by admin | Mar 9, 2022 | Hot Topics

Let’s say that you visited the doctor and you are wondering how much that visit is going to cost. A short while later, you receive something in the mail that looks like a bill – and even says “amount you owe” at the bottom. However, it doesn’t have a return envelope or tear-off portion for the bill. Confused? You’re not the only one!

Let’s say that you visited the doctor and you are wondering how much that visit is going to cost. A short while later, you receive something in the mail that looks like a bill – and even says “amount you owe” at the bottom. However, it doesn’t have a return envelope or tear-off portion for the bill. Confused? You’re not the only one!

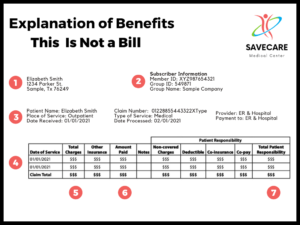

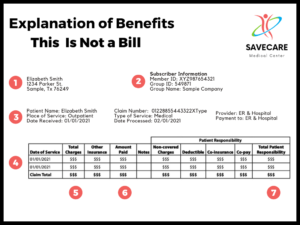

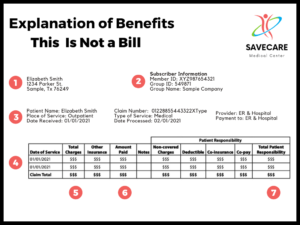

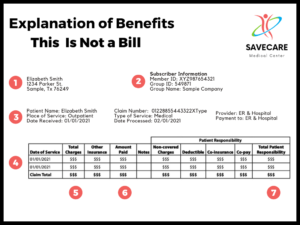

Most likely, you’ve just received an Explanation of Benefits (EOB) from your insurance company. The most important thing for you to remember is that an EOB is NOT a bill. It is essentially “one big receipt” that explains your visit. It shows what was billed, how much you can expect your health plan to pay, and what you – the patient – have to pay. It is always important to review your EOB to make sure it is correct.

An EOB is a tool that shows you the value of your health plan. It will detail the cost of the services you received and how much your insurance will pay.

How do EOB’s work?

The health care provider will bill your insurance company after your doctor visit. Then, your insurance company will send your EOB. Later, you will receive a bill for the amount you owe. However, if the bill does arrive before the EOB, don’t pay it yet. Wait until you have the EOB in hand so you can compare it to your medical bill.

While an EOB will differ from one insurance company to another, they typically all include the following information:

- The Account Summary – lists your account information with details like the patient’s name, date(s), and claim number.

- The Claim Details – lists the services provided and the dates of the services.

- The Amounts Billed – details the cost of the services and what costs your health plan did not cover. It will also include any outstanding amount you are responsible for paying. If there is a portion that is not covered by insurance, the reason why will also be listed.

Remember, insurance companies rarely pay 100% of the bill. You will need to pay any applicable deductible, copay and coinsurance.

Deductible: The amount you pay for health care services before your insurance begins to pay anything.

Copay: A flat fee that you pay on the spot each time you go to your doctor or fill a prescription.

Coinsurance: The portion of the medical cost you pay after your deductible has been met. Coinsurance is a way of saying that you and your insurance carrier each pay a share of eligible costs that add up to 100%.

Why is Your EOB important?

Medical billing companies sometimes make billing errors. Your EOB is a window into your medical billing history. Review it carefully to make sure that you did receive the service being billed and that your procedure and diagnosis are listed and coded correctly.

EOBs can help you understand how the health insurance system works and provide transparency in the complicated finances of health care. While the EOB may be complicated, understanding it can help ensure that you and your family get the most out of your health insurance. Knowing what an EOB is and what is included on the statement ensures that you stay in control of your health care finances.

by admin | Mar 8, 2022 | Employee Benefits, Human Resources, Workplace

If only everyone valued the same things, benefits planning would be a lot easier. If. Only.

If only everyone valued the same things, benefits planning would be a lot easier. If. Only.

However, most employers have five generations of employees active in the workplace who want different things. With generation gaps spanning more than 75 years, finding a one-size-fits-all benefits package can be challenging. However, there are certain things to consider to tailor employee benefits for each generation.

