by admin | Dec 4, 2023 | Health & Wellness

‘Tis the season for family, festivity, and food—lots of food. The holidays dish up a triple whammy of wintry weather, irresistible foods, and stress, which can cause even the strongest-willed person to reach for another festive goodie.

‘Tis the season for family, festivity, and food—lots of food. The holidays dish up a triple whammy of wintry weather, irresistible foods, and stress, which can cause even the strongest-willed person to reach for another festive goodie.

While the notion of enjoying “healthy holidays” has a nice ring to it, reaching that goal can be very challenging. Between the endless social gatherings and the to-do lists that seem longer than Santa’s list of names, balancing the season’s obligations often means that our diets take a backseat until the New Year.

If you’re trying to maintain a healthy lifestyle this holiday season, you may be wondering what foods you should prepare and how to stay on track with your goals.

Here are six tips for savoring a healthier holiday season:

- Portions Matter – Eat slowly and mindfully and opt for smaller portions. Also, avoid going back for seconds; your body needs time to feel full so give yourself 20 minutes before you reach for more.

- Fit in Favorites – No food is on the naughty list. Deprivation leads to backlash – it’s better to have a plan and do it on purpose. In advance, plan for the indulgences that matter most to you so you can be sure to savor a small serving of Aunt Carol’s pie!

- Make Movement Merry – Be active after a big meal; not only does activity help you burn off some calories but you may also feel more energized. Exercise is the secret to holding the (waist)line when holidays indulgences call. Choose fun activities like ice skating or sledding with friends and family or take a walk with family after a holiday meal.

- Include Some Healthy Options – A platter of raw veggies or fruit with a low-fat dip can be a colorful and healthier alternative to a tray of sliced cheese, deli meats and crackers. Or replace the cheese dip with a bowl of cold large shrimp with cocktail sauce.

- Try a New Tradition – You may not be the only person at the gathering trying to maintain healthy eating goals. Why not try a healthier recipe that may become a new tradition?

- Get Your Zzz’s – Going out more and staying out later means cutting back on your sleep. Sleep loss can make it harder to manage your blood sugar, and when you’re sleep deprived, you’ll tend to eat more and prefer high-fat, high-sugar food. Aim for 7 to 8 hours per night to guard against mindless eating.

Set an example for your children. By incorporating some of these ideas, you can create healthy traditions for your kids. As these traditions are passed down from one generation to the next, your family will learn that it’s possible to make positive lifestyle choices while still enjoying the holiday season.

Remember, a healthy holiday makeover doesn’t require drastic changes to have a significant impact. Modifying a few choices and behaviors can lead to health benefits that can last a lifetime of happy, healthy holidays.

by admin | Nov 29, 2023 | Employee Benefits, Health Insurance

If you have a health plan through a job, you can use a Flexible Spending Account (FSA) to pay for health care costs, like deductibles, copayments, coinsurance, and some drugs. They can lower your taxes.

If you have a health plan through a job, you can use a Flexible Spending Account (FSA) to pay for health care costs, like deductibles, copayments, coinsurance, and some drugs. They can lower your taxes.

How Flexible Spending Accounts work

A Flexible Spending Account (FSA, also called a “flexible spending arrangement”) is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

You don’t pay taxes on this money. This means you’ll save an amount equal to the taxes you would have paid on the money you set aside.

Employers may make contributions to your FSA, but they aren’t required to.

With an FSA, you submit a claim to the FSA (through your employer) with proof of the medical expense and a statement that it hasn’t been covered by your plan. Then, you’ll get reimbursed for your costs. Ask your employer about how to use your specific FSA.

To learn more about FSAs:

Facts about Flexible Spending Accounts (FSA)

- They are limited to $3,050 per year per employer. If you’re married, your spouse can put up to $3,050 in an FSA with their employer too.

- You can use funds in your FSA to pay for certain medical and dental expenses for you, your spouse if you’re married, and your dependents.

- You can spend FSA funds to pay deductibles and copayments, but not for insurance premiums.

- You can spend FSA funds on prescription medications, as well as over-the-counter medicines with a doctor’s prescription. Reimbursements for insulin are allowed without a prescription.

- FSAs may also be used to cover costs of medical equipment like crutches, supplies like bandages, and diagnostic devices like blood sugar test kits.

- Get a list of generally permitted medical and dental expenses from the IRS.

- You can’t use a Flexible Spending Account with a Marketplace plan.

FSA limits, grace periods, and carry-overs

You generally must use the money in an FSA within the plan year. But your employer may offer one of 2 options:

- It can provide a “grace period” of up to 2 ½ extra months to use the money in your FSA.

