by admin | Aug 11, 2025 | Health Insurance

Health care terms, medical bills, and forms can be hard to understand. Here are some common health care terms, and what they mean.

Health care terms, medical bills, and forms can be hard to understand. Here are some common health care terms, and what they mean.

Allowed Amount

This is the maximum payment the plan will pay for a covered health care service. May also be called “eligible expense,” “payment allowance,” or “negotiated rate.”

For example, if you get services during an office visit from an in-network provider and your health plan’s allowed amount for an office visit is $100, you’ll pay $100 for that visit if you haven’t met your deductible, and the visit is subject to the deductible. If you’ve met your deductible, you’ll pay your coinsurance or copayment amount instead, if applicable (see coinsurance, copayment, and deductible).

Under certain circumstances, if your provider is out-of-network and charges more than the health plan’s allowed amount, you may have to pay the difference (see “balance billing”).

Balance Billing

When a provider bills you for the balance remaining on the bill that your plan doesn’t cover. This amount is the difference between the actual billed amount and the allowed amount.

For example, if the provider’s charge is $200 and the allowed amount is $110, the provider may bill you for the remaining $90. This happens most often when you see an out-of-network provider (non-preferred provider). A network provider (preferred provider) may not balance bill you for covered services.

Coinsurance

Your share of the costs of a covered health care service, calculated as a percent (for example, 20%) of the allowed amount for the service. You pay the coinsurance plus any deductibles you owe.

For example, if your health insurance plan’s allowed amount for an office visit is $100 and your coinsurance is 20%:

- If you’ve paid your deductible: you pay 20% of $100, or $20. The insurance company pays the rest.

- If you haven’t paid your deductible yet: you pay the full allowed amount, $100 (or the remaining balance until you have paid your yearly deductible, whichever is less).

Complaint

Healthcare providers, emergency facilities, and insurance plans must follow rules that protect consumers from surprise (unexpected out-of-network) medical bills. If you believe your provider, emergency facility, or health plan didn’t follow the rules that protect consumers, you can submit a complaint to the No Surprises Help Desk at 1-800-985-3059. You may need to send supporting documentation like medical bills and your Explanation of Benefits.

Copayment

A fixed amount (for example, $15) you pay for a covered health care service, usually when you receive the service (sometimes called “copay”). The amount can vary by the type of covered health care service.

For example, your health plan’s allowable cost for a doctor’s office visit is $100. Your copayment for a doctor visit is $20:

- If you’ve paid your deductible, you pay $20, usually at the time of the visit.

- If you haven’t paid your deductible, you pay $100, the full allowed amount for that visit (or the remaining balance until you have paid your annual deductible, whichever is less).

Cost Sharing

This is your share of costs for services that a plan covers that you must pay out of your own pocket (sometimes called “out-of-pocket costs”). Some examples of cost sharing are copayments, deductibles, and coinsurance. Family cost sharing is the share of cost for deductibles and out-of-pocket costs you and your spouse and/or child(ren) must pay out of your own pocket. Other costs, including your premiums, penalties you may have to pay, or the cost of care a plan doesn’t cover usually aren’t considered cost sharing.

Deductible

An amount you could owe during a coverage period (usually one year) for covered health care services before your plan begins to pay. An overall deductible applies to all or almost all covered items and services. A plan with an overall deductible may also have separate deductibles that apply to specific services or groups of services. A plan may also have only separate deductibles.

For example, if your deductible is $1,000, your plan won’t pay anything until you’ve met your $1,000 deductible for covered healthcare services subject to the deductible.

Dispute

If you don’t have health insurance or don’t plan to use your insurance to pay for your care, you may be able to use the patient-provider dispute resolution process if you disagree with your medical bill. In this process, you can ask an independent third party to review your case. The third party, called a dispute resolution entity, will review the good faith estimate, your bill, and information from your health care provider or facility to decide if you should pay the amount on your good faith estimate, the billed charge, or a different amount. During the patient-provider dispute resolution process, you may still negotiate your bill with your provider or facility.

Explanation of Benefits (EOB)

This is a summary from your health plan of the total charges for the health care services you received and how much you and your health plan will have to pay. This could be a paper copy that’s mailed to you or an electronic statement. This is not a bill. Learn more about the explanation of benefits.