The Five Generations in the Workforce:

- Generation Z: 1997-2012, (5% of workforce)

- Millennials: 1981-1996, (35% of workforce)

- Generation X: 1965-1980, (33% of workforce)

- Baby Boomers: 1946-1964, (25% of workforce)

- Traditionalists or The Silent Generation: 1928-1945, (2% of workforce)

Regardless of their generation, every employee wants traditional benefits like time off, healthcare insurance, and retirement planning. To create a benefits program with multigenerational appeal, employers should first think about their employees’ shared concerns and varying needs.

One strategy for managing multiple generation is customizing benefits offerings to core demographics. For example, would your staff value on-site child-care? Would a retirement plan that highlights the need for saving early or tuition assistance be relevant for your employees? Think about who your employees are and which benefits are most likely going to support their success.

Many employees are concerned about their financial wellness. Seven out of 10 new college graduates each owe $37,000 or more. These unprecedented levels of student debt make financial concerns a primary concern for Millennials and Gen Z. Gen Xers share financial concerns as they look to pay for their children’s education. While fear of not saving enough for retirement is a concern for all age groups, it is most concerning to Baby Boomers and Traditionalists for whom retirement is around the corner.

Gen X values benefits that support better work-life balance, such as caretaker support, flex time, well-being and support and financial protection. Meanwhile, Gen Zers favor benefits that support career growth, mental health and diversity, equity, and inclusion programs and perks that relate to job security, a key concern for this generation.

While every generation faces uncertainty at different stages of life, Millennials are more likely to purchase legal insurance compared to other generations. Many Millennials started working during a recession which has greatly affected how they view their long-term careers. Millennials have adopted an “anything can happen” mentality and are willing to pay for peace of mind to be financially stable.

To handle the unexpected, health, dental, vision and life insurance are all valued traditional benefits and are especially important to Baby Boomers and Traditionalists. Some Traditionalists and Boomers may not be full-time employees. Companies employing more of this generation of workers should offer some sort of wellness benefits like gym memberships or health services.

Beyond the core offerings like health care and retirement savings plans, employers can offer a menu of non-medical voluntary benefits that employees can select based on their individual needs. Those might include legal insurance, caregiver leave, student debt assistance or tuition reimbursement, on-site child-care, pet insurance, financial counseling, accident insurance and more.

Whether a Boomer or a Gen Xer, all employees want to feel confident and informed about their healthcare decisions. Quality healthcare that is accessible and affordable is a priority for all generations. Creating a customizable benefits experience that recognizes the diversity across the multigenerational workforce will likely result in employee retention and increased job satisfaction as well as making recruiting top talent easier. By focusing on communication, the benefits mix, and understanding what is important to each generation, your company may well be on its way to a successful benefits strategy.

by admin | Mar 1, 2022 | Human Resources

Today’s offices potentially span five full generations ranging from Generation Z to the Silent Generation. A coworker could just as easily be raised with a smart phone in hand as they could have used a typewriter at their first job. Some see differences between generational colleagues as an annoyance (“kids these days!”) and many rely on generational stereotypes as fact. The truth of that matter is that generational stereotypes have about as many holes in them as a piece of Swiss cheese. Current research questions the validity of generational stereotypes. This five-part series uncovers top generational myths as a strategy to support a diverse and healthy employee population.

Let’s start with the greenest part of the workforce: Generation Z. This cohort was born between 1997 and 2012 and the elders of this group turn 25 this year. The top three myths of Gen Z include:

- Their interest in workplace flexibility is fueled by the desire for remote work. Workplace flexibility refers to how, when and where work gets accomplished. Historical literature pegs Generation Z as a group keen to choose when and where they complete their work. A recent survey completed by Annemarie Hayek, President and Founder of Global Mosaic, refuted this prior claim with data. It showed less than a third want a fully remote position. More exciting to Generation Z? Compensation and having their opinions heard by leadership.

- Mental health benefits fall into the “nice to have” category. Generation Z felt the effects of the pandemic mental health crisis and value quality healthcare. The National Institutes of Health study predicts that one third of today’s teenagers will experience mental health difficulties related to anxiety. Prior generations may hear “mental health” and think of fluffy wellness programs, but Gen Z sees it as so much more than a webinar on work-life balance. While this attribute is shared with Millennial colleagues, this group is more active in communicating their needs with managers and peers. No shying away from uncomfortable conversations here! Mental health was an ongoing conversation in their youth. For this reason, they are realistic about the hard costs and prioritize therapy and paid time off benefits.