- It can allow you to carry over up to $610 per year to use in the following year.

Your employer doesn’t have to offer these options. If it does, it can be either one of these options, but not both.

Plan ahead At the end of the year or grace period, you lose any money left over in your FSA. Don’t put more money in your FSA than you think you’ll spend within a year on things like copayments, coinsurance, drugs, and other allowed health care costs.

Originally posted on Healthcare.gov

by admin | Nov 20, 2023 | Health & Wellness

You may have heard the saying attitude of gratitude. It’s a great little rhyme to remind us to live a life of gratitude – and practice it! When we practice being thankful on a regular basis, it not only impacts our mental and physical health, but those around you as well.

You may have heard the saying attitude of gratitude. It’s a great little rhyme to remind us to live a life of gratitude – and practice it! When we practice being thankful on a regular basis, it not only impacts our mental and physical health, but those around you as well.

The Definition of Gratitude

The emotion of gratitude is defined as “the quality of being thankful; readiness to show appreciation for and to return kindness.” We are familiar with the act of “thank you” to represent gratitude, but it also includes thinking on positive things that have happened during the day or your life, meditating on positive thoughts, and feeling grateful.

The Health of Gratitude

Beyond making someone feel appreciated, gratitude also has other benefits. In fact, there are physical health benefits associated with the act of gratitude. The Greater Good Science Center produced a list of benefits to gratitude.

For the individual:

- increased happiness and optimism for the future

- improved mental wellbeing

- greater satisfaction with life

- increased self-esteem

- better physical health

- better sleep

- less fatigue

- lower levels of cellular inflammation

- encourages the development of patience, humility, and wisdom

Research has shown that consciously practicing gratitude can reduce feelings of stress and anxiety. In fact, studies have found that a single act of thoughtful gratitude produces an immediate 10% increase in happiness and a 35% reduction in depressive symptoms. These effects disappeared within 3-6 months, which reminds us to practice gratitude over and over.

In addition to these above benefits, psychologically, the act of gratitude has been shown to reduce toxic emotions like envy, frustration, resentment, and regret. Those who focus on gratitude have even been reported to visit the doctor less!

The Act of Gratitude

So, how do you practice gratitude in your everyday life? Here are some easy-to-do exercises to strengthen your gratitude muscles:

- Say thank you

- Keep a gratitude journal or gratitude jar

- Write handwritten thank-you notes

- Think/meditate on positive thoughts

- Create gratitude rituals

- Put sticky notes around your home and workspace to remind you to be grateful

Our daily lives are fill of distractions and stress, and we often let our small achievements go unnoticed, even internally. Think about the past few days – what have you accomplished that went unnoticed? Did you cook a delicious meal, start a new book or chat with a loved one? Take a moment to celebrate that, to express gratitude for life’s everyday joys. Perhaps you might even write it down in a journal. This simple act that we’ve all been taught since we were born (Moms always remind you to say “thank you!”), has far-reaching benefits so start flexing your muscles of gratitude today.

by admin | Nov 14, 2023 | Health Insurance

Accidents happen. Whether you fall off a ladder, slip and break an arm, or get injured just living everyday life, an accident can happen. Anytime. Anywhere.

Accidents happen. Whether you fall off a ladder, slip and break an arm, or get injured just living everyday life, an accident can happen. Anytime. Anywhere.

What Is Accident Insurance?

Accident insurance helps provide support when life’s most unexpected moments happen. It makes an accident less painful financially because it helps to pay the bills that your medical insurance doesn’t completely cover. It is important to understand that accident insurance is not intended to be a substitute for medical coverage. Instead, it is used as additional coverage and financial assistance.

Accident insurance may be offered by your employer as a voluntary benefit. Medical insurance doesn’t cover all of the expenses that result from an injury – you will likely owe a deductible and co-pays – and accident insurance helps fill in the gaps.

Examples of What Accident Insurance Covers:

- Emergency treatment and medical exams

- Hospital stays and surgical care

- Diagnostic tests such as X-rays and CAT scans

- Physical therapy and rehabilitation

- Family lodging and travel needs related to follow-up care

Examples of What Accident Insurance Does Not Cover:

- Injury due to extreme sports like bungee jumping or skydiving

- Self-inflicted wounds or suicide attempts

- Injury that occurs while doing criminal activities

- Injury that occurs while under the influence of drugs or alcohol

How Does Accident Insurance Work?