Good Faith Estimate (GFE)

An estimate from a health care provider or facility for the expected costs of items or services. If you’re uninsured or not using your insurance, the provider or facility generally must give you a GFE before you get a health care service if you ask for one or if you schedule an appointment at least 3 days before you get a health care service. In certain circumstances, a provider that isn’t in your plan’s network must also give you a GFE as part of its notice and consent to charge you more than your plan’s in-network cost sharing amount. Learn more about good faith estimates.

In-network Providers

Providers or facilities that have a contract with your health plan to provide services for plan members at certain costs. Generally, if you get care with an in-network provider or facility, it will cost you less than if you get care with an out-of-network provider or facility.

Insured

Someone with health insurance (this can include people with insurance through their employer or health insurance they bought through the Health Insurance Marketplace®, directly from an insurance company or through an insurance agent or broker, Medicare, Medicaid, or TRICARE).

No Surprises Act

A federal law that provides protections against getting surprise (unexpected) medical bills for out-of-network emergency room services, some out-of-network non-emergency services related to a patient visit to an in-network facility, and out-of-network air ambulance services.

Notice and Consent Form

A form you may get from out-of-network providers or facilities that tell you about your rights and protections against surprise (unexpected out-of-network) medical bills and that gives you the option to waive those rights. If you sign this form, you agree to give up rights that protect you from balance billing and you may be charged more for your medical care. This form is also known as a waiver. This type of notice and consent form is separate from other medical consent forms that a provider or facility may ask you to sign before treating you. Learn more about notice and consent forms.

Out-of-network Provider

A provider who doesn’t have a contract with your plan to provide services.

If your plan covers out-of-network services, you’ll usually pay more to see an out-of-network provider than a preferred provider. Your policy will explain what those costs may be. This may also be called “nonpreferred provider” or “non-participating provider.”

Out-of-pocket Limit

The most you could pay during a coverage period (usually one year) for your share of the costs of covered services. After you meet this limit the plan will usually pay 100% of the allowed amount. This limit helps you plan for health care costs. This limit never includes your premium, balance billed charges or health care your plan doesn’t cover. Some plans don’t count all of your copayments, deductibles, coinsurance payments, out-of-network payments, or other expenses toward this limit.

Preferred Provider

A provider who has a contract with your health insurer or plan who has agreed to provide services to members of a plan. You’ll pay less if you see a provider in the network. Also called “preferred provider” or “participating provider.”

Provider

An individual or facility that provides health care services. Some examples of a provider include a doctor, nurse, chiropractor, physician assistant, hospital, surgical center, skilled nursing facility, and rehabilitation center. The plan may require the provider to be licensed, certified, or accredited as required by state law.

Self-pay

When someone who has health insurance chooses to pay their health care costs out of pocket without using health insurance.

Surprise Bill

An unexpected balance bill for certain types of out-of-network costs your insurance didn’t cover.

Uninsured

Someone without health care coverage.

Originally posted on CMS.gov

by admin | Nov 5, 2024 | Compliance, Health Insurance

As the year comes to an end, a crucial compliance deadline looms for employers with health plans. Under the Consolidated Appropriations Act (CAA), health plans and insurance issuers must submit a Gag Clause Compliance Attestation by December 31, 2024.

As the year comes to an end, a crucial compliance deadline looms for employers with health plans. Under the Consolidated Appropriations Act (CAA), health plans and insurance issuers must submit a Gag Clause Compliance Attestation by December 31, 2024.

Since its enactment in 2020, this regulation prohibits health plans from including gag clauses—provisions that limit transparency around provider pricing, quality, and claims data. These clauses are especially important for employers looking to make informed decisions about their healthcare offerings.

Key Information:

Who Must Comply?

Fully insured and self-insured group health plans, including ERISA plans, nonfederal government plans, and church plans, must file the attestation. While grandfathered health plans are not exempt, plans offering only excepted benefits or HRAs are not required to submit.

- Fully Insured Plans: If the issuer of the health plan submits the attestation, employers do not need to file it themselves. This ensures the plan remains compliant with CAA requirements.

- Self-Insured Plans: Employers are responsible for ensuring timely submission, even if a third-party administrator (TPA) handles the attestation. Some TPAs may not agree to submit the attestation, so employers must verify compliance themselves.

Why It’s Important:

Employers should review their contracts to confirm they align with these requirements. Failure to comply may lead to penalties, making immediate action essential. It’s vital that agreements with healthcare providers, TPAs, or service providers do not contain gag clauses that restrict access to key cost and quality-of-care data.