- They are uncomfortable with face-to-face conversations. This generation was raised with technology at their fingertips and social media omnipresent, so many assume they rely on text for all professional communications. This common misconception does not pan out, says Ryan Jenkins, Inc. columnist and generational expert. Data shows that 84% of Gen Z favor live communication with their bosses. This group does not hide behind a screen in or out of the office. Generation Z was raised in an ever-changing sociopolitical environment that included school shootings, economic recessions, and increased focus on climate change. Because of this early exposure, they are comfortable activists, and they bring this social awareness to work.

Despite what you may have heard, the majority of Generation Z isn’t opposed to working in the office. They prioritize “hard” mental health benefits and prefer live conversations with their managers.

© UBA. All rights reserved.

by admin | Feb 22, 2022 | Human Resources, Workplace

Since the start of the pandemic, the gig economy has become more ubiquitous. Human Resources leaders need to understand the new kind of worker attracted to the world of gigs, and learn how to make that kind of non-traditional worker fit into their teams.

Since the start of the pandemic, the gig economy has become more ubiquitous. Human Resources leaders need to understand the new kind of worker attracted to the world of gigs, and learn how to make that kind of non-traditional worker fit into their teams.

Some mistakenly believe that the gig economy, also known as the shared economy, only refers to on-demand jobs like driving for Uber or Lyft or making Amazon deliveries. However, it is also applicable to white-collar jobs. It’s becoming a solution for employees, who need more flexibility, and employers, who need talent during a historic labor shortage. The HR Exchange Network’s State of HR Report revealed that HR leaders hold flexible work culture as a top priority, second only to employee engagement and experience. Buying into gig work might be a way to address both those priorities.

What Is the Gig Economy?

“The gig economy is a free market system in which temporary, flexible jobs are commonplace and companies bring on independent contractors and freelancers instead of full-time employees, and in many cases, for short-term engagements,” according to Embroker.

A look at the numbers demonstrates how important it is for HR leaders to pay attention and get up to speed on how this new kind of work arrangement could influence their business. By 2023, the global gig economy is expected to be a $455 billion industry, according to Harvard Business Review. Two million new workers joined the U.S. freelance workforce in 2020. In fact, one in three working Americans rely on freelancing for all or part of their income. Gallup estimates roughly 57 million Americans are gig workers, according to Forbes.

“The rapidly accelerating growth of the gig economy represents one of the most significant and all-encompassing challenges faced by Human Resources professionals,” according to SHRM. “The fundamental question is whether Human Resources can demonstrate the agility to lead the change in culture, programs, processes, and policies originally designed for work completed by full-time employees to a new era when more of the work is being completed by a talent portfolio increasingly represented by contingent workers (also referred to as gigsters, free agents, temporary help, agency workers, on-call workers, contract workers, independent contractors, or freelancers).”

Pros of the Gig Economy

Affordable Labor

A full-time employee requires a salary and benefits. You have to make hefty investments in training and career progression. Hiring an on-demand worker eliminates the need for all that. You pay them per project or on an hourly basis for as long as you need them. They usually can work remotely or only need to come into an office or place of business on a limited basis.

Specific Skills or Talents

Sometimes, you need an expert in an area for one or two projects and not on a regular basis. Being able to hire contract workers as you need them means you can look for exactly what you need at that moment. You don’t necessarily have to worry about well-rounded skills like you might with a full-time hire.

Flexibility

Freelancers and on-demand hires offer flexibility. Even if you’re renewing a contract with one of them on a regular basis, you only have to pay them for the work they actually do. You can turn to them when the work demands more help or when their particular service will enhance outcomes.

Cons of the Gig Economy

Carousel of Workers

Team dynamics can be hard to pin down when you are always working with different people. Even if you consistently work with the same freelancers, they are not bound by the same participation expectations as full-time workers. This can make it even more challenging to define a culture or help teams better collaborate.

Different Kind of Relationships

There’s more of a hierarchy when you are working with full-time employees. Managers and supervisors oversee their work and usually provide some sort of performance measurements to track their progress. With freelancers, you are their client. They are still working for you, but it changes the dynamic of the relationship.