You pay a premium every month for coverage which is often automatically paid through payroll deductions. If you get injured, you submit a claim as well as any required verification for the accident. Then, once approved, the insurance payment will be sent directly to you – often in a one-time lump sum. Some plans pay out according to your expenses up to a maximum specified in the policy while others pay out a predetermined amount based on the injury.

One of the biggest advantages of accident insurance is that the payouts come in cash, which can relieve the financial burden after an injury. Additionally, there isn’t a waiting period, so you get the money immediately. This money is given to you in addition to what your health insurance pays. When you receive your payout, you can use the money to pay for any of your expenses – rent or mortgage payment, groceries, childcare, medical expenses, or other needs. How you use the payment after your injury is up to you as you recover.

No one wants to think accidents can happen, but they do. So, while life may dose out the accidents, remember there is insurance that can help.

by admin | Nov 9, 2023 | Compliance

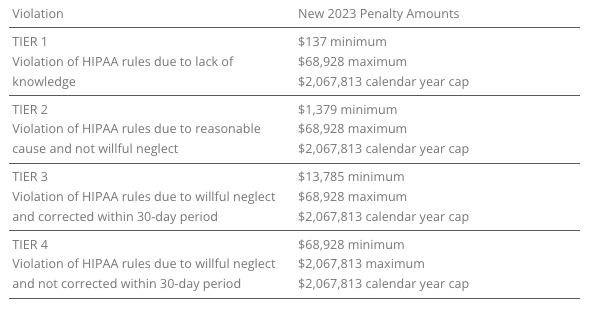

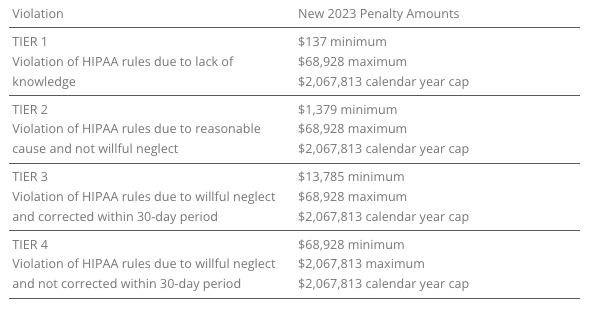

ADJUSTED CIVIL PENALTIES

ADJUSTED CIVIL PENALTIES

The U.S. Department of Health and Human Services (HHS) has recently announced adjustments to civil penalties related to violations of the Health Insurance Portability and Accountability Act (HIPAA), the Affordable Care Act (ACA), and the Medicare Secondary Payer (MSP) rules. These penalty adjustments take into account inflation and are applicable to violations that occurred on or after November 2, 2015, and for which penalties are assessed on or after October 6, 2023.

HIPAA, which focuses on privacy and security rules, categorizes penalties based on the level of intention behind the violation.

The maximum penalty for failing to provide an SBC to eligible individuals before enrollment (or re-enrollment) in a group health plan has increased from $1,264 to $1,362.

The Medicare Secondary Payer (MSP) rules prevent employers from providing incentives to Medicare beneficiaries to waive or terminate primary group health plan coverage. The maximum penalty for not complying with MSP rules has increased to $11,162 from $10,360. Furthermore, the maximum penalty for failing to inform HHS when a group health plan is or was primary to Medicare has risen to $1,428 from $1,325.

EMPLOYER CONSIDERATIONS

To avoid these penalties, employers should carefully review their plan documents and operations to ensure compliance with the HHS-related requirements.