Next Steps:

- Review Contracts: Ensure your contracts with healthcare providers, TPAs, or service providers don’t include gag clauses.

- Confirm Submission: Ensure your health plan’s attestation is filed before the December 31, 2024, deadline.

- Use CMS Resources: The attestation process can be completed through the CMS web form, with detailed instructions, user manuals, and FAQs available on the CMS website.

For more information or assistance with the attestation, feel free to reach out. Compliance goes beyond meeting deadlines; it ensures your health plan operates transparently and with integrity for the benefit of your employees.

This reminder is crucial for employers managing healthcare compliance. Don’t let the December deadline catch you off guard!

by admin | Jul 1, 2024 | Health Insurance

In today’s world of complex health insurance options, High Deductible Health Plans (HDHPs) have become increasingly popular. But with a name like “high deductible,” it’s natural to have questions. Let’s break down the basics of HDHPs:

In today’s world of complex health insurance options, High Deductible Health Plans (HDHPs) have become increasingly popular. But with a name like “high deductible,” it’s natural to have questions. Let’s break down the basics of HDHPs:

What is an HDHP?

An HDHP is a health insurance plan with a higher deductible than traditional plans. This means you pay more out of pocket for covered medical services before your insurance kicks in and starts sharing the costs. However, HDHPs often come with lower monthly premiums.

Here’s a breakdown of the key features:

- Higher deductible: This is the amount you’re responsible for paying before your insurance starts covering costs. HDHP deductibles are typically in the range of $1,600 for individuals and $3,200 for families (as of 2024).

- Lower monthly premiums: Since you’re shouldering more upfront costs, the monthly premium for an HDHP is usually lower than a traditional plan.

- Possible Health Savings Account (HSA) compatibility: Many HDHPs allow you to open a Health Savings Account (HSA). HSAs are tax-advantaged accounts where you can save money specifically for qualified medical expenses. You contribute pre-tax dollars to the HSA, which reduces your taxable income, and the funds grow tax-free. You can then use the HSA funds to pay for deductibles, copays, and other qualified medical expenses, tax-free.

Pros of HDHPs:

- Lower monthly premiums: This can be a significant advantage, especially for young and healthy individuals who don’t anticipate needing frequent medical care.

- Tax advantages of HSAs: HSAs offer a triple tax benefit – contributions are tax-deductible, funds grow tax-free, and qualified withdrawals for medical expenses are tax-free.

- Potential for cost savings: If you’re generally healthy and have good budgeting skills, an HDHP can lead to overall lower healthcare costs by combining lower premiums and tax-advantaged savings in an HSA.

Cons of HDHPs:

- Higher out-of-pocket costs: With a high deductible, you’ll be responsible for a larger chunk of medical bills before your insurance kicks in. This can be a burden if you have unexpected medical needs.

- Not suitable for everyone: If you have chronic health conditions or anticipate needing frequent medical care, an HDHP might not be the best choice due to the high out-of-pocket costs.

- Requires financial discipline: To truly benefit from an HSA, you need to be able to contribute and save money on a regular basis.

Is an HDHP Right for You?

There’s no one-size-fits-all answer. Consider these factors:

- Your overall health: If you’re generally healthy and have a low risk of needing frequent medical care, an HDHP could be a good option.

- Your budget: Can you comfortably afford to pay a higher deductible if needed?

- Your financial discipline: Are you comfortable managing and contributing to an HSA?

- Your future health needs: Do you anticipate needing frequent medical care in the future?

Make an informed decision before enrolling in an HDHP to ensure that it’s the right choice for you, your family and your medical needs. But remember, you can always re-evaluate your health insurance plan during open enrollment periods.

by admin | Apr 16, 2024 | Health Insurance

Insurance Costs

Insurance Costs

Consumers typically pay the following types of costs when they have insurance.

- Premium: The premium is an amount of money a consumer pays for a health insurance plan. The consumer and/or their employer usually make this payment bi-weekly, monthly, quarterly, or yearly. The premium must be paid regardless of how many services, if any, the consumer uses.

- Cost Sharing: Cost sharing is the share of costs for covered services that consumers must pay out of pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn’t include premiums, balance billing amounts for out-of-network providers, or the cost of non-covered services. Cost sharing in Medicaid and Children’s Health Insurance Program also includes premiums.