This becomes most complicated with contingent workers, who work consistently for a company but without job security or traditional benefits. They do this for a number of reasons, including having more freedom over their schedules, being able to work for others, and being their own boss. As a result, the contract dictates their work more than the manager does. However, the manager or company could end up being a dissatisfied customer, and contingent workers can be let go at any time and you don’t have to prove they deserved to be fired.

Lack of Routine

If you’re working with a blended team – full-time employees and freelancers or contingent workers – you might have a hard time creating a solid schedule or routine for the group. Potentially you could still get the job done, but full-time employees might feel inconvenienced or maybe even a bit resentful. They have to be in one place for a certain amount of time, whereas their freelance counterparts are free to work on their own clock.

Obviously, there are pros and cons to the gig economy. But HR leaders can’t afford to ignore the fact that there is a societal shift toward this kind of workplace, where people have more freedom over their schedules, the kind of work they do, and even the relationship they have with employers. There’s still so much we have to figure out when it comes to the gig economy.

“Online gig work has grown increasingly common in recent years – and yet there’s still limited understanding of how to effectively support these non-traditional workers,” according to Harvard Business Review. “While gig workers can benefit from greater flexibility and autonomy than traditional employees, they also face unique challenges: less job security, fewer resources for career development, and often, a strong sense of alienation and difficulty finding meaning in their work.”

In fact, many reports have suggested that HR leaders in the future will provide access to resources regarding benefits like medical insurance instead of paying for it as they would for a full-time employee. Companies may begin to support co-working spaces to prevent isolation of their contingent or freelance workers. The point is that change is afoot, and HR leaders are paving the way for this new work paradigm.

By Francesca Di Meglio

Originally posted on HR Exchange Network

by admin | Feb 14, 2022 | Health & Wellness

February is American Heart Month, a time when all people can focus on their cardiovascular health. Do you know how to keep your heart healthy? You can take an active role in reducing your risk for heart disease by eating a healthy diet, engaging in physical activity, and managing your cholesterol and blood pressure.

February is American Heart Month, a time when all people can focus on their cardiovascular health. Do you know how to keep your heart healthy? You can take an active role in reducing your risk for heart disease by eating a healthy diet, engaging in physical activity, and managing your cholesterol and blood pressure.

Heart disease accounts for nearly one-third of all deaths worldwide. Studies and experts recommend exercise as an important way to maintaining a healthy heart, but your diet plays a major role in heart health and can impact your risk of heart disease. The most important factor in healthy eating is having a balanced diet, watching portions, and eating foods you actually enjoy. This will allow you to stick with it for the long term.

Let’s take a closer look at the 4 key factors for a heart healthy diet and examples of how you can incorporate them into your daily life:

1. Fruits and Vegetables:

Leafy green vegetables are well known for their wealth of vitamins, minerals, and antioxidants. An analysis of eight studies found that increasing leafy green vegetable intake was associated with up to a 16% lower incidence of heart disease.

2. Healthy Proteins:

Lean meat, poultry and fish, low-fat dairy products and eggs are some of your best sources of protein. Legumes – beans, peas and lentils – are good, low-fat sources of protein and are a good substitute for meat. Also, substituting plant protein for animal protein – ie. a black bean burger for a hamburger – will reduce your fat & cholesterol intake and increase your fiber intake.

3. Healthy Fats:

Not all fats are bad. Foods with monounsaturated and polyunsaturated fats are important for your brain and heart. Limit foods with trans-fats, which increase the risk for heart disease.

4. Whole Grains:

Whole grains are good sources of fiber and other nutrients that play a role in regulating blood pressure and heart health.

Eating heart healthy is a lifestyle, it’s about nutrition, balance and retraining our mind to make better food choices. What you eat can influence almost every aspect of heart health, from blood pressure and inflammation to cholesterol levels and triglycerides. A well-balanced diet can help keep your heart in good shape and minimize your risk of heart disease. With planning and a few simple substitutions, you can eat with your heart in mind!

Let’s say that you visited the doctor and you are wondering how much that visit is going to cost. A short while later, you receive something in the mail that looks like a bill – and even says “amount you owe” at the bottom. However, it doesn’t have a return envelope or tear-off portion for the bill. Confused? You’re not the only one!

Let’s say that you visited the doctor and you are wondering how much that visit is going to cost. A short while later, you receive something in the mail that looks like a bill – and even says “amount you owe” at the bottom. However, it doesn’t have a return envelope or tear-off portion for the bill. Confused? You’re not the only one!