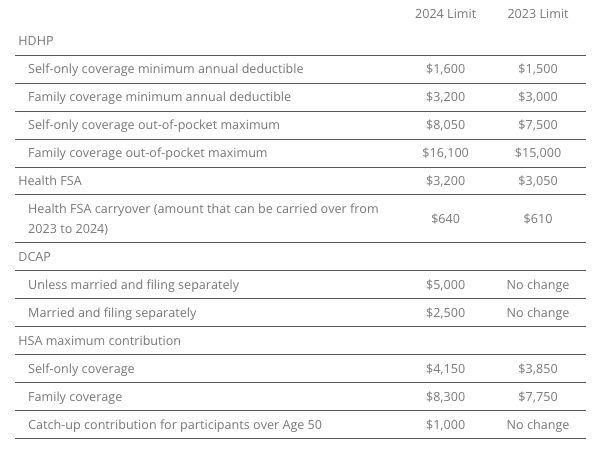

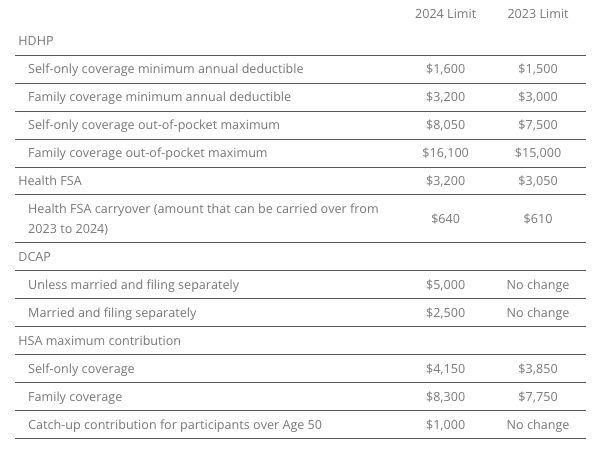

2023 LIMITS ANNOUNCED FOR HDHPS, HSAS, FSAS

The Internal Revenue Service (IRS) announced the new limits for high-deductible health plans (HDHPs), health savings accounts (HSAs), and Dependent Care Assistance Plans (DCAPs), and health flexible spending arrangements (FSAs). The new limits take effect beginning January 1, 2024.

MINNESOTA PAID SICK AND SAFE LEAVE LAW

Minnesota has recently passed a statewide paid sick and safe time leave law set to take effect on January 1, 2024. This law mirrors similar laws already in place in four Minnesota cities—Minneapolis, St. Paul, Duluth, and Bloomington. The key feature of the state law is the “front loading method,” which allows employers to provide employees with 48 hours of earned sick and safe time (ESST) in the first year of employment. Employers can pay out the value of unused hours at the end of the year and avoid carrying over unused hours into the next year.

EMPLOYER CONSIDERATIONS

This option provides flexibility for employers in managing employee leaves of absence. Local ordinances are not preempted by the state law, and employers must follow the most protective provisions of the state or local ordinances. The determination of which is more protective depends on whether more leave or monetary benefits are considered more beneficial for employees. See the FAQs for more information.

CALIFORNIA EXPANDS PAID SICK LEAVE

On October 4, 2023, Governor Gavin Newsom signed Senate Bill No. 616 into law, amending California’s paid sick leave regulations. The key changes introduced by SB 616 are:

- Starting January 1, 2024, California employers must provide employees with five days or 40 hours of paid sick leave, an increase from the previous requirement of three days or 24 hours.

- Employers can continue to provide paid sick leave at a rate of one hour for every 30 hours worked. If they use a different accrual rate, employees must accrue a minimum of 40 hours by their 200th day of employment and at least 24 hours by the 120th day of employment. Employers can also front load the entire paid sick leave amount.

- Employers may still limit the annual use of paid sick leave, but SB 616 increases the annual usage cap from 24 hours to 40 hours. The bill allows employers to cap paid sick leave accrual at 80 hours or 10 days, up from the previous limit of 48 hours or six days.

- While SB 616 continues to exempt certain collective bargaining agreement employees from the accrual requirement, it extends some provisions of California’s paid sick leave law to non-construction industry collective bargaining agreement employees. These employees may use paid sick leave for specific reasons, such as health-related issues or domestic violence, without facing retaliation. Employers cannot require these employees to find replacement workers when using sick days.

EMPLOYER CONSIDERATIONS

To comply with SB 616, employers are advised to review and update their paid sick leave policies to align with the new requirements and usage caps. Human resources and managers should also ensure proper implementation and adherence to the law.

QUESTION OF THE MONTH

Q: My wife and I work in the same small company. Is having her on my plan as spouse allowed? Can we both contribute separately from our own paychecks into our own Health Savings Account (HSA)? Or does it need to be my deduction only since I am the policy holder?

A: Yes, each spouse can have an HSA. The family limit, however, is divided between the two spouses, meaning the contributions to both HSAs combined cannot exceed the family HSA contribution limit.

Answers to the Question of the Week are provided by Kutak Rock LLP. Kutak Rock provides general compliance guidance through the UBA Compliance Help Desk, which does not constitute legal advice or create an attorney-client relationship. Please consult your legal advisor for specific legal advice.

| This information is general in nature and provided for educational purposes only. It is not intended to provide legal advice. You should not act on this information without consulting legal counsel or other knowledgeable advisors. |

| ©2023 United Benefit Advisors |

‘Tis the season for family, festivity, and food—lots of food. The holidays dish up a triple whammy of wintry weather, irresistible foods, and stress, which can cause even the strongest-willed person to reach for another festive goodie.

‘Tis the season for family, festivity, and food—lots of food. The holidays dish up a triple whammy of wintry weather, irresistible foods, and stress, which can cause even the strongest-willed person to reach for another festive goodie.