equitably. To be sure an employer is not over incentivizing employees to drop the plan, which could impact the nondiscrimination participation requirements, the monthly cash benefit should not exceed $200-$300.

When a Section 125 plan already exists (Premium Payment Plan, Health Care Spending Account, Dependent Care Spending Account), the plan can be amended to add the cash out feature. Where no Section 125 plan is in place, it is standard to have an attorney provide this service. It is important to note that, although the Section 125 plan protects the employees electing coverage from taxation, the cash-out incentive is an after-tax benefit.

As always with any IRS-qualified plan, proper documentation is essential. An employee should only be allowed to waive coverage when there is another plan available, and proof of enrollment is provided. If there is a subsequent loss of that coverage, HIPAA Special Enrollment Rights will allow entry onto the plan, and the cash-out incentive will cease.

Considerations

Cash in Lieu of Benefits funds cannot be used to purchase individual health coverage. For companies over 20 lives and Medicare is secondary coverage, the plan should not be structured to incentivize employees over 65 to opt out of the employer plan to enroll in Medicare.

Another factor to consider is the impact to employers considered Applicable Large Employers (ALE) and subject to the affordability determination and reporting under the Affordable Care Act (ACA). An ALE is an employer averaging 50 or more full-time plus full-time equivalent employees for the preceding 12 months. If a cash out option is offered without an IRS qualified Cash in Lieu of Benefits plan, the payment must be included in the affordability calculation.

There are also Fair Labor Standards Act (FLSA) implications. Any opt-out payments made by an employer to an employee must be included in an employee’s regular rate of pay and therefore is used in calculating overtime compensation for non-exempt employees.

These considerations should be reviewed with a tax expert and/or ERISA attorney to determine if a Cash in Lieu of Benefits program is the right option for your organization. These professionals, along with a Section 125 Plan Administrator, can provide the necessary guidance to ensure the program will satisfy compliance requirements. For further information on this topic, please contact your Johnson & Dugan team.

By Jody Lee, Johnson & Dugan

You’ve probably been hearing about the Great Resignation (or however you want to describe it) for months now. Even if you’re not dealing directly with increased turnover, your employees know they have options. Their friends, family, and people they know peripherally or on social media have made the leap and are gleefully announcing it on LinkedIn.

You’ve probably been hearing about the Great Resignation (or however you want to describe it) for months now. Even if you’re not dealing directly with increased turnover, your employees know they have options. Their friends, family, and people they know peripherally or on social media have made the leap and are gleefully announcing it on LinkedIn.