- Deductible: The amount a consumer must pay for covered health care services received before their plan begins to pay. For example, if a consumer’s deductible is $1,000, their plan won’t pay anything until the consumer has paid $1,000 for covered health care services. A plan with an overall deductible may also have separate deductibles that apply to specific services or groups of services. For example, a plan may have separate in-network and out-of-network deductibles.

- Copayment: A fixed amount ($20, for example) that a consumer pays for a covered health care service after they’ve paid their deductible.

- Coinsurance: The percentage of the costs of a covered health care service that a consumer pays (for example, 15% of the cost of a prescription) after paying a deductible.

See Appendix A for examples of how cost sharing works.

Tips to Know:

- Sometimes consumers with most types of health insurance don’t have to pay any cost sharing for certain services. This is often true for preventive services like flu shots and some cancer screenings. The goal is to keep enrollees healthy and catch health problems early.

- Many health insurance plans have an out-of-pocket maximum. This is the most a consumer could pay during a coverage period (usually one year) for their share of the costs of covered services. After they meet this limit, the plan will usually pay 100% of the allowed amount. This limit never includes the premiums, balance-billed charges, or care that the consumer’s plan doesn’t cover. Some plans don’t count all of a consumer’s copayments, deductibles, coinsurance payments, out-of-network payments, or other expenses toward this limit.

- In the majority of situations, the most important document for tracking health insurance costs is usually called an Explanation of Benefits (EOB). The EOB is a summary of health care charges that a health plan may send after a consumer receives medical care. It is not a bill. It shows the consumer how much their provider is charging the health plan for the care they received, and the amount the plan will cover. If the plan does not cover the entire cost, the provider may send the consumer a separate bill, unless prohibited by law.

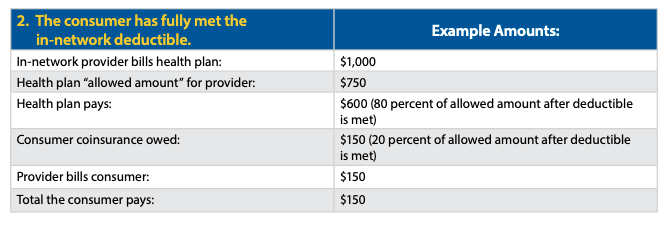

Appendix A

Examples of Health Insurance Cost Sharing

This appendix provides some examples of how health insurance cost sharing works for consumers. These examples show different outcomes depending on whether a consumer has met their deductible and whether their health insurance includes out-of-network coverage. This information is intended to illustrate some of the basic steps that are typically used to calculate cost sharing in the absence of consumer surprise billing protections (or when such protections don’t apply).

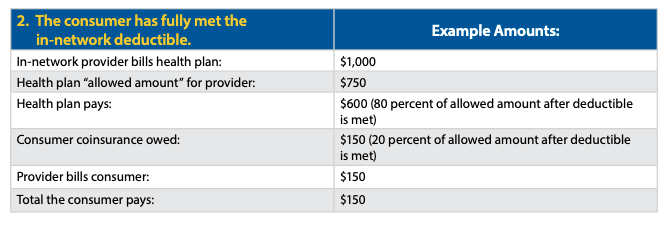

IN-NETWORK:

A consumer receives covered items or services from an in-network provider or facility.

If the services are covered by the consumer’s health plan and furnished by an in-network provider or facility, the amount a consumer pays will vary based on whether the consumer has met their in-network deductible as well as the level of their coinsurance. Note the “allowed amount” is the maximum payment the plan will pay for a covered health care item or service and is generally the basis for cost-sharing calculations. In the next two examples, assume the consumer’s health plan specifies that coinsurance is 20 percent of the allowed amount after the consumer has met a $2,000 deductible for in-network coverage.

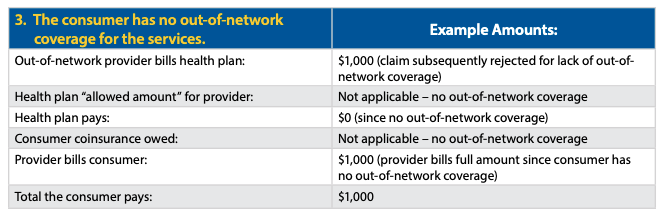

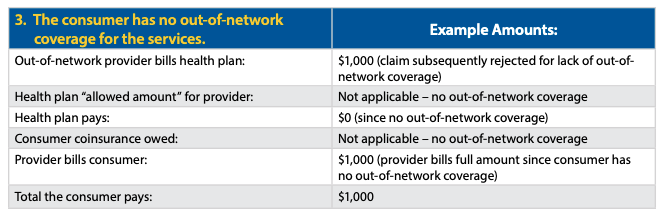

OUT-OF-NETWORK:

The consumer receives covered items or services from an out-of-network provider.

If the covered items or services are received out-of-network, a consumer’s billed amounts will vary based on whether the consumer’s health plan provides any out-of-network coverage and whether the consumer has met their out-of-network deductible.

In some circumstances, the No Surprises Act may limit what a consumer may be billed in each of the following examples. See the No Surprises Act: Overview of Key Consumer Protections.

In the next two examples, the plan covers out-of-network services with consumer coinsurance of 40 percent after the consumer has met a $4,000 deductible for out-of-network services. If the consumer has not paid anything toward the out-of-network deductible, the provider would bill the consumer for the full amount of the charges if the charges are less than $4,000 (example 4). If the consumer has already paid their full deductible, a provider might balance bill a consumer for the difference between what the provider receives from the health plan and the provider’s initial billed amount (example 5).

Originally posted on CMS.gov

by admin | Mar 26, 2024 | Health Insurance

Everyone needs health insurance but many people don’t fully understand it. One important concept to understand is your deductible. A deductible is the amount of money that must be paid for covered services before the health insurance company begins paying for expenses.

Everyone needs health insurance but many people don’t fully understand it. One important concept to understand is your deductible. A deductible is the amount of money that must be paid for covered services before the health insurance company begins paying for expenses.

For an individual plan, the deductible is straightforward. But family plans are a bit more complex.

Embedded vs. Non-Embedded Deductibles

Family health insurance plans can have one of two types of deductibles:

- Embedded Deductible (includes an individual and family deductible)

- Non-Embedded (Aggregate) Deductible (includes only a family deductible)

Understanding the specific type in your plan and how it operates can help you prepare for out-of-pocket healthcare costs.

Embedded Deductible: Each family member has an individual deductible in addition to the overall family deductible. Meaning if an individual in the family reaches his or her deductible before the family deductible is reached, his or her services will be paid by the insurance company. However, these will be paid solely for that family member. Once multiple family members’ medical expenses add up and surpass the family deductible, the insurer would begin to pay covered medical expenses for all members of the family. This applies even if a member did not meet their individual deductible.

Typically, embedded deductibles are exactly half of the entire family deductible. For example, the family could have a deductible of $10,000 and individual deductibles of $5,000 for every covered member of the family.

Embedded Deductible Example

Ashley and Robert have a family health plan that covers them and their two children. Each family member has a $4,000 individual deductible, and they have a $8,000 family deductible. Ashley meets her $4,000 deductible after giving birth to their son in March who was in the hospital for an extra week. Their daughter, Emma, has surgery in May and meets her $4,000 individual deductible in April, which means the family deductible of $8,000 has now been met. Later in the year, when Robert needs shoulder surgery, he only owes a co-payment because the family deductive was already met.

Non-Embedded Deductible: There is no individual deductible. So, the overall family deductible must be reached, either by an individual or by the family, for the insurance company to pay for services. The non-embedded deductible is most common in high insurance health plans.

Non-Embedded (Aggregate) Deductible Example

Marc and his family have a health plan with a non-embedded deductible. The family deductible is $10,000. Son Ben dislocated his shoulder and medical care cost $700. Daughter Victoria had acute appendicitis that required surgery costing $3,300. Marc had an accident while working on his farm which resulted in a hospital stay costing over $6,000. The combined out-of-pocket expenses from Marc, Ben, and Victoria’s medical treatments met the family deductible. Any further medical care for anyone in the family will be covered by the insurance company according to the plan benefits.

No matter what type of deductible your health plan uses, keep in mind that you must personally cover that amount before your insurance kicks in. When you understand how deductibles work and how it impacts your family’s household budget, you can make wise, informed choices to set aside funds for your family’s medical expenses.

Health care terms, medical bills, and forms can be hard to understand. Here are some common health care terms, and what they mean.

Health care terms, medical bills, and forms can be hard to understand. Here are some common health care terms, and what they mean.